Introduction

Here the study look for the spirit of Tesco from which it has driven to introduce consumer banking, has it come from the strategic decision of the board or it has just introduced as an opportunistic outcome. Strategic decision of any organisation is the major decision making process, by selecting contingent situation in long term implementation in organisational performances. Tesco Plc is known as major grocery retail store worldwide. But now Tesco is going to offer Consumer Banking n the financial market to gather potential customers.

This discussion would be a tactical explanation for reaching the decision whether the implication of consumer banking is an outcome of availed opportunity of the 2008 turmoil or it comes in to execution as a goal of strategy of Tesco. To do so this paper would research on Tesco’s strategy and reports the findings with evaluation of the broad trends and competitive forces of Tesco.

An analysis of the Tesco’s strategy and findings

Tesco Personal Finance: An overview

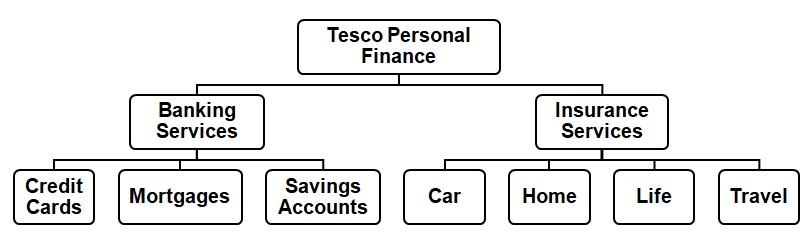

TPF is a combination of the Banking and Insurance service that started operation initially only in UK. The banking service is mainly based on the online and telephone operations. TPF is a ten years old joint venture of Tesco with the Royal Bank of Scotland. The key services offered by TPF are:

Now, Tesco decides to buy the 50% share of RBS of 950 million pounds and own the total share of TPF. Tesco will offer the basic Banking services. That is Tesco will compete now in the local banking sector as a street bank. Tesco will put more weight on the basic banking services such as loans, savings account and insurance. It will expand its store based banking service as well as online. Ultimately, Tesco is trying to use the present downside trend of world economy.

This decision of Tesco regarding TPF can be both strategic one. It is very difficult to get the correct result. Analysis of the Tesco’s trends and decision making process can help to decide. But at first, the present global economic and financial crisis condition should be analyzed.

Current condition of global economy and finance and Tesco’s offering

Now, world is experiencing a recessionary period. This global economic disorder was started in USA. The root cause was the high amount of loans of Banks and other financial institutions. Most of the industrialized countries of the world are affected by this unintentional turmoil. UK is also one of them. In UK, the affect of this turmoil varied industry to industry. The banking sector of UK is also affected and the key issue was the Credit service. The credit market was become vulnerable and Tesco Personal Finance is thus getting the scope to expand its financial services in a high manner. As a retail bank, it has a bank and credit service related image.

Now, it has drive to be a street bank and use the present condition to advertise their strength as a retail bank. They can keep the consumers attention by enlarging the failure of the street banks. This is true in the sense that, as a retail bank they can serve better than any other street bank as because they have both the retail and basic banking offerings. As a whole, Tesco would emerge in the banking sector as a giant and can ensure that the people will not lose their money invested.

Though, Tesco has retail banking experience, but they are now trying to enter in a new market. There are some strategies to enter in a new market. These are:

Tesco has to invest directly, because no other strategies are suitable. From direct investment, it will get high risk, but also will be able to get high profit. It can expand its operation wherever in the world by direct investment. Tesco is now going to break up the joint venture with RBS and starting to do direct investments in its TPF sector. This is a strategic decision because; the other three strategies do not suitable to the present condition of he Tesco’s strategy.

Strategic decision of Tesco

The strategic decision of owning total share of the TPF is now in an introductory level. At first, Tesco will establish 30 branches of Tesco bank. Its ultimate goal is to gain a strong position in the market. At the very first level of promotional activities, Tesco will use low cost advertising tools. As because they are one of the established retail banking service provider, they need this type of advertisement. To acquire the consumer attention they will do some many other promotional activities.

Tesco has taken into account to practice many types of strategic decision. One type of strategic decision is to do more with less. This is the way to serve the best service with the minimum level of resources. Organisations like Tesco, who has lack of proper knowledge and resources, can take decision of these types.

Another type is to develop a completely new business. In this case a complete new form of business plan, design a new process, establish new distribution channel and new product line is essential. As because these decision requires more resources and knowledge, Tesco’s strategy can not be of these type.

Business partnership is the last type of decision. Here the partners decide what to do and in what process. Tesco has been leaving its present joint venture with RBS; its strategic decision is not this type.

Analysis of the Tesco’s strategy

Tesco’s strategic decision of being the only owner of the TPF is a strategic decision. There are certainly some methods to ensure that this strategic decision is right or wrong. Many types of analysis can be done here. These may be:

- SWOT analysis.

- PESTEL analysis.

- Service quality dimension analysis.

SWOT analysis of Tesco

Strength

Tesco can do its operation by its own. It has some strength to do TPF solely.

- Tesco is a well established name in UK. Its financial services are very well known to the consumers. This present brand equity will be strength of Tesco in building the new banking service a successful brand. Consumers experienced the retail banking service of TPF will certainly motivated to invest in this bank and the brand equity of Tesco will completely transfer to new bank.

