Executive summary

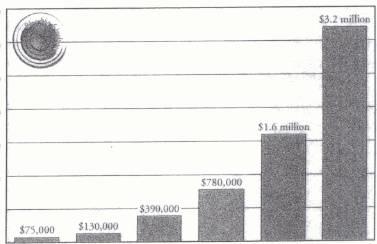

The marketing plan presented forms the foundation for introducing new wine brands into the Indian market by the Treasury Wines Estate. The analysis provides the outlined strategies the company will follow to attain its primary strategic objective. New wine brands will be presented as a unique liquor while emphasizing on the company as the world leader in the wine industry. The marketing strategy presented is expected to reach out to over 13.9 million targeted people estimated to be consuming wine within the Indian market. The sales growth is forecasted to reach over 17.3% in the next four years, increasing the company revenue by 56%. The success will be reflected by capturing a substantial market share while thriving to uphold the company as a leader in the liquor industry.

Introduction

Treasury Wines Estate is a publicly listed Australian company specializing in brewing and production of natural wines and other alcoholic beverages. Under the wines category, the company products are diverse, making over 54 brands, which are sold worldwide. The company brands consist of both new and old brands whose growth in popularity is ever-increasing, particularly in the Australian market. The main company objective is to increase its brand awareness within the Australian market and establish itself in the international market. The company aims at establishing and increasing brand loyalty in major Asian markets such as India and China.

With the expansion and establishment within the Indian market, the company worldwide market share will increase by over 12%. The company expects to take advantage of the growing Indian wines and alcohol beverages market, particularly with the growth of the middle class, which is a significant target market. Besides, the growing entertainment and luxurious hotels in India will provide many opportunities for the consumption of the company products since wines are majorly consumed in the hotels and entertainment industry.

The research aims at formulating a marketing plan for introducing new wine brands into the Indian market by the Treasury Wines Estate. A tool such as marketing mix, SWOT analysis, and Porter’s five forces are used to analyze the prevailing market situation in the wine industry.

Situation analysis

Company analysis

Currently, the Australian wine market share is valued at approximately five billion dollars with Treasury Wines Estate’s products claiming 1.6 billion dollars, second after the other firm’s products combined. The alcohol and beverages market is expected to grow in the next five years, with approximately 0.55% annually. The growth reflects the world growth, particularly in the major markets such as India and China, which the company targets. In Australia, Treasury Wines Estate market share is robust with the expected growth of 1.67% annually. The growth in the market share is driven by the popularity of brands, particularly among the middle-income younger generation. Another advantage the firm has towards international expansion appertains to the fact that the brands are very popular in many countries, especially in Asian countries.

Most of the company brands are highly welcomed by a majority of the middle class, including the young generation. The popularity of the brand has enabled the company to be successful and become the leader in the wines and alcohol beverages market under the highly competitive and volatile environment (Herzog, 2010). The company’s recently created brands have remained appealing in the Asian market and have contributed over two billion dollars in revenue to the company.

However, the market is highly competitive with new smaller firms and brands entering the market. The majority of companies are targeting markets such as India whose popularity in alcohol consumption is ever-increasing (Aulakh & Kotabe, 2007). The company is targeting middle-income earners who are also growing rapidly in India.

Macro-environment analysis

Political environment

Many factors may affect company marketing operations in the foreign market. These include political factors, economic, social, and technological factors (Hartline, 2010, p. 99). The political factors are found to be predominant, given the fact that the company expects to sell products at very different political climates. However, political stability is very critical for the success of the company in the Indian market. Like any other industry or business, Treasury Wines Estate requires a politically stable environment to achieve the set goals. In a stable political environment, any industry or business will thrive since they will generate revenue (Handlechner, 2008). Treasury Wines Estate will thrive on investing in those countries that experience political stability. This forms part of the assertions why the company targets markets in the developing and developed countries that experience political stability and enhance investments.

