Executive Summary

The purpose of this paper is to develop an international marketing plan for Emaar Properties since the company would enter a foreign market (preferably London, England) in order to expand its business operations within the British territories. As a result, this research first prepares a brief overview of the company, outlines its main products and services, selects the target country, delineates the main target markets, and formulates the primary entry strategy; in addition, in order to understand the entire study adequately, the paper precisely clarifies the research methodology, situational analysis, and company analysis.

Moreover, to make sure that the marketing plan is aptly carried out, the paper assesses the organization’s assets and skills, conducts market analysis and business environment analysis, defines the political/ legal/ institutional environments, evaluates the present and anticipated regulatory environment, and reviews the conditions and trends of the economic environment and social and cultural environment. In order to identify the key trends of the prospective market, the paper assesses its demographic environment, the scenario of the technological environment, the natural conditions, effects of seasonal or climatic factors, and physical environment (that is infrastructural indicators).

Subsequently, in order to understand the consumer behavior, this paper analyses the nature, size, and extent of the demand; additionally, it examines the product category stages of the product life cycle, the configuration of the industry, the cost structure of the industry, the competitive composition, and SWOT analysis (comprising of internal strengths, weaknesses, external market opportunities, threats, and their implications).

It incorporates a competitor analysis in the country of investment and the key international and marketing objectives of the entry, whilst preparing the recommended marketing strategy, target market identification and segmentation strategy, market positioning, market entry strategy, marketing mix strategies and tactics, product and service branding strategy, place (distribution) strategy, price strategy structure, and promotion strategy (including promotional budget). The paper also plans the entire budgetary requirements, whilst defining the planning assumptions, implementation and control, and formal project plan for implementation of the recommendations.

Introduction

Emaar Properties or Emaar is a Dubai-based company located in the UAE that provides services in commercial and residential property development throughout the world. It was created in 1997; it continues to be one of the major real estate developers in the United Arab Emirates and internationally, with more than 50 subsidiaries functioning internationally. Its flagman projects include Burj Khalifa, the Dubai Mall, the Dubai Fountain in Dubai, HITEC City in Hyderabad, India, the Tuscan Valley in Turkey, etc.

It should be noted that due to its international presence, the company operates in multiple countries, including the UAE, Egypt, India, Pakistan, Saudi Arabia, and other parts of Asia Pacific. Its target markets include citizens and tourists of the middle class, upper-middle-class, and upper-class levels from the Middle East, North America, Europe, North Africa, etc. The new target country of Emaar is England; the company is not yet present in the country but aims to enter the market by presenting its properties to potential target markets.

In 2017, the company opened a showcase for its properties in Dubai at Harrods, London, with hopes to attract more customers and clients to their offers in the relevant territory. It is notable that the target market of Emaar can be divided into several groups: it is travelers ‘who seek a strong lifestyle experience’, young families and Gen-Y travelers in Europe, business travelers, and MICE (meetings, incentives, conferences, and events) tourists interested in new experiences and travel destinations at affordable prices. Therefore, one can assume that the target market is citizens of England, of any age, who are interested in quality leisure at a reasonable price; business travelers are more interested in quality hotels that provide short stays, while young families and Gen-Y travelers are looking for affordable hotels with quality services that allow prolonged stays.

Research Methodology

The research methodology of this paper is a qualitative research that incorporates the following research techniques: web analytics (data gathered from primary and secondary sources was analyzed and applied to the paper’s objectives) and interviews with key informants (employees of the company). Web analytics allowed the researcher to gather and analyze data related to the company, the industry, the company’s target markets, make comparisons to establish the preferred marketing strategy, etc. Interviews with key informants provided the researcher with primary data that was necessary to provide more detailed, relevant recommendations. All interviews were conducted with present or former employees of the company; each of the interviews was conducted via E-Mail correspondence. To view the interview summary, see the Appendix.

Emaar Situational Analysis

Situation analysis shows that the company holds a strong position both in local and foreign markets. Its operating revenues grow each year, and its successful business strategy allows it to attract more customers who prefer to choose Emaar instead of its competitors. Please see the appendix below accordingly for further detailed information.