- The service offerings will be also strength for Tesco. It will expand its offers giving a very high weight and differentiate these services for the consumers. These differentiated services will attract consumers.

- Use of maximum technologies is another important strength of Tesco. It is now offering online banking. After the introduction of basic banking service, the online banking and the basic banking combination will ensure the highest use of technology.

- Tesco has a strong financial condition. Its last years profit and revenue earning can be act as a strong resource for establishing a new banking service. Many of the banks can not operate due to lack of financial resource. But Tesco has enough financial scope to do it. Having a 23% market share is another important strength. This market share can be fully utilized in establishing a new service offering.

- Having experienced and well trained employee is great strength to Tesco. It has a good number of employees who can serve best in the new bank. By introducing new Insurance services, Tesco will use its insurance offerings to ensure the depth of its banking service.

Weakness

- Tesco experienced retail banking service but it has no proper knowledge of basic banking service. Thus, lack of knowledge can be a weak point. Tesco may need expert help and other type of financial advice to resolve the problem.

- To acquire the 50% share of the RBS, it will need a huge amount of money. So, the monetary related problems will arise and it will reduce the current balance of Tesco.

Opportunity

- By accessing the financial market, it can establish as a strong organization. Its banking service will add opportunities to attract many types of consumers, who would invest in any where if Tesco will not offer the banking service. TPF will increase the opportunity of strong brand portfolio.

- A good amount of profit can be achieved through the financial services. This portion of profit was not available past. But now Tesco can get the total profit.

- Tesco need a high cost to gain the 100% share but it will need low cost to maintain the operations. So, the expense of running the Banking business will less.

- As a local brand, the people will welcome TPF as a local figure. Thus, it can keep a close relation with its consumers.

- TPF has an opportunity to expand its basic banking and insurance services to the global market. It can establish banks in many other countries and thus can become a global bank.

Threat

- The present recessionary situation has almost created by the basic banking service providers. Thus, the public sentiment is against the banks which can hamper the TPF also.

- The present giants of banking sector can create intolerable pressure on Tesco and can generate barriers to enter into the market. TPF is a low cost oriented offering. So, competitors may become hostile and do hamper to the profit earning.

- All of the cost of materials and services are now increased in both local and global market. So, TPF can face cost related problems also.

- From the above SWOT analysis, it is clear that the strategic decision to acquire 100% share of TPF is a superior imitative for TPF.

PESTEL analysis of TESCO’s strategic decision

- Political Factors: The government is now trying to regulate the banking sector in a strict way to overcome the recession. Thus, the government decisions can be considered as key factors. European Union, Commonwealth, United Nations and many other international organisations can also keep pressure.

- Economical factors: The present down trend of economy will make the path of success narrow for Tesco. It can not be able to get loans from any where as easily as past. It will keep pressure on the financial strength of Tesco.

- Social factors: Banking service is closely related with the social practice. The society is not alike ten years before. Women are now working with full vigor. Religious and cultural beliefs and values are now liberalized.

- Technological factors: Tesco is using technology in almost every part of its operation. It always tries to do maximum utilization of any new technological innovation. Its online banking service is present and Tesco is trying to enlarge its internet based facilities.

- Environmental factors: Tesco’s basic banking service will not do any harm to environment. Besides it has many corporate social responsibility related programs which make it more environmentally friendly.

- Legal Factor: Present unfriendly situation can create a little problem for Tesco. Government rules and regulations may create barrier to operate the service in a full swing.

Service quality dimension analysis

TPF has offered some new service. It has to ensure the service quality. The service quality can be measured by five distinctive dimensions.

- Reliability: It means the Delivery of services according to promise. Tesco has enough resource to deliver a low cost oriented better service which it was promised. Its well trained and experienced employees can be the key issue here.

- Responsiveness: It means the willingness to help the consumers with prompt service. Tesco has fame of doing better after sales service and also serve better in their premises. So, its responsive nature will help to attract new customers.

- Assurance: Tesco always ensures its customers about the service quality. Its all promotional activities regarding TPF will not only for aware the consumers but also to create trust and confidence of the consumers.

- Empathy: It means to treat the consumers as individuals. Other basic banking service providers were failed to achieve the trust of consumers. So, Tesco targeted the customer satisfaction mainly. Their customer oriented service offerings of TPF will ensure empathy.

- Tangibility: It means the Physical nature of the service. Tesco always do their job in a way that customer feel Tesco physically. This quality will be transferred to its TPF and also TPF will get the tangible nature.

Broad trends and competitive forces

Porter’s Five Forces Model Analysis

The competitive force of Tesco could be considered by Porter’s five forces model analysis and PESTEL analysis:

- Threat of new entrants: Many other grocery or retail banks can become enthusiastic to become a street bank to see the success of Tesco. Thus, new competitors will enter in the market.

- Bargaining Power of Suppliers: Supply chain management is a key issue to bargain with suppliers. Tesco has a strong supply chain management system. For, this Tesco never experienced any sort of problems from suppliers. This will help the TPF also.

- Bargaining Power of Customers: TPF has target to get a good number of customers. Their service design and offerings are of unique nature which has the lowest price also. These features will shape the customer mind to act positively. This will help TPF to grab the local and global market.

