Company Vision; Mission; Guiding Principles

Vision:

- A world of understanding and care.

Mission:

- To deliver distinctive experiences for our guest.

Guiding Principles:

- Respect.

- Integrity.

- Humility.

- Empathy.

- Fun.

As depicted above, Hyatt Hotels’ vision and vision statements and guiding principles provide a strong basis for the corporation’s outstanding performance as one of the multinational chains of hotels with well-established brands in the world. The company has experienced rapid growth and success to become one of the models of excellence in the high-end hotels and resorts niche. The company’s vision statement aligns with Hyatt Hotels’ strong commitment to deriving guest and customer personalization. Particularly, the vision statement underscores the corporation’s aim of fostering “direct relationships with our guests by engaging with them in more direct ways, such as direct booking, communication, digital engagement, and on-property interactions” (Hyatt Hotels, 2019, p. 7). Furthermore, the vision statement reflects how the chain-branded hotels and resorts conduct themselves and their business in the various markets and communities in which they operate and serve.

One of the company’s functional strategy for enhancing the company’s brand recognition and reputation is their global corporate social responsibility (CSR) program. The CSR initiative allows Hyatt Hotels to get involved with and volunteer in the local communities they serve and support grassroots organizations that work to improve living standards in the communities they operate (Hyatt Hotels, 2019). Moreover, the multinational is strongly dedicated to environmental protection and conservation through its efforts of reducing waste and carbon footprint. Such commitments are reflected in the company’s vision and guiding values as they seek to make the communities in which their company-managed and franchised properties operate to be place where the company, its guests and visitors, and the local communities would aspire to live, visit, or invest.

Similarly, Hyatt Hotels’ mission and corporate values supports the company’s strong brand, which is one of the vital business strengths and points of differentiation identified in the SWOT, Porter’s Five Forces, and value chain analyses of the corporation. Particularly, the mission statement suggests that the company is committed to delivering distinctive experiences for their guests and customers (Hyatt Hotels, 2019). The Term “distinctive experiences” encompasses not just the rooms and physical amenities, but also the intangible services delivered to their clients. The mission statement aligns with the firm’s commitment to providing quality products and services which differentiates Hyatt Hotels from competition.

Besides that, the guiding principles, particularly respect, integrity, humility, and empathy are major drivers of customer and employee satisfaction and loyalty to Hyatt Hotels. The management teams at every managed asset are exemplary in their leadership approach. Managers are empowered by giving them the authority to make decisions and shape their respective areas of work. This tactic motivates them to perform to the best of their ability and maintain high business standards. High points of client satisfaction enhance guest inclination to the Hyatt brand which eventually strengthens the revenue base in the long run.

However, there are some areas in the vision and mission statements that need improvement. Most importantly, the company’s mission should be structured to reflect the types of products and services they offer, as well as their target market segments. In addition, the mission should incorporate some information about their employees to make the mission statement easier to embrace and put it into practice in day-to-day operations. The vision statement provides a clear picture of where the multinational strives to achieve. It is also abstract and inspiring to existing employees and customers as well as prospects. However, the vision is brief and provides a general picture of the company’s future direction. In this regard, the vision statement should be adjusted by adding more details to clearly articulate the firm’s strategic direction and the desired future state.

External Environment Evaluation

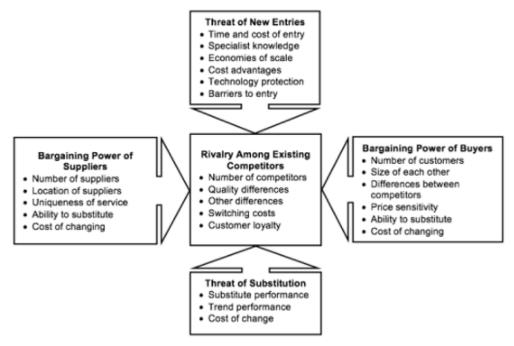

Threat of New Entry

As depicted in Appendix C, Hyatt Hotels’ position in the global high-end hotels and resorts market can be affected by the ability of new firms to enter this niche. Drawing on an case study of Airbnb, Nurlansa and Jati (2016), argue that the threats of new entrants show how the new rivals in the market create a threat to the current market players. Generally, the profitable industry with low barriers to entry in the market lures more competitors and as such, a high threat of the new entrants. Hyatt Hotels Inc. faces limited threats of new entrants due to various factors.

Potential entrants require substantial capital and resource investment to establish in the hotels and resorts industry. The need for heavy capital and resource investment may also be more since Hyatt has high product differentiation and offers a unique experience that meets the demands of customers.

Furthermore, the threat of new entrants is low due to challenges that may result from the current regulatory framework that create various challenges to the companies intending to make an entry in the hotel industry. Businesses in the hospitality sector are subject to several legal policies and procedures regarding employment relations, occupational safety and health, environmental protection, and taxation. Compliance with some of these stringent legal requirements can be costly and time-consuming, consequently discouraging potential entrants. Hyatt Hotel also faces low threats of entrants due to the existing loyal customer base that increases the cost for consumers switching between the brands.

However, the threat of entrant can be heightened by new policies that support the entry of new players. Nevertheless, Hyatt Hotels have enhanced intervention measures to limit the threats. For instance, strong brand loyalty resulting from outstanding customer experiences raises the psychological switching costs, which in turn, weakens the threat of entry. The company can promote its brand through increasing investment in research and development. The strategy would increase the dynamism of the market and keep defining operational standards. New firms would face difficulties joining such dynamic markets. Moreover, enhancing innovation to produce new products and services can be helpful. New customers can find a reason to use Hyatt’s products while existing customers would have a reason to become loyal to the brand.

Power of Suppliers

The bargaining power of suppliers describes the pressure that merchants put on business organizations. Suppliers employ various approaches to negotiate for better terms, including decreasing the product availability, reducing the quality, or raising the prices (Cho et al., 2019). The majority of the firms in the hotel industry purchases raw materials from various distributors. Suppliers who dominate the market can reduce the profitability of the company by hiking costs of their offerings. Strong supplier bargaining power is detrimental to a firm’s profitability because merchants have more influence when negotiating the price of their supplies.

The Hyatt Hotel experiences high bargaining power of suppliers due to various factors. Most importantly, the high concentration of hotels and resorts in certain markets in the Europe and America compared to the number of suppliers boosts suppliers’ bargaining power. The high demand for merchants’ products improves the supplier’s competitive position against the Hyatt Hotel. On the other hand, Hyatt is likely to have faced a low bargaining power of suppliers if the concentration of the suppliers is low, with low product differentiation.

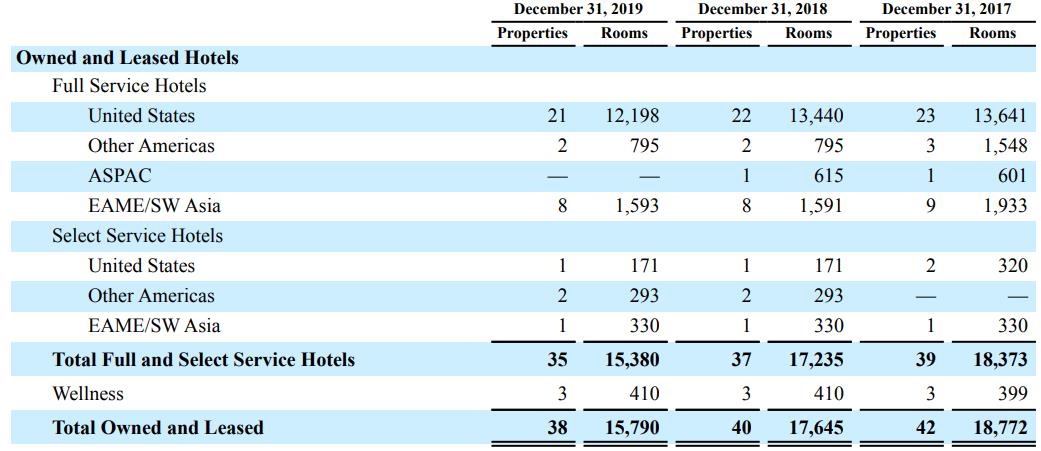

Hyatt Hotels can limit the bargaining strength of the suppliers by avoiding reliance on selected sellers. In addition to that, the firm has created a lasting contractual relationship with providers from various regions which reduce the supplier bargaining power besides enhancing the source chain efficacy. It has developed an effective supply chain with various suppliers. As demonstrated in Appendix B, the business has a diversified product line which creates more options for raw materials in case of price increase of others. These tactics enable the corporation to exercise more influence when negotiating with suppliers.