Company Analysis

Emaar was established by Chairperson Mohammed Alabbar in 1997 with headquarters in the UAE; since then the company has remained to be extremely successful in its industry, and today it has six corporate divisions and sixty dynamic subsidiaries – which operate in more than thirty-six countries globally (especially in America, North Africa, Middle East, Europe, and the Asia Pacific).

Organization’s Assets and Skills

The company has assembled huge volumes of assets from its global operations; in the table below, it can be seen that throughout last three years, the asset accumulation has increased gradually, reaching its peak in 2016; this shows that the company has sufficient skills to ensure the growth of assets:

Table 1: Assets and skills of Emaar.

Market Analysis

The foreign market suggested the company’s expansion in London in England, UK. This market was chosen for different reasons. First, the company expressed interest in expanding its business to major European cities: “We are looking at key gateway cities. We are looking at London, Rome. In addition, we are looking at cities where opportunities can lie.” Second, it is interested in feeder markets for the Middle East. Third, such a business hub as London includes a large target market that consists of business travelers and travelers with good/high income. The selection criteria were the following:

- The target market is large

- Company expressed interest in the country

- The country/city heavily relies on business

- Real estate market is stable or growing

Business Environment Analysis

A brief glimpse of the business environment analysis for Emaar Properties has been provided in the table below; however, it should be considered in detail in the subsequent sections:

Table 2: Business environment analysis for Emaar Properties.

Political/Legal/Institutional Environments

Although a number of political and institutional instabilities are haunting the UK at present times, from an overall perspective, these are unlikely to hamper the country’s business environment significantly; therefore, the market entry can still become successful.

Regulatory Environment (Present and Anticipated)

The regulatory environment in the UK has remained to be quite strict in comparison with the UAE, and now, due to certain national issues, the UK government has undertaken measures to make it even stricter – and this may create some hassles for Emaar’s entrance in the future.

Economic Environment (Conditions and Trends)

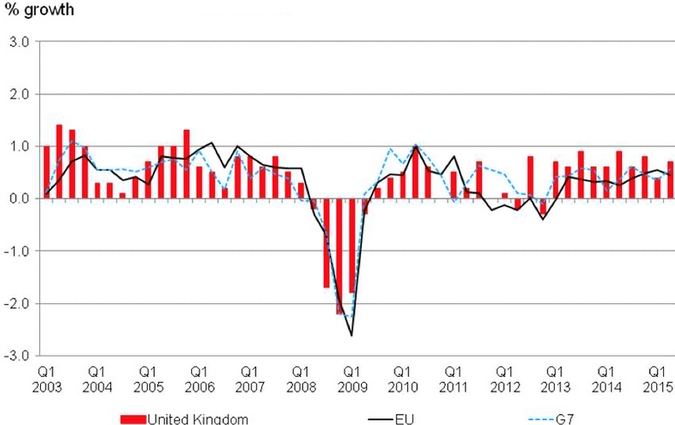

The UK economy seems quite stable since it has recovered from the effects of the global financial downturn; even in the middle of the national unrests, the economy has shown stable growth rates:

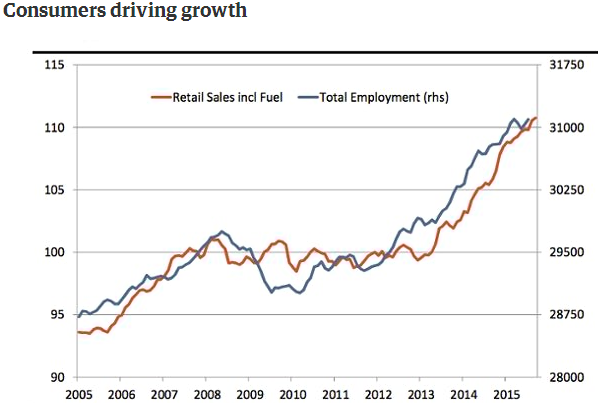

In addition, the British consumers promise a very lucrative market, since the consumer-driven growth has been gradually increasing every year:

Social and Cultural Environment (Factors and Trends)

The UK society is quite liberal and the country’s cultural backdrop welcomes people from different racial backgrounds; moreover, the civilians are generally friendly with foreign businesses and the cultural dissimilarities do not usually affect the overseas companies adversely.

