Executive Summary

Usage-based insurance is a highly progressive view of a vehicle insurance service. The basis of this new development lies in telematics devices and the evolution of analyzing technologies that allowed insurance companies to begin exploring innovative methods of providing their service. The disruptive technology that started this trend has been gaining widespread use in the past six years (Gupta, 2020).

As of today, an overwhelming amount of vehicles in the United States have this device integrated, which makes the product my company is planning to provide easy to obtain (Gupta, 2020). The state of Colorado currently does not have strong competition, as most insurance companies that operate there do not have the most flexible options that are present on the market (Sims & Walker, 2020). The product is highly sought after by low- and middle-income households with one or two economic-type vehicles (Hunt, 2019). Therefore, there is an opportunity for my company to enter the market of usage-based insurance, as it shows a high potential for future growth.

Situational Analysis

Nowadays, vehicle insurance is a crucial part of people’s lives. In the United States, numerous policies require drivers to have insurance coverage on their cars. Therefore, this product is more often viewed as a nuisance and associated with adverse events. It might come as costly, and unnecessary at most times, and the vast majority of plans were not suitable for people who need a vehicle for a short time. In recent times, insurance companies took advantage of new technologies in order to provide sustainable plans for people who encounter these problems when choosing what type of insurance will suit them the best. The product of my choosing is usage-based insurance coverage. Many disruptive technologies stem from the internet of things (Ralph, 2019). One of them is flexible insurance coverage, which allows vehicle owners to optimize their spending and pick the option of satisfying their needs.

Environmental Situation

Flexible insurance is a disruptive technology that allowed companies to develop a highly customizable set of plans that rely on varied car accident rates due to different factors. These factors include high traffic amount, the location of the vehicle, the driving style of vehicle users, and adherence to the road rules (Sims & Walker, 2020). The primary source of this technology is the development of advanced tracking devices and the increased availability of analytical means to work with massive amounts of data. Gupta (2020) states that, in 2018, “about 80 percent of new car sales in the US were equipped with onboard telematics.” This industry is in its early stage of development, yet it already shows a promising future. Nowadays, not all states are covered by the primary types of usage-based insurance.

Insurance companies often provide tracking devices for their customers for free or offer them to install a phone application that uses an accelerometer and GPS to monitor all necessary information. These devices collect data regarding fuel consumption, braking and accelerating behavior, idling time, location, vehicle speed, and any issues in the car’s systems (Sims & Walker, 2020).

Moreover, if the tracking is conducted via a mobile application, it collects data about cellphone use while driving as it increases the chances of getting into an accident (Sims & Walker, 2020). The market experiences a slight slowdown in growth partially due to these devices’ nature, as there are numerous concerns regarding the privacy and security of collected information (Sims & Walker, 2020). Many companies use application-based telematics, which can be viewed as more intrusive since it requires access to the customer’s phone (Sims & Walker, 2020). A separate tracking device is preferable to people who put a significant emphasis on the privacy and security of their personal information. With the ever-evolving technologies, it will be possible to alleviate these concerns, and the market will grow even faster than it does now.

Competition

While vehicle insurance is massive and oversaturated with highly competitive companies, usage-based insurance targets a smaller population. Telematics is expected to be implemented for meaningful use by over 70% of insurance companies in the United States during this year (Gupta, 2020). The most significant competitor in the usage-based market is GEICO – the second-largest car insurance company – which recently began providing the pay-as-you-go type of car insurance. Its primary strengths are higher publicity and general renown; however, it does not offer a discount for safe driving and implemented telematics very recently, and only in two states (Sims & Walker, 2020). The largest companies on the market do not cover their majority, which signals the availability to enter it.

