IPO Market Overview

It’s quite evident that the world’s largest mining and metal industries have become troubled by the ‘wall of debt’ that has a serious impact on the supply of these metals in future. This can cause a very high process for the products in coming years. Debt concerns are a major problem to mining companies because of the dramatic degrees of borrowing that have been taking place over the past decade (Zalkieva,2005, p. 20). Mining and metal companies are expected to raise their initial public offers across the globe from 2010 to 2011. The mining firms will be taking advantage of the fact that there is so much rivalry in the equity market when it comes to selling shared and efforts of reducing debts. Investors have placed a very keen eye on the mining sector, considering that they have cracked an enormous amount of new equity sums from new listings on the stock market (Zalkieva, 2005, p. 20). Last year, mining and metal firms brought very big investment to the stock market by raising over 250 million US dollars in 10 IPOs.

The 2008 economic downturn greatly affected business, and many investors were scared of investing in the metal and mining industry. However, since then, the market is gradually gaining stability, and as of now, there are many mining firms that have lined up their Initial Public Offers following several postponements (Bancel & Mittoo, 2008, p. 845). Still, investors question the valuations and the projection of the metal prices. Gold is particularly important in this report. It’s estimated that its price would rise up to 1200 US dollars for one ounce for many companies, and there are still uncertainties about other factors that can influence the prices. The biggest gold investors like African Barrick gold and Real Gold are actively placing IPOs across the world. Real Gold intents to raise at least 132 million in Hong Kong, while African Barrick Gold was recorded to have raised 581 million pounds in London. This means that the market of metals, and specifically gold, is picking up as the major economies of the world recover from the economic downturn (Zalkieva, 2005, p. 20).

IPO as a Source of Finance in Mining

As the prices of metals keep on increasing, investing in mining and metal industries can be a very viable venture. These companies over the past suffered some serious problems that resulted from the economic crisis that faced the world in 2008. This resulted in increased borrowing by these companies so that they could sustain their operations. Very few investors had the guts to invest in these companies because of the fear to lose out (Zalkieva, 2005, p. 26). Furthermore, very few had extra money to invest while, on the other hand, banks had reduced their lending.

The initial public offer is a way of getting new capital into the business. The company in question offers its shares to the public so that they can be bought at the stock exchange for the first time. Following this declaration, the stocks are normally registered at the public stock exchange, and from these, private investors are able to access the stock easily, make purchases and sell freely (Bancel & Mittoo, 2008, p. 849). The funds tom this process is directly debited to the accounts of the company rather than passing opt the investors as it is in the case of the already established firms in normal public ventures. Thus the issuer gets capital that can be used for expanding the company and its operations without getting into unnecessary debt or burning up resources on searching for business partners and individuals to invest.

The company is not under any strict obligation of reimbursing the new stockholders with distributions that are guaranteed. The new stockholders’ only right is to benefit from the profits that will be obtained in future as the company continues growing and expanding operations (Bancel & Mittoo, 2008, p. 849). The company can as well give out additional shares at a later period of operation, but any further listing after that would constitute what is called secondary placement and not an initial offer. Several IPOs that were conducted by mining firms from 1990 to 2005 in over 39 nations provide this evidence (Zalkieva, 2005, p. 26). From their reports, every company was able to raise a very substantial amount of resources as new capital from the IPO, even though many of the companies from Europe sell a relatively bigger percentage of the shares of their firms. The reports also indicate that the money raised from the process of initial offers are used for the various function of boosting the operations of the company, including growth financing and rebalancing leverages.

It’s not a surprise that accessing new finance, with concomitant improved prospects of expansion, has been cited as the main reason that attracts businesses to float their stock at the stock market. The proceeds of the process itself are not essentially dedicated to immediate expansion. Another survey of the motives of new entrants into public stock reveals that many firms would prefer expansion by acquiring and refinancing their loans (Bancel & Mittoo, 2008, p. 852).

In the long term, the idea of public equity aids the process of raising money in a number of ways that are conceptually different.