Besides the political stability, the environment must promote investments. The company aims to invest in countries where political authority encourages fair competition. Being one of the companies operating in a highly competitive environment, the company requires a political environment where fair competition is encouraged (Davies & Ellis 2000, p.1190). The company relies heavily on the distribution of products and international suppliers for international operations. Therefore, Treasury Wines Estate requires an environment where trade barriers are minimized, and there are less trade bureaucratic procedures. The fact that Treasury Wines Estate is a firm within an industry where strict regulations are sensitive issues, the favourable political environment has great impacts on marketing the company products.

The favourable political climate in India offers the best opportunity for the company to expand internationally. There are less strict regulations in the alcohol industry, and the industrial players are encouraged to be socially responsible and work with communities to reduce the negative effects of alcoholism among younger generations. The tax policy is favourable to the industrial players, and this will be an added advantage to the company to increase sales revenue (Crane & Matten, 2010). Instead of increasing corporate tax to regulate the consumption of alcohol, the Indian government has reduced taxes to encourage investments. The reduced taxes will enable the company to offer products at lower prices to remain competitive and increase customer base.

Economic environment

The current economic situation around the world has profound effects not only on the company products but also affects the general production capacity. The recent economic downturn experienced in America and Europe has a considerable consequence on the wines and alcohol beverages domestic market. Sales for the wines and alcohol beverages reduced, given that most consumers switched to other essential products as their income reduced. Reduction in sales was also experienced in many parts of Asia as well as countries around the world (Wernerfelt, 2009). However, this presented an opportunity for the company to introduce cheap wines in the market. Moreover, in such an economic environment, the company must increase capital flow to avoid negative effects presented by economic shocks.

However, as other parts of the world, we’re experiencing the effects of the economic crisis, India, the biggest Treasury Wines Estate target market was experiencing an economic boom. The company will, therefore, concentrate most resources in India. In the last two years, India has experienced rapid economic growth with increased consumer spending (Saggi, 2012). Also, the India government has encouraged most nationals to buy products and services that have been produced in the country. Thus, the economic situation has presented the greatest opportunity for the company to sell products, especially the newly introduced wines. Besides, the Indian population consists majorly of the middle class who are the major consumers of the company products. All of these factors are good for company growth and expansion.

Currently, the Indian economy is at a stable state with a formidable growth in GDP. The growth in GDP is also accompanied by the growth in the middle class and the increased number of the upper lower class, which consumes most of the company products. The steady growth in the economy means that there is enough disposable income spent on luxurious products such as entertainment where wine is consumed. The targeted middle class is expected to have an extra amount to spend on wine.

The social and cultural environment

The company wines will be sold in an open cultural environment. Moreover, the target market that consists of the middle incomers pursue vogue and like cultures (Carroll & Buchholtz, 2008). Their lifestyles are similar in almost all parts of the world. The company wines and other beverages are processed in a simplified manner to meet the needs of all cultures. The company brewing processes combine simplicity and magnificence, the logic that is praised highly in all parts of the world. All the wines that the company has launched into the market have been popular among the target markets, which have revolutionized the generation cultures. With the current globalization, where there are no cultural boundaries, the company-brewed products have been seen as the engine behind the current globalized industry (Orth et al., 2005). However, company-brewed products focus on the needs and want of the target market.

Technological environment

Treasury Wines Estate like in any current firm ventures in online operations and therefore, technology is integral for the company’s success and operations. The company relies on the development of ICT, as all undertaken operations rely on the availability and usability of information technology (Haan & Moraga-González, 2011). Therefore, Treasury Wines Estate will only invest in an environment where technology is available and are cost-effective. The technology must be in the form of hardware and software that would support all operations (Follett, 2011). For technology, Treasury Wines Estate has no choice since this is crucial for company development and success.

The company will take advantage of the Indian developed and cheap ICT sector. The country is boasting of business outsourcing processes, which the company uses to boost operations in India (Haan & Moraga-González, 2011). In addition to the developed ICT sector, which will form the basis of the marketing strategy, the company mobile phone sector is also on par with that of Australia. The company will use the sector to market products.

