Summary

The company background

Emaar is one of the most successful businesses ventures in the United Emirates corporate landscape. The company is home to investors providing a friendly business environment for future opportunities to settle on after making sound financial decisions. Emaar is located in the United Arab Emirates in Dubai. The company is a joint-stock company (PJSC) in Dubai Financial market. It commenced business operations in early 1997 with an initial paid-up capital of AED 1bn. The company has constantly raised to greater heights to its present premier styles. With over 60 sub-companies, Emaar is currently the region’s largest land and real estate developer.

The company has immensely invested in properties and development including property management services, education, hospitality services, retail, and healthcare as well as investing in financial services providers. Emaar demonstrates commitment in providing excellent and customer-satisfying services as well as quality products. However, in the plight of consistent economic changes experienced locally and internationally and fierce competition, the firm has a rough pathway (Allaman, 2010).

The mission statement

The company’s mission is to transform Emaar into a one-stop, global solution provider for lifestyle, including homes, work, play, leisure, retail, health, education finance, and more. Emaar of tomorrow will become synonymous to “quality lifestyle across the globe”

Corporate vision

Our vision for EMAAR is its transformation into one of the most valuable lifestyle developers in the world beyond real estate development.

Introduction

The corporate landscape is in a state of metamorphosis with contemporary issues such as corporate reorganizing, mergers and acquisitions, and valuation reoccurring on a daily basis. In the view of the constantly changing business world, financial managers need a wide scope of knowledge in their routine decision-making. Valuation has become a part of their life in the current corporate global not only for knowledge purposes in class but in the business design practices (Allman, 2010).

This paper seeks to present the valuation of EMAAR, a premier business entity in the United Emirates located in Dubai. It is of great interest to present these findings before all the concerned parties in this entity. The report has utilized extensively all the available information resources to come up with these brief and concise findings. Both primary and secondary information resources have been adequately resourceful in the construction of this quality report.

It is worth noting that this report has intensively examined the relevant information about the economy, industry, markets, competition, operations, and financials EMAAR from several sources. These elements are perceived as the fundamental concepts that to a larger extent determine the business trend of a concerned firm (Allman, 2010). Nonetheless, the report has reached extra miles to restructure and analyze this information to estimate future cash flows, projected growth rates, and rate of return.

Furthermore, the report has gone the extra mile to make sound recommendations based on the facts from the findings.

However, one drawback of this document is that time as an important resource was limited for the group to make further investigations.

Aim of the Report

The primary aim of this document is to ascertain and produce true and honest estimations for valuing EMAAR GROUP based on reliable facts.

The Objective of the Report

- to critically examine and revise the economic, industry, markets, competition, operations, and financials that EMAAR GROUP operates within

- to internally, analyze the information, to estimate the future cash flow, growth rates, and rates of return

- to apply appropriately, use these models to estimate the value of EMAAR GROUP

- through our findings, to give recommendations to the concerned parties

Discussion

Economic analysis

EMAAR economy has been recently experiencing economic fluctuation. This can be because of the economic turndown that has slapped the Eurozone that is struggling back from the economic turmoil. However, there are warnings from the real estate experts predicting a further slowdown in the industry due to economic hardships experienced by the US markets. However, the firm believes in a change of situation and projects growth next year. The firm internal economic condition is significantly promising. A visionary management team and a group of committed and goal-oriented employees are the heart of the company driving the momentum to the firm’s objectives. Although the recent economic turmoil on the global landscape has had a great impact slowdown, the growth of the firm project in the next year. The company’s recent acquisition of new software is a good sign for commitments demonstrated towards greater achievements. In addition, EMAAR promotes customer relationship management through its customers’ motto “customers are not only a source of revenue to our ultimate business but also our business ambassadors.” It is worth noting that EMAAR believes in the notion that well-maintained capital resource is a fundamental element in achieving efficiency and effective output. The company promotes this through regular communication between management employees as well as among the employees. Moreover, employees’ compensation and relations such as safety and health are priorities and timely addressed.

Economic Indicators

Key economic figures for UAE

Financial Analysis

The experienced management team prepared the financial analysis report for EMAAR in line with the International Reporting Standards. Thereafter, the external auditors in accordance with the International Standards on Auditing express an opinion on the financial statements. However, the EMAAR company financial analysis ratios indicate a promising environment for the business. Furthermore, according to Pinto (2010), the company’s financial statements evidence provides substantial reasons showing the company in a forward track. This report finds it significant to employ some financial calculations, including current ratios, acid ratios, net profit ratios, gross profit margin ratios, return on assets ratios, asset turnover ratios and return on capital ratios.

