Executive Summary

The paper gives a report based on industrial attachment held at Harvey Davidson Company in Saudi Arabia. The paper starts first by introducing the topic of the study based on the internship, this is followed by a description of the company’s background; this section gives details on the nature of the company’s activities, size, vision addressing the issues on quality and empowerment of employees, mission, as well as organization chart based on the financial department. SWOT analysis (strength, weakness, opportunities and threats) is an organizational marketing strategy that focuses on the various means and channels the company utilizes to reach consumers within the market environment. An organization’s competitive strategy describes the various internal and external adjustments the company indulges enabling it to compete favourably within the industry.

Job history gives a presentation in form of a table showing major assignments and the timeframe for each as well as a detailed description. The conceptual framework of the study leads to a discussion on the technical part which reflects the actual nature of projects undertaken within the company during the internship. This is followed by a brief discussion on experiences identifying the fact that major performance areas involving finances within Harley Davidson focus on inbound delivery performance, quality of produced goods, and total cost of expenses involved in the process of the overall cost of production. The study also states the importance of performance management within purchasing. The paper reveals the reasons why Harley Davidson should own the responsibility of recognizing individual and co-operate contributions from the finance department. This is followed by a summary of the findings, recommendations and finally the conclusion.

Introduction

Business Corporations describes objectives used in the process of reinforcing the position of business Companies; this leads towards strengthening of some respected positions within the industries enabling the establishment of business above existing competitors. Business ethics and regulations are observed to realign business institutions towards their respectful positions. Corporate and financial ethics revolves around the company’s key strengths and opportunities, and at the same time assist in preventing any form of weaknesses as well as protecting the company against threats. However, there is a possibility that a company could create a competitive advantage through the implementation of appropriate business models (Camardella, 2003, pp. 103-107).

Organized Financial statements help in creating a company’s good reputation which at times act as a good basis considered by banks for future loans. The management team should focus on the company’s financial strength since this is the core that determines the status of each section of the company. Calculations on financial ratios are derived from information obtained from the financial statements. The ratios provide the required guidelines for measuring the progress of the business and at the same time alert the management on the problems which might occur within the Hospital. The profitability ratios indicate the level of efficiency on how capital is being utilized. Liquidity ratios on the other hand help in indicating the ability of the Company to continue with its normal operations even during unexpected problems. Growth ratios are best used in the process of tracking down the financial progress within a Company’s (Whalen et al, 2010).

Company background

Harley- Davidson Company was founded in 1901 by William Harley and Arthur Davidson. The two built their first motorcycle in 1903 and are currently the world’s number one manufacturers of heavy weight motorcycles, commanding more than 4% of the market share. Harley Davidson deals with Automobile, they are involved primarily in retailing new and used automobiles as well as trucks, sports utility vehicles, passenger and cargo vans. The company has been supplying the best motorcycles into the market for close to one hundred years. The company provides its employees with a unique heritage and culture which enables workers to provide excellent services enabling the company to maintain its top profile. Harley is one of the leading companies dealing with heavyweight motorcycles, motorcycle parts, accessories, apparel and general merchandise.

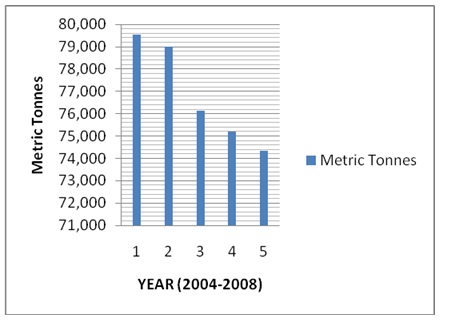

The company is known to operate in two business segments which are motorcycles and related products and Financial Services segment which deals with financial services including wholesale and retail financing as well as insurance programs. In the third quarter of the last financial year, the financial service department recorded an operating loss of close to 110 million compared to operating income of $ 108 million for the previous year (Whalen et al, 2010). The Company further incorporates innovation-related measures which enhance differentiation and efficient costing of goods. The finance department is fully involved in the processes of generating and developing performance indicators acting as a good connection point between the level of performance and individual employees within various departments. Review of the supply and purchases are done quite often to ensure that all the operations are in line with any dynamic change within the marketplace. This provides some assistance to the management in the process of developing purchasing performance measurement systems that are well in operation with the rest of the Organization’s strategies. Purchasing department develops strategies with the capability of measuring short-term and long-term performances.

