Executive summary

Rolls Royce and BAE are some of the most profitable defense companies in the UK. Rolls Royce is the second largest manufacturer of integrated power systems in the world. The company is well known for its innovative capability in the production and design of competitive aero-engines and car manufacturing. BAE is the second largest global defense corporation in the world. The company has many subsidiaries in different countries such as United Kingdom, Sweden, Australia and South Africa.

This paper critically analysis the financial performance of Rolls Royce and BAE systems to identify the most profitable company. To complete our financial analysis of the companies, this paper employs ratio analysis, horizontal and vertical analysis. It was established that BAE has a low current ratios, return on capital employed and asset turnover. However, Rolls Royce is suffering from low inventory turnover which is an indication the company does not turn stocks into sales quickly. This report highlighted that although Rolls Royce is facing low inventory turnover, it has outperformed BAE systems in most financial aspects. Therefore, investor should consider investing in the company.

Introduction

This study intends to carry out a comparative financial analysis in the defense industry. Specifically, the report will carry an in-depth financial analysis of Roll Royce and BAE systems. Today, the defense industry is one of the most lucrative sectors in the developed countries such as Britain, US and Russian Federation. However, due to the level of competitiveness in the sector, it has become imperative to carry out a financial analysis to identify specific company’s long-term sustainability before making investment decisions. It includes evaluating the risk, profitability and liquidity of the companies.

The main objective of this report is to explore the financial and nonfinancial aspects of Roll Royce and BAE to determine their long-term profitability and sustainability. Both companies are in the defense industry which is experiencing financial challenges due to the current financial crisis in Asia, Middle East and Europe. Although the financial crisis coupled with high interest rates has affected many governments, the industry is expected to grow with sales expected to hit $10 million by 2020 (Paton 2005, p. 221).

This is due to the increasing demand for unmanned drones in the Middle East and Asian-Pacific. Due to the nature of competition in the industry, it has become imperative to analyze the both financial and nonfinancial aspect of different players to identify long-term sustainability. Specifically, the report intends to analyze both financial and nonfinancial aspects of Roll Royce and BAE. This analysis shows that Rolls Royce has an impressive performance in the gearing, liquidity and vertical analysis. However, the company is facing low inventory turnover ratios. BAE has a low asset turnover ratio which is an indication the company does not use its assets effectively to generate profits.

To complete this analysis, we shall critically analyze the financial ratios of both companies to identify their profitability, financial risk, liquidity and efficiency. This report will analysis profitability ratios, efficiency ratios, liquidity ratios and financial gearing ratios. After computing the ratios, we shall critically analyze and compare both companies to identify their financial positions and ability to remain competitive in the industry. Moreover, we shall carry out a vertical and horizontal analysis of the balance sheet items to identify the financial position of each company. Finally, we shall analyze the business performance of the best performing company.

A snapshot of Roll Royce

Rolls Royce is the second largest manufacturer of integrated power systems in the world. The company is well known for its innovative capability in the production and design of competitive aero-engines and car manufacturing. The company is located in Britain and operates both in the motor vehicle and defense industry. Recently, the company has developed innovative aerial drones that are gaining market share the Middle East.

However, the company has faced stiff competition from its main rival BAE systems which has a large market share. The company has experienced negative momentum with profiting falling in the last three years and the same trend is expected in 2016. The negative sale is as a result of economic slowdown on many countries that improve defense products. Consequently, this has pushed sales down and therefore it profit margin in the last three years.

Although the company appointed Warren East as the new CEO to try to reverse the negative sales trend, recovery may take more time than expected. If the negative trend continues, the company will have to review its strategy to reduce costs. For instance, according to Julia (2015) the company has announced that it will lay down 2600 employees which are expected to affect Bristol and derby employees.

The company is also expected to reduce its marine costs by increasing efficiency. Due to the current financial difficulties, the company has decided to suspend it £1bn share buyback. However, the CEO is optimistic that the company will recover soon. The negative profit from civil aerospace section is being offset by the profit in the Trent 700 engine sales for airbus A330 (Sarah 2015, para. 2). The continuous losses have been reflected in the share prices for instance, in 2015-share prices decreased by more than 8 percent. Although the company has secured a $3 billion contract with Saudi airline, it might take time before the company recovers fully (para. 5). Although the company is facing many financial and operational difficulties, analyst believes that it will recover.