Power of Customers

The bargaining power of purchasers reveals the force that consumers put on the business companies to acquire high-quality products at reasonable prices with efficient customer services. The bargaining power of customers directly affects the potential of Hyatt Hotels to meet its operational goals. The strong bargaining power of purchasers reduces profitability and triggers competitiveness in the industry. A highly concentrated consumer base increases the bargaining power of buyers (Varelas & Georgopoulos, 2017).

Low costs of switching between brands would also give power to the buyers. Hyatt Hotels faces medium bargaining power of customers due to several reasons. First, the company has diversified its consumer base through the introduction of new products that target new market fragments. In addition to that, it has developed loyalty through an excellent customer experience that makes it costly to switch from the brand and hence attaining a superior competitive position.

Threat of Substitutes

Hyatt Hotels face a high threat of substitute products and services. Consistent with Porter’s five forces framework, the high threats from substitutes indicate that the consumers can utilize alternative products and services from other players to satisfy their demands (Varelas & Georgopoulos, 2017). The threat from substitute products is high because cheaper alternatives reduce the cost of switching from one brand to substitute products. Potential substitutes include small accommodation establishments that are owned and operated independently in local markets firms offering web-based booking and other travel services, rental apartments, and properties for short stays (Hyatt Hotels, 2019).

However, the Hyatt has reduced the threat in various ways. The firm has emphasized the products and services it offers as superior to the available substitutes. Moreover, the corporation also offers a better experience and value for money to consumers. The Hyatt Hotel Corporation has developed a strong customer base loyalty which has increased the switching expense of customers.

Intensity of Rivalry

The intensity of rivalry among the existing players indicates the number of competitors that provide tough rivalry to the Hyatt. High contention indicates intense pressure from competing companies which can potentially reduce the growth ability of the business (Varelas & Georgopoulos, 2017). Rivalry among the existing players is high due to the high concentration of competitors in some markets, especially those that are highly saturated, such as North America and Europe. The presence of highly differentiated products with each player having its target segment would also imply low competition.

Furthermore, intense rivalry can be explained by the fact that many hotels and resorts target the same market segment and offer undifferentiated products. In agreement with Richard (2017), the high presence of competitors contributes to disloyal customers who find it easier and cheaper to shift from one brand to another. Hyatt Hotels employ robust marketing and other aggressive to lessen market competition. It focuses more on offering products and services that match the unique needs and demands of their segments, consequently building brand awareness and loyalty.

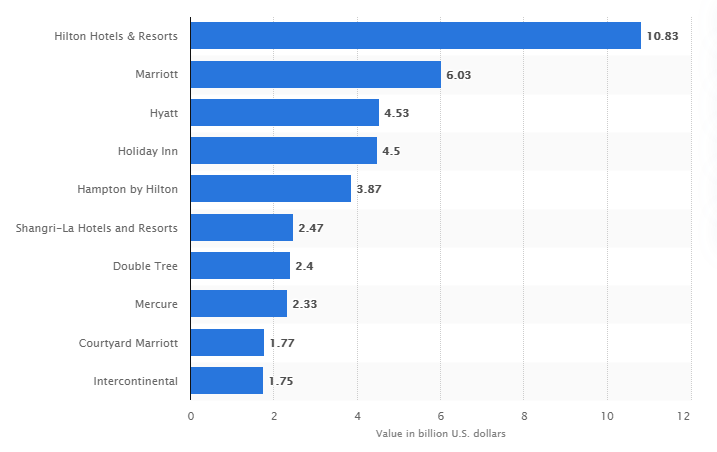

Identification of Differentiators

Hyatt Hotels has a number of notable competitive advantages that are well-aligned with its mission of delivering distinctive guest experiences, driving market growth, and creating value for their clients. The first and major source of distinction and source of competitive advantage of Hyatt Hotels is their world class brands. According to the multinational, its reputable corporate image is relatable to their deep understanding of the unique needs of their target market (Hyatt Hotels, 2020). The strong global suite of distinct brand explains why the corporation was ranked third among the leading hotel brands based on brand value worldwide in 2020 (Lock, 2020).

However, as illustrated in Appendix E, Hyatt Hotels compare poorly among the top three leading brands. For instance, the value of Hilton doubled that of Hyatt Hotels at 20.83 and 4.53 U.S. billion dollars, respectively (Lock, 2020). Hyatt Hotels trail behind Marriott by over 2 U.S. billion dollars. Nevertheless, being among the top three most valuable brands generates competitive advantages in terms of positive influence on consumers’ purchase behaviour (Ryan & Casidy, 2018). The company maintains existing customers and attract prospects by projecting its strong brand.

Second, a compelling growth potential distinguishes Hyatt Hotels from its competitors. The corporation leverages its aggressive market growth strategies, particularly franchising, licensing, and acquisitions, to increase its presence both in the domestic market and globally (Hyatt Hotels, 2019). These tactics support the corporation’s objective of enhancing its global presence, especially in key urban centers. The company entered 281 new markets between 2009 and 2019 (Hyatt Hotels, 2019).

Appendix F shows the corporation’s global presence, which includes all continents on the earth (Ollila, 2019). In addition, the multinational corporation focuses on gaining strategic partners to heighten its global presence. This strategy is evidenced by the partnerships with American Airlines and Lindblad Expeditions, which bolstered its presence in strategic locations, such as near airports and busy urban centers. By the end of December 2020, Hyatt Hotels’ property portfolio had accumulated 975 hotels and 235,272 rooms (Hyatt Hotels, 2020). The ability to gain greater market share in most populous urban centers and selectively pursue new growth opportunities in new emerging markets with limited rivalry contribute to the company’s competitiveness.

Third, Hyatt Hotels have one of the strongest capital bases and most disciplined financial attitude to doing business. The financial approach focuses on maintaining apt levels of financial leverage, which helps the company to adapt to all seasons and downturns. However, the COVID-19 pandemic proved detrimental to the corporation’s earnings and cash flow from hotel and resort operations.

By the end of December 2020, the company reported a borrowing capacity of$1.5 billion, with $1.9 billion in cash and cash equivalents and short-term investments (Hyatt Hotels, 2020). Despite the devastating consequences of the pandemic and other industry cycles, the corporation remains a firm financial position to exploit strategic opportunities to grow their business and increase its global market share.

Another important differentiator is the presence in strategic locations worldwide. The corporation remains focused on its mission of scaling up its presence in key urban centers worldwide. By the end of December 2020, the multinational had operations in major cities, such as New York, London, Paris, Miami, and Zurich (Hyatt Hotels, 2020). The strong focus on these strategic locations is reinforced by rapid expansion into new emerging markets with a low concentration of competitors, including China, Hong Kong, India, Singapore, and South Africa. This aggressive growth strategy is supported by the company’s diverse exposure to operating, managing, franchising, owning, and developing hotels and resorts around the world.

Lastly, Hyatt Hotels’ outstanding talent and experienced management teams make the company compete fairly in the hotel market. As reported in the 2020 annual report, “The Hyatt family is united by shared values, a single purpose, and a deep commitment to listening, understanding, and personalizing experiences for our guests and customers” (Hyatt Hotels, 2020, p. 5). These strong values contribute substantially to employee and customer loyalty, consequently differentiating the Hyatt brand from the competition. Having an excellent customer service staff and advanced technology are particularly important in driving customer experiences and business value in the hotel industry (Bilgihan et al., 2016). Therefore, the skilful and competent personnel differentiate Hyatt Hotels from rival brands such as Marriott and Hilton.

Analysis of Internal Environment

Strengths

Appendix D illustrates several strengths that help the corporation prosper in the marketplace. According to Arif and Hossin (2016), Hyatt Hotels have experienced consistent success since its establishment. It has a history of implementing effective business strategies focused on product differentiation and rapid growth through franchising and targeted marketing (Hyatt Hotels, 2019). Such business approaches have increased the consumer demand for Hyatt assets.

Furthermore, the multinational company is dedicated to fostering workplace diversity and inclusion. The organization provides multicultural-based training which has significantly enhanced employee morale, engagement, performance, and retention. Every manager also swaps from one country to another to attain a multicultural experience. Insights and support from diversely knowledgeable managers enhance achievement of strategic business goals such as product development, customer service, and market growth.

