Introduction

The Saudi Arabian Oil Company (also called Saudi Aramco) is one of the largest companies in terms of profits and revenue. This state-owned organization or enterprise operates in the oil and gas industry and has the biggest hydrocarbon network in the world by the name the Master Gas System. Saudi Aramco has its headquarters in Dhahran and it has over 65,000 workers. The company’s topmost managers focus on evidence-based leadership strategies that can make it successful and support the Saudi Vision 2030.

This case study utilizes different concepts and ideas to analyze Saudi Aramco’s business model and how most of the implemented strategies and decisions have contributed to its success. Personal observations and recommendations are offered to describe how this company can evolve to remain profitable and relevant in its industry.

Company History

The history of this giant corporation began in 1933 after the government of Saudi Arabia signed a Concession Agreement with the Standard Oil Company of California (Saudi Aramco 2019). This partnership resulted in the establishment of the California Arabian Standard Oil Company (CASOC). In 1938, the company’s drilling efforts paid off after Dammam No. 7 started to produce crude oil (Saudi Aramco 2019).

After several years of oil exploration, the agreement resulted in record-breaking milestones in terms of oil production. CASOC became Aramco in 1949 (Saudi Aramco 2019). During this period, it was producing over 500,000 barrels on a daily basis (Saudi Aramco 2019). In 1971, the company’s initiatives and strategies led to a new record whereby over 5 billion barrels of different petroleum products and crude oil were shipped overseas every year.

By 1990, the company had discovered high-quality gas and oil in the Raghib area. This catalyzed a new strategy aimed at marketing crude oil to different Asian countries, including the Philippines, Korea, and China. In 2001, Saudi Aramco embarked on a new venture called the Gas Initiative with the aim of exploring gas reserves and increasing its energy production (Saudi Aramco 2019). By 2004, the organization was producing around 8.6 million barrels on a daily basis (Saudi Aramco 2019). It also became the largest producer and exporter of oil and natural. Its market value during the same period was around 781 billion US dollars (see Appendix B). The country’s Ministry of Petroleum and Mineral Resources has been keen to monitor the operations and activities of this organization to ensure that it achieves its potential.

Business Strategy

The book Strategic Management: Logic and Action, offers evidence-based ideas and concepts for promoting business performance and formulating strategy. The case of Saudi Aramco reveals that effective organizational approaches can take any corporation to the next level. Huff, Floyd, and Sherman (2009) indicate that the ultimate objective of strategy ‘is to create something of value to customers or clients and make enough money doing so to stay in operation’ (p. 3).

At this company, organizational leaders and managers collaborate and present superior action plans, objectives, and practices that can make it sustainable and capable of supporting Saudi Arabia’s energy and economic needs. A good strategy should be able to link strengths to existing opportunities in the business environment, generate more or additional resources, guide, and coordinate activities and respond to emerging challenges (Huff, Floyd & Sherman, 2009).

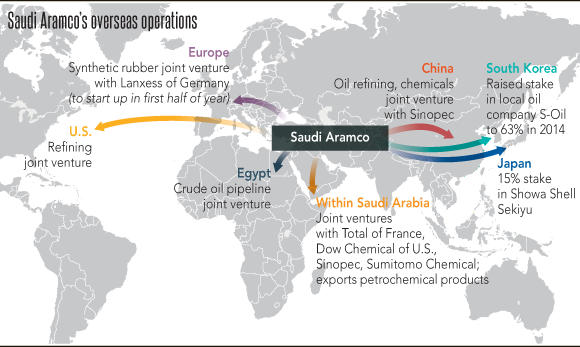

With the increasing demand for natural gas and oil and the proliferation of modern technologies, Saudi Aramco embraces the concept of strategy to attract several partners. This is something critical since there is no single player who can succeed independently. This approach has increased the levels of competitiveness and performance. The company has also continued to embrace the idea of global business integration, thereby becoming a leading provider of high-quality gas and petroleum products in the European, Asian and American markets.