A snapshot of BAE systems

BAE is the second largest global defense corporation in the world. The company had the highest global defense turnover of 22.4 billion pounds in 2010 (Paton 2005, p. 276). The company has many subsidiaries in different countries such as United Kingdom, Sweden, Australia and South Africa. The company offer services to more than 100 countries in the world. The company offers almost every defense product ranging from sea, air, water and information technology. However, the company is because of its ability to manufacture innovative land base defense combat vehicles.

The company produces a wide variety of defense product that has enabled it to remain competitive and profitable in the last 5 years. Although the company has reported profits in over the previous years, the lack of order within the company might cause the company to cut it typhoon jet production. The company has been able to win big contracts due to its ability to produce high-tech combat aircrafts. For instance, BAE is expected to deliver 28 jet fighters to Kuwait air force in the next three years. The company has failed to secure contracts with Saudi Arabia, which is one of the largest defense importers in the world.

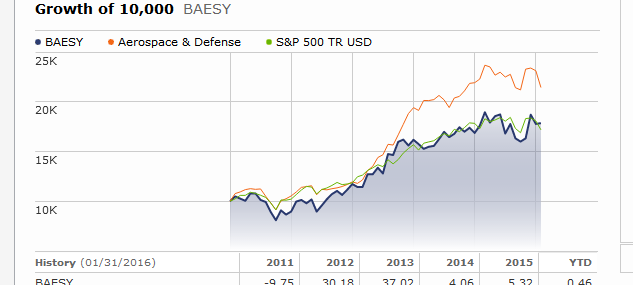

Due to the current economic crisis in many countries, the company has been compelled to cut expenses by laying down 371 employees. Paton argued that the current competition in the market for long-range fighter jets has shifted demand to the Russian made Sukhoi. Consequently, BAE management expects sales of the typhoon jets to decrease from £1.3 billion to £1.1 billion this year. Irrespective of the challenges on its typhoon jets, the company has sustained positive return in the last four years as shown in the graph below.

Ratio analysis

Ratio analysis is a technique used to identify the strength and weakness of a firm by establishing the relationship between different figures in financial statements. These figures can be obtained from cash flow statement, statement of financial position and statement of financial performance. Different stakeholders use financial statements to make informed decisions. Andrijasevic and Pasic (2014) argued that these stakeholders include managers, shareholders, investors, the public and customers. Since the figures in financial statements do not convey a lot of meaning, ratios are computed to enable stakeholders to make sound decisions. In this analysis, we shall compute profitability ratios, efficiency ratios, liquidity ratios and financial gearing ratios.

Profitability ratios

Profitability ratios are very essential because they give insight to stakeholders about the company’s performance. When evaluating these ratios, shareholders must be very mindful when comparing them with other organizations in the same industry. Profitability ratios usually show the ability of a company to generate income from investment. It also indicates the ability of company to control cost of sales and financial expenses (Bansal 2015, p. 52). These ratios are categorized into two: profitability in relation to investment and profitability in relation to sales.

Comparing BAE and Roll Royce return on shareholder/equity

Return on shareholders ratio (net worth ratio) indicates the ability of a company to make profit from utilization of capital contributed by shareholders plus reserves. When comparing two companies, the higher the ratio, the better the performance.

From the ratios above, Rolls Royce has outperformed BAE by 16.18%. This shows that the return from shareholders investment in Rolls generated more income compared to those of BAE. This also implies that the shareholders of Rolls expected to receive more dividends per share compared to those in BAE. In 2013, both companies witnessed significant decrease on return on equity. For instance, Rolls return on equity decreased by 46 % which was a significant reduction compared to the previous year.

In 2013, Rolls also outperformed BAE by a significant margin indicating that the company was making more returns from shareholders investment. The decrease of return on equity can be associated with the existing financial crisis that has resulted to low demand for military equipment in both companies. However, in 2014, BAE outperformed Rolls Royce by 27.19% which is attributed winning major contract including supplying typhoon jets to Kuwait. In 2014, BAE demand for fighter jets increased significantly resulting to high revenues. In the same year, BAE also secured a contract with the US government to supply armed vehicles.

This ratio shows how well both companies have been able to invest shareholders dollar to generate return which is considered as one of the most important ratio to shareholders. It helps investor in both companies to understand how well their capital is being reinvested to generate returns. Investors are more interested in companies that can be able to reinvest their capital to generate profits which are paid to them as dividends. In our case, Rolls Royce has outperformed BAE in two years which shows that the company has effectively reinvested shareholders money.