The company’s mission statement focuses on “fulfilling dreams through the experiences of motorcycling, by providing to motorcyclists and the general public an expanding line of motorcycles and branded products and services within selected market segments” (Whalen et al, 2010). The company is further guided by a business code of conduct which is driven by a value system that promotes honesty, business integrity as well as personal growth within every cycle. The values under which the company operates encourages sincerity in dealing with business promises, respect to individuals and at the same time encouraging intellectual curiosity. Their vision emphasizes crucial relationships contributing to the ultimate success of the company based on relationships with customers and suppliers.

The vision of the company states thus “Harley-Davidson, INC is an action-oriented, international company, a leader in its commitment to continuously improve our mutually beneficial relationships with stakeholders (customers, suppliers, employees, shareholders, government, and society). Harley-Davidson believes the key to success is to balance stakeholders’ interests through the empowerment of all employees to focus on value-added activities.” The vision of the company helps them remain focused on delivering quality rather than quantity products. This also encourages as well as reminds employees of their roles of satisfying stakeholders. The focus has since made Harley-Davidson become a world leader in the supply and delivery of super-heavyweight motorcycles. The basis is not only in satisfying customers but in meeting their expectations by supplying products with superior value (Whalen et al, 2010).

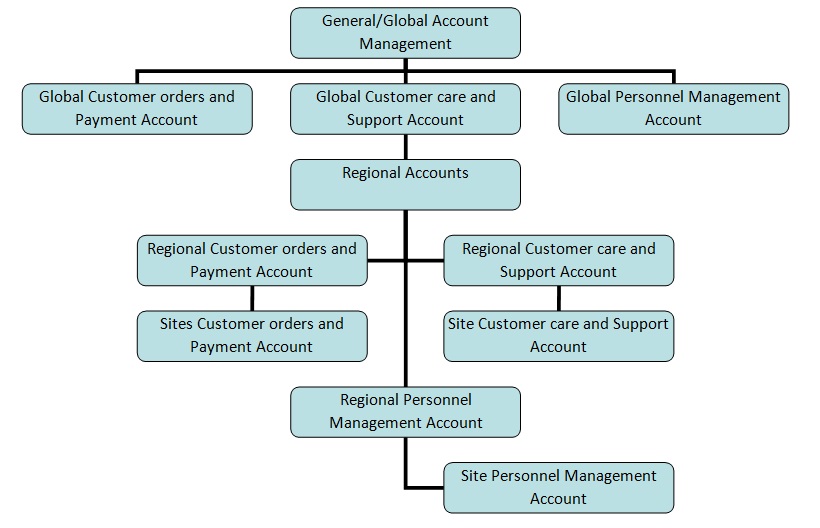

The Organization Chart in the financial department

In designating Management within the accounting section, Harley Davidson Company operates in a three tier framework. The first tier comprises global accounts (Customer orders and payment, Customer support and care and Personnel management) managed according to categories related to Global markets. Such categorization assists the company in achieving larger economies of scale (McNeill, 2009, pp 12-29). The second tier comprises regional management of accounts while the third tiers have site specific accounts for specific areas of business operations as shown in the figure below.

The Accounting management section is headed by a Chief Executive Officer whose functions are to direct and implement strategies for the business as provided for by the management board. Directly under him/her are the global account managers whose mandates are coordinating and executing the management of global accounts to whom regional managers report. At the very end are site managers who are critical in providing ready and prompt solutions to local customers. In a resolution of conflicts, personnel managers at each tier are mandated to execute the settlement of any financial conflicts specific to each area of operation (McNeill, 2009, pp 12-29).

