Introduction

To analyse organisational strategy and planning of a business organisation, this paper would go for Bradford & Bingley Plc. The credit crunch and fall down of the US sub-prime money market as well as recession has been seriously injured the UK economy. Therefore, the report of Bradford & Bingley Plc begins with a strategic analysis of the company with an exhaustive SWOT and PEST analysis of the organization based on its current position in recession. This paper would analyses the strategy of B & B, its organizational structure, culture and environment. This paper will determine the a number of major points regarding the external and internal environments, goals, strategic missions, business, corporate and global strategies, the present economic climate of B & B. This management report will also consider and critically evaluates a variety of key implementation, alternatives, recommendations and organizational changes in recent global crisis, it will identify the key mistakes that the company has made, and it relates to the strategy schools by Henry Mintzberg.

Overview of Bradford & Bingley Plc

In 1851, Bradford & Bingley had started its journey to provide their mortgage product and services at Northern Mill towns of UK. It is a UK based financial services business, which has two main products such as Buy-to-let and Self-cert. At this instant, they have almost 197 branches those maintain as third party branch as their agent does. These agents are the resource of their 140 network all over the country. By using these sources, they make it possible to play an important role on saving business, buy- to-let market and on the national economy of UK. Last year (in 2008) their earnings increased by 27% that amounted £8.3 million. In 2007, B & B’s group investment was about £125 million. At the end of 2007, their profit growth amplified by 5% (£351.6 million).

Their prime strategy is to deal with risks. At corporate level their regions of managing risks-attracting competitive markets, prove specialised in mortgage lending, shift funding on a strong base, make an effort to realise and carry out consumers necessity and make variation in mortgage distribution. Ultimate target of mentioned steps is to develop and keep continuing their intense performance level at any circumstance.

In administrative level, their experienced groups have executed tremendously occupation though they have faced many recessionary constraints at the end of 2007. Sir George Cox gave his ultimate effort throughout his 7 years working at B & B. As a result, this company has achieved a lot of conquest and performed with a communal spiritual attitude. In order to maintain improved credit superiority they reduce their interest rate and to hold consign in lending market.

The Organisation Today

Annual report 2008 of B&B quoted the director’s statement where they argued that from third quarter of 2007 to 2008 was a very disappointing period for this company. Under the present recessionary economy the issues of corporate risk management has been emphasised more widely both in UK and in rest of the world. The corporate world is in serious threat to keep upheld corporate governance as well as internal control. In September 2008, the UK’s largest mortgage lender Bradford & Bingley has collapsed by the hit of credit crush in Europe. The government of UK announced to nationalising B&B and funded £18 billion to rescue troubled Bradford & Bingley as an auxiliary part of US bailout. B&B has tried to decrease expenses because the surface of business was reduced. For example, in August 2008, there were more than 3,061 employees but it has only 800 employees. Figure no- 2 has showed the Profit before tax of B&B from the year 2000 to 2008 where it is found that the profit of this company is decreasing dramatically.

In order to asses the current financial condition, it should require to consider net present value, Payback period, and Accounting rate of return. Now net present value of B & B is £ 35.6 million. Selection of choosing a project is depending on the value of NPV. In 2007, B & B’s internal rate of return is increased 5%, which amounted £351.6 million. Amount of B & B’s investment is almost £ 125 million and return on equity is 19.1%. Payback period (PP) – time take to return of initial investment is named as payback period. It is a ratio between initial investment and annual cash inflow or funding. Recently B & B took only six weeks or one and half hour to increase their NPV in £2.5 billion. Accounting rate of return (ARR)-another term of ARR is return on equity (ROI). It analyses the financial statements and estimate an investment’s profitability. In 2008, B & B’s profitability is about 27%.

The Key Mistakes made by B&B

The illustrious buy-to-let lender Bradford & Bingley has been distressed in the course of a triple impulse of credit crunch coupled with write-downs resting on investments in course of elevated all-embracing borrowing costs as well as on the increasing numbers of borrowers have failed to repayments. B&B has been for all the way vulnerable to the money markets crisis on the grounds that it has in the past raised additional a quarter of its investment since the money market. The course of action of fund-raising has turned into intricate, more costly to save from harm and inadequate for the cause of its credit crunch and fall down of the US sub-prime money market as well as recessionary economy.