Legal environment

Legal factors are critical for the establishment and operations of the company (Wernerfelt, 2009). The company is within a highly regulated industry and compliant with the legal requirements of the country where the corporation operates is critical. India’s regulations on alcohol and beverages are highly flexible, and therefore the company will take advantage of that flexibility. However, the firm must adhere to some of the legal requirements of the country business establishments. For instance, some of the Muslim dominated states do not encourage open consumption of alcohol and as such, have their unique regulations. The company should only open business operations in states where the legal framework supports business operations.

Competitor and industry analysis

Porters Five Forces

To facilitate the analysis of the industry and surrounding where Treasury Wines Estate will operate in India, the five forces model proposed by Porter will be applied. That is, the Porters five forces approach will be utilized in evaluating Treasury Wines Estate competitiveness in the Indian market (Porter, 2000).

The customers bargaining power

The Treasury Wines Estate products can easily be substituted with other products offered by competing firms at any point in time, and this could weaken the Treasury Wines Estate control. The buyers of Treasury Wines Estate products comprise of individuals, business, and luxury hotels that in the last few years have not drastically increased. The clientele is the end-users. Therefore, the report can conclude that the buyers’ power is quite high (Porter, 2000).

Bargaining power of suppliers

Firms found within the wines industry mainly deal with the suppliers of highly perishable products. However, these companies may integrate to form a new competing company. Furthermore, firms such as Treasury Wines Estates are not capable of switching quickly and cheaply between supplying companies. Such attributes make the bargaining power of suppliers rather high (Dunning, 2003).

New entrants threat

Given the renewed competition emerging from the entry of the firm, Treasury Wines Estate will have to incur additional cost to maintain the brand loyalty and promote new products. However, firms clientele will tend to be indifferent based on brand differentiation. There could be an easy switch of brands among non-loyal consumers of the company brands. Thus, such an incident presents low product differentiation and a barrier to entry (Dunning, 2003).

Competitive rivalry within an industry

Alcohol beverages and wines are amongst the highly competitive industries in the world. A majority of large and international firms like Treasury Wines Estate find it easy to set up since they could utilize their market leadership capabilities (Wernerfelt, 2009). Treasury Wines Estate will have an additional advantage in both technological and financial capabilities. Regarding the market accessibility, Treasury Wines Estate will be free to sell the brands to the consumers. However, the intense competition will lower Treasury Wines Estate control, particularly the prices of products given that local firms are producing alternative products at a cheaper cost.

The threat of substitute products

There are several similar products offered by other local firms in the industry. Therefore, the threat of substitutes to the Treasury Wines Estate products is quite high. In other words, Treasury Wines Estate products demands will be threatened by substitutes from other firms’ products. Under conditions where there is an increased threat of substitute, there would be a variety of alternatives. Aiginger (2006) claims that this presents a disparaging situation to the corporation. Treasury Wines Estate will utilize strong promotions to increase brand loyalty and capture a considerable market share (Aiginger, 2006).

Customer environment

The company targets the middle class, particularly the middle-income earners aged between thirty-five and forty-five years. Most of the people within the age group buy wines compared with other alcoholic beverages in the Indian market. However, the company will still target the larger population within the ages 22-39 years with good earnings and accounts for 45% of the Indian population. Researches done indicate that 56% of the middle-income earners’ purchases wine. Generally, the company target market will consist of open-minded characters with high disposable earnings for sumptuous items.

As indicated before, the Indian wines market consists of a diverse clientele, which reflects their diversity in their decision-making. Besides cultural factors, pricing, quality and brand loyalty are other factors that determine the Indian consumer decision-making (Chen & Riordan, 2007). Therefore, the company will focus on creating, communicating, and delivering value offerings to the target market. In the differentiation strategy, the firm will position products and services in such a way that the clients understand the ability to fulfil their needs (Handlechner, 2008).

Strategy Formulation

SWOT analysis

The analysis highlights the corporation internal strengths and weaknesses while providing opportunities available to the Treasury Wines Estate and the threats the corporation is facing in the external environment (Davies & Ellis 2000, p.1190). Treasury Wines Estate offers flavoured and highly valued wines as well as an experienced platform in which clients are recognized, respected, and their business conducts are treasured. The strengths of the organization should be leveraged to take advantage of rising opportunities. At the same time, the contingency plans must be formulated in such a way that it could easily deal with threats posed by the external environment (Fyall & Garrod 2005, p.23).