SWOT analysis

Strengths

The level of performance of Harley Davidson within the market segments makes up more than 68% of the European heavyweight motorcycle market. The company’s strength is also revealed in the fact that it operates in two segments which include motorcycles and related products and also offers Financial Services. Harley-Davidson is one of the major suppliers of heavyweight motorcycles within Saudi Arabia. It boasts of a Strong brand name which enables them to look more attractive to customers. The Harley Owners Group (HOG) is an association of the company, which have 750,000 member’s worldwide. This presents it as the industry’s largest company sponsored motorcycle enthusiast organization. Buell Riders Adventure Group (BRAG) forms one of the affiliate company’s manufacturing products under the Harley brand name. At the same time customization of the bikes earns Harley-Davidson extra revenue on top of their products. The company has further precisely divided market segments such as those dealing with promotions, customer events, advertising through media and direct-mail as well as public relations.

Weakness

Weaknesses of the company are exhibited on the high price of products, problems in obtaining more market share within Asia and European countries. The company is unable to penetrate the biggest markets such as India; there is also the problem of attaining the required production which could enable them to supply future markets adequately on a heavyweight motorcycle.

Opportunities

The demand for Harley Davidson products is high within the European market presenting the largest motorcycle market in the world. Using a motorcycle is becoming increasingly interesting in women and the younger generation widening the market share in Europe and Asia. However, the US market is also registering increasing demand for motorcycles. The majority of the customers from all the regions attach so much value to quality parts of automobiles.

Threat

The company has got capacity restraints which have caused a shortage in supply as well as a loss in domestic market share. The motorcycles’ noise standard regulations vary across regions and countries. At the same time, some of the competitors within the market have wider financial base and marketing resources as well as having more diversified operations within the same automobile industry. Some company’s like the Buell division produces motorcycle under Harley’s brand name, this presents a potential threat since at some point they might compromise on the quality.

Organizational marketing strategy

Strong customer relationship is one of the critical values that the company utilizes. Long term relationships built on this platform has enabled Harley Davidson Company (HD) to market its products to a wide array of marketers including national retailers, large-scale customers and wholesale stores. This has made it possible for HD Company to meet the adequate demands of consumers. HD has utilized product diversification under the same brand name as those manufactured by Buell and MV Agusta and this has proved to be effective in catering for all population groups. In future, the organization needs to enhance web advertising to explore new markets.

To enhance market growth the company has developed its existing strategies by adding more experienced and educated workers who are much more dedicated to the business entities operations. There was the case where the merchandisers were the only ones left to enforce the selling prices, this allowed for the existence of bias since they could twist everything to serve their self-interests. Innovative processes involving pricing and product processing are currently controlled by the senior management team. Such restriction led to the selling of old traditional brands despite the tremendous change in the consumer desire and demand for modern product designs. The company at one point reported low sales since they lacked good procedures through which they could market their products and even perform sales promotions since most of their products were obsolete (Magretta, 2002, pp 86-92).

All the plans concerning marketing strategy for Harley Davidson are aimed at improving organization performance, maximization of the profits and expansion of the market share. The management established an implementation process that included the processes of allocating resources to win customers and satisfy their needs. While planning, strategies help only in identifying the desires, implementation involves convincing the market that the desires of the company are good, of quality and beneficial (Magretta, 2002, pp 86-92).

The marketing strategies were tested before implementation to establish the quality of their effectiveness within the global market. Every activity within the company depended solely on the already set goals. The controls used enabled the establishment of the company’s progress and proper implementations of the right plans. The company is currently involved in gathering knowledge about current customers which is ultimately used by Harley Davidson to reveal preferences and buying patterns of the consumers. These details have enabled the marketing department to easily reach the desired customer with the right finished product or parts. This has further facilitated close relationships enabling easy satisfaction of consumer needs. The issue of differentiating consumers enables the marketing department to establish the purchasing power of the customers, hence making it possible for the department to identify customers by their needs. HD embarked on the method of selecting the best customers and this has enabled reinforcement of the relationship between marketers and the customers. The company has also focused so much on improving the quality of goods following consumer preferences (Doole & Lowe, 2008).

The formation of strategic partnerships forms one of the best options for Harley Davidson. According to the World Bank reports, partnerships are important at various levels in the global campaign for Company’s financial security reasons. This requires companies to form partnerships and operate under strategic plans. Harley Davidson should also recognize the importance of a security action plan and the need for partnerships to increase security for entire consumers within the market (Magretta, 2002, pp 86-92).

