Financial statements analysis is very crucial for a firm as it helps the firm to understand its financial position. The analysis also helps the firm to forecast the future financial possibilities of the firm. In order to analyze a company’s financial position in an effective way it is very crucial to analyze the company performance in four broader aspects, which are liquidity and solvency, operational efficiency or otherwise known as asset management efficiency, leverage management of the firm, and profitability of the firm. Mentioning the importance of financial analysis Savchuk quoted from Subramanyam and Wild in his paper “The use of financial statements to analyze a company’s financial position and performance and to assess future financial performance” (7).

Liquidity/Solvency of Delisle Industries

It is believed by many academics that liquidity management is very crucial for a firm for paying off its current liabilities otherwise the company will be exposed to the threat of bankruptcy. As a tool of liquidity management, a company can use the liquidity ratios to manage its current liabilities efficiently. Khidmat and Rehman asserted “liquidity ratios are used within the support of liquidity management inside each organization within the form of current ratio and quick ratio with the intention of extremely influence on the profitability of organization” (3).

The company is miniating a healthy current ratio (3.85) which is comparatively higher than the industry average (3.17). The trend is suggesting that the company is actively managing its current assets by gradually reducing its current assets over the past five years. But the income trend is suggesting that the strategy did not have any significant impact on the profitability of the firm as the company has been losing its operating profit gradually.

From the cash ratio result (.05) of the Delisle, it can be said that the company is maintaining lower cash and cash equivalents compare to the other firms in the industry (.16). The trend is suggesting that company has reduced its cash reserve over the last five years but the income statement is showing a negative result of this strategy taken by the top managers.

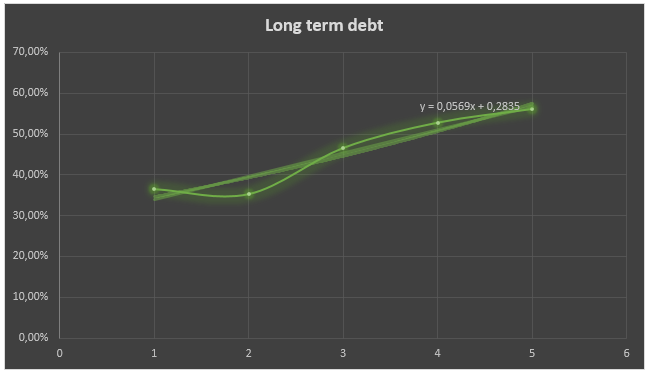

The solvency ratio of the firm is suggesting that Delisle is gradually becoming insolvent as the company has been increasing its debt for the last five years. The firm has a debt-equity ratio of 4.59 which is significantly higher than the industry average.32. The reason for this high debt equity ratio is the unplanned expansion of the business, the firm might have taken some investments by increasing its debt over the periods. The sales trend is showing that it has increased over the period but the income trend is suggesting a negative impact.

The overall solvency situation of the firm is suggesting that the company is maintaining a standard liquidity but it is in a vulnerable position as the trend is exhibiting a tendency of becoming insolvent in near future.

Asset Management of Delisle

The profitability of a firm is totally depended on the proper assets management strategy, it is suggested by many researchers, academicians, and renowned top managers of different companies that a firm should manage its income generating assets effectively. In order to understand the financial position of the company, it is necessary to understand the operational efficiency of the company as well, because operations are the main source of financial inflow for the firm.

From the Data of Delisle we find that the company is taking an aggressive production strategy for which the RM inventory turnover of the company takes fewer times (22.32 days) compare to the industry average (33.86 days), but the company has production inefficiency as it has been increasing its WIP inventory over the past five years period. Also, the WIP inventory gets finished in 17 days where it takes 9 days for other companies in the industry. Compare to the industry the firm is selling much faster as it takes only 46 days to finish its inventory whereas the industry takes 96 days to finish its inventory, which implies the company might be credit selling aggressively.

The accounts receivable timing of the company is justifying the high inventory turnover, the firm is taking having problem in managing its accounts receivable. In support of the strategy of the firm, Michalski concluded holding high cash in the firm is not good for a firm but keeping a higher inventory is a good indicator as it indicates higher sales in the future (9). Asset turnover ratio (1.13) of the company is giving a good signal although the fixed asset turnover ratio (1.90) is little lower than the industry average (2.19) which is covered by the total assets turnover.

It can be said from the analysis of the asset management of the firm, the firm is efficient in managing its assets but due to the aggressive selling strategy the accounts receivable is not under control, and it would be very beneficial for the firm if it can manage its accounts receivables.

Leverage of Delisle

The earning management idea has been considered as one of the most important issues of the finance. There are certain theories that suggest that the more leverage a company can use the better the strategy would be for the firm, but it has also been observed that too much leverage can lead a firm to its liquidation.

Earning management is completely the strategies of the firm that are taken by the decision makers it doesn’t have any relation with the leverage ratios of the firm (Ardison et al. 2). The leverage ratio just reveals the current scenario of the firm’s capital mix. The leverage ratios of the firm are indicating that it has been maintaining a huge amount of debt (4.59) which could be a considerable issue for the firm as the firm is managing leverage far above the industry average (.32) and a similar scenario is observed from the cash flow coverage ratio (.12) which is indicating that the firm is lagging behind due to high leverage.