In summary, shareholders in Rolls received more dividends in both 2012 and 2013. Rolls Royce has a higher return on equity compared to BAE which is likely to attract more investors because they will earn more return on their capital investment in the company.

Comparing BAE and Roll Royce return on capital employed

The return on capital employed is a critical ratio that is used to measure the operating profit of a company to its capital employed. This ratio measures the ability of a company to generate enough operating profits from capital employed. In this case, capital employed is a measure of long-term finance and stakeholders finances. When stakeholders invest in a company, they expect to get returns from their investment. Kaur (2015) noted that the ability of a company to generate net profits from capital employed assures shareholders that their finances are generating profits. An investor should select the company that generates a higher return on sales.

During 2012, Rolls had the highest return on capital employed compared to BAE. Rolls Royce has a capital-employed ratio of 35.11 percent compared to 16.74 percent for BAE. This shows that Rolls has a higher long-term profitability while taking into consideration the capital employed (long-term financing). This ratio is calculated by measuring the profitability of BAE and Rolls Royce by expressing its operating profits as a percentage of capital employed.

In 2013, Rolls Royce outperformed BAE by 11.59 percent. The high return on capital-employed shows that Rolls Royce uses its assets more effective compared to BAE. However, the outcome of capital-employed ratio can be affected by internal factor affecting companies such as management decision and long-term projects. Year 2012 also indicates that Rolls Royce had a more successful way of investing its long-term finances to generate profits. It also shows the effectiveness of Rolls Royce profit generating capability when compared with capital employed. In simple terms, the ratio shows how effective BAE and Rolls Royce generate profit from every dollar of capital employed.

In 2014, BAE capital employed ratio outperformed Royce. This can be attributed to good investment decision and winning of lucrative contracts. For instance, the company won a contract to supply US government with armed vehicles. Moreover, the company might have realized loopholes in investment decisions which allowed managers to be strategic in their decision-making.

In summary, Rolls Royce has outperformed BAE which indicates that the company has effectively been able to generate more profits from capital employed. Moreover, it can be argued that Rolls Royce shareholder receive more dollars in profits for every dollar of their capital investment in the company.

Since capital employed can be a convolutional term, this analysis assumes that it refers to total assets of the company less the current liability. Capital employed can also be calculated by equity less long-term liabilities of a company.

Comparing BAE and Roll Royce return on assets

The return on capital employed is a profitability ratio that measures the ability of a company to generate profits from total assets. In simple terms, it refers to the ability of a company to generate profits from utilization of total assets. This ratio is effective since it helps investors to measure the ability of a company to generate income from all the assets of a company.

In 2012, Rolls Royce had a return on asset of 13.21% compared to 4.71% in BAE. The return on capital-employed ratio shows the net income produced by total assets. Rolls Royce has outperformed BAE which is an indication the company’s assets are generating profits. The sole purpose of a company’s asset is to generate future cash flows. By comparing the total assets of a company with the net profit, management can be able to assess the ability of a company to utilize its assets to generate profits. Therefore, it can be argued that Rolls Royce is using its assets effective to generate profits.

In 2013, Rolls Royce also outperformed BAE by 5.84 which represent a significant effectiveness in conversion of assets to profits. In general, BAE did not have an effective asset utilization strategy to convert asset investment into profits. The money invested in capital assets is measured by the amount of profit generated from those assets. Therefore, Rolls Royce has generated more revenues from capital asset investment compared to BAE.

In 2014, BAE performed better than Rolls Royce by 3.45 percent. The increased return on asset can be attributed to good management and improved efficiency. The return on asset is good tool that can be used by management to measure the effectiveness of asset to generate profits. When measuring the return on assets, it is essential to consider the time. For instance, if management intends to measure the return on assets on quarterly basis, they must use the net profit for the quarterly dividends by average assets in the same period. From the ratios above, Rolls Royce has outperformed BAE in 2012 and 2013. However, BAE recovered in 2014 to report return on assets at 3.75. As a rule, the higher the ratio, the better the performance of the company. Therefore, we can conclude that Rolls Royce has a better return on asset compared to BAE between 2012 and 2014.