Harley Davidson Company needs to pay much attention to the value customers attach to their parts. Consumers always pay attention to how the company utilizes resources. The business model constructs for the company expresses the existence of some opportunities that could better utilize the translation of the available resources into quality products. The Company’s resources could be utilized to create process advantages, which leads to performance benefits hence making the HD enjoy superior efficiency on the key variables which influences outcome profits (Doole & Lowe, 2008).

Harley Davidson uses customer charters which assists the Company is reinforcing its commitment to the offering of excellent services. This has enabled HD to clearly outline its benefits to customers including compensation benefits in case of failure in the process of product delivery. This is used by Harley Davidson to forestall legal requirements against any failed delivery. Application of marketing needs internally results first of all in the satisfaction of internal customers which ultimately acts as a boost towards external consumer satisfaction. This measure clearly defines the role of customers within the entire market environment (Magretta, 2002, pp 86-92).

The company views customers in the mechanistic perspective where they focus on collective rather than individual consumers i.e. they believed in only targeting those above forty years male in particular and ignored women and youths below that age bracket. However, the services which Harley Davidson offers to customers have the credibility of adding value to the Company. The company lacks a statutory foundation that would enable the building of a foundation supporting customer service practices. Ideas involving a proactive approach especially in thorough scrutiny on the quality of products before dispatch could help in sustaining a large market segment in the long run. This is because all the employees would aspire to focus all their efforts on delivering better services alongside quality products (Magretta, 2002, pp 86-92).

The customers focus on opportunities since any changes made within the Company opens up other possible avenues for satisfaction. When Harley Davidson proved not to deliver to the expected standards, the customers automatically shifted their focus to other companies delivering quality products and services. The same case of opportunities would be utilized by the suppliers. The suppliers can shift at will depending on the level of loyalty existing between them and the company they are supplying materials to. This shows that the business environment is never restrictive on the sides of the suppliers (Doole & Lowe, 2008).

Customers will continue buying from Harley Davidson as long as they continue showing concern for their needs, delivering their orders appropriately and listening to their service requests. The company should ensure that it goes beyond, even to satisfying the customer’s unstated needs and offering them products and parts at fair prices. Harley Davidson resorted to utilizing advertisement through the media channels and sales promotion activities; this is since through these methods they were able to establish consumers’ core needs. This helped them focus on the right kind of products that the company was capable of selling to consumers. These methods assist in the creation of a friendly atmosphere between the marketing department and customers hence making them comfortable transacting any kind of business (Chandon et al, 2000, pp 65-81).

Organizational competitive strategy

The company strategizes on reinforcing Social responsibilities by implementing ethical strategies as well as reinforcing ethical principles which would enable profitable business operations. There’s a plan to get involved in charitable contributions and also create a work environment that would enable the enhancement of quality of life. Building a diversified workforce is also one of the strategic moves by the company, there are plans on protecting the surrounding environment by cutting greenhouse gas emissions (see table below).

Job history

Table 1: Activities are undertaken every week during the internship.

Conceptual framework

Within Harley Davidson Company groups of employees were left to a small group of managers manning various sectors of the Company who also maintained control of the staff and policies. The nature of control of the management from the top managers determined the outcome of every production process, and this, in turn, brought some level of organization within the Company’s management team. The kind of dominance exhibited with such a management team led to the production of quality products as well as customer related services (Chan & Lynn, 1991, pp. 57-87). In addition, there are seven components of financial statements which are very crucial for the running of any business entity some of which include the following;

Assets

These were described as the entities which a business owns and are always used to describe the future financial benefits of Harley Davidson. Assets were normally controlled from the business premises and obtained as a result of previous analyzed business transactions. Assets usually possess some crucial characteristics which can either place the organization in jeopardy or success. These characteristics include; placing the organization in a position where it could benefit from any predicted economic stabilities within any market irrespective of the location. Then the assets are essentially controlled by the organization’s management. And finally, it comes as a result of analyzing previous financial transactions. One of the weaknesses of Harley Davidson’s Company is the level of production which is unable to supply adequate products to the same region. Assets are used for the calculations of the current ratio which is an ideal situation that is always expected to be twice the current liabilities. This helps in revealing the satisfactory level of the Company’s financial performance (Pink et al, 2007, pp 87-96).