- Threat of Substitutes: Tesco will offer the basic banking along with the retail banking and online banking. This combination has the strength to overcome the threat from substitutes. Competitors are basically street banks who has image crisis for the present turmoil. So, substitute services are of less threat.

- Bargaining Power of Competitors: Competitors are now in a bad situation. Tesco can use this situation as their opportunity. Thus, the competitors have less bargaining power. Beside, People will welcome TPF as a basic bank because other banks were failed to satisfy consumers.

Trends in financial service and in TPF

In the UK banking sector, there are some key factors of trends. Firstly, globalisation makes financial services in a holistic manner. Every bank is now not only concerned with its local market but also the international market. Secondly, in UK, the economic condition and the culture are favorable to the expansion of financial services. Government is now a little bid sensitive for the banks but still the environment is friendly. Thirdly, banks need to manage its risk properly. Risk management in UK is easier because of the high per capita income and strong economic condition. Finally, the regulation of banking sector is helpful and friendly for last few years. Government tries to handle the present unfavorable situation but still regulatory bodies will help TPF to emerge.

The financial trend analysis of TPF can be drawn for 2007and 2008. In 2007 the tesco group profits were 106 million pound. But it increased in 2008 of 128 million pound. But the Tesco personal finance experienced a downsize from 75 million pound to 64 million pound.

Corporate social responsibility of tesco has a significant trend to gain competitive advantate in UK market. Tesco is trying to use environment friendly machines. It reduced its CO2 emission from operations. In last year it established 30 automated recycling machines. It has reduced the use of harmful carrier bags and use local resources. It is continuously do its auditing program to ensure its corporate social responsibility.

Corporate governance

Presently the corporate body of Tesco has designated with seven executive directors, seven sovereign non-executive directors. The election of the directors is done in every three years. The chairman has the liability to manage and drive the work of the board. The board has some responsibilities.

There are some committees to assist the board. Nominations Committee, Remuneration Committee and Audit Committee are evaluating the decision of the board give opinion.

Conclusion

The world is now become a global village and the markets of today has no boundary. Organisations like Tesco are continuously expanding its business. Tesco decided to hold 100% share of the TPF and the recession of 2008 is just give the opportunity to take the decision in time. This is a strategic decision which was made before but was not in action for the lack of the proper time. From the above discussion, it is clear that Tesco use the 2008 turmoil situation to implement the strategic decision.

Tesco’s United Kingdom (UK) Strengths and Weaknesses

In the last few decades, there were signs of tremendous growth in the consumer banking market in the United Kingdom UK. However, due to the continued economical shock such growths are hampered. Tesco personal finance (TPF), the market leader of supermarket retail banking in UK, subsidiary of Tesco Plc., is operating very well in the same industry though there is an adverse economical condition.

Strengths

- Growing market split: Tesco Plc is growing very rapidly throughout the UK in its supermarket chain. The UK supermarket giant uses its supermarket chain for the purpose of point of sale of its TPF. Therefore, since investment in supermarket chain increases, market share of TPF also increases. According to Datamonitor (2004), in 2004 Tesco had 13% market share of UK retail superstores market. News release published by Tesco (2008, pp-4) argued that, TPF had resulted 6.9% market share grab in credit card business in 2008. It further argued that, such a market share grab was possible by TPF because of its customers’ quality. Most of the customers of TPF were loyal customers of Tesco. Moreover, Tesco’s policy to grow in multi-product dimensions also helps the TPF to gain more market share over its competitors.

- Wide varieties of financial products: TPF allows its consumers to have a wide variety of financial services at a single point of sale throughout the UK. TPF carries a wide range of general insurance policies (such as pet, motor car etc.), credit cards, personal loans, personal saving products, on-line insurance comparison service (namely the Tesco Compare), and highly equipped ATM networks throughout the UK. According to News release published by Tesco (2008, pp-4), TPF’s had over 5 million customer accounts up to 2008. Moreover, its insurance subscription amounted 2.7 million policies, ATM placements amounted 2700 in numbers throughout the UK.

- 24/7 operations: the superstores of Tesco run 24/7 days. Therefore, it is also able to operate 24/7, at least its ATM and credit card segments. Providing continued services to the consumers is always sought as a prime competency of any service provider.

- Strength regarding cash flow position: position regarding cash flows of TPF also is very strong. It happens because TPF’s most of the loans are intra-group loans and therefore, there is no risk of missing this money, moreover, cash flows with ease from these loans. On the other, according to News release published by Tesco (2008), only 0.4% of TPF’s credit cards balances were in three months arrears in July, 2008.

- Leading supermarket bank: Tesco is the giant domestic superstore in the UK and the TPF is the leading superstore bank in the UK. Tesco’s multi-format strategy paves the way of building the TPF as the leading supermarket bank. Its superstore marketing and point of sale, by their capabilities, help TPF to operate with ease. Therefore, in terms of size, coverage, and quality personnel etc., TPF became the market leader.