Efficiency ratios

Efficiency ratios measure the ability of a company to utilize its assets and internal liability to generate income. The ratios can be established by measuring the turnover of receivable or repayment of liability to determine how effective a company has been able to use its assets and liabilities internally (Knežević, Rakočević & Đurić 2011, p.26 ).

Comparing BAE and Roll Royce sales revenue on capital employed

The sales revenue on capital employed is an efficiency ratio that is used by managers to measure the effectiveness of asset employed to produce revenues. This ratio can be calculated by dividing the sales revenue with capital employed (share capital + reserves + noncurrent liabilities). Higher sales revenue on capital employed is preferred because it indicates that a business is using its assets effectively to generate income. As a rule, a business with higher sales revenue on capital employed is preferred. However, the high sales ratios may suggest that the company is overtrading on its assets.

Rolls Royce has a high sales revenue on capital employed which is an indication the company has effectively used its asset to produce revenues. In 2012, BAE had a sales revenue ratio of 4.45 percent which is lower than Rolls Royce 12.38 percent. This is an indication the company has been able to utilize its share capital, reserves and noncurrent liabilities to generate profits. However, both companies show a decline in sales revenue on capital employed at the end of 2014. The decreasing sales revenue on capital employed can be attributed to increased cost of sales in both companies. Moreover, the current financial crisis has affected the defense industry significantly. Specifically, competition between rival firms is stiff that has compelled companies to invest huge resources in research and development. Although both companies have a declining sales revenue capital employed, they have remained stable over the three years covered in this analysis.

Comparing BAE and Roll Royce asset turnover

The asset turnover ratio is an efficiency ratio that is used to measure the ability of a company to utilize it assets to generate income. It is used as an indicator of efficiency with which a firm has been able to deploy its assets in generating income. This ratio can be calculated by dividing total sales/revenues with total assets. In general, a higher ratio is preferred because it indicates a company is generating more income per dollar of asset invested. However, it is worth noting that different industries have different ratios. Thus, the two companies must belong to the same industry to make an accurate comparison. For instance, the asset turnover of a telecommunication company cannot be compared with that of an energy company.

In 2012 and 2013, BAE performed better than Rolls Royce which shows that the company is managing its assets more effectively. In both cases, the companies have maintained a stable asset turnover ratio that indicates good asset utilization. In 2014, both companies reported a declining asset turnover ratio. BAE outperformed Rolls Royce by 0.17 percent which is a good indication of that the company is utilizing its assets efficiently to generate revenues. However, Faello (2015) argues that there is no one set of ratios that represent an effective asset turnover because it varies significantly depending on the industry and the existing business model (p.78). Moreover, the asset turnover ratio is affected by the relationship between labor and capital structure. A higher asset turnover ratio is an indication that the company is utilizing its assets effectively to generate revenues. Moreover, it can also be an indicator of pricing strategy of a company. For instance, organizations with low profit margins are incline to have a high asset turnover. However, those with high profit margins tend to have a low asset turnover (Banerjee 2015, p. 61).

In summary, BAE has outperformed Rolls Royce which is an indication the company is utilizing its assets effectively.

Comparing BAE and Roll Royce revenues per employees

This ratio measures the productivity of input resources (labour). A higher ratio is preferred because it indicates a company is generating more income for every input resource. However, it is worth noting that different industries have different ratios which can be affected by the business sector and the number of employees in a company. Moreover, it also depends whether the company is in the manufacturing or service industry. The ratio is a gauge of personnel productivity which indicates the amount of sales generated per employee

Rolls Royce has higher revenues per employee compared to BAE across the three years of this analysis. For instance, in 2012, Rolls Royce had a 23.4 percent revenues per employee compared to 7.2 percent in BAE. The high revenue per employee ratio shows that Rolls Royce is utilizing its workforce efficiently.

Comparing BAE and Roll Royce inventory turnover

The inventory efficiency ratio is used to measure how effective companies are managing inventories by comparing the cost of goods sold with average inventory. This ratios measure how effective a company can be able to turning the stocks into sales. In simple terms, it measures the ability of a company to sell total inventory during a specified period. A higher ratio indicates that the company is turning most of its stocks into sales. This is a clear indication the company is generating profit from sales. A low inventory turnover ratio indicates a company has poor sales or it has accumulated inventory. This ratio should be compared with the industrial average to determine the most appropriate sales level. A high ratio might indicate a business has strong sales. However, if the ratio is too high, it might be a clear indication of ineffective buying. A high inventory turnover ratio is an indication the company has maintained high stock levels which represent an investment at zero return. Moreover, high inventory is an added cost to the company because of high holding costs associated with stocks.