First, this strengthens the equity base and reduces leverage hence alleviating the potential debt overhang in future and also blocking other agency issues. This advantage would, of course, also be accessed via the placement of the private equity. This, therefore, means that it itself alone cannot be necessarily the reason for going public unless the major advantage is liquidity per se (Zalkieva, 2005, p. 29).

In business, it’s quite evident that potential and serious investors greatly value liquidity. In the valuation of the potential investment, they must consider the transactions that are expected in future, their costs and their financial expenses during liquidation. Therefore, the expected current worth of the future trade expenses will appear like a discount on the prices of the issue (Bancel & Mittoo, 2008, p. 852). Empirical researches have found a strong connection between the trading costs and the essential return on capital. When stock is invested by very few big investors, it is not advisable to incur the expenses of placing it on public offer since the expected frequency of trade is very low; seldom do big blocks require changing of hands, carrying out search and spending on it for counterparty (Zalkieva, 2005, p. 32). Contrary, broadly held stock is the one that can change hands very often. Therefore, it’s cost-efficient to offer a listing of such a firm on a market that is well organized, like the stock exchange.

This call for a questioning of why it is so important to attract a shareholder base that is so diverse and dispersed. Diversification and sharing of risks have been cited as the main reason, particularly in the nations that are still developing collective investment. This presents the initial public offers as a trade-off of spreading the risk and the cost of information (Bancel & Mittoo, 2008, p. 852). Stress is also another reason. The initial owners could prefer dispersing share ownership so that excessive meddling into the large external owners is discouraged.

Gold is the most famous and most expansive item of all the known precious metals and, as such, is also a very popular investment. Investors generally purchase gold as a safe haven to protect themselves from any political, economic and social troubles like inflation, economic failure and increasing national debt. The gold market has been subjected to a lot of speculation, just like other products in the market, particularly via the use of futures contacts. Many companies dealing in gold mining have, over the past, been forced to go public so as to increase their capital, especially that Gold has found use even in central banks as a means of safeguarding wealth against financial uncertainties (Bancel & Mittoo, 2008, p. 855). The companies, however, do not get sufficient finances for their operations and secure their survival in the future. As such, sufficient liquidity has been seen to be a prerequisite in the equity market for increasing capital, as indicated by the advantages of having a wider shareholder base.

The Decision to Go Public

Going public decision is very critical for businesses through this topic does not get the extensive study it deserves. There are two main theories that attempt to explain why firms decide to offer part of their stock to the public, the Life cycle and Market timing theories. Basically, most researches have been carried out about this question as to when should a company go public, but these studies restrict themselves to the description of the institutional factors of the decision and provide very few remarks on the motivation. The convention wisdom has been that when a firm decides to go public, it is just on its verge of growth, as in Life cycle theory. Though there is some sense in this perception (Bancel & Mittoo, 2008, p. 856). This kind of thinking alone cannot be a good explanation of the patterns that have been observed when listings are being made. Even the capital markets that are considered to be developed like the US and in Canada, big companies are usually not public. In other countries like Italy and Germany in Europe, the companies that are public are few only exceptions and not the order of the day. Even the private companies are much bigger than the public companies in these areas (Bancel & Mittoo, 2008, p. 857). This is, therefore, neither an indication that going public is not a trend for every company nor a rule that eventually all companies follow, rather, it’s a choice.

The decision of listing a company for the initial public offer is a very complicated one, and there is no single theory or description that can be able to conclusively give the explanation. For this reason, there are several theories that have been set apart to help describe the possible reason for going public. There is very little research in terms of empirical conclusions that have been drawn for this. Few studies that are available, like one conducted in Italy, show that companies turn to the initial public offer in order to rebalance their leverage and then for the company owners and managers to be able to liquidate like in market timing theory(Bancel & Mittoo, 2008, p. 863). Generalizing these findings to other countries is the main problem since different settings can have a different impact on the companies that operate within them.

The benefits of IPOs are also the basis for the decision to go public. Basically, the owners usually weigh the advantages of this crucial decision versus the cost or remaining in that same situation.