Another major source of competitive advantage of the company is the strategic locations of its properties. As illustrated in Appendix G, the multinational has located its properties in strategic places, including major towns and airports such as Los Angeles Airport and San Francisco airport. A majority of the full-service hotels are situated in major destinations, such as Los Angeles, London, New York, Miami, Seoul, and Zurich (Hyatt Hotels, 2019). These strategic geographic locations expose the company to a large pool of potential clients.

Furthermore, the company has established a strong brand portfolio and global recognition. Hyatt Hotels has gained global reputation due to its tradition of providing unmatched products and services. The hotel has numerous hotels in various parts of the world and as such as well popular hotel chain. The well-established brand shelters a large range of product lines consisting of full-service accommodation, select-service lodging, extended stay lodging, and all-inclusive resorts that are appropriate to different needs of the customers (Yue & Sue, 2018).

Excellence in both product and service quality reduces the risk by a high margin with a relatively lower value of beta. The brand has persistently received top ranking awards and credits for its effective administration and services. The multinational firm has been rated high by private productions and reviews such as Travel and Leisure, Forbes, AAA, and J.D (Hyatt Hotels, 2019). These positive evaluations heighten its brand awareness and loyalty.

Moreover, Hyatt Hotels has attained a relatively large consumer base. The company has special types of provisions that ensure a high retention rate of its customers. The employees handle customers with high priority, which promotes loyalty from the existing client’s while also attracting prospective consumers. Establishing customer relationship management section is an essential factor in ensuring consumer satisfaction.

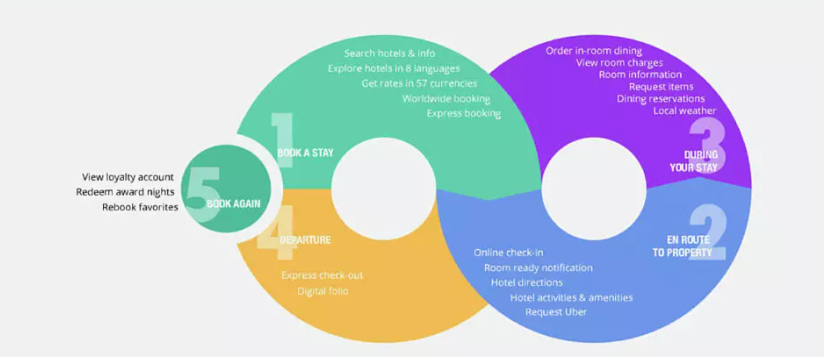

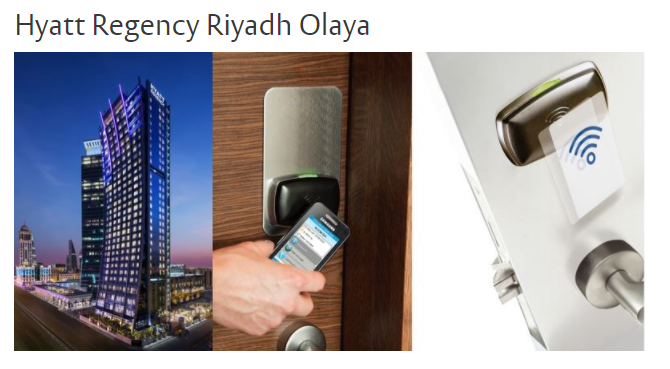

Another factor that defines Hyatt Hotels is the company’s industry-leading digital hospitality. The corporation has deployed advanced innovations to enhance customer experience. Particularly, the new World of Hyatt App demonstrates the firm’s commitment to providing excellent customer service. The digital channels and the mobile app have revolutionized customer experience by allowing members to easily view and access all app features and hotel services (Hotel technology News, 2019).

Appendix H provides a clear picture of the wide range of services customers can access using the company’s app, including booking rooms, making reservations for dinner, entering guestrooms and other public spaces, and requesting a taxi (Slalom Build, n.d.). Upgrading their digital ecosystem, including the deployment of new guest-facing apps, enables Hyatt Hotels to compete favourably with leading hotels, such as Radisson Hotel Group and Marriott International, which have also upgraded their digital systems (Hotel technology News, 2019). Overall, these innovations enable Hyatt Hotels to deliver more personalized customer experience, which heighten customer loyalty.

Weaknesses

The company is highly dependent on its line of luxury brands. It fails to introduce economy class brands and hotels make the company lose a big part of the economic benefits. The firm is concentrated in high-end markets, such as London, Los Angeles, Berlin, Rome, and Singapore. The strong presence in such expensive town leads to higher labor and operational costs. Furthermore, these markets experience intense rivalry among competitors, consequently posing a threat to the company profitability and market share. Hyatt Hotels maintain s quality and standard in all the branches globally and as such, any decline in quality and standard in any branch may affect all other branches.

Furthermore, the firm needs to invest more resources in research and design. Constant introduction of improved products services, and technologies will enhance organizational efficiency and earnings as the company expands into new locations. New technological innovation would be appropriate from the integration of processes across the network. The firm also loses numerous opportunities compared to the rivals due to ineffective product demand prediction. The losses in prospects are also due to low investment in research and development (R&D) which ranks lower than the fastest developing market players. Despite the high R&D investment, its brands are facing fierce competition from other leading players in the industry.

Opportunities

The positive economic outlook indicates higher living standards, real income, and expenditure. Particularly there is increasing customer spending following several years of recession, slow economic growth, and the COVID-19 pandemic (Gursoy & Chi, 2020). The corporation can exploit these opportunities to capture new customers and increase its global market share. Furthermore, growing demand for hotels and resorts in emerging markets such as China opens another window for the firm to exploit untapped more potential segments. Furthermore, the stable free cash flow can enable the corporation to invest in adjacent product lines, new technologies, and R&D.

In addition to that, Hyatt Hotels can take advantage of the new free trade agreements to explore and expand into new emerging markets, especially in the Asia Pacific region. Lastly, new trends in hotel and resort consumer behaviour and preference present the corporation with a greater opportunity to increase its market share. The new tastes and preference can open up new markets for the firm.

Hyatt Hotels use capital and borrowing money for meeting its goals effectively. The company has also established a focus on franchising. The background of Hyatt that includes operating business in numerous countries for several years has created a consideration as a specialist in the market due to its smooth operation strategies. A majority of the people currently consider brand name when searching for services and hence, Hyatt has a chance to earn more and serve a larger customer base.

The hotel industry experiences rapid changes in consumer needs and demands. These trends can open up new markets for the firm and thus offering a new opportunity for establishing new revenue channels and diversification into new product types. Hyatt Hotels have an opportunity to enter new emerging markets due to a government agreement that facilitates the opening up of new markets. The organization has adopted new technology levels which, along with the government free trade agreements have been helpful.

Lastly, the company can take advantage of new innovations in digital hospitality to provide a friction-free experience to their guests and customers. Drawing on the case of the World of Hyatt App, for example, the company can explore other guest-facing innovations to stay ahead of competition in the hotel and resort niche. The digital migration demonstrates the company recognized and exploited the opportunity to use mobile devices that are widely used by clients to enhance customer satisfaction, exceed the digital experiences offered by rival brands, and find more operational efficiencies at their hotels and resorts.

By investing more in the digital experience, the corporation can push the boundaries beyond the experience perspective. Similarly, the company can leverage these innovations to learn consumer purchase behaviors. For example, these systems allow the company to capture information about guest preferences, which enable the company to develop product services that meet unique needs and demands of their target segments.