BAE has maintained a high inventory turnover ratio which is an indication the company have high sales. It also indicates the company has a high control of its merchandise. A high inventory turnover ratio shows that BAE does not spend most of resources in buying too much inventory that cannot be converted to sales quickly. Moreover, it is an indication BAE can effectively sell the stocks they buy.

Rolls Royce is less liquid because it has a low inventory turnover ratio. The company has maintained a low inventory turnover ratio which is an indication that it does not convert stocks into sales quickly. The low inventory turnover ratio shows that Rolls has maintained high stock level in its stores compared to BAE. Credit management is imperative because it is considered relevant by creditors and is often put up as collateral. Financiers want to be sure a company will be able to convert inventory into sales quickly to repay loan obligation (Niedzwiedz, Pell & Mitchell 2015, p. 2093). In conclusion, BAE has a higher inventory turnover ratio which indicates the company has high sales.

Liquidity ratio

Liquidity ratio is one of the most interesting ratios because it measures the ability of a company to meet its obligations when they fall due. They measure the ability of a company to pay off their short term liabilities (Oruç Erdoğana, Erdoğan & Ömürbek 2015, p. 41). The gearing ratio measures the long-term liability to the capital structure of a company. The liquidity ratios can be obtained from financial statements by dividing the liquid assets of a company with current liabilities and borrowings. This shows the number of times debt capital can be covered by the current assets of a company and cash. When the ratio is more than one, it means the current liabilities can be able to cover all current liabilities of a company.

As a rule, the higher the ratio, the higher the margin of safety that can be used to cover short-term liabilities of a company. The higher the ratio, the more stable a company is in good health or less likely of going into financial challenges. However, when calculating this ratio, inventory is eliminated from current assets because it cannot be turned into cash quickly. Some analyst only considers cash and cash equivalent to be the only relevant current assets while others argue that debtor should not be counted as current asset. For this analysis, we shall consider current assets to be debtors, trade receivables, cash and cash equivalent. Financial gearing is a term used to refer to a business when it is partly financed by borrowed funds instead of shareholders capital.

Comparing BAE and Roll Royce current ratio

The current ratio measures the ability of a company to pay its short-term liabilities from the current assets. The current liability ratio is critical because it measures the short-term liabilities of a company that must be met the next year (Mankin & Jewell 2014, p. 206). It is essential to measure this ratio because a company has limited time to raise the capital required to meet the obligation. When a company has a higher current ratio, it means it can be able to meet its short-term financial obligations when they fall due without having to sell any asset.

BAE has a low current ratio compared to Rolls Royce across the three years of this analysis. For instance, in 2012, Rolls had a current ratio of 1.33 while BAE had 0.78 which represent a low current ratio. As a rule, a company with less than 1 show that the company might not be able to meet it short term maturing obligations when they fall due.

In 2013 and 2014, BAE seem to have maintained a low current ratio which indicates the firm might potentially not be able to handle meet its short term liability when they fall due next year. A high current ratio is important especially to meet the short-term liabilities that fall due in less than one year.

In conclusion, Rolls Royce has a higher current ratio that indicates the company will be able to meet it short-term maturing obligations when they fall due. BAE has a low current ratio which is not healthy for the company. To be secure, the company must maintain a current ratio of more than 1.

Comparing BAE and Roll Royce interest cover

Interest coverage ratio is used to measure the number of times earnings before interest can be able to cover interest expense. This ratio helps managers to determine the ability of a company to meet interest expense on outstanding debt (Ježovita 2015, p. 106).

Rolls Royce has a high interest coverage ratio which indicates the company can be able to meet its liability resulting from interest expense. For example, in 2012, BAE interest cover ratio can be able to cover interest from debt capital by 4.29 while Rolls can coverage interest expense by 27.02 times.

Rolls has a high interest coverage ratio compared to BAE systems which is a clear indication the company can be able to meet its obligations from interest expense.

Horizontal analyses

Horizontal common size analysis is a financial statement analysis that shows the changes in the corresponding financial statements. It is also referred to as trend analysis which shows the changes in the financial statements when items in the first period are considered the base of the analysis (Clauss 2010, p. 228).