Demographic Environment (Data and Identification of Trends)

The UK has an aging population, which is essential for a property business like Emaar because it is generally the old and the middle-aged individuals who are willing to buy properties; therefore, the demographic environment of the country has been outlined below:

Table 3: Demographic environment of the UK in 2016.

Technological Environment (Factors and Trends)

The technological environment of the country is highly business-friendly, and it is able to offer the latest technical advancements, innovations, IT infrastructures, scientific experts, and other relevant facilitates to Emaar in order to help it in expanding the business. Moreover, various solutions are present through which the country can help this potential market entry to become successful; these can include the integration of cloud computing mechanisms, online payment systems, and so on.

Natural Environment (Effect of Seasonal or Climatic Factors)

The climatic conditions of the UK remain stable throughout the year and there are no chances of any kind of serious business disruptions due to the atmospheric conditions.

Physical Environment (Infrastructure Indicators)

The UK possesses a strong physical environment where both foreign and local businesses can flourish; it has a solid base of infrastructural facilities that can ensure smooth operational activities.

Nature of Demand

The UK consumers conventionally demonstrated a very high demand for the real estate industry; however, following the Brexit actions, the industry has observed a slight fall in consumer demands, mainly due to uncertainties in the market – this can make the market entry a bit tougher for the company.

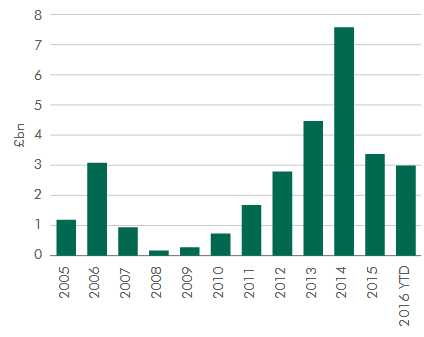

Size and Extent of Demand

Due to the above-mentioned reasons, the size and the extent of the demand in the real estate industry have diminished recently; this is apparent since the investments in the UK’s property sector has lowered significantly in current times in comparison with 2014; this can be noticed from the figure below:

Product Category Stage of Product Life Cycle

The following figure illustrates the product life cycle for Emaar, showing the prospective product category stages in the real estate sector of the UK in the post-market penetration phase:

Structure of the Industry

At this stage of the paper, the structure of the UK’s real estate industry shall be considered in terms of the cost structure and the competitive structure of the industry.

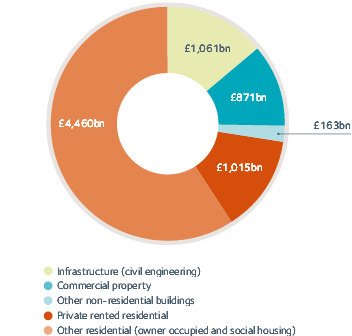

Cost Structure of the Industry

The following figure shows the cost structure of the UK’s real estate industry; it is notable that ‘other residential houses’ (owner-occupied or social housing) has the largest share in the cost structure, whereas infrastructure is the second biggest area of investment and commercial property is the third-largest:

Competitive Structure of the Industry

In the UK, the real estate industry can be described as a highly competitive sector, as a huge number of players tend to control the entire industry, and the threats of new entrants are low as well.

Competitor Analysis in Country of Investment

There are many companies offering real estate and property services in the UK, which, for example, includes CLS Holdings, Emerson Group, West Properties, Galliard Homes, Opal Property Group, Allied London, Balkan Dream Properties, Capital and Centric, and so on; as a result, Emaar must adopt relevant strategies to sustain in this area.

Emaar SWOT Analysis

The SWOT analysis for the company in order to start its operation in the UK has been delineated in the subsections below:

Internal Company Strengths and Weaknesses

Table 4: Internal company strengths and weaknesses.

External Market Opportunities and Threats

Table 5: External market opportunities and threats.

Implications of SWOT Analysis

From the above SWOT analysis, it can be construed that the company has enough strengths to overcome the possible threats and weaknesses in the British market. Since this new market promises fresh revenues for the company, it is highly likely that it would overcome the risks involved in the market entry process and use its full potential to monetize the opportunities.