To check on the liquidity of the company, the report employed the liquidity ratios such as current ratio and acid ratio. The company’s current ratio was 2.1:1 in the year 2010 and 2009; a figure of 1.8:1 was indeed reported. According to Pinto (2010), the current ratio is very useful to the company since it serves as the liquid reserve available to satisfy contingencies and uncertainties. The company had an acid ratio of 0.28:1 and 0.18:1 in 2010 and 2009 respectively. To examine the condition of EMAAR Company concerning efficiency and profitability, the report utilized asset turnover and return on asset. Through return and asset ratio, the company reports a figure of 0.19 and 0.13 in 2010 and 2099 respectively.

Although these ratios were inconsistent, not excellent in some ratios, the company conditions are auspicious in accordance with figures obtained from the industry and its immediate competitor in the same industry.

Competition

The rapid growth of business ideas in the present world has inhibited fierce competition in the business context. In the view of a radically changing business environment, new ideas and high innovations outsmart conservative and stagnating business ventures. This indeed has shaped the business setting and led to the provision of quality services. EMAAR as a real estate company has acquired a cutting edge in the industry through the provision of excellent services and quality products that meet customers’ specifications. This is extremely due to a cutting neck competition that prevails in the industry. Nevertheless, the company in pursuit to be a premier company on the global scene facilitates its strategies of countering competition from other firms in the same industry. The firm faces stiff competition from their archrivals Arenco real estate to be sincere; I recognize the efforts demonstrate not for personal interest but for shareholders’ interest, by the management in the process of ensuring firm continuation (Allaman, 2010).

The industry

The real estate industry is one of the most successful and competitive industries in the United Arabs Emirates business context. The industry boasted around 1,600 property sales this year, which is 70% less than they were at the peak in 2008 although a small transaction is hailing as a good indicator.

The Dubai residential market operation has remained largely subdued consecutively for two years according to the report by the analysts. Two years ago, the industry has been stagnating as the analysts warn of a further slowdown from the crisis that had fallout the euro market. However, EMAAR is one of the companies that are trying to pull out from the business-unfriendly situation. The industry believes in coming back in 2012 despite the negativity posed by the ongoing economic turmoil in the United States and European markets that mostly controls global markets (Poitras, 2010).

Market analysis

The survey shows the global projection turns out to be better for properties in Dubai, Abu Dhabi, and the rest of UAE. According to the Dubai finance market, the company’s share is competitive with a slight constant improvement. Though the recent economic turmoil affects the market, there is a good sign of better change. The EMAAR properties are listed to over 10 stock markets all over the United Arab Emirates and in Africa. The markets include Dubai finance market, Kuwait, Beirut stock exchange, Tunis SE, Casablanca SE, Amman SE, Bahrain SE, Egypt SE, Muscat SE, Abu Dhabi SE, and Saudi SE. According to the latest market reports on 12th Dec.2011 at 16:05, the EMAAR group had recorded the following figures after a combination of all listed stock reports.

Valuation for the company

Company valuations have many methods and processes involved. The common ones are:

- Book value method

- Economic profit method

- liquidation value method

- discounted cash flow method

- comparable company method

- option valuation method

The report has identified and utilized two methods.

Firm Valuation: The cost of capital approach

The firm valuation using the cost of capital approach, the value reached is through discounting the free cash flow to the firm at the weighted average cost of capital (Zawya.com, 2011).

Value of the firm=FCFF1/ (WACC-gn)

Where FCFF1=Expect FCFF1 next year

FCFF1=cash from of operations –Capital expenditure

=3781481-2798132

= 983379

WACC= Weighted average cost of capital

![]()

Where:

- Re = cost of equity

- Rd = cost of debt

- E = market value of the firm’s equity

- D = market value of the firm’s debt

V = E + D

- E/V = percentage of financing that is equity

- D/V = percentage of financing that is debt

- Tc = corporate tax rate

Re= D/S/current stock value +dividends growth rate=5%

Rd=3%

- E= 31300031

- D = 9410112

- V=40710143

WACC= {(31300031/40710143)*0.05+ (9410112/40710143)*0.03(1-0.3)}

WAAC= (0.77*0.05) + (0.23*0.03*0.7)