Threats

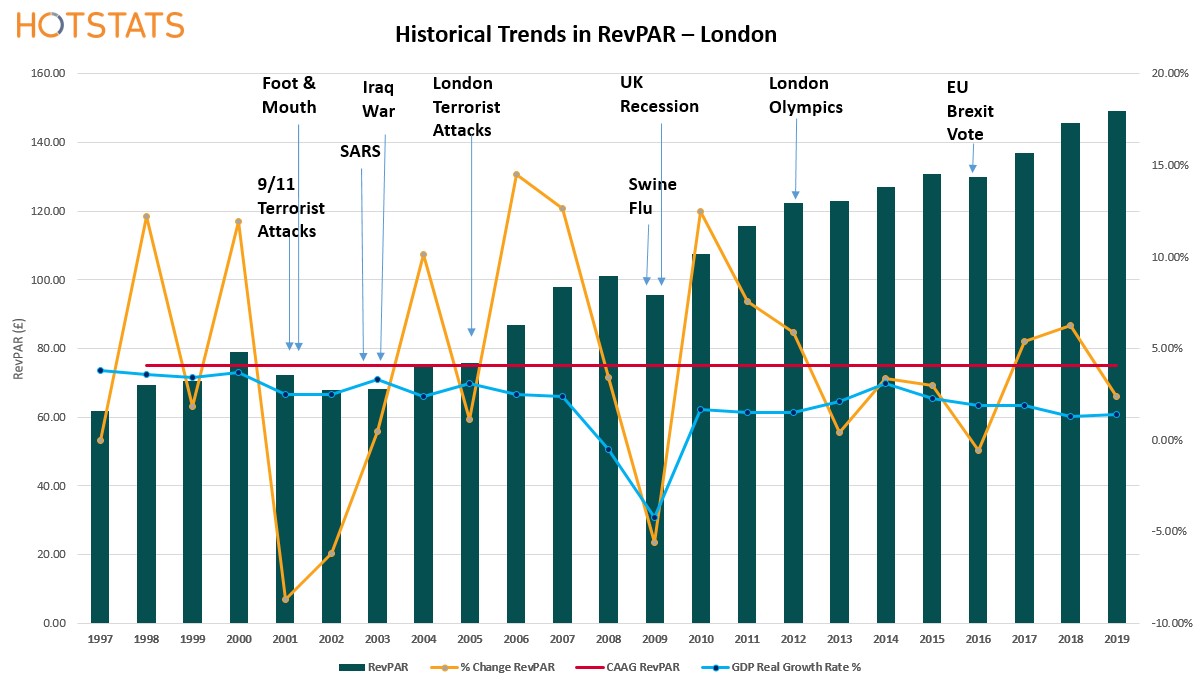

There are several micro and macro factors that threaten Hyatt Hotels’ profitability and growth. Appendix I provides a graphical snapshot of the major threats to the hospitality industry in the last few years. Notably, Hyatt Hotels face the risk of attacks including terrorist attacks. Environmental issues, political instability, economic recession, and technological data theft are also risk factors that could influence the organization. Recent terrorist attacks have mainly targeted hotels and guests and hence taking more attention from the management (Hyatt Hotels, 2020). Hotels, including Hyatt, have shifted more focus on the safety and security of their property and visitors rather than business operations and improvement of services.

The decision by the United Kingdom (UK) withdraw from the European Union (EU) is perhaps the most significant political threat to Hyatt Hotels’ operations. With the uncertainties caused by Brexit, the UK hotel industry has been adversely affected in many ways, including weakening pound and disruption in the move and access to employees from EU nations (Farazad, 2020). The move to exit the Union was a blow to Hyatt Hotels and other hotels and resorts in this market because the UK hospitality industry relies on a substantial number of workers from EU countries.

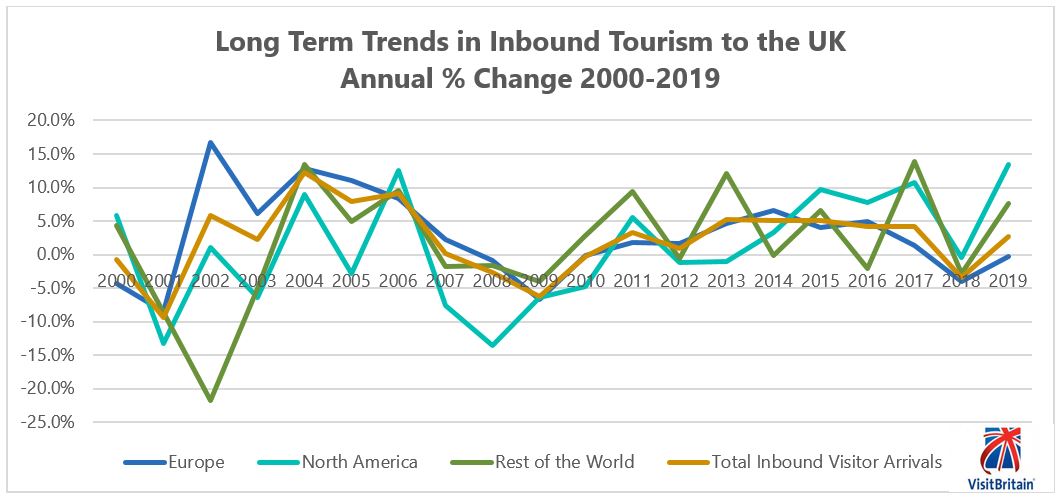

As depicted in Appendix J, new requirements on entering and working in the UK have adverse impacts on UK outbound and inbound travels, which in turn affect hotel occupancy rates (Goldstein & Frank, 2020; Pappas, 2019). Such political issues in future may threaten Hyatt Hotels’ operations and market growth.

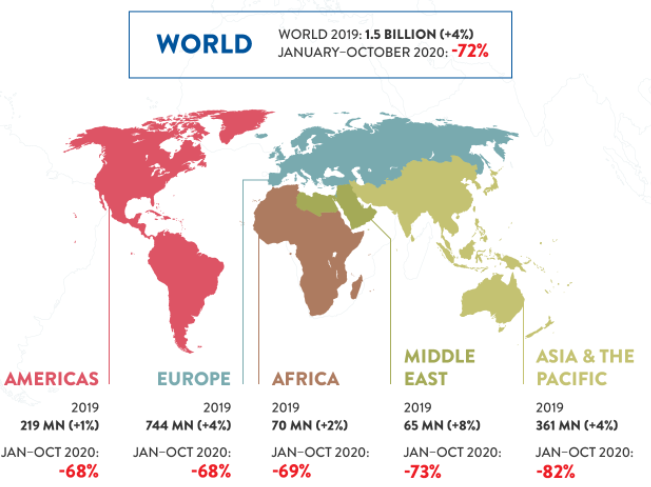

Outbreaks of natural disasters such as the novice coronavirus, are a serious threat to both domestic and international travel. The latest issue of the World Tourism Organization (UNWTO) World Tourism Barometer revealed a 72% drop in international tourist arrivals between the months of January and October 2020 (UNWTO, 2020). This accounts for a 900 million decline in international tourist arrivals during the study period (UNWTO, 2020).

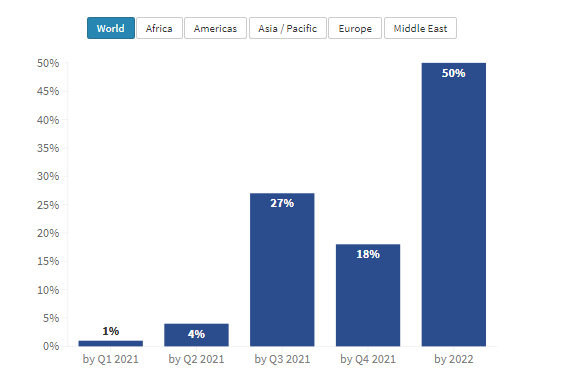

Appendix K provides a clear picture of the devastating impact of the COVID-19 pandemic on international tourist arrivals between January and October 2020. As shown in Appendix L, Africa, Americas, and Europe are anticipated to take longer periods to recover. The negative trend can be attributed to several factors, including low traveller confidence and restrictions on travels. Hotels may incur huge losses due to massive cancellations associated with such unprecedented events.

New laws and policies related to environmental pollution are a significant threat to the company. In addition to that, frequent natural disasters such as earthquakes, cyclones, floods, and heatwaves pose a threat to the sustainability of the business. Besides that, the economic recessions are becoming common and detrimental to the hotel industry.

Consumers have in the recent past altered their buying behavior that involves online buying. The changes pose a threat to the current physical infrastructure under the operation of the Hyatt Hotel supply chain (Johnson et al., 2019). Local suppliers have also become stronger and hence receiving higher pay margins due to the increase in competition. The last two years have seen an increase in the number of players in the industry due to stable profitability.