Emaar International Objectives

International Objectives

The international objectives of the company should be to further boost its key strengths, particularly, its advanced technologies, financial strengths, fast growth, brand awareness, and quality in order to aggressively compete in the UK market.

Market Objectives

The market objectives of the company should be to persuade the target customers in getting involved in the property trade and make sure that its pricing policies are strong enough to compete with the rivals.

Recommended Emaar Marketing Strategy

The recommended marketing strategies for the market entry of Emaar in the UK are specifically analyzed below:

Target Markets Identification and Segmentation Strategy

The target market should be the high-income earners, who are principally middle-aged or elderly; this is because aged individuals tend to have more money in their hands, and are more likely to invest in the property market – thus, the market would be segmented according to ‘high to low’ income groups, and age demographics.

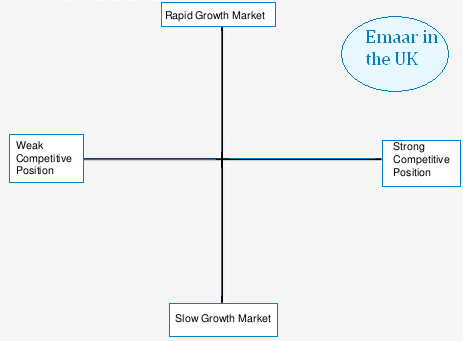

Market Positioning

The following figure shows the market positioning of Emaar in the UK; it suggests that the company would principally focus on high growth markets and strong competitive positions:

Market Entry Strategy

Whilst there are many ways in which the company can make its market entry, it is highly advisable for the company to follow the joint venture strategy, as other entry routes can be highly expensive and risky. If it solely enters the market, the risks would be high, as being a UAE-based business; it is unaware of the UK market. As a result, it is pragmatic to select a stable local real estate company and enter into a joint venture with them, so that the market can be easily accessed at low costs and the expertise of the local business can be used.

Emaar Marketing Mix and Tactics

The key marketing mix strategies and tactics are considered below:

Product/Service and Branding Strategy

The company would offer its existing range of services in the UK, but try to focus more on creating brand awareness amongst the public by using brand promotional strategies over a longer period.

Place (Distribution) Strategy

As the company plans to enter the market by the joint venture, it would try to keep the costs lower and make sure that it uses the existing distribution strategy of its partner company – since they have better knowhow of the market, this should be appreciated.

Price Strategy Structure

Emaar would be using highly competitive pricing strategy because there are a huge number of competitors in the market who are able to offer lower prices; in fact, in the second year of its operations, the company would provide regular discounts in order to attract the customers and create a loyal customer base.

Promotion Strategy (Including Promotional Budget)

Table 6: Promotion strategy of Emaar.

Table 7: Promotional budget for Emaar.

Emaar Budget Planning

Table 8: Budgetary Planning for 2017 and 2018.

Planning Assumptions

The above budgetary plan assumes that the market conditions and the economy of the United Kingdom would remain stable throughout these two years and other external factors would not adversely influence the revenues generated from the market.

Implementation and Control

The company would closely observe the implementation and controlling phase of the project in order to make sure that Emaar is able to penetrate the British property market promptly and successfully.

Formal Project Plan for Implementation of Recommendations

The formal project plan for the apt implementation of the key recommendations includes the following:

Table 9: Project plan for implementation of the recommendations.

Appendices

Situation Analysis

Table 10: Situation analysis for Emaar Properties.

SWOT Analysis

Table 11: SWOT analysis.

Evaluation of Alternative Marketing Strategies

Table 12: Evaluation of alternative marketing strategies for Emaar Properties.

Company Promotional/Product Brochures

The promotional or product brochures of the company shall be renovated and enhanced before making the market entry in the UK so that the customers can be persuaded in getting involved with the business.

Tariff Rates

There are no fixed tariff rates imposed by the UK government over foreign companies, and the rates regularly vary in each quarter.

Summary Table of Interviews

It should be noted that the participants of the interviews preferred to remain anonymous and asked to change their names if it was possible.

Table 13: Summary table of interviews.

Record of Contact and Activities, and Project Plan

The interviewees remained reluctant in permitting to disclose the records of the contact activities, and so these records shall be stored safely in order to respect the data protection act. However, the entire project plan has been precisely described in the main marketing plan above.