The management of B&B had totally failed to gesture the descending of market trend rapidly. Another charge against the management of B&B could be framed that they has intentionally hidden the real corporate risks to the stakeholders. Yet they has raised fund by right issues but botched to take any meticulous steep to overcome the state of affairs. In April 2008, the B&B has proclaimed an £89 million hit that in due course turned £142.1 million into write-downs as bad credit. However, the management did not mention it in the previous annual report to the shareholders. Though the management B&B has until now been moderately optimistic on the panorama of buy-to-let market and exposed that the quantity of borrowers failed to repayments has been getting elevated enthusiastically.

In the second quarter of 2008, Bradford & Bingley was unavoidable to move up millions of pounds by rights issue. The conscientious bodies for underwriting the issues had lost the full of their funds along with the announcement of nationalisation of Bradford & Bingley. More or less 850,000 presented very small shareholders would also lose the entire of their money by the pronouncement on 29 September 2008. In addition management of B&B sold out 200 retails outlets to the Spanish bank Santander, despite the fact that the retails savers up to limit £ 35000 has been sheltered by the Governmental guarantee.

External environment or PEST analysis of B&B Plc

Porter, M. E. (2004) argued that the modern political, demographic, social, technological factors are reformulating this industry’s historical potential. B&B’s external environment should be experimented by a PEST analysis –

Political factors

B&B has functional activities in UK so operating principles such as investment policy, supply & chain management, corporate risks management and stockholders are bound by various UK laws, moreover it has to follow different recommendation of HM Treasury, FSA and LSE. In order to be transparent to customers and local governments, B&B has maintained its regular activities with honesty, reliability & fair dealing and in conformance with high ethical standards as well as it never condone unlawful payments to any individual, institute, or government.

Economic factors

From the year 2007, B & B has in serious financial crisis and to maintain its position stable, it has reduced employees from business all sectors. The Annual report 2008 of B &B shows that in the fiscal year 2008, net operating income was £886.7m, net interest income was £737.4m, profit before taxation £134.3m and profit for the financial year £18.2m. Comparing to the year 2006 and, it can be found that it has reduced its profit from all sectors, for example, in 2007 B&B’s profit for the financial year was £ 93.2m.

Socio-cultural factors

In UK, there lived people from different culture, race and religion and among them 40% are minorities of the total population. Its culture influences on quick and relax decision formulation on a plain, formulated network though it is characterized by huge bureaucracy. In 2008, the Board of Directors arranged six scheduled meetings in order to develop employee relationships, selecting, evaluating and compensating the CEO as well as overseeing CEO succession planning, reviewing, approving and observing fundamental financial & business strategies.

Technological factor

For B&B, technological factor in important to perform financial activities successfully and to promotional activities of the company. Now-a-days most of the larger company is highlights in implementing INSIS functional system to serve the function of in main process, object-system, maintenance, data security and so on. In addition, INSIS functions are leveraged enough for process efficiency IS integration, high control and productivity, important insight practice, actuarial and calculation by reporting alternatives and future growth support for insurance companies are demanding day-by-day.

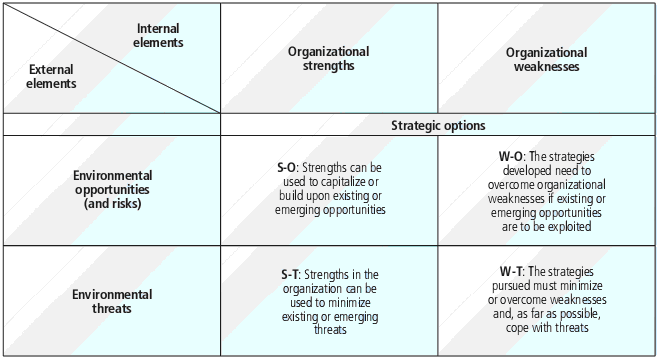

SWOT analysis of Bradford and Bingley

To form an appropriate business strategy, it is important to analysis the strengths, weakness, opportunity and threats of B & B. In the SWOT analysis, two thinks should be incorporated and these are corporate risk management and global financial crisis. SWOT analysis of B & B could be ready to lend a hand to reach a new resolution, make new approach and identify effective solution for the contemporary problems.