Good leaders should be aware of specific approaches that have the potential to deliver positive results. For instance, strategists will always be influenced by different stakeholders, such as governments, employees, business partners, customers, stockholders, community members, suppliers, and special interest groups (Huff, Floyd & Sherman, 2009). In Saudi Arabia, Saudi Aramco engages key stakeholders in the pursuit of continuous impact research and technological developments that have the potential to enable business performance. This initiative has resulted in cutting-edge innovations that have made it possible for this corporation to achieve its objectives.

Some of these partners include King Fahd University of Petroleum and Minerals (KFUPM), the King Abdulaziz City for Science and Technology (KACST), and the King Abdullah University of Science and Technology (KAUST). Internationally, Saudi Aramco is partnering with different learning institutions to find lasting solutions to the issue of sustainable energy and how to conserve the natural environment (Saudi Aramco 2019). The major actors and employees are involved to present revolutionary ideas and procedures that can make this corporation profitable while at the same time addressing emerging problems.

This means that they acknowledge that a strategy is usually a powerful tool for ‘defining a desired objective and communicating what will be done, by whom, how, for whom and why the output is valuable’ (Huff, Floyd & Sherman 2009). The intended outcomes or results at Saudi Aramco include generating revenues, increasing productivity, minimizing costs, conserving the natural environment, and leveraging available resources.

The president and chief executive officer (CEO) of Saudi Aramco are always keen to formulate the appropriate mission and vision statements, business models, and objectives that become the foundations of every strategy. They achieve this goal by collaborating with different stakeholders, examining the changes experienced in the micro and macro environments, monitoring emerging issues in the oil and gas industry, considering legal and political attributes of the targeted markets, and taking new technological developments into consideration. This means that strategizing is essential to continue discovering, creating new resources, and identifying supporting activities for driving organizational performance (Huff, Floyd & Sherman, 2009).

The current target is to capitalize on several initiatives, such as promoting the long-term supply of energy, strengthening infrastructure and maritime development, engaging in research and development (R&D), and producing high-quality chemicals. Saudi Aramco is constantly undergoing a transformation that is informed by the shifts and developments in the global industry (see Appendix A). At this corporation, failures and successes recorded in other companies become good lessons for pursuing the strategy.

Developing Resources

The identification and effective use of resources is something that can result in competitive advantages, thereby making a given business organization profitable in its business segment. Saudi Aramco has a long-term commitment aimed at producing unconventional products that can support the future economy of Saudi Arabia. Its program is part of Saudi Arabia’s effort to improve and diversify its energy resources and meet the growing energy demands. The company’s leaders have been keen to promote appropriate logistical procedures that can result in efficiency and improve economic viability (Saudi Aramco 2019).

Through Saudi Aramco’s resource development strategy, new technologies have become critical to promote hydraulic fracturing. The corporation partners with other key stakeholders to overcome different challenges that affect the gas and oil industry.

From the above analysis, it is agreeable that organizations can create competitive resources through branding and introducing supportive activities. They can also invest widely, accumulate new ideas, establish a powerful business position and engage in socialization (Huff, Floyd & Sherman 2009). At Saudi Aramco, a powerful model has been considered to adjust unconventional obstacles that can disorient oil production. The organization is embracing the power of research and development (R&D) to deliver sustainable solutions to the country’s energy sector. It is also collaborating with key stakeholders to present superior technologies that can meet these growing demands.

Managers should go further to identify competitive advantages, focus on new investments, look for emerging opportunities to leverage resources, plan for continuous renewal of existing resources and identify changes that have the potential to affect performance. Saudi Aramco achieves this resource development strategy by leveraging emerging technologies, monitoring changes in global oil demand, and introducing evidence-based practices that are informed by industry trends (Saudi Aramco 2019). Such approaches have resulted in competence-enhancing changes that are essential for strategists who want to emerge successfully and make their respective organizations successful. The adoption of such a model will maximize profits and ensure that Saudi Aramco remains profitable in its business environment.