Competitive Analysis

Value Chain Analysis

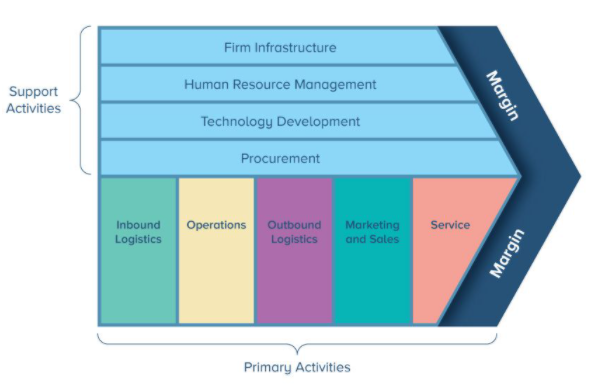

Hyatt Hotels employ diverse approaches to gain a competitive advantage in the market. As illustrated in Appendix M, Hyatt Hotels’ key resources are the company’s inbound logistics, operations, external operations, marketing, and trading. On the other hand, the support procedure consists of the setup of the organization, human resource management, technology improvement, and the procurement method.

As illustrated in Appendices B and G, the organization owns over 535 properties which reflect a stable firm infrastructure. The company’s diverse portfolio or properties are managed and operated by culturally experienced management teams (Hyatt Hotels, 2019). The enhanced reservation system (SPIRIT) helps customers during room reservations. Appendix N presents the mobile entry solution used at Hyatt Regency Riyadh Olaya, which has spearheaded the company’s global digital program aimed to revolutonalize guest convenience.

Furthermore, the corporation has knowledgeable staff members are always available to receive the customers on arrival at any of the Hyatt’s properties. Customer service personnel lead guests to their rooms to enjoy various amenities including WI-FI, the Hyatt Plug Panel, toiletries from the June Jacobs and Le Labo suppliers, and Portico beddings. Hyatt Hotels utilize an excellent service standard, acknowledgment levels, and client experience to the highly devoted consumers through the Gold Passport program. Consistent with Stankov, Filimonau, and Slivar (2019), such innovations enhance guest experiences and customer loyalty.

Moreover, Hyatt Hotels endeavor to improve the relationship with the suppliers and hence promote their retention. The company can establish value by creating an effective relationship with its employees and suppliers. Enhancing motivation will promote better prices and improve the quality of services and hence more sales. The business can also identify the most appropriate and sustainable differentiation. The Hotel can start charging guests extra costs for the exclusively customizable provision. Furnishing an apartment to a specific guest will utilize capital and distribute the procedure and hence necessitates the additional funds to pay for the losses.

Rivalry Analysis

The rivalry of Hiatt Hotels varies from one region to another since different market segments have exhibit varying preferences. The quality of hotels is subject to the location, individual management strategies, quality of service, and other aspects that determine the rivalry. Direct competitors, such as Marriott, Hilton, and Wyndham offer similar prices and quality of services (Hyatt Hotels, 2019). As depicted in Appendix E, these rival brands have large market share, financial stability, and own hotels in strategic points in large hub cities across the world. Marriott International, Hilton Hotels, AccorHotels, and Wyndham Hotel Group are some major rivals (Morris, 2017; Butters & Hubbard, 2019).

These hotels have substantial financial resources, well-established brand reputation, and vast amounts of properties across the world. Their presence in a given market can compromise Hyatt Hotels’ ability to grow and earn profit. Furthermore, these corporations operate in many international markets. The high global presence means that they have access to a larger market outside the United States while the Hyatt Hotels has limited access to other foreign markets (Rajaguru, & Hassanli, 2018). Hyatt also faces stiff competition in the North American markets due to the presence of financial stable rivals with strong competitive brands and a significant number of properties in the country.

Local brands in international regions also pose a competitive threat to Hyatt Hotels. Appendix G shows some of the international markets in which the corporation manages or leases properties. Small hotel establishments most of the key urban centers Hyatt Hotels are present offer similar products and services, consequently heightening the level of market rivalry. Although these small hotels have less-established brands, they offer competitive customer experiences.

By applying porter’s framework can help determine the significant forces in the hotel industry that directly influence the organization. The rivalry in the industry is the greatest force affecting both existing players and potential entrants. The global hotel market is saturated with numerous players offering almost similar products and services. The bargaining power of the buyers is also a significant contributor to the intense competition. In line with Rajaguru and Hassanli (2018), consumers in the hospitality sector enjoy low switching costs because they are at liberty to select the destination of choice.

The presence of the internet has exposed potential customers to a wide range of lodges and destinations to select from, a majority of which provide similar amenities. There is an increase in the threat of a new entrant due to the reduction in the expenses on real estate. Hyatt Hotels Corporation however enjoys a low impact on the bargaining power of the suppliers since the costs of hotel supplies, utilities, and altering services are low.

Strategic Group Competition

Strategic group maps compared Hyatt Hotels against its competitors, including Diamond Resorts, Wyndham, Starwood, and the Marriott. The analysis indicated that Marriott is superior in the market in the category of room per property. In addition, the multinational company topped the list of market players with the largest number of assets and properties, as well as global presence. Hyatt Hotels and Wyndham are relatively level in the competitive position although the two lags Starwood (Rajaguru, & Hassanli.2018). However, Hyatt Hotels command almost the same market share after the acquisition of the Starwood Hotel. However, Hyatt Hotels have fewer staff with numerous localities in more regions. Hyatt Hotels is therefore among the top rivals in the hotel industry.

Company Life Cycle

The Hyatt is at the early phases of adulthood of the company lifecycle. The global hotel industry and global economy has started recovering from the previous events, such as economic recession and COVID-19 pandemic (Gursoy & Chi, 2020). Consistent with this trend, the corporation is likely to experience substantial growth. Market players like Marriot and Wyndham are also present in the mature phase. Post-turnaround, by worldwide enlargement through buying Starwood, The Hyatt Hotels Corporation will occupy an advantageous position in the growing phase while other opponents stay at the mature stage.

Grand Approach Environment

The outcomes of the Grand Strategy Matrix indicate that Hyatt belongs to Quadrant I. This places them in a fast developing market with a resilient competitive position in their market segment. The Hyatt approach in Quadrant I that is appropriate for consideration include market infiltration in emerging areas, expansion of existing possessions, and enlargement of other diverse amenities. These strategies are accomplished through strategic moves, such as the purchase of Starwood and the implementation of a Pet Service. Furthermore, the company offers a Roku for guests, and including a car service on location. With the recognition of Marriott as Hyatt’s strongest competitor, the approaches are structured to increase the competitiveness of the hotel while also winning a significant market base.