Liabilities

According to accounting principles, liabilities present the negative economic benefits which an organization suffers from. These aspects of an organization come up as a result of financial obligations which the organization is expected to fulfil using its current finances. The liabilities could further be expressed as means of providing services to other entities as per future predictions. There are several characteristics of liabilities some of which include; being used as the only future sacrifices to be made for the stability of future financial position. They share one of the crucial characteristics with assets since they are obtained from the results of future transactions. The liabilities are also used in the analysis of the current ratio and liquidity ratios; it helps in revealing the level by which the HD Company could settle its debts (Pink et al, 2007, pp 87-96).

Current Ratio = Current Assets/ current liabilities

Liquidity Ratio = Liquid Assets/current liabilities

Equity

In accounting, equity presents the remaining part of interests obtained from assets, especially after the analysis of financial statements subtracts all liabilities. It is an essential part of an organization since it is one of the ways which assist in revealing the financial stability of the business. It is presented as; Equity = assets – liabilities. The debt to equity ratio for the Company would indicate the soundness of the financial position of the Company in the long run. High debt to equity ratio is a representation of an unstable financial position (Pink et al, 2007, pp 87-96). It is calculated as follows;

Debt to Equity ratio = Loan/Equity

Revenues

This presents the inflow of finances as a result of acquiring assets and at the same time settling all the financial woes of the organization. They normally arise as a result of producing goods and providing efficient services for the benefit of the organization. Characteristics of revenues are derived from the process of obtaining assets and settling financial woes within the organization. This could also be derived in the processes of administering excellent services (Pink et al, 2007, pp 87-96).

Gross profit margin (%) = (gross income/ sales) ×100%

Expenses

These indicate financial outflows arising as a result of using assets. They form an essential part in maintaining the inflow as well as production of the same goods. Expenses can as well be derived from the kind of services rendered to or by the organization. The main characteristics of expenses are an outflow of total assets and delivery of goods and services (Pink et al, 2007, pp 87-96).

Benefits

This presents the privileges gained as a result of the increases realized from analyzing the organization’s transactions on equity. Gains or benefits have some essential characteristics which include improvements realized from the analyzed transactions; it excludes all the benefits realized from personal investments (Pink et al, 2007, pp 87-96). Losses on the other hand present the kind of decreases realized from analyzing transactions on final assets. One of its characteristics is that it represents a drastic decline in the present organization’s equity owing to the analysis of transactions (Pink et al, 2007, pp 87-96).

Net- Income

This represents the number of finances left within the organization after removing expenses, losses and gains from the total revenue of the company. It is essentially characterized by high revenues as a result of fewer overall financial subtractions (Pink et al, 2007, pp 87-96). The calculations that would be necessary for the analysis include;

Net Income= financial revenues – (financial gains + Expenses – financial losses)

Net profit margin = (Net income/sales) ×100%

Financial Performance

The financial performance of Harley Davidson is most important since it determines to a greater extent the stability of the Company. Whether the identified section produces higher sales or lower sales in specific items lies with the strength of the company. The strength can further be determined through the reactions of consumers and to some extent suppliers. The strength encompasses financial management, marketing, management skills as well as production. The handling and processing of money within this department posed a very big challenge, the payment and orders were often overloaded by demand. There was no evidence of effective supply chain management within the Company. This is since the processes were not carried out by specific qualified staff members; any employee could undertake the purchase and supply processes (Chu et al, 2001, pp 39-58).

Technical part reflecting actual projects undertaken

Table 2: Trial Balance accounts.

Table 3: Balance Sheet.

Table 4: Profit and Loss Account.

Difficulties

There was poor handling of financial data concerning creditors and debtors. The situation was that no follow-up was always done to claim any outstanding debt. This created lots of delays in payment by the private sector buyers. There was a lot of cheating and difficulties involved when it came to settling debts the Company owed to creditors. In addition to all these, the company implemented poor costing systems that lead to loss of finances during transactions. So many items expired within the stores due to poor stock taking processes, this contributed to high production costs since the stores were considered as an extension to production processes. Some amounts of money, used for other purposes were not at times accounted for within the financial records, despite the invoices being approved for payment by the management.