- Brand positioning, awareness and image: Because of using its parent’s customer base, TPF gained the highest market acceptance throughout the UK. In addition, brand image of Tesco has helped TPF to gain tremendous brand awareness. Tesco has very prominent image in the market place. It has the image of rendering quality and a value excellence. The same image is also worked for TPF, therefore, it is considered as the quality financial service provider withholding the capability of enhancing the value of money of its customers.

- Personnel resources: TPF has the quality personnel for its success. All these people are very well equipped with banking knowledge and also have enriched experiences of banking business. Moreover, the aggressive growth of TPF would be reinforced by the RGB’s personnel who have years of banking business experiences.

- Online presence: online presence is the most valued competitive advantage of TPF over its both direct and indirect competitors. Usually 60% of total sales of TPF are done on internet, described by the news release of Tesco of July, 2008. Therefore, banking over internet came true for TPF. Since the industry is going to emerge information technology more and more and try to state the technology as a competitive advantage, TPF is really is in advantaged place.

- Abilities to revolve resources into competitive advantages: TPF has the finest ability to turn its resources into competitive advantages. The capability also comes from the Tesco, the UK superstore giant. For instance, banking over internet was a resource for TPF but later on the resource became the competitive advantage for TPF since it has gaining most market share of banking over internet.

Weaknesses

- Perceived quality: there are chances that the consumers of TPF may think it as a low quality financial service provider because the Tesco perceived quality. The consumers may think that in a completely irrelevant service industry Tesco would provide them very low quality financial services.

- Deficiency in socio-cultural knowledge: TPF has its uniform offerings and promotions throughout the UK. It is malicious one, because all the financial products’ consumers are not equal in terms socio-cultural variables. Since TPF has had neither socio-cultural segmentation nor the psychographic segmentation, therefore, it has not tailored its offerings and promotions. It may become a reason of consumers’ depression.

- Dependence on the UK market: According to Datamonitor (2004), Tesco is completely depends on its UK operations (approximately 73.8% of its revenue comes from the market). The same is also true for TPF. Such dependence has several advantages with few disadvantages such as investment portfolio problem that is loss in the market would emerge as the cause of destruction of TPF.

- Reduction of debt: Tesco’s aggressive expansion strategy limits the corporation to expend money except investing. Therefore, debt reduction became problematic. This kind of adverse effect of Tesco is also true for the TPF.

- Effects of consecutive acquisitions: Tesco’s multi-format aggressive growth strategy requires consecutive acquisitions and it has been doing the same. However, these acquisitions are highly correlated with more debt and more expenses. Moreover, such regular irrelevant expansion and acquisitions would make the consumers confused about the Tesco and its performances. The customers of TPF might think that financial services would not be up to the standards.

UK consumer banking system and level of competition

UK consumer banking system is a highly regulated industry. It is constituted by the participation of some supermarket banks along with a number of high street banks. There is a clear evidence of increase of competition due to the application of information technology in the industry. Most of the players of the industry tend to invest more and more on information technology as they see it as a competitive advantage to suppress rivals. It has been the case from the late of 1990s.

According to the estimation of Financial Times (1998, as adopted by Lisa Harris 2001, pp-36), in 1999 standalone, the industry would face investments on information technology amounted more of $21 billion. Harris, L., (2001) stated that, telephone banking, such as operation of First Direct, completely different from other key players of the market, might possess a prominent degree of competitiveness. He further argued that the industry was going throughout a readjustment of the industry. Various acquisitions and mergers had been taken place. Moreover, by letting out own identity, the building societies tended to serve more financial services. These three scenarios are still vivid in the UK consumer banking system. According to Welch, P., and Worthington, S., (2007), there are two basic characteristics of consumer banking system of UK are:

- Selective offers: Players in the consumer banking market are very selective in their offerings. They rarely provide home based mortgages to their consumers. Welch, P., and Worthington, S., (2007) stated that, the retail banking organizations do not provide current account and residential mortgage facilities to their customers. They also stated that, the financial service providers make a move to the mutual fund segments.

- Small market share: though the market players are playing well withholding handsome amounts of loan assets in their balance sheets but they succeeded to grab only a low fractional share of the existing market.

However, there are some other characteristics of consumer banking system of UK as the following:

- Acquisitions and mergers: acquisitions and mergers are very common phenomenon in the banking industry. Both high street banks and supermarket banks engage themselves in such processes. These are made to provide aggressive growths to these organizations. These processes are also related with coverage throughout the UK. It is also thought that such processes would increases customer base of these banks.

- Credit cards customer base: According to Taylor, S., (2001) top eight banks of the banking industry had almost 88.5% of customer base. Now a days, it is more prominent than that of stated because more and more banks are serving credit cards to their customers. For instance, the business of TPF largely is dependent on its credit cards services. TPF has almost 2700 ATMs throughout the UK and such a large ATM network helped TPF to gain tremendous growth in terms of market coverage and customer base.

- Direct marketing: direct marketing means the employment of consumer unswerving channels to contact and distribute goods and services to customers without employing marketing intermediary. It includes direct mail, and catalog marketing. In the banking system, it is very common using direct mail to obtain customers. Taylor, S., (2001) stated that, financial services providers use direct mail on the basis of customer lists, society members, questionnaire fill up personnel and consumers, electoral roll etc. He further argued that, since the blanket advertisement to niche market is too expensive, it is convenient to reach niche markets through direct marketing devices such as phone calls, faxes etc.