Financial Analysis

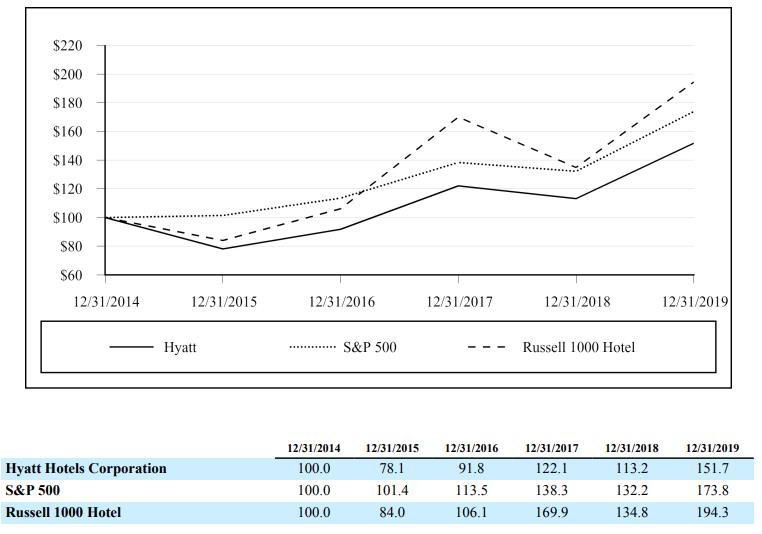

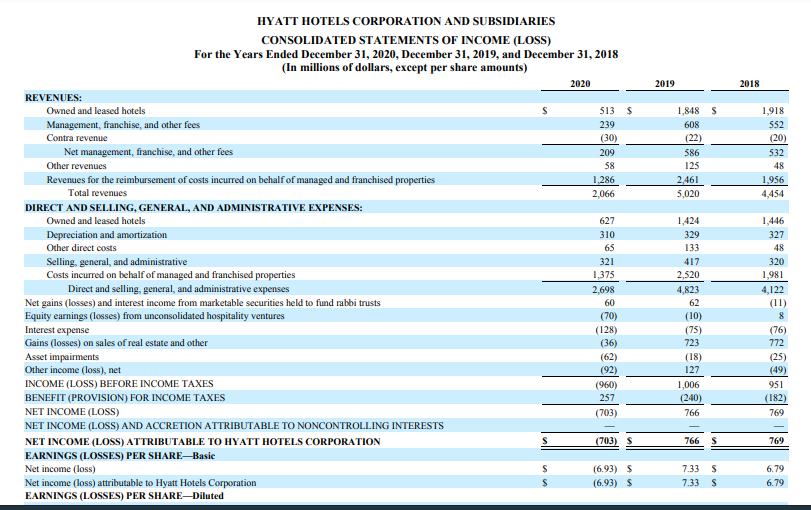

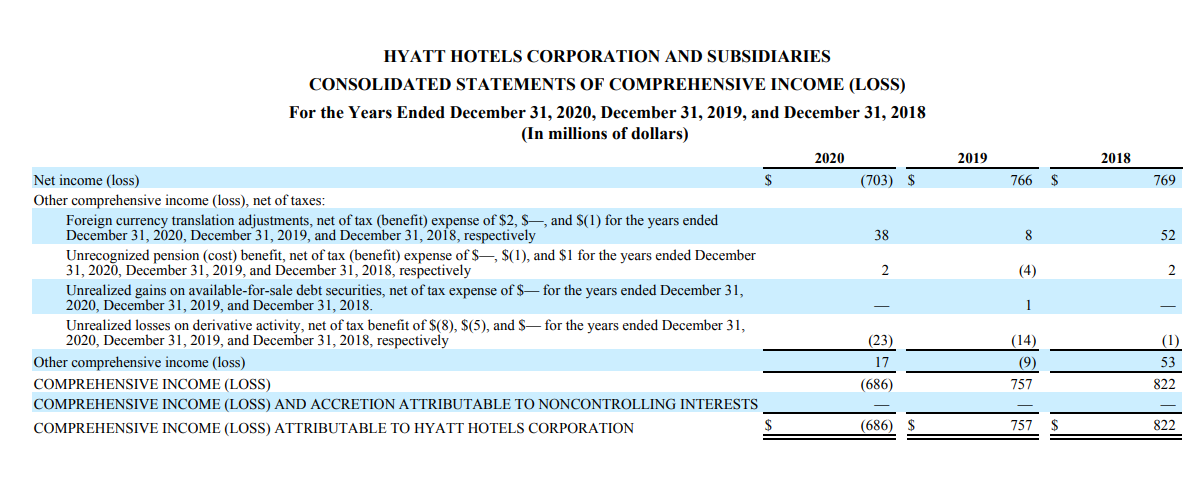

Appendix A presents an overview of Hyatt Hotels’ performance between 2014 and 2019. The company’s revenue was about 4.68 billion dollars by the end of 2019 which signified an increase of 5.8% compared to the previous year 2018 (Hyatt Hotels, 2019). Appendix O provides a clear picture of the company’s financial position and performance between 2018 and to 2020. As illustrated in the figure, the company recorded a marginal increase in overall income between 2018 and 2019, increasing from 6.79 to 7.33 million US dollars, respectively (Hyatt Hotels, 2020). However, the trend took a negative turn, declining in 2020 to 6.93 million US dollars (Hyatt Hotels, 2020).

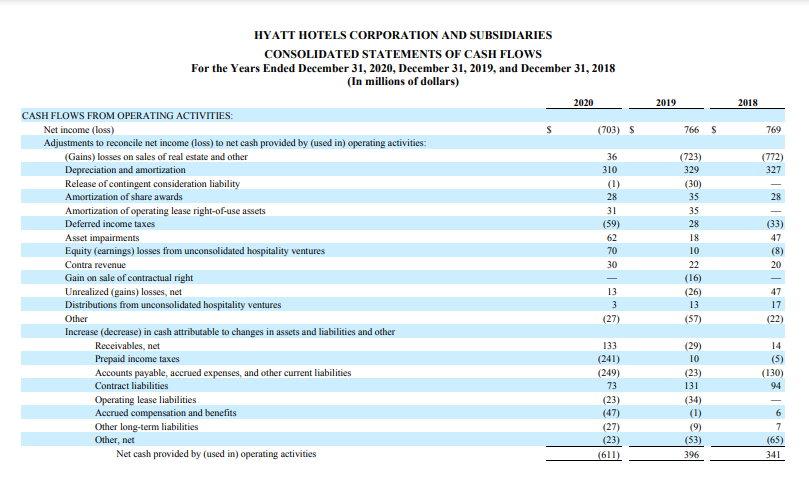

The comprehensive statement of income for the same period presents a different trend, showing that the company has consistently made losses since 2018. According to the comprehensive statement, the corporation, earned 822 million US dollars in revenue which dropped to 757 and 686 million US dollars in 2019 and 2020, respectively (Hyatt Hotels, 2020). The statement of Cash Flows for the Year Ended December 31, 2020, presented in Appendix Q, reveals consistent positive performance throughout the last three years. The amount of cash flow increased slightly between 2018 and 2019 from 341 to 396 million US dollars, and then rose again significantly in 2020 to 611 million US dollars (Hyatt Hotels, 2020).

The financial statement report shows that about 78%-80.6% of the hotel’s total income resulted from operations in the United States. The Return of Assets (ROA) for the company has been comparatively modest although there has been an increase compared to the previous years. The ROA has increased from -0.6% to 1.5% (United States Securities, 2017). The positive ROA provides strong evidence that Hyatt Hotels are financially stable.

The earnings per share for Hyatt Hotels fell below average in ratings compared to its rivals. The total EBITDA per earning per share for the organization totals about 144, 676, 409 (Hyatt Hotels Corporation, 2019). The firm gets its revenues predominantly from hotel activities with the management and franchise fees creating a subordinate income flow. The net income Hyatt Hotels realized by the end of 2019 totalled 204 million dollars.

Hyatt Hotels realized marginal net income, making it less profitable compared to its competing brands. The accustomed EBITDA for the year 2019 was 785 million for the hotel processes (Hyatt Hotels, 2019). Based on this data, it is valid to assert that Hyatt Hotels has attained a small marginal growth stage (Hyatt Hotels, 2019). The position of the hotel in the local market is a direct determinant of the capability to grow. The position of the hotel is also directly linked to the ability to grow in several potential markets found in foreign regions.

After the analysis, several significant conclusions may be made. The United States is still the primary source of financial revenue for the hotel. The relationship between the income and ROA indicates that the firm’s revenues have a direct linkage to the economic progress of the population. Low growth of EBITDA is monetary evidence that the company is stagnating. The relatively high EBITDA scores indicate that the corporation is financially sustainable.

In addition to the decline in net revenue, the company reported a persistent increase in total expense and operating costs in the last three years. The poor financial performance between 2018 and 2020 can be attributed to several cycles in the industry and downturns in the overall global economy. Notably, the COVID-19 pandemic has substantially contributed to the negative trend in Hyatt Hotels’ revenues, expenses, operations, capital markets, debt, and market growth (Hyatt Hotels, 2020). The multinational acknowledges the impact of the disruption caused by coronavirus. Considering the slow recovery from the pandemic across the world, the chain of hotels is likely to record marginal revenue, increased expenditure due to contentment measures, and slow pace and timing of its growth.

Trend Analysis

An evaluation of Hyatt Hotels’ financial statement information generated insights into the company’s financial health. Generally, dominant players, excluding Wyndham, experienced a significant decline in their ROE Margin in 2019 (Research and Markets, 2020). The weakening of the EBITDA margin is linked to the recent economic crisis which proved detrimental to business by adversely impacting the number of travels and hotel stays. Estimates reveal that Wyndham faced less effect because of their lower price brands such as Super 8 and Days Inn. Observations reveal that Hyatt is moving steadily with the Industry average in the recovery of EBITDA, along with Starwood and Marriott (Richard, 2017). Hyatt Hotels’ strong brand reputation has stayed steady over the last few years with slow growth towards recovery.