=0.0385+0.0483

= 0.0868

gn = growth rate in the FCFF forever

gn in net income=reinvestment rate *Return on capital

Reinvestment rate=net income/capital expenditure

=2477011/2798132=0.88

= 88%

Return on capital = net income/total capital

Total capital= debt + shareholders equity

=2477011/31300031=0.079

=7.9%

gn = 0.88*0.079

= 0.0695

Valuation = FCFF1/ (WACC-gn)

= 983379/ (0.0868-0.0695)

=983379/0.0173

= 56842716

According to this method, the company can be valued at AED 56,842,716,000

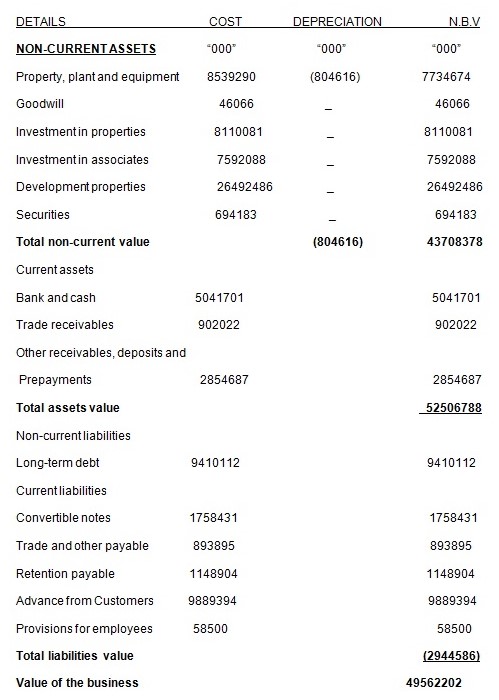

The valuation of the firm book value approach

Book value as of 31 Dec. 2010

The business is valued at cost of 49,562,202,000 using the book value method of valuation. However, this method has its drawbacks

Financial calculations of EMAAR Company

Liquidity ratios

Current ratio

For the year 2010:

Current assets ratio=current asset/current liabilities

=64504328/31204297

=2.067

=2.1:1

For year 2009:

=64144798/35265790

=1.81

=1.8:1

Acid ratio

=bank and cash=5041701

=trade receivables=902022

=other receivables=2854687

=5041701+902022+2854687=8798410/31204297

=0.28=0.28:1

For year 2009:

Bank and cash=2266835

Trade receivables=981354

Other receivables=3211297

=2266835+981354+3211297=6459486/3526790=0.18

=0.18:1

Working capital

For year 2010:

Current assets –current liabilities

=64504328-31204297

=33300031

For year 2009:

=64144798-35265790

=28878008

Profitability

Gross Profit margin

For year 2010:

=Gross profit/revenue

= 4546744/12150274=0.374

=37.4%

For year 2009:

=4099456/8413262=0.487

=48.7%

Net profit margin

For year 2010:

= Net Income *

Net Sales

=2477011/12150274=0.203

=20.3%

For year 2009:

=289376/8413262=0.034

=3.4%

Efficiency ratios

Total Assets turnover

For year 2010:

=Net Sale/Average Total Assets

=12150274/64324563=0.188

=0.189:1

For year 2009:

=8413262/64324563=0.13

=0.13:1

Cash turnover

For year 2010:

=Net Sales

Cash

=12150274/5041701=2.409

=2.41:1

For year 2009:

=8413262/2266835=3.711

=3.7:1

Difficulties met in the process of valuation

- access of some sensitive information was relatively difficult as the management was unwilling to deliver it

- Some financial information was missing in the company’s income and balance sheet statements

- the problem of choosing appropriate valuation method that will give an exact figure of valuation

Recommendations

From the thorough analysis that is contained in this document after a fair and honest valuation of the firm, the proposed acquisition is promising and is an ongoing business. The figures provided after critical valuation give a true picture of the business and are the center of benefit to all concerned parties. The parties engaged in this acquisition must pay attention accorded with respect in all disciplines represented in this document. It is also worth noting that all the concerned parties in this treat must comply with the valuation. In view of the fierce competition at local and global levels, the further survey is encouraged to ensure the findings are true and in due course.

References

Allman, K. (2010). Corporate Valuation Modeling: A Step-by-Step Guide. New York: John Wiley and Sons.

Pinto, J. (2010). Equity Asset Valuation. New York: John Wiley and Sons.

Poitras, G. (2010). Valuation of Equity Securities: History, Theory and Application. New York: World Scientific.

Zawya. (2011). Financial Markets. Web.