Many competitors in this market have taken a selective approach, and their products are appealing to a relatively small portion of the market. For example, MetroMile provides usage-based insurance, yet it focuses on the pay-per-mile type of coverage, does not account for drivers’ behavior, and is not available in many states (Hunt, 2019). In turn, Progressive Insurance enables drivers to receive a substantial discount of up to 30% based on their behavior over a 30-day evaluation period, but it does not cover all states (Hunt, 2019). The fact that many states are excluded from the main competitors’ coverage leaves significant space for the entrance.

Another significant competitor is Allstate, which has a discount program for customers known for their safe driving. It gives an option to install a telematics device that will evaluate the customer’s driving style. However, the policy for qualification is strict, and the driver is required to use the car for at least 90 days in a six-month period (Hunt, 2019). Other competitors similarly rarely provide a direct calculation of premiums depending on the vehicle usage rate. Instead, they often offer a discount of up to a certain amount, which does not exceed 40% (Hunt, 2019). It is crucial to establish the desired market share and a location where this opportunity can be realized.

In order to become a challenger in this market, my company will need to discover the state which is the least covered by the companies that provide the most flexible insurance coverage, for example, Colorado. A personalized program will produce the desired competitive advantage for my company for each customer, who will choose a program that supports his or her driving style and needs.

The primary feature will include hourly and mileage usage rates, which will enable the company to calculate premiums based on the chances of getting into an accident while driving during a specific time in a given location. For example, when competing with Allstate, who also operates in Colorado, my company can set a low initial fee with added price per mile per time of the day, instead of providing a discount. In conclusion, flexibility is the main attraction of this market, and my company must exploit this concept to the limit in order to stay competitive.

Target Market

To compete for a share of this market, it is crucial to understand how people view the product. The product in question is highly sought after nowadays since it allows customers to save a considerable sum of money. People who do not actively use cars, beginners charged with higher premiums due to their lack of experience, and drive safely are the primary customers for the companies in this field. Cassells (2020) states that “some insurers charge less for miles driven when the roads are emptier and accidents less likely.” It is vital to present this product as desirable for people who aim to save on insurance or decrease the frequency of vehicle usage.

The primarily targeted demographics contain students and beginner drivers who aim to reduce the initial spike in insurance costs. Since it was established that people who are less prone to car accidents benefit from this type of insurance the most, advertisements should also attract people with a clean driving record. Pay-per-mile and specific daytime tariffs are not mutually exclusive; it is also vital to count people who drive less than 10,000 miles annually as potential customers.

The market for usage-based insurance coverage is relatively new due to the recent technological advancements that enabled its creation, yet it shows a promising future. Gupta (2020) argues that the usage-based insurance market “is projected to reach USD 125.7 billion by 2027 from an estimated USD 24.0 billion in 2019, at a CAGR of 23.0%” during that period. Moreover, Gupta (2020) states that “North America is estimated to be the largest market for usage-based insurance owing to the high adoption rate of usage-based insurance in new and on-road vehicles equipped with telematics units.” These statistics, coupled with a relatively low concentration of firms, signify the current window of opportunity to enter the market at the peak of its growth.

Most companies also consider the driver’s mileage per time period, and the technology that monitors vehicle usage also allows insurance companies to detect the driver’s compliance with road safety rules. Moreover, faulty telematic devices can incur high costs for customers and require closer monitoring for the user (Sims & Walker, 2020). Insurance companies need to monitor the status of telematic devices in order to avoid unnecessary expenditures. To create a sustainable business in this market, a company must first obtain a technology that will suffice all customers’ needs and preferences while also including all of the required functions.

Relevant trends and similar markets include temporary car insurance and pay-per-mile type of insurance. They aim to achieve the same result as hourly/specific days insurance policies – reducing insurance payments for customers who do not use the vehicle often, drive safely, or struggle with high premiums for regular car insurance. It is possible to expand the available programs with these options to increase insurance coverage flexibility further.