Comparing Rolls Royce and BAE systems

The horizontal analysis shows a decrease in revenues with corresponding decrease in cost of sales in BAE. The decreasing cost of sales and revenues is attributed to the financial crisis which has negatively affected the defense industry. This trend is also reported in Rolls Royce where sales decreased from 27.5 to 12.9 percent. However, the operating profits in Rolls Royce decreased significantly from 55.43 to 69.6 percent. This shows that Rolls Royce is losing its market share to competitors. It could also be a sign that the sales department is ineffective due to management policies that affect sales. For instance, Rolls Royce has a low inventory turnover ratio which is an indication the company does not turn stocks into profits quickly. Moreover, it also suggests that the company produces many products above the real demand in the market. Consequently, the company has high stocks that increase the holding cost or costs associated with inventory.

BAE has recorded a decreasing finance costs. In 2013, the finance cost increased by 23.4 percent, but later decreased by 55.4 percent. This is an indication the company has significantly reduced external financing which is associated with high finance costs. On the contrary, Rolls Royce financing cost has increased significantly by 68.9 percent. This is an indication the company has obtained external finances that attract interest expense every month. A company can obtain external finances to buy assets or invest in a new line of business. However, managers must ensure the finance costs do not exceed a certain limit that could expose the company to financial difficulties.

Vertical analyses

Vertical analysis is a financial analysis technique which is mostly used to show the percentage increase or decrease of items in the balance sheet. Every item in the balance sheet is restated as a percentage of a base figure (Rich, Jones, Mowen & Hansen, 2012, p. 223). For instance, in this analysis, the total asset is the base figure and every item is expressed as a percentage based on that figure. It helps stakeholders to establish the financial position of two companies by comparing them. Moreover, it shows the profitability of each company thus helping investors to make sound investment decisions. All figures in the balance sheet are expressed as a percentage of total assets.

Comparing Rolls Royce and BAE systems

From the vertical analysis above, BAE has maintained a low inventory which is consistence with the high inventory turnover. From the ratio analysis, BAE has a high inventory turnover which is an indication the company is turning inventories into sales faster. Since most of what is produced are sold, the level of inventory is always low. However, Rolls has a very low inventory turnover ratio which is an indication the company is maintaining high stocks levels. For instance, in 2012, Rolls Royce had a 15.1 percent inventory level compared to 2.9 in BAE. This is a clear indication Rolls Royce has low sales level compared to BAE. Moreover, it could be a signal the company is ineffective especially stock management.

Both companies have maintained a stable tangible assets level. This indicates that both companies have not invested in new assets. Moreover, it can be attributed to the low demand in the defense industry due to the financial crisis facing many countries.

Evaluating business performance Rolls Royce

From the financial ratios above, it can be understood that Rolls Royce had an impressive financial performance from 2012-2014. Although the company has faced stiff competition of its main rival BAE, it has remained stable over the last 3 years. A critical analysis of the financial statements shows declining sales revenues, which is an indication the company is facing challenges while marketing its products. However, although the company is facing many challenges especially due to the current financial crisis, it is still stable. For instance, Rolls has a high current ratio compared to BAE which indicate the company can be able to cover its current liabilities from the most liquid assets. Moreover, the company has performed well on the return on assets. Overall, Rolls Royce has a stable financial position which is a clear indication that investors should invest in the company. Financiers are more interested in the financial stability of a company.

When financiers are assured a company can be able to meet its obligations, they are more likely to have grand finances for future expansion. Moreover, when a company is stable, it can be able to diversify its businesses without requiring external finances. While considering the period covered in the tables, the result reveals an impressive business performance. However, the company has very low inventory turnover ratios, which is an indication the company does not turn stock into cash quickly. Since the company is very stable and therefore there is nothing that should worry investors while investing in the company. Although the analysis in this paper shows that the company has performed well, it does not give an exhaustive outcome on the company’s business performance.

Other analysis tools can be applied to evaluate the performance of the company such as accounting policies and the quality of accounting estimates that can affect a business outcome. Moreover, a business strategy can be an effective tool for generating performance expectation. Managers should also consider evaluating the risks and opportunities of the business that can affect future performance. These risks can include but are not limited to industrial impacts and environmental impact since any solution to the environment can present an impressive opportunity for the company to prosper.