Recognition: research has shown that investors can only get a chance to invest in the companies that they are familiar with. Therefore when a company is more recognized, then its reputation and credibility also increase. Many of the companies that have sought to elevate their prestige have often done so by increasing their shareholder base. This is by IPO listing, and this is a trend commonly observed in Gold Ming firms across the globe. In such a case, the decision to go public then becomes a strategy for the firm to increase the first-mover benefit in the marketplace by increasing its credibility, visibility and reputation eventually. The argument behind this hypothesis is that the higher disclosure needs for listing at the stock exchange and the public exposure to auditing boost the confidence and expectation of the potential investors, clients, suppliers and creditors. Nonetheless, the firm incurs expenses during the processes of disclosure since very sensitive information about the company has to be produced. This could be very useful for the competitors, particularly those industries that are experiencing very fast technologic change.

More financing– this is perhaps the most obvious reason that companies can base on when going public decision is to be made. New capital to the firm for growth is essential because, through this, the company can acquire other businesses to help it increase its client base and scope of operations. Very reputable companies in a thriving business like gold can attract a lot of investors and raise very large sums of money. For instance, Barrick Gold shares are over 44.10 US dollars, AngloGold sells its shares at $ 42, NEWMONT shares go for over $59, LIHIG GOLD sells its shares at $3, and the trend is quite varied across the industry, but most companies show that gold mining is a very profitable venture based on the number of shares that are traded.

The money raised is used to leverage the position of the companies. On the other hand, faster growth can be achieved when the capita raised is used for acquisition and merger purposes.

Bargaining Power: when a firm goes public, research has evidence that its financial flexibility is increased, and this, therefore, increases the companies bargaining power. Bankers and other financial creditors then increase their confidence in the company, and the cost of credit is reduced. Companies in Italy were found to reduce their percentage credit points by 0.30 upon offering their IPOs. Sometimes when the company is growing very fast, the business tends to become very risky. Dealing is gold is one such business that is very delicate. The owners of the companies, therefore, tend to start relying on external finances for funding these investments instead of using their own resources. The argument is that the IPO would allow the company to increase its financial flexibility by attaining more resources for expansion. Financial flexibility is regarded by business managers as the most significant factor in determining the debt policy of a company.

Exit Strategy: the going public decision could be part of the initial laid down strategy by the company’s initial owners. According to studies about IPOs across Europe, the market is usually very competitive when it comes to shareholding, but corporate control is not. Therefore introducing IPO is the first step of the strategy by the owners to maximize the profits from the company as part of the cash flow is given up and the rights of ownership relinquished later. IPO is a means of ensuring that the company in question achieves a liquid secondary market for the shares of the company to allow the owners to sell their shares at different levels by enhancing the value of the company and its liquidity.

Monitoring: IPO model considers monitoring from external parties as a cost while others this is a great benefit. There are several theories that indicate the company’s dedication to meet regulatory and disclosure needs of stock exchange increased levels of transparency. Agency costs are reduced between the managers and the bigger percentage of the shareholders. The stock market and the regulations will be a managerial discipline source for the company as it creates the risk of hostile takeover since the market analyses expose decisions by the management. Furthermore, the shareholder will have the right to access the information of the company, whether stock prices of the design of operation or other operations.

Window of Opportunity: according to this hypothesis, it’s argued that managers can use their privilege of accessing company information to make very critical decisions concerning when to bring about the IPO. This is an opportunistic way of taking advantage of the favourable market and attracting the best stock prices. This is the time when the prices in the industry are mispriced. Firms that can realize the overvaluation of their competitors have the incentive of making the decision to go public.

IPO Performance

Just like the underpricing, the occurrence of long-run stock return has also been recorded as a consisted element of the initial public offers in many Mining companies thou some empirical researches. One such explanation was postulated by Miler (1997), suggesting that, during the time when an IPO is being evaluated, the prices of the share are usually set by very enthusiastic and optimistic investors. However, more information gets to be known about the venture as time goes by. The market variance of their prospective prices starts to reduce the stocks price. In another related explanation, researchers have shown that the underwriters offer aftermarket price support to maintain all the initial return maximum, and once it is withdrawn, there is the adjustment of the stock prices to the essential market values.