Seeking Opportunities

Competent managers understand that emerging trends and changes experienced in a given industry are essential when planning to improve performance. Huff, Floyd, and Sherman (2009) identify the concept of seeking opportunities as appropriate for changing strategy and introducing additional action plans that can take a large corporation to the next level. Saudi Aramco has mastered this idea by examining the changing demands for oil and gas in different markets.

This habit has made it possible for the organization to identify new regions that have the potential to support its business model. For instance, the company’s annual report of 2019 revealed that the corporation produced over 10 percent of global crude oil in 2018 (Saudi Aramco 2019). The report further indicated that Saudi Aramco was producing a total of 13.6 million barrels of unrefined oil daily (Saudi Aramco 2019). This achievement made the corporation the fourth-largest refiner of crude oil in the world. Currently, Saudi Aramco is planning to promote strategic integration of its business operations, capture value throughout its hydrocarbon chain, attract more partners, and offer sustainable services and products to its global clients.

Saudi Aramco has taken the idea of innovation to the next level. Through a continuous partnership with key stakeholders and the establishment of research centers, this organization is focusing on emerging ideas and technologies that can result in the transformation of the petrochemical and gas sectors. It has become a major global partner in every trend aimed at improving the way petroleum is converted to petrochemical. Consequently, it has continued to attract more customers by delivering high-quality products to them.

Saudi Aramco’s global research network is making innovative research possible. For example, this organization has over 60,000 sq. feet of research and lab space at its Houston Research Center (Saudi Aramco and Chinese partners pursue research programs to optimize fuel and engine technologies 2018). Other professionals conduct their investigations and studies at the company headquarters in Dhahran.

The emerging needs of different consumers of automobiles and oil products have encouraged Aramco to partner with key stakeholders as part of its strategy for identifying new opportunities. The corporation has collaborated with different Chinese firms to undertake new research studies aimed at optimizing engine and fuel technologies (Saudi Aramco and Chinese partners pursue research programs to optimize fuel and engine technologies 2018).

Such an initiative will add value to this company while at the same time addressing the demands of different customers. Its collaboration with Mazda is something aimed at producing an advanced engine that can result in fuel-saving while at the same time maintaining the integrity of the natural environment (Technology development 2018). Other areas that are benefiting from ongoing research include carbon management and the transformation of transport technologies.

Within the past few years, Saudi Aramco has been keen to get additional resources in an effort to transform its business model and achieve every intended objective. For instance, it acquired Novomer’s polyol business and other technologies to enhance its downstream expansion (Saudi Aramco acquires Novomer’s polyol business and associated technologies, enhancing its downstream expansion strategy 2016). Its in-house development efforts have resulted in new technologies that are capable of fulfilling customers’ demands and improving business performance.

Strategy Questions

Aramco’s core historic activities have led to numerous achievements, such as the production of large quantities of crude oil and the improvement of Saudi Arabia’s economic performance. However, the idea to diversify is more appropriate and sustainable since more consumers of energy are now focusing on renewable sources. This company can consider its current resources and assets to venture into new fields (Saudi Aramco 2019). For instance, it can invest in the solar and wind energy sectors to produce superior products that can fulfill the changing demands of more customers. Such a diversification strategy will eventually make this company more profitable.

Within the past decade, Saudi Aramco has embarked on an aggressive expansion into renewable and non-fossil fuel technologies. This move has delivered numerous results and achievements. For example, it has become a competitive strategic partner in different supply chain networks (Saudi Aramco 2019). These developments are not changing or undermining the very basis of its original model. Instead, the organization has expanded its strategy, thereby fulfilling the demands of different stakeholders.

The leaders of Saudi Aramco are preparing for the described IPO in the next few years. Such an offering can take place sooner or later depending on a number of considerations. When it is implemented soon, chances are high that the company will increase its capital and pursue numerous goals. It will become a public-owned company, thereby being in a position to venture into different segments, markets, or regions. The main disadvantage is that rushing the process might affect the company’s performance due to the issue of resistance. The other consideration is ensuring that the IPO takes place later.