Rolls Royce organizational structure

Rolls Royce is one of the best technology and defense global leaders. It employees more than 35200 workers and operates in 48 countries. The company is headquartered in the UK with it largest manufacturing plant based in US and China. Rolls Royce uses a hierarchical organizational structure to manage business operations. Since the company has many business operations outside the UK, managers decided to use the traditional hierarchical structure to supervise and develop the business.

Moreover, Rolls Royce is managed by detailed systems and procedures due to the high sales every year. For instance, a turnover of £5645 million and a 25 percent engine market requires an extensive system to be in operation. Due to the complexity of business operations especially due to the high demand in the defense sector, it becomes imperative to implement hierarchical business structure. Decisions are made by the top management who give guideline (set policies) that must be followed by others on the bottom layer without asking questions. The group structure is made as follows:

- Chairman.

- Directors.

- CEO.

- Board of management.

- General managers.

The company has been militarized because employees do not have a right to question decision made by top management. Workers cannot be able to develop innovative business ideas because they have to follow orders and procedures without contributing in any decision making. Consequently, the lack of communication in the business has resulted to more conflict between employees and departments. The downward follow of information in a hierarchical structure does not favor good working condition.

Moreover, it results to lack of efficient business operations. Communication is one way from top to bottom because employees are required not to questions orders, but to follow them. Workers use their skills to achieve business objective. However, this system is very effective where a business has too many operations. This system enables management to make decisions faster because they have adequate skills and experience.

Recommendation

Rolls Royce looks more attractive to investor than BAE systems. Although the company pays high dividends, management must address inefficiency within the business. Rolls has a low inventory turnover which is an indication the company has poor forecasting mechanism. Therefore, managers can improve business performance by developing new strategies that will specifically address issues of forecast. This means they should be able to forecast who will want the product and when the product is required.

Secondly, the company should speed up production and deliver to ensure they eliminate maintaining stocks. In this case, the company should produce only when there is a firm order which will prevent against keeping a large stock that increases holding cost. However, this might require the company to simplify it product design and train more workers to ensure efficient production. Moreover, the company should also consider adding more production lines to increase capacity.

Finally, the company can improve deliver by hiring an independent shipping company that has the expertise to deliver items faster. Organizations prefer a high inventory turnover because it indicates the company is stocking more than what is required. When product sales are efficient, a company will have small stocks. This is because sales will be faster which will be reflected in a higher inventory turnover ratio.

Rolls Royce should change it business structure from hierarchical to flat organizational structure. A flat organizational structure is a system that does not involve middle level management between the executive and supervisors. A flat organizational structure is designed on the basis that workers are well trained and knowledgeable to be productive when they are involved in major decision making. If Rolls Royce uses a flat organizational structure, the organization will be able to leverage the creativity within it workforce. Employees are a source of competitive advantage, if managers can involve them in major decision-making; they will not only foster creativity, but also a well-motivated workforce. Decentralization is critical in the organization because it has resulted to inefficiency in business operations. Moreover, Rolls Royce management will be able to leverage customer’s feedback since customer feedback will reach management which can help them to make rapid response depending on customer feedback.

A flat organizational structure is cost effective and promotes creativity within the organization. If Rolls Royce management changes the organizational structure, they can be able to take advantage of faster decision-making processes based on customer feedback that will allow the company to generate competitive advantage. This organizational structure will also allow Rolls Royce management to take advantage of direct communication between workers and top-level management thereby boosting employee morale and innovation. When workers feel that their views are considered in major decision-making, they are more likely to become motivated.

The major challenges facing Rolls Royce when it comes to inefficient business operations is lack of clear communication between top management and workers. In the current organizational structure, information passes through a series of management levels before it reaches to employees. In most cases, this information ends up being puffed up or deflated resulting to lack of coordination in the company. However, with a flat organizational structure, managers will be able to pass policies directly to workers without information being deflated or distorted. Finally, a flat organizational structure requires less supervision because employees know what should be done and when it should be done which encourages them to be more productive and responsible. Studies have also shown that when workers are given more freedom to make their own decisions, they become more motivated and productive because it gives them a high sense of responsibility.

Conclusion

Rolls Royce and BAE are in the defense industry. Both companies have reported decreasing sales level due to financial challenges facing many countries. Although the demand for drones has increased in the last five years, the demand in the defense industry seems to be decreasing significantly. From the profitability ratios, Rolls Royce has outperformed BAE. This shows that the return from shareholders investment in Rolls generated more income compared to those of BAE. This also implies that the shareholders of Rolls expected to receive more dividends per share compared to those in BAE.