Financial management in any Company is considered very strategic since it helps in overcoming some of the challenges organizations face within the market. Purchasing and supply management is responsible for a variety of activities that ultimately have great impacts on overall financial performance. Harley Davidson considers purchasing as more administrative than strategic. The purchasing department is more so concerned with the general management of the materials without paying attention to pricing and buyer-supplier relationship. The availability of critical materials at affordable costs within Harley Davidson requires excellent management of risks that may be brought by global supply and associated uncertainties involved (Monczka et al., 2005).

Financial management should mostly focus on the quality of products and the role of suppliers. There’s a need for the existence of cooperation between buyers and suppliers to avoid bias and unnecessary confrontation. Management of finances provide avenues for the successful implementation and development of key suppliers with the ability to support the long-term strategies of Harley Davidson. Purchasing and supply performance can influence the profitability of the Company when implemented at the initial stages of product manufacture. The company should incorporate the use of value chain mapping which would enable the identification of opportunities existing within their supply chain (Monczka et al., 2005).

The supply performance strategy is faced with constraints in products supply which affects the demand through interference with the pricing of goods within the Company. There is a lack of resources which slacken the rate of supplies due to difficulty in the production processes. The financial performance strategies lack enough support from the commercial conditions which justifies large and long-term investments. The consumers’ perpetual demand for quality products poses a big challenge to the company since it requires putting together complex chains that are costly. This should be done to ensure that customers in competitive markets are supplied adequately with quality goods and services at affordable prices. The Company needs to work out their business models through appropriate segmentation to enable them to work comfortably with the changing market economy (Monczka et al., 2005).

Professional training of the employees on financial management strategies needs to be done. The firm at the same time needs to diversify its sales to cope with the consumers changing trends on tastes on products’ quality (Van-Weele, 2005). Measurement of purchasing performance within Harley Davidson is a very big issue. There is a need for the finance department to be more alert and have the ability to account for every transaction within the department. The level of purchasing and supply used at Harley Davidson is not at all linked to the business strategies of the Company.

Harley Davidson should exploit the opportunity of using available tools in measuring general performance and at the same time use the same tools in transacting purchases. This is since purchasing performance measurement is has got direct links to other departments and this can affect the general performance of the business when not considered (Monczka et al., 2005).

Generally, financial performance within Harley Davidson should be addressed based on the overall contribution towards the objectives of the Company. Purchasing performance should contribute largely towards the general supply of quality goods and services per the consumers’ tastes. Production of quality goods at affordable prices should be given priority by the purchasing and supply departments. The flow of products should follow the recommended channels till it reaches the final consumer. This would be to the benefit of all stakeholders involved within the company (Monczka et al., 2005). There is a lack of use of modern performance measurement methods within the finance department

Evaluation of the internship experience

One of the notable experiences was the level of attention the Human Resource gave to customers. Harley Davidson Company had poorly designed customer delivery services which hindered the level of sales within the market. This hence interfered with the financial position of the Company, because of low returns realized. The focus given on superior delivery of services to customers presents one of the key drivers which could help improve employee performance within the Company. These levels of interaction could be improved within Harley Davidson Company by implementing effective communication links, designing effective ways of compensation and benefits to workers, developing clear customer focus strategies, and choosing integral leadership

The total supply of goods to the business was not accounted for within the performance management strategies. Development of financial performance measurement included some important aspects which included first of all the definition of the purposes of purchasing performance management systems. The purchasing performances encompassed all the opportunities which helped in adapting the Company to the conditions of the suppliers for the reasons of gauging Harley Davidson business performance measurement. The performance of financial departments should be attributed to the Company’s business strategies.

Summary of findings

Harley Davidson Company serves as one of the strongest companies within the automobile industry. This calls for the company to focus so much on eliminating ineffective production models and brands. Some crucial steps should be undertaken for the realization of success in marketing products these include; the making of short-term measures to check marketing efforts, knowledge about current customers being dealt with, know how to differentiate the customers, selecting the best customers and finally giving offers to best customers. However, the factors that affect and drive employee performance vary widely depending on the segment that an employee is found. True investment in these segments guarantees the Company a better competitive advantage. This is since segments provide easier means of implementing Human Resource programs and also allow for the development of return on investment (Whalen et al, 2010).