The Desired Portion of the Target Market

The target market can include lower-income households and people who do not intend to use their vehicles often. Since I chose Colorado for an example, my company will need to appeal to low-income households. In 2016, this percentage reflected approximately 33% of Colorado’s total population, which equals 1.82 million of potential customers (Ely & Propheter, 2018). It is essential to communicate with customers regarding these benefits and take their preferences into account.

By having face-to-face communications with customers, a company can increase the efficiency of interactions, achieve more positive reception, and directly observe customers’ behavior (Kotler & Keller, 2016). Statistics show that an average driver from a lower-income household in Colorado drives approximately 12,825 miles annually and pays $1,169 for car insurance (Ely & Propheter, 2018). After taking a closer look at the situation, the primary target customer group for my company will be people between ages 18-24, as well as drivers who own compact cars.

Marketing Strategy Plan

Marketing Objectives

As has been described, usage-based insurance companies are currently on the rise across the globe. They are highly successful, and the projections for future market expansion show immense potential (Gupta, 2020). Naturally, any insurance company is based around the idea of the protections of its customers’ well-being and alleviating the hit they would take in the case of an adverse incident. The value proposition for the company that specializes in providing usage-based insurance is similar, however, it includes a significantly higher amount of control that the customer can exert when purchasing a service from such a company. It is vital to reach my potential and existing customer base regarding these options and how they can benefit them.

The environment analysis from the previous paper has shown that there are other competitors on the same level and above my company, which increases the importance of narrowing down the audience for marketing implementations. An appropriate marketing strategy requires a clear set of goals, which should be consistent, realistic, quantitative, and hierarchical (Kotler & Keller, 2015).

After building a clear set of plans based on the customers’ profiles, it will be vital to reach to them to show the advantages of my company over others. The strategy has to address the average cost of car insurance per year and describe the value that my customers can obtain by choosing usage-based insurance. Nowadays, it is essential for insurance companies to provide access to their complete profiles through the Internet and create an extensive website to reach the highest number of potential customers (Blue Corona, 2019). After defining my desired market share, my company will require thorough online and offline advertising among the designated population.

Therefore, my clear value proposition will be a cheap and flexible car insurance plan for people with low and middle incomes in Colorado who are looking for a way to cut expenses. Unlike my competitors, we are willing to allow our customers to choose a set period of driving and generate their premiums based on this preference. Our business will be the most beneficial for drivers who are known for their safe behavior on the road.

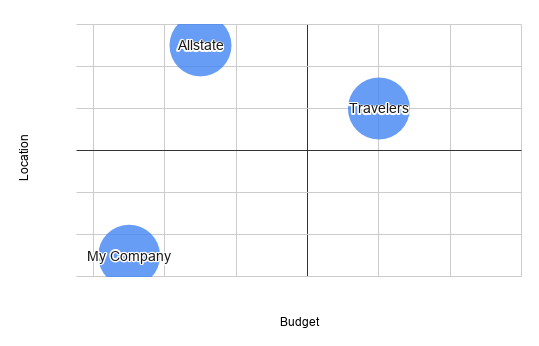

Competitive Positioning

In order to ensure the successful growth of the company, it is necessary to establish the position of the company among other competitors. As it has been discovered in the previous paper, the Allstate company also provide their services in the area of our operation. It is a widespread company whose services have a moderate degree of flexibility while covering most of the customers’ needs, as well as providing an extensive set of discounts for the target audience (Motor1.com Team, 2020). On the scale of location, my company must aim at the nearest locations in the beginning, due to the strong presence of competitors. Moreover, since usage-based insurance is a service that primarily specializes in the optimization of currently costly and unwieldy systems and services that are provided to people, my company will focus on low-budget locations.