Strengths

- Brand name and the image of B & B in saving business is the major strength for B&B,

- For its goodwill, it has funded £ 18 billion to rescue the company from down turn,

- It has efficient and innovative administrative groups.

- Sound interest rates and ensure of better required rate of return,

- in order to minimize the risk, it has always consider customer’s feedback and provide equal attention for all customer,

- distribution channel is play vital role to its profit

Weakness

- From the end of September 2008, B & B had stopped to take any new mortgage applications and it also ceased to increase loans; therefore, buyers who had paid the fees for valuations were returned to them.

- this company has collapsed for high payment to the top level executives as remuneration,

- the conflict between internal administrative groups is increasing,

- Corruption made by the top-level executives for the lack of accountability,

- It is difficult to understand its corporate social responsibility method.

Threats

- Current recession of the world economy is the main threat for B&B as its balance sheet is running down,

- High inflation rate is another important factor for its business,

- Reducing regions to invest recently,

- investors of B&B are not able to invest any more for this company, which may enlarge the loses,

- if the recession is longer for few months, the unemployment ratio will increased for continues job cuts of employees,

- B&B may be affected for the movement for global warming,

- Rapidly changes of consumers demand for recession. Now-a-days people are busy to meet the necessity rather than luxury,

- Decreasing the residential areas is the problem for B&B.

Opportunities

- Though it was difficult for this company to survive because the profit is decreasing but it may revive their position for bail out package.

- still it has enough assets for further expansion of its market,

- It can adopt new technology for advertisement and online selling purpose.

Strategy of Bradford & Bingley Plc

In recession, its profit and growth rate has decreasing therefore B&B has focused more attention on the strategy of the company. In addition, it is now public limited company, so it should treat buyers and creditors fairly to minimise destruction and losses and to restructure the company.

Business Level Strategy

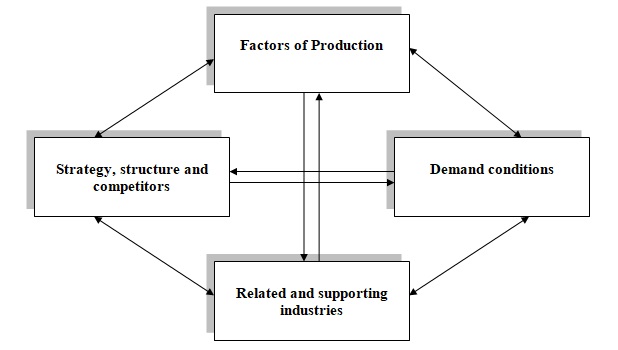

From the strategy, it can be found the B&B’s current situation in relation with other rivals as it has been found as one of the largest company in UK focusing on 5% growth rate annually in banking sectors, specially it is continuing to drive-growth by expanding its distribution channel. Therefore, the B&B can generate Porter’s five forces view as its business- oriented strategy, for example-

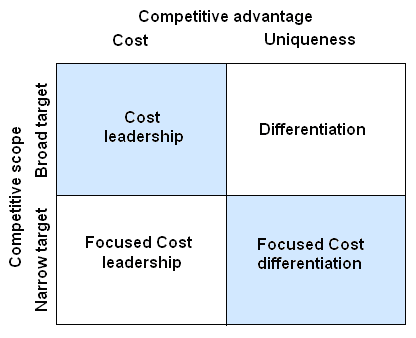

According to Hitt, M. A., et al (2001, p-154), by introducing the focus strategy, a company would have to design its items for serving the needs and demand of particular segmented customers while it is characterized as the exploitation of the short- focused target differences from the equalization of the industry with centralized efficiency and effectiveness. In conclusion, the focused- differentiation concerns with highly differentiated goods along with above- average return, as a result, B & B should not follow focus cost differentiation strategies in this recession.