- Online banking: to gain competitive advantage over rivals more and more banks are going online. Since access to internet is increased and more and more people use the service for their daily activities, it becomes urgent to go online. However, going online has proved its necessity, because going online increases market share and profitability of the banks. For instance, major portion of TPF’s sales are done online. More importantly the products of online banks are more flexible and easy to customize.

- Demographic segmentation and credentials based marketing: most of the banks are based on demographic segmentation because they are placing their products based on age, income, and location etc. of consumers. These banks usually stress their size, age, and experiences. Therefore, these banks are using credentials based branding. According to Harris, G., (2006), these banks are mostly relying on stressing their names instead of focusing consumers.

To analyze the consumer banking industry to result the level of competition, it is required to analyze the competitive forces that TPF faces in the market place. To do so Porter’s five forces model is used in this case.

- Barriers to entry: barriers to entry in the UK retail banking industry are very high. Due to tough regulatory system, entrant to the industry is no more attractive. Moreover, for the being of saturated market, the industry is further unattractive. Differentiation of offers from rivals is also tough job to do in the industry due to the market saturation.

- Bargaining power of buyers: bargaining power of buyers in the industry is relatively high. Since in the industry, there are very low costs associated with operator switching. Moreover, since all the players are equal in their offerings, it is easy for consumers to switch financial service operator to operators.

- Threat of substitutes: threat of substitutes in the market is very low. Since there is nothing to substitute financial services, there is very low substitution threat. However, in the industry, there can be some complementary threats due to the aggressive growth of supermarket banks.

- Competitive rivalry: competitive rivalry in the industry is very high due to the lack of opportunities of differentiations. All the competitors of the industry usually offer same sort of financial services. Therefore, they have very little competitive advantages. Moreover, competitors of the industry copy point of differences of other service providers with very ease. Moreover, for the very reason, credential based marketing is always the first choice. However, stretching on own name, size, and experiences is no more special to the consumers due to their little value association with the consumer’s needs

- Bargaining power of suppliers: bargaining power of suppliers is relatively high though there is no need of raw materials (parts of products) in the industry. The players of the industry require papers and many technological appliances. Due to the aggressive expansion to technology based operations, the bargaining power of suppliers is on the rise.

The level of competition of industry can be measured by considering industry concept of competition. Kotler, P., and Keller, L., (2006) argued that to measure competition under industry concept of competition as the following:

- Number of sellers and degree of differentiation: in the consumer banking industry there are various players including both high street banks and the rising supermarket banks. According to the above statements, it is clear that the market is not a pure competition market though there are little differentiations among the players’ offerings, but still there are various players with differentiations in terms of services and prices.

- Entry, mobility and exit barriers: Philip Kotler and Kevin L. Keller (2006, pp-345) stated that, entry barriers include high initial capital requirements, economies of scale, regulatory barriers etc. They further stated that mobility barriers are barriers to enter an attractive segment. Again, they stated exit barriers as legal and ethical obligation to stakeholders. In the industry, there are a lot of entry, mobility, and exit barriers present. For the very reason entering the market requires accommodation with various state laws and regulations. On the other hand, though acquisitions and mergers are routine phenomenon of the industry, however, these require huge costs and regulatory burdens. Moreover, exiting the industry is also a tough one due to the already emerged and emerging state laws and regulations and market variables.

- Cost structure: the adoption of information technologies is rapidly increasing the costs burden of the industry. However, attainment of econoomies of scale will lessen the problem.

So withholding the above pertinent, it is obvious that the structure of the industry is monopolistic competition. All the players of the industry are in very high competitive rivalry and therefore, differentiation of offerings would be the key of success.

Resources and capabilities Tesco could muster to make a success of consumer banking:

To make success in the consumer banking TPF should employ two strategies as the following:

- Online operations: as stated above in the paper, TPF has superior result in its online operations. It should continue employing its online operations with much concern because of its high profitability.

- Differentiations: differentiations in the saturated market can only be made by the following:

- Psychographic segmentation: since the total industry is relying on the demographic segmentation, it is very wise for TPF employing psychographic segmentation. Because such a market position would give more value to its customers and they would be satisfied.

- More service options and innovation: innovation of new offerings is the key to sustain in a saturated market. Therefore, TPF has to employ more emphasis on this dimension. For instance, TPF’s ClubCard is such an offering.

Can Tesco make a success in consumer banking?

Collis and Montgomery (1995, p-118-28) in their paper argued that whether a resource or capability can become competitive advantage to make success can be judged by the following tests:

- Test of inimitability: TPF’s online operations can be inimitable but its ClubCard and Tesco comparer are completely unparallel to rivals and thus not inimitable.

- Test of durability: TPF’s both online operations and Tesco comparer are being operated for a long period and therefore, its resources pass durability test.

- Test of appropriability: TPF is completely employing the resources of its parent, Tesco, Inc., and is gaining economies of scale.

- Test of substitutability: most of the resources of TPF need no substitution thus it has strength in terms of its resources.

- Test of competitive superiority: TPF has unparallel resources and therefore, is in completely superior place. For instance, ClubCard and Tesco comparer are very competitive variables.