Strengths

Treasury Wines Estate has well established and differentiated strategy that distinguishes the company’s products from those offered by market competitors. Moreover, the corporation has flat, decentralized structures that ease management and reduces costs. Also, the management and staff consist of diverse skills, which are resourceful to the Treasury Wines Estate. The shared values of the company are easily understandable and well communicated to all members of staff. The strategy is combined with a strong and participative culture of all stakeholders (Porter, 2000). All the staffs at Treasury Wines Estate are highly skilled, experienced, motivated, and specialized. The personnel consist of a well-trained team that is proud, respects and promotes the corporation brand values. The staff in the corporation presents the brand values that bring about brand loyalty amid the existing and new clients. The corporation also enjoys a strong reputation within the domestic and international markets given the quality, reliability, and exemplary products offered to the clients (Nijssen & Frambach, 2000).

Weaknesses

Treasury Wines Estate differentiated strategy needs to be well communicated both at the local and international markets. Moreover, seasonal staff turnover needs continuous training and orientation, which might be costly to the corporation. The company distribution channels have not yet fully developed to allow speedy delivery of the products to the consumers. The environment where the company operates is highly volatile depending on the economic and political condition the country presents (Porter, 2000).

Opportunities

There are growth opportunities in the industry, given that the target market is the largest segment demographically, and the growth in the disposable income among the middle class appears to be high. Opportunities are also available in the target market where similar models for the company are yet to be established. Moreover, the expansionist company strategy ensures absorption and mergers with companies that offer direct competition (Porter, 2000). The aspect creates a vacuum for the company to thrive. Treasury Wines Estate has already established a strong and long-term relationship with the suppliers thereby reducing most of the supply costs. Besides, it is in Treasury Wines Estate where clients enjoy most flavoured and quality wines as well as other alcoholic beverage products. Porter (2000) claims that this has enabled the corporation to enjoy repeated corporate business outcomes, especially in the newly established markets. Therefore, clients’ dependency hitherto established and developed is another opportunity for the Treasury Wines Estate management to thrive.

Threats

From reports, it is easy for new competitors to enter this market with similar products and brand. In essence, the occurrence could pose a potential threat to Treasury Wines Estate. New entries can either be from both the domestic and international firms. International corporations might have the advantage of both technology and finance (Nijssen & Frambach, 2000). In addition to the threats of new entrants, small and medium-sized firms and larger corporations offer substitute products. Treasury Wines Estate is also offering similar products that are offered by traditional firms in the industry. The slow growth and development of the industry could be another threat. Also, the ever-changing legal and regulatory framework controlling the industry poses a huge threat to the development and growth of the firm in the new market. The legal and probable economic instability has a greater impact on the general sales volume.

Problem statement

The analysis highlights the corporation internal strengths and weaknesses while providing opportunities available to the Treasury Wines Estate and the threats the corporation is facing in the external environment (Davies & Ellis 2000, p.1190). Treasury Wines Estate offers flavoured and highly valued wines as well as an experienced platform in which clients are recognized, respected, and their business conducts are treasured. The strengths of the organization should be leveraged to take advantage of the rising opportunities, and the contingency plans should be formulated in such a way that they could easily deal with threats proffered by the external environment (Fyall & Garrod 2005, p.23).

Overarching strategy selection

The company will use various marketing strategies to position products in the new market. Included in the market, skimming strategies are product and pricing strategies, placing strategies, and promotional strategies (Reid & Bojanic, 2009).