Corporate Level Strategy

B&B has maintained the low-levels of diversification where over 95% of sales revenue generates from the mortgage and loan business, that means, it forms of less than 50% of revenue creates from dominant-business and in production process all businesses share technology, marketing procedure and distribution channels. It has mainly two products, among them buy-to-let is most popular and it has earned 70% from by to let, in this sense B & B has followed lower to moderate level of multi-product or corporate level strategy.

International Strategy

Bradford & Bingley Plc is a UK based mortgage and loan provider though it had 197 seven branches in UK and USA. Therefore, specific international strategies for being successful in each of those regions are required. Important considerations are-

Most of the investors of B&B’s are US based organization, so B&B has collapsed for US credit crunch. Therefore, it can recommend the factors of international strategy to decrease the B&B’s exposure to risks. At the same time, B&B is subject to risks linked with international operations, including, changes in exchange-rates for foreign currencies, which may have adverse effect on the mortgage market and it may reduce international customer demand or enlarge supply-costs.

Cooperative Level Strategies

B & B has a number of strategic options regarding this strategies which is discuss as follows-

- In this recession, B&B can formulate partnership with other banks like Lloyds TSB, according to the method of strategic alliances, through a mutual interest of resources and capabilities from designing to distribution level.

- By means of a joint venture, B&B can promote a new venture with other by amalgamation of their resources.

Implementation of Four Strategies

The Implementation of the above four strategies is progress by the following parties-

Corporate governance of Bradford & Bingley

In 2008, the business of B&B and investor of B & B Lehman Brothers have been collapsed for not to follow the measures designed for expense of remuneration paid to the directors’ guided in the Companies Act, therefore corporate governance is essential part for B & B. It specifies the co-relation of stakeholders for determining the control and directive performance of B & B formatted by Companies Act that is responsible for carrying out strategies by several sequential steps.

Role of the board

As a UK based company, B & B bound to follow the combined code and the report of corporate governance, which has listed in LSE and B&B has operated Financial Services Authority. B & B maintained a Board and it is responsible for conforming guidelines, previous plan approval and investment as well as divestment strategies by permission of FSA. Moreover, executive management team and the corporate audit committee is review the internal risk of the company and recommend principles to ensure sound management system and refining the strategies as well.

Independence of Directors

According to the Combined Code and Higgs report, which are implemented by the LSE, a majority of the non-executives should be independent of the company; in addition, a committee configuration must be place in order to advance the responsibility of the selection of the executives, the salary of the directors as well as the audit procedure. B&B’s corporate responsibility offer to follow the rules of LSE and it has two independent non-executives in their audit committee in order to monitor, analysis and advice the Board.

Compensation of Employees

Director’s remuneration is a most energetic issue in the today’s business world because overpayment of remuneration may create corporate scandal. B & B should be designed for attracting and deriving the talent human resource for successful strategic implementation that focuses on base rate of pay, competitive compensation package over time, balance of gifts and so on.

Appropriate Selection for B&B’s Strategy in light of Ten Schools Thought

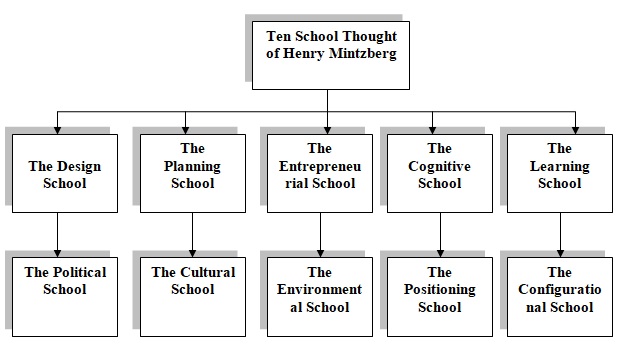

Luis R. Gomez-Mejia, David B. Balkin, R. Cardy, L. (2006) mentioned that in the late 1960s, Henry Mintzberg, a graduate student at MIT, undertook a careful study of five executives to determine what these managers did on their jobs. On the basis of his observations, B & B concluded that managers were performed different, highly interrelated roles-or sets of behaviours-attributable of their jobs. Besides that, he also introduced the hypothesis of ten-school thought to define and to develop the strategic management of an organisation. Landrum, N. E, (1999) argued that his theories are important to review the shareholders feedback and it could be apply to categories the issue of strategic management. This theories has been showed in the following diagram-