So, since TPF’s resources and capabilities pass all tests with ease, therefore, TPF can easily succeed in the consumer banking industry.

Presence of Tesco in the United Kingdom

In this part of the essay, it should require to considering the presence of Tesco in my country, being an UK resident, this paper would present the market positioning and competitive strategies of Tesco in the current UK market, major competitors of Tesco in the credit market and finally it will discuss how TPF use resources and capabilities to compete with other competitors. In this report, the sales of financial services according to the capabilities to compete are main concern in overall UK financial and credit market and settle on what strategy Tesco needs to follow to be successful in UK.

United Kingdom is the mother country of Tesco and its trade mark registered under UK legislation. Tesco Personal Finance is owned as financial services for providing real estate and mortgages in 23 July, 1999. It is registered and licensed as using “Tesco”, which is the corporate name of TPF. It has 5 million customers’ accounts with the 26 ranges of value in financial services. In the completion of 10th years of Tesco Personal Finance in UK with fastest growth of profits, this can be earned by launching strong branded of new products and growing online sales. In the financial market, the reason for difficulties in gathering profits of TPF has occurred because of falling bad debts and unpaid credit cards.

The financial services of TPF are followed customers’ preferences for bringing simplicity and value in the financial market of UK. The common services offered by TPF are general insurances, ATMs, online banking services, online insurance services, credit cards and savings for UK customers. The current financial services of TPF are given in the following figure.

Market Positioning and Competitive Strategy of Tesco

Kotler, P., & Kevin L., (2006) argued that the market positioning means the process of marketers for creating an image or identity of the products and services, brands or organisation as a whole to target consumer’s mind. The basic elements of market positioning are:

The annual report shows that its sales are increasing each year both in national and international markets for example in 2004 to 2008, its total sales were £33,557m, £37,070, £43,137m, £46,611m and £51,773m accordingly. Tesco provides services according to the customer’s demand of the customer but the price of the product and services are comparatively lower than the competitor’s product price.

In order to ensure quality of services, Tesco is first considering customer’s mind. The consistencies of services are assured by the control of Tesco. The policies of services according to governance of UK are also customer friendly. TPF is always considering value of customers’ services and their support. It has highest degree of customer awareness in financial services in the time of joint ventured business in the market. Tesco always prefer to choose cheap media for advertising and distributing of services for example posters or leaflets in the retail stores, which is also important part of positioning.

As TPF offers only services, the packaging is not important in financial services. It is adopting some positioning strategies in resource management and maintenance of these capabilities, which are:

- Selective offers of services: TPF is highly selection sensitive in terms of financial services offered to customers. It is not limited in offering services of current accounts or residential mortgages to customers. But it is also considering the capabilities of resources.

- Less Market Shares: TPF has chosen markets with small shares with more than £2 billion deposit portfolios in 2006. It has also paid substantial dividends in last two years.

- Core Regulation: The main policy of TPF is core discipline in managing costs and delivering better levels of services. The effectiveness of TPF is measured with proper forecast and proper system of providing services, which are user friendly for customers according to the resource management system of TPF.

- Accurate and Influential: In TPF performances and productivity, it requires more powerful and simple in using forecast in cost effective methods of customers’ value of services in resource management of services. For an example, the employees needed in TPF are determined by the quantity of work loads in serving customers.

- Included without any Effort: The culture of TPF and ways of working are included in the performance and productivity of management of resources after testing properly. The improvement of services are not included any additional costs in the services to the customers. It can be possible only if the proper utilisations of current resources are made in services over time.

- Holistic Approach: TPF is considering holistic approach in business solutions in its business and customers’ services. The operations of resources are challengeable in managing costs and availability of services.

After describing market positioning of TPF, it is required to be defined competitive strategies according resource management capabilities of TPF services. The competitive strategies taken by TPF are discussed in below:

- Rising Online Aggregators of TPF in UK Consumer Financial Market: Online aggregators are working in low costs customers’ acquisition and distribution channels. They are mainly focus on price of customers with low profits and also offer cross-sell opportunity in services as the capabilities of resources in competitive credit market.

- Advantages of Non-traditional Players by TPF in Financial Market: From non-traditional players, inexpensive distribution, leverage of brand, and capabilities of providing resources as customers services are possible. These players’ abilities and skills are changing the impact on internal and external people related with TPF.

- Opportunities of Strategic Growth of TPF: TPF is mainly focus on future areas of business in competitive growth advantages.

- Adding Value to Customer Services: TPF earn more profit by adding value to services of customers, with additional service offerings.

- New Environments of TPF: TPF has 229 offices in 111 countries, including UK. It generates more working environments to it’s’ staffs.

- To Motivate Employees in Driving Sales: The link with customers and employees are important in driving sales of TPF.

- To Improve Communication: TPF has launched internal customer call centre for customer supports and improves internal communication with business groups.

- To Improve Customer Services: By the best value performances of TPF, it wants to improve customer services and also UK’s citizens.

Competition of Tesco Personal Finance

For accessing competition with Tesco, there are several factors have to be analysed and these are sales, profitability, value services and financial ratios. The primary competitors of Tesco are mainly lending industries, banking and insurance brokers sectors of Europe. There are some top competitors of Tesco, which are Barclays, HSBC Holdings, Sainsbury’s Bank, and Asda in UK financial market. Some other competitors are also involved with TPF such as Abbey national, Nationwide, Halifax, which are related with TPF with service offerings and market strategies. In this paper, the strengths and weaknesses of Sainsbury PLC and Asda will be discussed as these are the main competitors of Tesco.