Profitability of Delisle

For having a proper understanding of the financial position of a company it is very important to understand the profitability capacity of a company. To analyze the profitability of a firm it is essential to understand different profit calculation tools, among the tools the profitability ratios are widely used around the world. To maximize the profitability of a firm a company needs to ensure the right amount of investment in its operation. According to Oladipupo and Okafor, operating cash cycle and accounts receivables management is the heart of the capital management of affirm that ensures profitability (2).

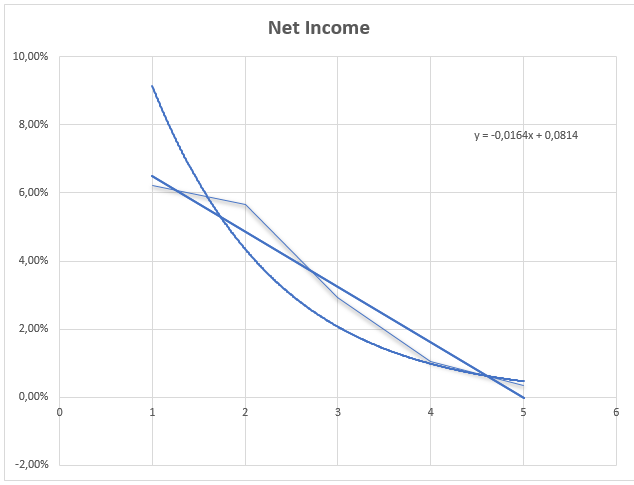

From the calculation of different profitability ratio of the firm, we find that the company is not on the money, as the trend is suggesting the company kept losing its gross profits, operational profits, and the net income as well. The firm has an operating profit of 3.76% while the other firms are earning around 15% of operating profit, which is suggesting that the company is incurring more operating costs than the other firms in the industry. The net profit is very minimal (.35%) compare to the industry average (9.08%). The same situation is observed from the ROA of the firm, it is generating only.40% return from its assets where the industry is generating 5.90% ROA.

Recommendation for Delisle

Based on the analysis it has found that the company is suffering from serious financial issues, and there are many reasons for the current conditions of the firm. Moreover, some of the decisions of the managers has increased the production costs and operational cost for the firm that has reduced the profitability of the firm. We also find a significant error in the financing decision of the managers that has become a burden for the firm and posing a threat to the existence of the firm. The firm can take following strategies to improve its condition:

- The company needs to improve its solvency by reducing the debt, the optimum solution to this could be going for the new public issue of company shares.

- The company should issue around 150,000 shares of 100 par for mitigating the interesting effect on the firm’s income.

- Aggressive selling strategy is not appropriate for the firm as it is reducing the profitability, the company must reduce it accounts receivable by generating more cash sales and reducing credit sales.

- WIP inventory must be managed actively to reduce the cost of goods sold which will help to improve the gross margin.

- In order to increase the company, profit the firm must reduce operational costs at the production area, as the trend is showing a significant increase in production cost.

The proposed expansion project would not add value to the firm until the firm is being capable of managing its operations effectively. So, it would be the suggestion to postpone the expansion project for the moment. Aebi et al. suggest that it is very important to manage the quantitative risk of an organization so that the firm can ensure a profitable operation even in a crisis situation (1). From the financial statements analysis, the firm has revealed so many errors, considering this it is suggested that further risk analysis is required for the firm for more clear understanding of the actual impact of different operational variables.

Exhibits and Quantitative backup

Financial ratio analysis

Common size statements analysis

Time series analysis

Du Point analysis

ROE = ![]()

![]()

The analysis is clearly suggesting that the company is having an unnatural financial leverage and very little profit. The cost of operations and productions are much higher which is reducing the profit margin, the firm must identify the issues that are reducing the profit margin and fix the identified issues. Increase in the profit margin will increase the return on equity of the firm.

Works Cited

Aebi, Vincent, et al. “Risk Management, Corporate Governance, and Bank Performance in the Financial Crisis“. Journal of Banking & Finance, vol. 36, no.12, 2012, pp. 3213-3226. Web.

Ardison, Kym Marcel Martins, et al. “The Effect of Leverage on Earnings Management in Brazil“. ASAA-Advances in Scientific and Applied Accounting, vol. 5, no. 3, 2013, pp. 305-324. Web.

Khidmat, Waqas, and Mobeen Rehman. “Impact of Liquidity and Solvency on Profitability Chemical Sector of Pakistan.” Economics Management Innovation, vol. 6, no. 3, 2014, pp. 34-67. Web.

Michalski, Grzegorz. “Value-Based Inventory Management“. 2013. Web.

Oladipupo, A. O., and C. A. Okafor. “Relative Contribution of Working Capital Management to Corporate Profitability and Dividend Payout Ratio: Evidence from Nigeria“. International Journal of Business and Finance Research, vol. 3, no. 2, 2013, pp. 11-20. Web.

Savchuk, Olena. “Liquidity Analysis of a Company“. 2014. Web.