- According to Mintzberg (2003 p- 112), design school has been mainly worried with congruence or fit, where capture success would be the slogan of this school. Under this school, both internal state and external expectations has been considered to reduce ambiguity and other difficulties. B & B should not follow this to overcome its barriers and to ensure strong environment for business because it has many limitation such as in a strategy, there have many variables but this school does not consider these issues.

- The steps of planning school is based on the design school but the formation of strategy has uphold the formal procedure and it includes all types of checklists and techniques rather than simplistic forms which seems like a machine. However, this strategy has some drawbacks for example it based on data analysis therefore it can turn into static forms, the jeopardy is present of groupthink and higher executives should generate the policy from an ivory tower. B & B should follow recommendation of this school though it is complex to follow because it may break the other strategy like corporate, business, and functional in smaller components, which includes budgets, visions, action plans, as well as control-systems.

- Positioning school has formed under analytical procedure as contrasting to the procedure focus of the design or planning schools, moreover, it has not focus on external environment. B & B should not choose the positioning strategy as it would create inconsistent situation.

- Landrum, N. E, (1999) argued that entrepreneurial school has established under the visionary procedure where CEO or leader of the organization is the designer of the strategy. B & B is a public limited company, it should follow the corporate governance theory, and therefore this strategy is not match with the Entrepreneurial school.

- Though, cognitive school is not practical in real life context but B & B should follow the strategy of cognitive school because to survive in this recession, it is essential to have mental strength and cognitive school based on mental procedure.

- The concept of learning school would not effective to restructure the B&B’s strategic movement because the strategy has formed as an emergent procedure and this school is not helpful in crisis period because it is no specific strategy for crisis moment,

- Though, the political school is useful strategy for large company or Joint Venture Company but B & B has passed their time in serious financial crisis so it is not possible for B&B to expense lots of money for negotiation procedures. The political or power school has followed the method of negotiation among the power holders within the organization and among the organization as well as its stakeholders; however, politics is sometimes not effective as it can be troublesome.

- Landrum, N. E, (1999) argued that cultural school analysis strategy has formed as a reflection of organizational-culture and maintained collective activities where the member of all department of an organization may shared their ideas and information. B & B is a large company so it would be an effective to follow strategy of cultural school.

- Mintzberg, H., (2003) argued that environmental school has shaped the as a reactive procedure and it provides the solution to the environmental challenges; therefore, it is most important for B & B because it is now in crisis.

- Configurational is based on the procedure of transformation and the steps of this school has established by life cycle. Here, the organizational structure and the strategy has been developed strategy as episodic procedures. B & B should observe its organizational strategy and it should reassess its life cycle to take further decision.

Recommendations

Based on the present financial downturn action plan to recover the national economy is still under process. This report would make recommendation for the B&B Plc, which would be useful for corporate management team and executors to face the recessionary impact –

- B&B should remove all internal conflict among inter-administrative groups,

- Lack of corporate social responsibility is one of the important reason to reduce its accountability; therefore it should be emphasis on this matter,

- It should abide by the national law as B&B has not followed the rule, which was set out in the Companies Act 1985 and CA 2006,

- Director’s remuneration is a most active issue in the today’s business world because many large companies like Enron and Worldcom has collapsed for the high payment to their executives, so it should make a restriction in taking huge amount of remuneration.