Entry mode

Utterly held auxiliaries

From Arregle et al., (2006) report, these subsidiaries imply that Treasury Wines Estate will have to cuddle a hundred per cent allotment of the far-off units. For the firm to own a subsidiary, Treasury Wines Estate must establish a new entity with full operations into this market or fully acquire an existing firm (Anders, 2008). The acquired firm must be well built within the industry. Treasury Wines Estate will stand to gain a lot from this mode as the company can easily promote the products and services. The firm has tight control over business operations given the full ownership. Also, compared with other modes, the firm will make and easily implement its strategic plans and will not risk losing the competitive advantage as well as technical skills to other firms. Apart from full control and reduced risks, the firm will also enjoy the full benefits of internationalization. However, there are increased costs associated with this mode of entry (Blomstermo, 2006).

Compared with all other modes, a fully owned subsidiary is the best entry mode for Treasury Wines Estate. As indicated, the fully owned subsidiaries in the international markets will make the firm have control of enshrined competencies and initiatives that forms the core of the business strategies. Also, the strategy increases Treasury Wines Estate geographical diversity while reducing both political and economic risks associated with this expansion (Chen & Mujtaba, 2007).

Identification of objectives

The objectives of this marketing strategy are based on measurable and achievable results and include

- Increasing the company sales volume by 36%

- Establishing the firm’s products in the highly competitive Indian market

- Creating and establishing brand loyalty among Indian customers

- Increasing the firm’s profitability and revenues by 10%

Marketing mix

Product and Pricing strategies

There are varieties of wines that the company produces. The innovative capabilities of the firm ensure the development and production of new wines, offering varied choices to the customers. Moreover, various flavours have been improved to suit the customer needs and bring convenience, a mixture of value and quality.

As expected, the quality and value addition attract high prices. However, the company wines’ prices are middle-high with some wines targeting high-end customers, while others are made for low and middle incomes. The high-quality and low-prices strategy is applied particularly to outperform the competitors. Also, the product and pricing strategy is aimed at widening the spectrum of customers the company is targeting. Nevertheless, with the entry of more competitors, the company is forced to widen the scope and capture middle and low-income clientele.

Placing strategies

The company will adopt the business to customer distribution channel to directly deal with customers. Direct interaction with the customers will lead to the development of the products that suit the customer needs (Henry, 2008). Moreover, the direct sales of products will lead to an expanded market share. However, the company stores in the country are still limited. Therefore, the company should expand its distribution stores to reach all manner of customers.

The promotion strategies

The promotion strategies will include advertising, public relations, and sales promotions. The company will use innovative advertising to attract and inform customers about the company products both in mass and digital media. Besides, the company will use corporate social responsibility to appeal to many people as a method of maintaining public relations (Belin & Pham, 2007). The success of the company in public relations improves the company goodwill and attracts public attention. Further, the company provides special offers as a good way to stimulate and retain customers’ loyalty.

Recommendations

The corporation should consider putting in place strategies that will increase competitiveness in the global marketplace. That is, the strategies should be visible within the global context. Besides, the corporation operations must be geared towards increasing customer value. Its services and products must be differentiated from those of the competing firms in addition to the continuous provision of quality services.

Conclusion

The corporation must focus on creating, communicating, and delivering value offerings to the target market. In the differentiation strategy, the firm must position products and services in such a way that the clients understand the ability to fulfil their needs. Pricing is critical in this strategy. Customers will always go for high-quality products, which attract high prices. However, for the corporation to remain competitive and attain the goal of offering high quality and value to the customers, the products must be at reasonable prices. In essence, the company must position products in feasible locations.

References

Aiginger, K 2006, “Competitiveness: from a dangerous obsession to a welfare creating ability with positive externalities,” Journal of Industrial Trade and Competition, vol.6 no.3, pp.63–66.

Anders, P 2008, “Strategy antecedents of modes of entry into foreign markets,” Journal of Business Research, vol.61 no.2, pp.132-137.

Arregle J, Hebert, L & Beamish, P 2006, “Mode of international entry: the advantages of multilevel methods,” Management International Review, vol.46 no.5, pp.597-611.

Aulakh, P & Kotabe, M 2007, “Antecedents and performance implications of channel integration in foreign markets,” Journal of International Business Studies, vol.8 no.1, pp.145-175.