Company overview of Sainsbury PLC

Sainsbury PLC is mainly known as food retailer and other business chain with 504 supermarkets and 319 convenience stores. In UK, it is operating its business through home delivery shopping services by internet. The products are including of clothing, alcohol and beverages, books, gift items etc and also other 30, 0000 products. Sainsbury Bank is joint venture with 50% stakes with Sainsbury’s PLC and Bank of Scotland. It was first opened major bank by retail stores in UK in 1997. It provides various financial products like insurance, credit cards, savings, loans etc. These services are also available over phone and internet. It has 1.5 million customers with £6 billion deposits.

Strengths of Sainsbury

- Changing International Procurement: Sainsbury Bank is mainly focused on regional process to international with several changes. The changes are implemented by individual and team staffs of it with various development resourcing programmes.

- Various Area of Covering Services: Sainsbury Banks are operating its financial services with health coverage, life coverage, instant access savings accounts, direct saver accounts, visa credit cards, personal loans, car financing, car insurance, home insurance, travel insurance, and pet care insurance.

- Commitment with Policies: Sainsbury bank is always committed with social, environmental and ethical policies for enhancing performance of financial services to customers.

- Strong Performance of Sainsbury Bank: In UK, every year Sainsbury Bank is earning £18.206bn profit after tax. The dividends paid to the stockholders are about 2.40p, up 11.6%. The performance improvement of Sainsbury Bank is:

- Core Growth Opportunities: Sainsbury Bank always takes strategies of quality services at fair prices for customers and also re-launching new brands with extensions in the financial market. The performance is much concern to them rather than size and amount of new branches of banks.

- Established Business of Financial Services: Sainsbury Bank proves itself as established place in the financial market with level net income, reducing costs, controlling risks, improving bad debts, targeting breakeven in loss segment and earning return from profits in 2007-2008 financial year.

- Improving Offer of Customers: Sainsbury mainly is improving in significant offers like price, range, quality and availability of services.

- Customers’ Offer: Sainsbury Bank mainly focuses on the basic services according with customers’ culture. The price investments to customers are 100 – 150 billion annually.

From the above discussion of strengths of Sainsbury Bank’s, some major focuses are identified in following figure.

Weakness of Sainsbury Bank

- Entry Barriers in New Financial Market: With concerning other competition, Sainsbury Bank has barrier in entrants of horizontal credit market. It is creating threat to the core brand of Sainsbury.

- Less Significant Comparison of Price: As Sainsbury bank is concerning on price, but in competitive market, non-price factors are more important to customers in financial services than price.

- Decline Reputation and Performance: In banking operations of Sainsbury, there are restrictions in change of reputation of its brand. The decline of reputation and performances are weakening Sainsbury’s strengths.

- Remaining Same Operations in Services: There are less significant differences in operations of financial services comparing with TPF. The innovations in core services are not noticeable in Sainsbury Bank.

Company overview of Asda

Asda is a popular player in UK as a pioneer of one stop shopping over decades and also second largest supermarket in the country, which is a part of Wal-Mart Group since 1999. It provides financial services for customers’ looking after family, home and belongings. Financial services of Asda include motor, travel, pet, life insurance, income protection and critical illness insurance and finally credit cards services to customers. Its strategy is to being simple with lower priced services to customers.

Strengths of Asda

- Ensuring Access to Customers: Asda is generating more customers by using ease money transfer services at any location with the help of Western Union. Customers can also transferring money to family and friends abroad by Asda.

- Enabling Shopping by Money Transfer: Asda also offering the transfer of money, and in the mean time shopping by the money transferred to the desired person/s by customer.

- Providing Greater Value with Low Prices: Asda are delivering greater value services with affordable prices, which helps them to gain 17 million customers in financial market.

- Keeping Sustainability: Asda always focuses on high sustainability by saving energy, reducing packaging costs, and proper waste management system, which are working as corporate responsibilities of Asda.

- Developing Personal and Professional Finance: One of the major qualifications of Asda is to adjust value and attach importance both in personal and professional finance of customers.

- Understanding Customers’ First: Asda financial services are enhancing its business to understand customers first. It is analysing detailed information about customers with prospective businesses and locations.

- Targeting Market Opportunities: Asda is also focusing on competitors’ weaknesses and potential achievement targets for gathering and targeting market opportunities in the operations to final performances of services.

- Improving Human Resources: With the help of improved human resources, rational and productive decisions about managing services and overall business performances are earned by Asda.

Weakness of Asda

- Customers less Loyalty to Asda as a Brand: Although Asda performs well in bonding with customers, but the customers of Asda are not so loyal to the brand of itself, because the lower price earns customers, not the brand.

- Hard to Fight on Price: In the competitive market like UK, Asda are fighting harder to get price sensitivity of customers, as all other financial services are also focused on the same area to connect more easily with potential customers.