Most of the Gold mining firms have shown a preference for issuing their share at the peak of their business when the performance is optimal, and profits are maximal. During this time, they are likely to be overvalued by the stock markets, hence over time, their operating performance decreases, and the prices of their shares also fall (Bancel & Mittoo, 2008, p. 862).

A study carried out across Europe, Asia, and Africa show that from 1990 to 2004 there was a positive performance in many of the Gold companies including, HARMONY GOLD, Zimplats GOLD FIELDS, AngloGold, BARRICK GOLD, POLYUS MINING, WITS GOLD, NEWMONT, NEWCREST, BHP BILLITON and SEABRIDGE GOLD LIHIR GOLD. However, during the period from 2007 through to 2009, the performance was very poor because of probably the economic crisis that the world when through in 2008. Backtracking on when some of the Gold companies listed on the stock exchange performed when they launched their IPOs, it is quite evident that they underperformed the comparable firms which were in private business or had gone public three years earlier. The pre-IPO characteristics are very varied in their power to offer a prudent explanation of the long-run returns, and the connection that exists between under-pricing and the poor performance of Mining firms, in the long run, has not been ascertained for sure. The underperformance, in the long run, can be attributed to the three reasons that; first, the information impetus results in or it’s in itself the short-run ‘twist’ in the demand curve that turns around as soon as the prices go back to the usual fundamental values. Second, they refer to the insiders betraying their positions and far-reaching fall of demand and price. Third, as alluded to in previous studies, the phenomenon of underpricing in itself is a problem. The consequent loss of prospective proceeds then reduces the long term value of every share.

Behaviour and expectation explanations of the poor performance after IPO describe the condition by use of underpricing models. In this regard, it’s been found that companies fail to put into consideration the expenses on legal processes during evaluation. The underwriters, on the other hand, have been accused of artificially maintaining the prices of the initial offer very high, and when they withdraw the support, the prices begin adjusting downwards to the actual.

Poor long-run performance is also closely related to the original owners of the company. Research has shown that there is a strong correlation between the post IPO company performance and the retention of equity by the original owners of the company. Still, mismeasurement can result in underperformance. This is either a result of failing to properly control the risks involved because of the problems related to the measurement of the returns over long horizons. Wrong benchmark choices can also end up in poor performance.

IPO Valuation

There are two major methods of IPO valuations, the Comparable multiples, which basically mean that prices will be compared to the other companies in the market. There is also the discounted cash flow which deals with profitability and equity through its quite imprecise (Dimovski & Brooks, 2008, p. 3).

Comparable companies’ method is when an IPO is a price in comparison to the financial and operational activities of other companies in the same business. The decision to price is based on the analyses of the market price rates, and some important adjustments are made to meet the company-specific dissimilarities, and the minimum and maximum price offers are determined. After this, the current information about the IPO market is collected, and from this, a final offer on the price to be implemented is made (Dimovski & Brooks, 2008, p. 4). Comparable multiples have several types, which include Price/earning, Enterprise value to EBIT, Price to Revenue and the Market to Book multiples.

Comparable Multiples

P/E Multiple

When the company is carrying out an IPO valuation for a takeover, then its valuation is done as follows:

Firm’s Value = Ave Transaction P/E multiple X Company’s EPS

Where EPS = Earning per Share

P/E = Price/Earning Multiple

The average transition multiple is in the above care, which is the initial IPO describes the average multiple of the current dealings.

When the IPO valuation is being carried out purposively to estimate the value of the company, the formula of the valuation will be

Company Value = Industry’s Ave. P/E Multiple X EPS of the company

Where EPS = Earning per Share

This method is especially useful when the companies in the Gold industry are very profitable, during the time when business is booming. It’s also specially used in the industry when the companies as experiencing a similar trend of growth, for instance, companies at a mature stage. The method is also beneficial in companies that have comparable capitals structure (Dimovski & Brooks, 2008, p. 5).