Recommendations

Several recommendations emerged based on their new vision statement which focuses on making the company one of the most globally recognized and sought brands within the automobile industry. There’s a need for the company to be proactive in nature as well as lead in the level of commitment leading towards continuous improvement in the relationship between the company and the stakeholders. The company should adjust the production level to reflect the current motorcycle sales within the global market. There should also be evaluation and screening of all brands to identify and adjust poor selling techniques (Whalen et al, 2010).

The company plans to reduce the current number of man-hours which will help in raising the standards of new production lines. This could be achieved by downsizing as well as reducing the number of employee working hours. There will also be a need for re-evaluating the performances of affiliate companies like Buell and MV Agusta. The evaluation process shall involve the integration of the MV Agusta technology for improvement purposes, as well as utilizing the same network of distribution. The company should try to eliminate any copy of motorcycle models which compete with each other under the same brand name from the affiliate companies (Whalen et al, 2010).

The finance department requires thorough evaluation to achieve long term profitability. There’s a need to outsource the finances of new motorcycle purchases made by customers, and this would help in the processing of positioning resources in profitable sections as well as reduce the level of risks. The quality issues existing within the product lines should be addressed as appropriate. These include the abolition of unions, improving the value chain efficiencies, incorporating more flexible capabilities as well as broadening the customer base (Daley, 1993, pp. 201-214).

Conclusions

Companies like Harley Davidson focus mostly on the quality, cost, performance, and issues concerning the prices at which their goods and services are offered to customers. They at times also focus on the level of supply of their goods to consumers at different locations. There is always a need to analyse customers concerning their potential and pay much attention to the processes through which products and services are administered to the specific customer groups. The company’s effort to evaluate the performance from the customer point of view contributes largely to the performance of the company. The processes through which they developed products are defined by quality measures, cost of production and time which contribute a lot towards customer satisfaction. The improved performance of Harley Davidson’s Company could be attributed to the improved image of the company inclined towards the expansion of customer base.

References

Camardella, M.J., (2003). Effective Management of the Performance Appraisal Process. Employment Relations Today, 30(1), 103-107.

Chan, Y.C. & Lynn, B.E., (1991). Performance Evaluation and the Analytic Hierarchy Process. Journal of Management Accounting Research, (1), 57-87.

Chandon, P., Wansink, B., & Laurent, G., (2000). A Benefit Congruency Framework of Sales Promotion Effectiveness. Journal of Marketing, (10), 65-81.

Chu, D. K., Zollinger T.W., Kelly A.S. & Saywell, R. M., (1991). An empirical analysis of Cash flow, working capital, and the stability of financial ratio groups in the hospital industry. Journal of Accounting and Public Policy, 10 (1), 39-58.

Daley, D. M., (1993). Performance Appraisal as an Aid in Personnel Decisions. American Review of Public Administration, (23), 201-214.

Doole, I. & Lowe, R., 2008. International Marketing Strategy. Web.

Magretta, J., (2002). Why business models matter. Harvard Business Review, (80), 86-92.

McNeill, R. G. (2009). The Go-To-Market Frontier: Global Account Management (GAM). Journal of Global Business and Technology (1), 12-29.

Monczka, R.M., Trent, R.J., Handfield, R.B., (2005). Purchasing and Supply Chain Management. (3rd edition). Thomson South-Western, London.

Pink, G., Imtiaz, D., McGillis, L., & Mckillop, I. (2007). Selection of Key Financial Indicators: A literature, Panel and Survey Approach. Healthcare Quarterly Journal, 10 (1), 87-96.

Van-Weele, A.J., (2005). Purchasing and Supply Chain Management: Analysis, Planning And Practice. (4th edition). Thomson International. London.

Whalen, B., Santos, G., Kaier, R., Snyder-white, D. (2010). Harley Davidson Motor Company. Alpha Dogs, (3), 1-29.