- Functional Bonding with Customers: Asda is now facing another problem is that, the customers, who trade up with Asda is bonded functionally rather than emotionally. For this reason, marketing efforts are not enabling growth of business in proper way.

Strategic Decision of Tesco

In the competitive financial market, it has to face difficulties to operate its business and to maintain potential customers. Some strategic decisions are:

- Lightening Brand Assurance: it has to be focused on brand assurance and marketing lines of revenue to attract more customers. In this strategy, it mainly generates the resource and financial capabilities according to competitive strengths and uniqueness of brand of itself.

- Enlarging Habit of Savings to Customers: UK markets are spent on credit rather than savings. Customers are paying loans in large amount of income of them, about 30% of their income. So, TPF can enlarge the habit of savings and wealth maximisation of them from the marketable wealth and from their income sources.

- Dynamics of Customers: The customers of Tesco have to be developed relationship with emotional support of the company. The relationship can be built up by financially benefiting the core customers such as it has provided pensions, equity release plans, flexible mortgages, loans, and savings accounts to the customers.

- Advertisement: it should increase budget for effective advertisements of financial services of Tesco to attain more customers in the service market.

- Expected Growth in New Market: As the new banking, finance and insurance areas are broadening, the TPF and its business are also expected to grow in potential market.

- Overcoming Economic Downturn: The recent economic downturn is affected the development of financial market but it can change strategies by future investment in other cities to overcome crisis and diverse economy.

- To Shape Public Policies: One of the major strategies of Tesco is to provide the facilities of valuable communication with customers. In recent time, the policies of communication have to be reshaped to hold potential customers.

Tesco can implement these strategies by developing the scope of resource and capabilities successfully in competitive market of UK and some implementation of these strategies are:

- Tesco has to be examined the general services are acceptable to the public of UK credit market for its banking sector.

- It has to review the future prospects of products and services according to the market and brand.

- It has to be ensured the commitment level of customers with services,

- It should be forecasted on the current market shares in terms of resources of services.

- It also implements the strategies by concerning players and segments of markets, rather than size of the market.

- To attract more customer, Tesco should follow the recommendation of several reports such as Higgs and Turnbull report to remove corruption, which made by top level executive.

- The strategies can be implied by effective and skilled staffs of Tesco in special area of services, which reflects the distinction of financial resources.

Conclusion

With high competitive market, TPF has generating profits and progress in UK sales by £41.5bn, with 4.3% growth in every year. These profits are gathered only because of valuable resources and capabilities in UK financial market. For generating more profits from the competitive market, Tesco has to change strategic decision and it requires continuous improvement in resource management. This can bring Tesco in top of the UK financial market in providing services to customers.

Bibliography

bankofengland. 2008. Financial Stability Report Summary, Issue No. 24. Web.

Creevy, J., 2005. Financial services: A market retail can bank on?. Web.

Download-it. 2009. Case Study-Tesco. Web.

Datamonitor. 2004. Tesco Plc: Company Profile. Web.

Deloitte, 2008. Panic, Turmoil and Rescues: Now What? A CFO Perspective from Deloitte. Web.

Harris, G., 2008. Brand strategy in the U.K. Retail-Banking Sector: Adapting to the financial services revolution, Journal of financial. transformation, Web.

Harris, L., Tesco Takes Full Ownership of Tesco Personal Finance and Targets £1 Billion from Retailing Services, News Release, Web.

HM Treasury, 2000, Competition In UK Banking: The Cruickshank Report, Web.

Kotler, P., & Keller K. L., 2006. Marketing Management, 12th edition, Pearson Prentice Hall, NJ. Web.

Leighton, T., 2007. Tesco Ready to Take on U.S. Retail Market. Web.

myfinances. 2009. Tesco to open 30 supermarket bank branches. Web.

Misra, B., 2008. Shopper Science. Web.

Muir, D., 2009. Is Asda stuck in a growth cul‐de‐sac? Web.

Nominet UK, 2009. Tesco Personal Finance Ltd -v- Gethin Nevett, Nominet UK Dispute Resolution Service. Web.

oft.gov.uk, 2008. Proposed Acquisition By J Sainsbury Plc of 171 Somerfield Stores From The ‘Springwater’ Bidding Group, Web.

Research and Markets, 2009. The Rise of Online Aggregators in the UK Consumer Credit Market. Web.

Research and Markets, 2009. Premium Company Profile: J. Sainsbury plc. Web.

Stoner, J. A. F., Freeman, R. E., & Gilbert, D. R., 2006. Management, 6th Edition, Prentice-Hall of India Private Limited. Web.

Tesco Plc, 2008. Tesco PLC Annual Review and Summary Financial Statement. Web.

Tesco Plc, 2009. Tesco Plc- Preliminary Results 2008/9. Web.

Tesco Plc, 2008. More than the weekly shop, Annual Report and Financial Statements 2008. Web.

Taylor, S., 2001. Commercial Dynamics in Financial Services. Web.

Western Union, 2008. Western Union Announces New Joint Initiative with ASDA (Wal-Mart Group). Web.

Welch, P., & Worthington, S., 2008. Banking at the checkout: are retailers really a threat to banks? Web.

Zeithaml, V., Bitner, M., & Gremler, D., 2006. Services Marketing, 4th edition, McGraw-Hill/Irwin.