This option means that those involved will make appropriate decisions and minimize chances of opposition from stakeholders (Saudi Aramco 2019). The main disadvantage is that postponing the IPO might force Aramco to continue operating in accordance with the existing business model. The end result is that it will take a long to realize its potential. Based on these arguments, it would be appropriate for Aramco’s IPO to take place sooner.

Aramco has the option to IPO domestically on Tadawul or internationally. A domestic IPO is good since it will attract many people who want to be associated with a local brand. This move will also increase market share without having to spend a lot of time strategizing for an international IPO. However, the number of potential customers and stockholders will be limited. Its leaders can consider selling internationally and locally.

This move will maximize the level of capital generated from the venture and make it more profitable (Saudi Aramco 2019). The disadvantage is that it might be time-consuming and expensive to IPO in different markets across the globe. These aspects reveal that it is appropriate for Aramco to IPO both internationally and domestically to expand its operations and eventually become a leader in the global oil and gas industry.

Summary and Conclusion

The success of Saudi Aramco is attributable to its leaders’ efforts and ability to undertake the roles of strategists. From the above analysis, it is agreeable that they have been presenting evidence-based decisions and action plans that have eventually resulted in desirable outcomes. For instance, the current business model is founded on the ability to defining strategy, develop adequate resources and identify emerging opportunities in the global oil and gas industry (In-house developed technologies 2018).

For example, the introduction of new technologies and the establishment of additional research centers are powerful approaches that continue to improve performance. The inputs of key stakeholders and the relevant ministries have taken Saudi Aramco to the next level. My personal opinion is that most of the past strategic decisions different managers made are acceptable since they have continued to reshape performance. The idea to partner with a foreign oil exploration company became the foundation of Aramco. Those involved in such an agreement worked tirelessly to find new oil deposits and improve performance. Such initiatives have made it possible for this organization to realize its potential.

The acquisition of SABIC was an igneous move that resulted in additional resources and customers. It has also partnered with learning institutions, foreign governments, and giant companies to create new oil products depending on the changing demands of different customers. The company’s leaders should, therefore, continue to embrace the ideas identified above in order to continue producing superior products. The changes recorded in both the macro and micro environments should inform future strategic decisions at this organization.

For instance, government policies, economic developments, social behaviors, and the desire to tackle the problem of climate change should guide Saudi Aramco’s actions and decisions (Huff, Floyd, and Sherman, 2009). The changes in technology and demand for renewable sources of energy should become new ideas for transforming the current business model. With its numerous assets and resources, Aramco can consider the demand for solar, wind, nuclear, and hydropower to present new solutions that can result in sustainable fuel use. Political changes should always inform the business model for this organization by considering appropriate markets and focusing on geopolitical changes.

The CEO of Saudi Aramco believes that the organization is a key strategic partner in the realization of Saudi Arabia’s Vision 2030. In 2018, the company was one of the sponsors of the Future Investment Initiative (FII). The purpose of the FII is to create the best platform whereby business partners, government officials, and global influence can influence various discussions on critical issues that are related to economic development. The company is focusing on this vision by creating new jobs, improving a capacity building, encouraging entrepreneurial tendencies, and assisting the industrialization of the country (Saudi Aramco 2019).

The production and distribution of oil and other key products is something that has contributed to steady economic growth. The corporation has doubled its researchers and innovators to ensure that its innovation programs support economic development. Additionally, Aramco is preparing for its initial public offering (IPO) to provide shares to different citizens (Saudi Aramco highlights its contributions to the realization of Saudi Vision 2030 2018). This approach will result in increased capital from investors and support Saudi Arabia’s Vision 2030.

In conclusion, Saudi Aramco is a company defined by a superior model that is governed by emerging trends in the global oil and gas sector. Its leaders focus on the best tactics to formulate strategy, leverage resources, identify new opportunities and create action plans that can result in positive outcomes. The pursuit of innovative ideas is an evidence-based practice for improving performance (Saudi Aramco 2019). The company’s leaders should continue to support such efforts and present additional initiatives that can eventually add value and make it a leading competitor in its sector.