In viewing ROE, it can be seen that Hyatt has had little to no improvement since the drop in 2019. Similar to Hyatt, Marriott, Wyndham, and Starwood have been able to rapidly recover demonstrating that they have had in rising in net income relative to their use of equity where Hyatt has not (Research and Markets, 2020). In regards to ROE, Hyatt can also achieve similar performance as Wyndham’s (19.17) progress through an increase in operating efficiency. Presently Hyatt has a lesser Debt to Equity Ratio than many of its competitors signifying that they are in a strong financial situation to increase funding through the use of debt.

Tourism and hospitality industry relies on arrays of visits. Decision makes pace emphasis on aspects that attract guests to support the sector and promote the multiplier influence. However, the COVID-19 pandemic has resulted in tourism restraints at both levels including the national and international. The travel bans, border restrictions, and quarantine have caused challenges to the hospitality industry. Hyatt Hotels Corporation has, therefore, experienced a drop in the number of reservations and hence, a decrease in revenue.

Net Worth Analysis and Stock Price

Hyatt Hotels’ net value was approximately $2.76 billion in 2019. Execution of new aggressive strategies and the acquisition of Starwood projected the new net worth to be at $18.85 billion. This observation can be explained by the corporation’s dramatic increase in net income. After 5 years The Hyatt’s net worth has been determined to be approximately $35.64 billion (Hyatt Hotels Corporation, 2019). The firm has achieved higher cost efficiency and more market share. However, the stock price dropped from approximately $48 to 14 dollars in 2019. This drastic trend can be attributed to the issuance of approximately 137 million shares to facilitate the acquisition of Starwood (Hyatt Hotels Corporation, 2019). However, the stock is anticipated to improve slightly over the next 5 years to reach approximately $34 per share in 2018.

Problem Identification, Resolution and Recommendations

Problem Identification

The analysis of Hyatt Hotels’ income flow for the past decade reveals several problems. When compared to its competitors, the diminished income is a sign of challenges that produce the organization’s stagnation. The failure of a company to propagate makes it lose its market share and competitive advantage (Krupskyi et al., 2019). Hyatt Hotels have several problems which need intervention to enable the business to maintain its success and market share.

First, the company lacks expansion space in the local market. The analysis reveals Hyatt Hotels had fallen in a decline due to the over-concentration of the US prestigious industry market. There is a minimal probability for Hyatt Hotels to expand and acquire an extra market share. The firm, therefore, has a choice to only retain its US market base and probably to work towards attaining marginal growth in the overall market base.

Second, Hyatt Hotels’ managed and franchised hotels and resorts are concentrated in major segments most of which are saturated with well-established competitors with stronger brands. As established in the SWOT analysis and Porter’s Five Forces evaluation, the multinational faces fierce competition from other multinationals, such as Marriott, Wyndham, Hilton, and Starwood. Most of these multinational corporations have a high footprint across the world. In contrast, despite Hyatt Hotels having properties in 60 countries worldwide, only 38% of the company’s rooms were outside the United States by the fiscal year ending December 31, 2018 (Hyatt Hotels, 2019).

These figures show that the company needs to consider exploiting new emerging markets that exhibit less intense competition and rapid economic growth, such as China and India. These countries are making huge investments in infrastructural development; attract talent and businesses from across the world, experience significant improvement in the quality of life of the citizens, and are embracing relaxed tax and regulatory requirements for foreign direct investments and global partnerships (Wei et al., 2017: Wang et al., 2018). These trends indicate higher potential for business, especially in travel and hospitality sectors. Penetrating these untapped markets can enable Hyatt Hotels to increase its market and make more profit.

Third, reactive approaches to foreign challenges and pressures threaten is a significant threat. The rate of expansion of Hyatt Hotels has been lower than other players in the market. Particularly, the multinational corporation has experienced stunted growth and expansion into additional markets in the last few years. Hyatt brand is not effectively popular abroad despite the multinational owning and operating a vast amount of properties and assets in multiple strategic business hubs. However, the company is outnumbered by its international and domestic in terms of the number of diversified assets. Offering a wide range of products generates competitive advantages by reducing the risks associated with the focus generic strategy.

Fourth, Hyatt Hotels depend hugely on their existing product line. This problem is evidenced by the company’s persistent failure to introduce innovative products and services to the market. This challenge can be attributed to limited investment in research and development.

One of the major reasons why the company has experienced difficulties to claim more market share can be explained partly by its inability to produce new and innovative strategies that can heighten its competitive position. The tendency to allocate a small budget for research and development compromises the firm’s ability to deliver innovate products and services. Moreover, the absence of an appropriately designed brand that provides a special service. Hilton or Marriott does not offer anything extra-ordinary that is missing in other hotel chains. The level of quality is consistent and identical across the luxury hotel division of the hospitality market.

Generation of Alternatives for Problem Resolution

First, enhancing productivity in the domestic market would be an appropriate solution to the underperformance of numerous assets in the local market. Underperformance leads to lesser income after incurring higher costs. The whole chain needs to undergo a broad value evaluation to identify the sections of the organization that are dragging progress and the factors for the lag. The analysis would be essential in eliminating inappropriate investments and hence saving costs without experiencing losses in the customer base.

Second, rapid entry into the international markets can help the corporation to enhance its competitive advantage. Hyatt is experiencing stagnation in growth. The firm needs to stop being a US-based Corporation and invest in international markets. Despite the suggestion, Five Porters’ analysis indicates that the barriers to entry in foreign luxury markets are high due to various factors. Establishing new hotels in a place requires time and large capital investment. There is the likelihood that all the suitable hubs are occupied. Hyatt possesses over 550 million dollars at the disposal for short-term projects and the capability of 1.5 billion dollar borrowing (Hyatt Hotels, 2019). However, setting up an average 5-star hotel would require about 200-300 million dollars. The Hyatt Hotels Corporation, therefore, needs to generate extra revenue to facilitate the growth and expansion to the Eastern continent.

Third, the company needs to establish and make more investments in R&D. Today, large companies cannot compete favourably without investing substantial resources. The department would also help in evaluating the effectiveness of the existing ways and proposing advancements. Currently, Hyatt depends on external firms to perform such duties. The reliance on external companies has however proven in the recent past to be an ineffective approach.

Lastly, Hyatt Hotels should strengthen its brand awareness and reputation. The corporation needs to work towards leading in technology in the hotel industry through the assimilation of the internet and enhancing developed cybersecurity aspects in its assets. The current generation is highly considerate of the internet, e-socialization, and cybersecurity. Hyatt is likely to become a leader in high-tech since it already tops the Hilton and Marriott in providing electronic facilities.

Strategic Recommendations

Overall recommendations

The Hyatt Hotels should pursue various objectives to increase its profitability and market growth. The company needs to generate adequate revenue to acquire new properties in Europe, Middle East, and the Asia-Pacific continents. The Hyatt Hotels need to limit its engagements in long-term constructions since such ventures could likely become unsustainable in the long run. The company should, however, strive to acquire a local chain of hotels and boutique hotels to expand the brand presence in main strategic locations worldwide. The firm needs to sell off various properties within the USA to raise the capital for making the above purchases.

The Hyatt Hotels should adopt a more proactive approach to managing business threats and opportunities. The corporation should make more investment in market research and forecasting to respond effectively to trends in the market. The company intends to execute cultural variations including a new mission and vision. The firm also needs an Environmental Awareness Initiative which will spur a reduction in some expenses linked to the available properties of the corporation. These will be implemented in the first two months.

Other implementations that need attention are finance-oriented, such as re-evaluating the stock repurchases program, the acquisition of Starwood Hotels and Resorts, and a reorganization of the firm. The company will also need an instant website restoration including training and development for customer service, green culture, and staff training. Apart from the strong short-term goals, the corporation will correspondingly be employing customer value-oriented and marketing strategies to retain the company at a superior position. Such approaches such as the employment of Roku in rooms will function as a multi-year amenity. Pet service and a taskforce of rental cars will be established to assist customers for several successive years and offer a diverse package that would maintain the organization at a more superior position than its rivals.

The management of the Hyatt hotels should use the annual revenue that the properties generate as a basis for selecting the assets for sale. Some hotels under the brand could be underperforming due to overconcentration in the US market. Powerful competition and the drop in consumer interest in the region could also be the cause for low annual revenue generation rates. Additionally, the business organization has to rebrand and shift from primarily a high luxury and customer loyal brand to a high-tech firm that uses the appropriate cybersecurity operations to safeguard the guests. Below are various recommendations that could be appropriate for the Hyatt Hotels Corporations

Specific Recommendations

Recommendation A

Hyatt Hotels need to expand its target focus to exploit new emerging markets across the world. As demonstrated in the company analysis, the corporation is highly presented in saturated markets, such as America and Europe. Diversifying its market will enable the hotel to earn more profits and increase its market share. Implementing this recommendation may lead to a temporary decrease in revenue but would eventually be beneficial in the long term.