Belin, J & Pham, C 2007, “Global expansion: balancing a uniform performance culture with local conditions,” Strategy & leadership, vol.35 no.6, pp.44-73.

Blomstermo, A, Sharma, D & Sallis, J 2006, “Choice of foreign market entry mode in service firms,” International Marketing Review, vol.23 no.2, pp.211-213.

Carroll, AB & Buchholtz, AK 2008, Business and society: ethics and stakeholder management, Cengage Learning, Farmington Hills, MI.

Chen, L & Mujtaba, B 2007, “The choice of entry mode strategies and decisions for international market expansion,” Journal of American Academy of Business, vol.10 no.2, pp.322-344.

Chen, Y & Riordan, M 2007, “Price, and variety in the spokes model,” The Economic Journal, Vol.117 no.522, pp.897–921.

Crane, A & Matten D 2010, Business ethics: managing corporate citizenship and sustainability in the age of globalization, Oxford University Press, Great Clarendon Street, Oxford.

Davies, H & Ellis, P 2000, “Porter’s competitive advantage of nations: time for the final judgment?” Journal of Management Studies, vol.37 no.2, pp.1189–1213.

Dunning, J 2003, “Internationalizing porter’s diamond,” management International Review, vol.30 no.6, pp.5-13.

Fyall, A & Garrod, B 2005, Tourism marketing: a collaborative approach, Channel View Publications, Bristol.

Haan, M & Moraga-González, J 2011, “Advertising for attention in a consumer search model,” The Economic Journal, Vol. 121 no.552, pp.552–579.

Handlechner, M 2008, Marketing strategy, GRIN Verlag, Munich.

Hartline, M 2010, Marketing strategy, Cengage Learning, Farmington Hills, MI.

Henry, A 2008, Understanding strategic management, Oxford University Press, Oxford, UK.

Herzog, C 2010, Strategic tools in dynamic environments: a framework, GRIN Verlag, Munich.

Nijssen, E & Frambach, R 2000, Creating customer value through strategic marketing planning: a management approach, Springer, New York.

Orth, U, Marianne, W & Tim, D 2005, “Dimensions of wine region and their impacts on consumer preferences,” Journal of Product & Brand Management, vol.14 no.6, pp. 88-97.

Porter, M 2000, “Location, competition, and economic development: Local clusters in a global economy,” Economic Development Quarterly, vol.14 no.1, pp.15–35.

Reid, R & Bojanic, D 2009, Hospitality marketing management, John Wiley and Sons, Hoboken, New Jersey.

Saggi, K 2012, “Market power in the global economy: the exhaustion and protection of intellectual property,” The Economic Journal, Vol.123 no.567, pp.131–161.

Wernerfelt, B 2009, “A resource-based view of the firm,” Strategic Management Journal, vol.15 no.26, pp.2171–2180.

Appendix

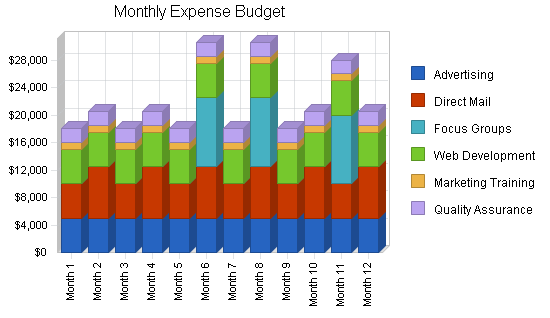

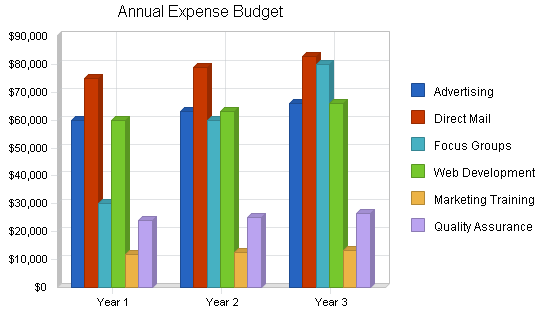

Preliminary budget

The graph indicate the sales growth in the next five years