- The most significant moral corruption can be observed the major payment of the top executives of the billionaire bankrupted firms. Devine, M. (2008) pointed out that CEO of Lehman Brother’s Mr. Richard Fuld got $480 million. Simultaneously Waxman went on a $US 440,000 variety of counting $US 23,380 on health resort treatments in late September from American International Group. Fuld, R (62) was well informed that his responsibility was to play as the “scoundrel” of Wall Street and did his best throughout his broadcast and he does not expect himself to feel repentant. The negative belongings are just like in concert the flute while Rome burns.

- B&B would take into account the aftermath conditions of recession and reconsider configure the merger decision,

- B&B should follow the recommendation of several reports such as Higgs and Turnbull report to remove corruption, which made by top level executive,

- It should maintain a strict inspection or monitoring process where it will exercise the recommendation of Corporate governance theories,

- Because of the imperfect valuation of risks in construction industry, many banks have not sufficient capital. As a result, the numbers of investment banks are being insolvent. Consequently many investors have a propensity to invest in risk free government treasury bills as well as negative balance of mortgage, construction industry has been extreme shortage of liquidity and now such complexity has been spread out from the investment banks to mutual, hedge funds as well as commercial banks.

- Required to excessive conveniences in housing loan tended to make supplementary supply that demand which reduced the price of houses making people not entitled of paying the debt etc.

- B&B should illuminate the inappropriate risk response strategy, as strategy of risk management would be appropriate for performance evaluation, minimizing costs as well as maintain target period.

Conclusion

The collapse UK’s largest mortgage lender Bradford & Bingley, and investment bank Lehman Brothers by the hit of credit crush in Europe overwhelming a new chapter of the credit crunch conveying the circuit of global banking sector and effectively fastening the economic fate of the sector. In the entire paper has described the present situation of B&B, different strategies and environmental position of this company. Here also present a short description of ten schools thought by Henry Mintzberg and suggest which strategy should consider for the development of B&B’s business. For a real progression, B & B required to reducing its dependency on investors like Lehman Brothers and at the same time, it is urged to more emphasis on euro zone as well as extends the economic cooperation with shareholders. The executives of B&B are optimistic to solve the economic crisis within 2011 because the macroeconomic condition of UK has lingered within a controllable position to over come the budget deficit by way of the tools of fiscal and external accounts measures intended for medium term. Finally, this report presents SWOT analysis and recommendation of Bradford & Bingley Plc to prevent the barriers in corporate level risk management.

Bibliography

Bradford & Bingley, 2008, Bradford & Bingley Annual report & Accounts 2008, Web.

Bradford & Bingley, 2009, Business Plan of Bradford & Bingley, Web.

Bradford & Bingley, 2009, Buy-to-Let Confidence Study February 2009, Web.

Bradford & Bingley, 2006, Bradford & Bingley Annual report & Accounts 2006, Web.

Chernev, A., 2007, Strategic Marketing Analysis, 2nd edition, Brightstar Media, ISBN: 978-0979003912.

David, F., 2008, Strategic Management: Concepts and Cases, 12th edition, Prentice Hall, ISBN: 978-0136015703.

Griffin, R. W. 2006, Management, 8th Edition, Houghton Mifflin Company, Boston New York, ISBN: 0-618-35459x.

Hitt, M. A., Ireland, R. D., Hoskisson, R. E., 2001, Strategic Management, 4th Edition, South- Western Thosmson Learning, Singapore.

Kotler, P., 2006, Marketing Management, 11th edition, Prentice Hall, NJ, ISBN: 0-13-0336297.

Porter, M. E., 2004, Competitive Strategy, Export Edition, New York: The Free Press, ISBN-10: 0743260880.

Landrum E. N. 2009, A narrative analysis revealing strategic intent and posture, Emerald journal article, University of Arkansas at Little Rock, Web.

Mintzberg, H. & Quinn, J. & Ghoshal, S. 2003, The strategy Process: Concepts, Contents and Cases, 11th edition, Harlow: Prentice Hall, ISBN: 9780130479136.

Stoner, J. A. F., Freeman, R. E., Gilbert, D. R., 2006, Management, 6th Edition, Prentice-Hall of India Private Limited, ISBN: 81-203-0981-2.