Reference List

Huff, AS, Floyd, SW & Sherman, HD. 2009. Strategic management: logic and action, John Wiley Sons, New York.

In-house developed technologies. 2018. Web.

Saudi Aramco and Chinese partners pursue research program to optimize fuel and engine technologies. 2018. Web.

Saudi Aramco. 2019. Web.

Technology development: transport technologies. 2018. Web.

Appendices

Appendix A

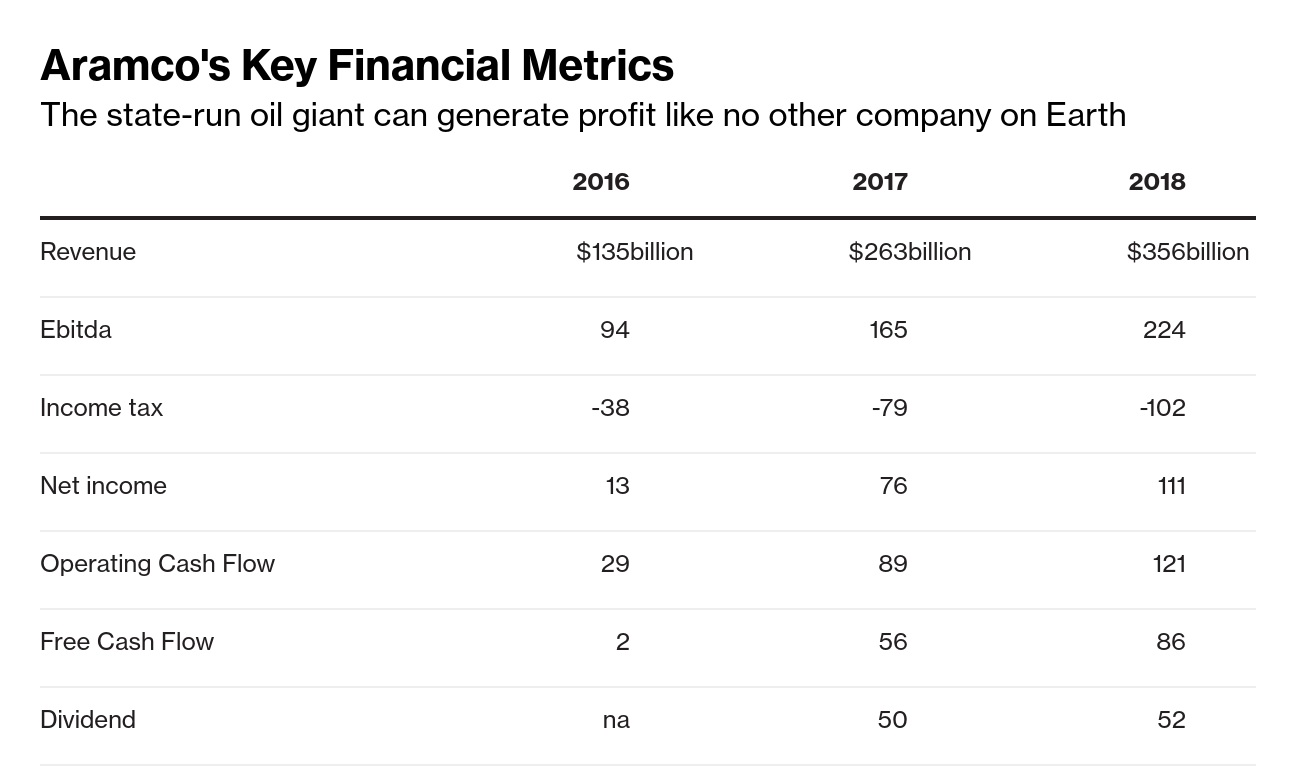

Appendix B