Price to Book

This approach is similarly applied to the P/E method. Considering that the book value of equity is, in essence, the worth of the invested equity capital in the company, the approach quantifies the market value of every unit (for instance, every dollar) of the invested equity. This approach is basically used for firms that are in the manufacturing sector, and their capital requirements are so large. Companies that are not in some technical default can use this method as they will not have that negative book value in terms of equity (Dimovski & Brooks 2008, p. 4).

Value to EBITDA

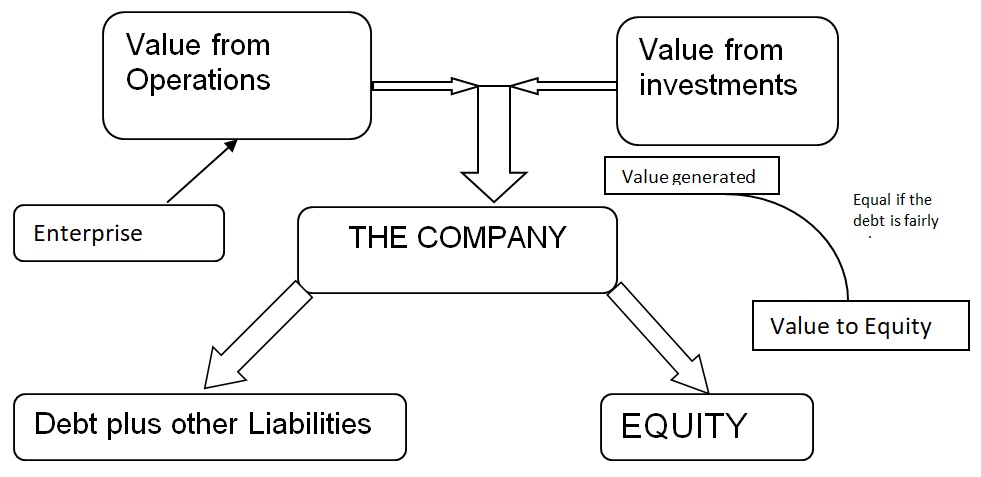

This approach entails the measurement of the enterprise value, which is the worth of the business dealings and not the use of equity value as other approaches have done. When carrying out the calculations of the enterprise value, the only factor included in the value of operation of the business. Investment activities values like treasury bills purchases or investing in bonds or at the stock exchange of other firms are included. The notion behind the enterprise value is clarified as below.

Table 1: Enterprise Value.

Enterprise Value – $ 1500

DCF Approaches

This has become the basic method of doing the IPO valuation in the mining industry for the companies in the mid-stage of their life cycle. This is the range from the late-stage mining to the last stage of processing mine (Dimovski & Brooks 2008, p. 13). It is, therefore, the most appropriate method to be used in the valuation of the Gold Ming companies. This process is just like the discounted cash flow that is usually used in capital budgeting. There is an estimation of the expected cash flows with consideration of the synergy observed in a takeover. The discount is at the most suitable cost of the capital.

The starting information includes the companies cost of debt-equity, Cash flow and the targeted debt ratio.

Table 2: Free Cash Flow Template.

The purpose of the above template is the estimation of the cash flows and not the company profits. There are three parts of the template, i.e., income statement, adjusted noncash items for tax calculations and adjusted capital items like salvage and working capital (Dimovski & Brooks, 2008, p. 13). Interest is not included in the income statement as this is the cost of debt, and it’s included in the cost of capital and placing it in cash flow will make it double count. There are two kinds of capital involved in the template.

- Fixed capital (also referred to as Capital expenditure, property, plant and equipment)

- Working capital.

Taxable income = Revenue – Costs – Depreciation + Profit (asset sold)

NOPAT = Taxable income – Tax

Free Cash Flow = Operating Cash Flow – Change In Working Capital – Capital Expenditure + Salvage Of Equipment – Opportunity Of Land + Salvage Of Land

Adjusting noncash items:

- Add the earlier subtracted noncash items and subtract earlier added noncash items

- The cost of debt is estimated from the yielded maturity of the debt

Value of Equity = the Enterprise Value + Cash on Investment – Debt – other Liabilities

Mining IPOs Characteristics

The Ming industry has more or less the same characteristics just like other industries but with some little differences because of the nature of the products that they deal in. the differences come in the number of underwriters, quality of these underwriters and the offered size (Janice, 2000, p. 4). These are the characteristics of signal mining, especially Gold mining, as a very superior industry in a given initial offering.