Moreover, Rolls Royce has outperformed BAE on the return on investment which is an indication that the company has effectively been able to generate more profits from capital employed. Royce has also performed better on the return on asset than BAE which represent a significant effectiveness in conversion of assets to profits. In simple terms, BAE did not have an effective asset utilization strategy to convert asset investment into profits. The money invested in capital assets is measured by the amount of profit generated from those assets. Therefore, Rolls Royce has generated more revenues from capital asset investment compared to BAE.

While comparing the financial risk in both companies, this analysis noted that Rolls Royce has a higher current ratio that indicates the company will be able to meet it short-term maturing obligations when they fall due. However, BAE has a low current ratio which is not healthy for the company because it might fail to meet all the short-term financial obligations.

BAE has maintained a high inventory turnover ratio which is an indication the company have high sales. It also indicates the company has a high control of its merchandise. This is also supported by the trend analysis that indicates BAE has low inventory levels. Rolls Royce has maintained a low inventory turnover ratio which is an indication that it does not convert stocks into sales quickly. The low inventory turnover ratio shows that Rolls has maintained high stock level in its stores compared to BAE.

From the analysis above, Rolls Royce has performed better than BAE in many aspects. Although the company is facing challenges in turning inventory into sales, the prospect is high. The profitability, gearing and horizontal analysis show that Rolls Royce has an impressive performance compared to BAE.

References

Andrijasevic, M, & Pasic, V. 2014. ‘A Blueprint of ratio analysis as information basis of corporation financial management’, Problems of Management in the 21st Century, vol. 9, no. 2, pp. 117-123.

Banerjee, S. 2015. ‘Do Financial Parameters Differ Based on IPO Grade: An Empirical Analysis from the Indian Equity Market’, SIES Journal of Management, vol. 11, no. 2, pp. 53-62.

Bansal, R. 2015. ‘A Comparative Analysis of the Financial Performances of Selected Indian IT Companies During 2010-2014’, IUP Journal of Accounting Research & Audit Practices, vol. 14, no. 4, pp. 43-60.

Clauss, F. 2010. Corporate financial analysis with Microsoft Excel. New York: McGraw Hill.

Faello, J. 2015. ‘Understanding the limitations of financial ratios’, Academy of Accounting & Financial Studies Journal, vol. 19, no. 3, pp. 75-85.

Ježovita, A 2015, ‘Designing the model for evaluating financial quality of business operations – evidence from croatia’, Management: Journal of Contemporary Management Issues, vol. 20, no. 1, pp. 101-129.

Julia, K 2015. Rolls-Royce share price plunges after latest profit warning. Web.

Kaur, P. 2015. ‘A Financial Performance Analysis of the Indian Banking Sector Using CAMEL Model’, IUP Journal of Bank Management, vol. 14, no. 4, pp. 19-33.

Knežević, S, Rakočević, SB, & Đurić, D. 2011. ‘Implementation and Restraints of Ratio Analysis of Financial Reports in Financial Decision Making’, Management (1820-0222), vol. 23, no. 61, pp. 24-31.

Mankin, JA, & Jewell, JJ. 2014. ‘A sorry state of affairs: the problems with financial ratio education’, Academy of Educational Leadership Journal, vol. 18, no. 4, pp. 195-219.

Niedzwiedz, CL, Pell, JP, & Mitchell, R. 2015. ‘The Relationship Between Financial Distress and Life-Course Socioeconomic Inequalities in Well-Being: Cross-National Analysis of European Welfare States’, American Journal of Public Health, vol. 105, no. 10, pp. 2090-2098.

Oruç Erdoğana, E, Erdoğan, M, & Ömürbek, V. 2015. ‘Evaluating the Effects of Various Financial Ratios on Company Financial Performance: Application in Borsa Đstanbul’, Business & Economics Research Journal, vol. 6, no. 1, pp. 35-42.

Paton, R 2005. Handbook of corporate university development managing strategic learning initiatives in public and private domains. Aldershot, Hants, England Burlington, VT: Ashgate Pub. Rich, J., Jones, J., Mowen, M. & Hansen, D 2012. Cornerstones of financial accounting. Mason., OH: South-Western.

Sarah, Y 2015. Reuters: New CEO cuts management layer at struggling Rolls-Royce. Web.