Recommendation B

The corporation should consider improving product offering by investing more resources in R&D. It emerged that Hyatt Hotels compared poorly in terms of R&D spending. This is a serious concern considering the importance of R&D in delivering innovative products and services. This suggestion will allow the company to constantly introduce new improved products and services, consequently achieving greater customer service and profitability.

Recommendation C

The company needs to hire experts in hotel logistics, IT, and Cybersecurity and establishing a complete and independent R&D section. This step would help increase the efficiency of the existing operations besides assisting to develop new services like complete customizable room projects which are new developments in the hotel industry.

Recommendation D

The Company needs to constantly tract its brand reputation to maintain a strong image. This improvement will help the firm make an entry in new emerging markets in the Asia-Pacific market. Although a majority of hotels claim in their advertisements to offer quality services, these Hyatt competitors are not high-tech and secure. Setting such standards would make Hyatt Hotel exceptional and hence attract new guests especially the young generations.

References

Alarussi, A. S., & Alhaderi, S. M. (2018). Factors affecting profitability in Malaysia. Journal of Economic Studies, 45(3), 442-458. Web.

Arif, T. M. H., & Hossin, M. Z. (2016). A comparative analysis of internal and external environments between Hotel Hyatt, UK and Hotel The Cox Today, Cox’s Bazar, Bangladesh. IOSR Journal of Humanities and Social Science, 21(6), 13-22.

Bilgihan, A., Smith, S., Ricci, P., & Bujisic, M. (2016). Hotel guest preferences of in-room technology amenities. Journal of Hospitality and Tourism Technology, 7(2), 118-134. Web.

Butters, R. A., & Hubbard, T. N. (2019). Industry Structure, Segmentation, and Competition in the US Hotel Industry (No. w26579). National Bureau of Economic Research. Web.

Cho, W., Ke, J. Y. F., & Han, C. (2019). An empirical examination of the use of bargaining power and its impacts on supply chain financial performance. Journal of Purchasing and Supply Management, 25(4), 100550. Web.

Farazad, K. F. (2020). The Impact of Brexit on Hotel Industry and 2020 Outlook. Hospitality Net. Web.

Goldstein, P. & Frank, K. (2020). Covid-19 – The impact on the UK Hotel Market and its forecast recovery. Knight Frank. Web.

Grandview Research. (2018). Luxury hotel market size, share & trends analysis report by hotel type (business, airport, holiday, resort & spa), by region (North America, Europe, Asia Pacific, Mea, Latin America), and segment forecasts, 2018 – 2025. Web.

Gursoy, D., & Chi, C. G. (2020). Effects of COVID-19 pandemic on hospitality industry: review of the current situations and a research agenda. Journal of Hospitality Marketing & Management, 29(5), 527-529. Web.

Hotel Technology News. (2019). Hyatt Upgrades Its Mobile App for Loyalty Members, Rolls Out New Guest-facing Features. Web.

Hyatt Hotels Corporation. (2019). 2019 annual report on form 10-K [PDF document]. Web.

Hyatt Hotels Corporation. (2020). Annual report 2020. Web.

Johnson, M. F., Johnson, M. S., & Tessmer, A. C. (2019). Hotel asset and equity risk before, during, and after the global financial crisis. The Journal of Hospitality Financial Management, 27(2), 59-71. Web.

Jouida, S. (2018). Diversification, capital structure and profitability: A panel VAR approach. Research in International Business and Finance, 45, 243-256. Web.

Kawugana, A., & Faruna, F. S. (2019). Role of financial statement in investment decision making. International Journal in Management & Social Science, 7(1), 87-99.

Krupskyi, O. P., Dzhusov, O., Meshko, N., Britchenko, I., & Prytykin, A. (2019). Key sources when formulating competitive advantages for hotel chains. Tourism: An International Interdisciplinary Journal, 67(1), 34-46.

Leigh, A., & Triggs, A. (2016). Markets, monopolies and moguls: The relationship between inequality and competition. Australian Economic Review, 49(4), 389-412.

Lock, S. (2020). Leading hotel brands based on brand value worldwide in 2020. Statista. Web.

Morris, J. (2017). Top 10 leading hotel groups. Tourism Review. Web.

Nicola, M., Alsafi, Z., Sohrabi, C., Kerwan, A., Al-Jabir, A., Iosifidis, C. Agha, M., & Agha, R. (2020). The socio-economic implications of the coronavirus and COVID-19 pandemic: a review. International Journal of Surgery, 78, 185-193. Web.

Nurlansa, O., & Jati, H. (2016). Analysis porter’s five forces model on Airbnb. Elinvo (Electronics, Informatics, and Vocational Education), 1(2), 84-96.

Ollila, J. (2019). World of Hyatt & Small Luxury Hotels of the World Partnership Now Extended More Than 200 Hotels. Loyalty Lobby. Web.

Pappas, N. (2019). UK outbound travel and Brexit complexity. Tourism Management, 72, 12-22. Web.

Rajaguru, R., & Hassanli, N. (2018). The role of trip purpose and hotel star rating on guests’ satisfaction and WOM. International Journal of Contemporary Hospitality Management, 30(5), 2268-2286. Web.

Research and Markets (2020). Global Luxury Hotels Industry (2020 to 2027) – Market Trajectory & Analytics. Web.

Richard, B. (2017). Hotel chains: Survival strategies for a dynamic future. Journal of Tourism Futures, 3(1), 56-65. Web.

Richard, B., Perry, W. P., & Ford, R. C. (2016). Crowdsourcing in the lodging industry: Innovation on a budget. In Open Tourism (pp. 79-94). Springer.

Ryan, J., & Casidy, R. (2018). The role of brand reputation in organic food consumption: A behavioral reasoning perspective. Journal of Retailing and Consumer Services, 41, 239-247. Web.

Slalom Build (n.d.). Welcoming world travelers with industry-leading digital hospitality. Web.

Stankov, U., Filimonau, V., & Slivar, I. (2019). Calm ICT design in hotels: a critical review of applications and implications. International Journal of Hospitality Management, 82, 298-307.

The World Tourism Organization (2020) Impact Assessment of the Covid-19 Outbreak on International Tourism. Web.

Varelas, S., & Georgopoulos, N. (2017). Porter’s competitive forces in the modern globalized hospitality sector–the case of a Greek tourism destination. Journal of Tourism Research, 8, 121-131.

Wang, R., Wijen, F., & Heugens, P. P. (2018). Government’s green grip: Multifaceted state influence on corporate environmental actions in China. Strategic Management Journal, 39(2), 403-428. Web.

Wei, S. J., Xie, Z., & Zhang, X. (2017). From” Made in China” to” Innovated in China”: Necessity, prospect, and challenges. Journal of Economic Perspectives, 31(1), 49-70. Web.

Yue, M., & Xu, S. (2018). The Perception of Hyatt Place—a mid-scale brand among hotel customers in China. Journal of Industrial Hygiene and Toxicology, 71.

Appendices

Appendix A: Hyatt Hotels Performance, 2014-2019

Appendix B: Hyatt Hotels Diversification Strategy

Appendix C: Porter’s Five Forces Framework

Appendix D: SWOT Analysis of Hyatt Hotels

Appendix E: Leading hotel brands based on brand value worldwide in 2020

Appendix F: Hyatt Hotels Global Presence

Appendix G: Top Hyatt Hotels Brands

Appendix H: Hyatt Hotels Digital Services

Appendix I: Major Threats to Hotel Industry

Appendix J: Long-Term Trends in UK Outbound Tourism

Appendix K: World Tourist Arrivals, January – October 2020

Appendix L: Expected Rebound In International Tourism

Appendix M: Value Chain Analysis of Hyatt Hotels

Appendix N: Mobile Entry Solution At Hyatt regency Riyadh Olaya

Appendix O: Hyatt Hotels Statement of Income for the Year Ended December 31, 2020

Appendix P: Hyatt Hotels Statement of Comprehensive Statement of Income at 31/12/2020

Appendix Q: Hyatt Hotels Statement of Cash Flows for the Year Ended December 31, 2020