Offer size: research has shown that larger companies’ thrift IPOs have a greater probability of being purchased, and they are able to more willingly absorb the expenses that are linked to the conversion of the company into public ownership. Large mining companies can take advantage of the economies of scale and range of dealings and hence make minimal payments when issuing equity. The mining companies can also use the benefit of being very large to increase the prices of their product since their deal directly with exploration (Dimovski & Brooks, 2008, p. 13). Thus, the initial offer, in this case, will be as a result of the better performance of the company. And the probability of this is related to the possibility of initiating dividends in the future and to the likelihood of a company becoming a target for acquisition.

The reputation of the underwriters: mining industry has the most strategic plans as compared to other production industries. For this reason, IPO Company CFOs pick on underwriters based on their general repute. The underwriters’ reputation in this question influences the IPO performance in the thriving equity markets. Specifically, Ming as an industry has been characterized by believing that reputable underwriters offer IPOs that are less risky and hence experience lower returns on the market (Janice, 2000, p. 6). In the same regard, the IPO reputation of these underwriters positively correlates with the company’s post IPO performance. The probability of paying dividends and also being targeted by investors increases for such companies.

A number of underwriters – larger offerings usually comes from large organizations. Large syndicates could also be an outcome of bigger degrees of risk, especially mining of precious metals that are inherent to the offering. Hence underwriters tend to reduce their own exposure to risk by offering an opportunity to other investors to take part in the offering. In the same line, the more the number of underwriters, the poorly the company performed in post-IPO. This means it becomes a target for acquisition (Dimovski & Brooks, 2008, p. 13).

Leverage: the company experienced the lowest leverage on the IPO stocks than the comparable companies during the year of the IPO and also the subsequent two years (Janice 2000, p. 6). This conclusion was found to be true whether measured as a ratio of the long term debt to the company assets or to market value. The IPO proceeds itself causes a considerable decrease in the leverage. Furthermore, since the firms that offer IPOs usually in the middle stage of development or life cycle, they experience less collateral and could therefore be characterized by low best possible leverage proportion.

The liquidity of a company is affected by the process of price stabilization that the underwriters undertake in a very short span of time following the offering. If the price of the stock in the secondary market decreases below the price of the initial offer, the lean manager usually calls the members to help in stabilizing the trade prices. The company with therefore face penalty bids or overallotment options, and this creates aftermarket liquidity (Zalkieva 2005, p. 34). This, therefore, implies that underwriters encourage demand via short cover in addition to the overallotment alternative.

Prior debt: The value of a firm going public during the best performance period is very different from the companies that offer their share to the public when the demand for IPOs is very low. When companies get into debt, they expose themselves to scrutiny by external parties (Zalkieva, 2005, p. 34). This increases the number of secrets and other information that is availed to the competitors and potential investors. Their cost of going public may be reduced. The companies secrets are exposed to competition. When there is prior debt, especially the rated ones, underpricing and information asymmetry is reduced (Janice, 2000, p. 14).

Reference List

Bancel, F & Mittoo, U.R. 2008.Why European Firms Go Public. European Financial Management, Vol. 15, Issue 4, pp. 844-884.

Dimovski, W & Brooks, R. 2008.The Under-pricing of Gold Mining Initial Public Offerings. Research in International Business and Finance, Vol. 22, Issue 1, pp 2-16.

Janice, C.Y. 2000.Initial and Long-Run Performance of Mining IPOs in Australia. Australian Journal of Management,. Vol.5, pp. 2-23.

Zalkieva, S. 2005.Under-pricing and long-Run Performance of Energy Initial Public Offer in the US market 2000-2005. Cass Business School. Vol.5, pp. 20 45.