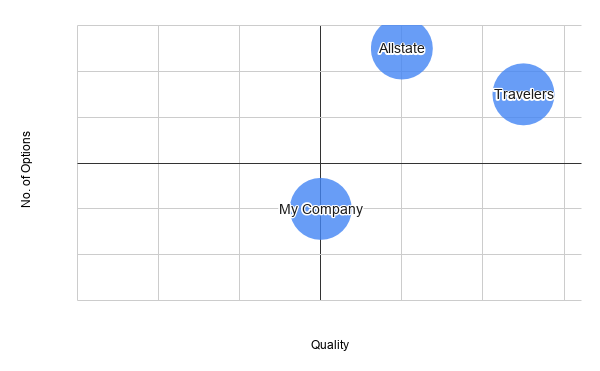

The second competitive positioning map involves the quality and range of provided services. While other companies offer a wide variety of options and do not mainly focus pay-as-you-go and other car insurance plans, this market shows the most significant potential and promises a rapid growth in the future (Gupta, 2020). For my company to become competitive in this field, it will be crucial to focus on this aspect of services only. Regarding quality, options must stay readily available for people in that region to be preferred over other companies, which requires avoiding reaching the luxurious quality of services.

Marketing Tactics

As the product of my company is an insurance service, its value lies in the benefits that the customer can obtain by choosing it over other companies. The intangibility of this service can be perceived as a negative trait for the product, but through good advertising, it is possible to appeal to the customers’ sense of reason. Marketing tactics involve a hierarchical model of the product that aims to construct a plan that will allow my company to successfully and clearly convey all benefits of the service to my target customer base (Kotler & Keller, 2015).

The core benefit of the product is the alleviation of losses caused by car accidents. The basic product is vehicle insurance that aims to reduce premium costs. The expected product for my target audience is a readily available and cheap option for flexible usage-based insurance. However, in order to create an augmented product, my company will need to add value to the product via customizable options, loyalty programs, and other possibilities for saving money.

The usage-based insurance industry is currently in its growth stage. The primary signals for this stage include growth in demand, an increasing amount of competitors, yet a relatively low concentration of the market share between the top companies (Kotler & Keller, 2015). By joining this market now, my company will become one of the early adopters, which gives it the highest chances for future success.

However, competition with Allstate can be troublesome for my company. To overcome its presence, an extensive advertising company, as well as low initial prices, will be required to gain a share of the market. There is a clear opportunity to outperform Allstate in the category of younger drivers, since they have to face the highest premiums if they choose this insurance company, up to $1,900 annually (Motor1.com Team, 2020). As one of my company’s primary target groups are students, it is possible to gain a good reputation through this audience by providing them with more options.

The hardest part of the consumer-adoption process will be the incentive to explore a new brand. To overcome it, my company will involve targeted advertisements. By using these marketing tactics, my company can optimize advertisement expenses by increasing the chances of attracting a customer, at the same time, decreasing the costs of advertising by excluding unfavorable options. Since my target customer base regularly owns one to two cars of compact type or one midsize vehicle, it is vital to create advertisements that focus these groups (Ely & Propheter, 2018).

Moreover, since my company operates in a relatively confined zone, it is vital to reach potential customers via local media outlets, such as newspapers, radio stations, and television channels. The service gap that can be expected during the product introduction is the issue with delivering the clear set of rules that the customer agrees to follow to ensure the smallest payments per mile. In order to address it, my company can provide additional consultation regarding this topic, as well as put this information in advertisements.

Product Pricing

The primary objective for my company in terms of pricing will be to provide an opportunity for drivers to save money based on their behavior on the road. It is necessary to understand how customers view the product and why do they purchase it. In the case of car insurance, it is done out of necessity, as is often regarded as an unavoidable expense (Manchester, 2020). To allow customers to lower their premiums, my company can introduce a flexible price that will be dynamically monitored via the telematics device.

According to the data from the Motor1.com Team, vehicle insurance costs for students under the age of 25 are as high as $1,991.16 per year (Motor1.com Team, 2020). This is significantly higher than the average car insurance in Colorado, which equals around $1,169 per car in low-income households (Ely & Propheter, 2018). Vavouranakis et al. (2017) state that “the average discount on insurance premiums for a driver who agrees to record his driving behavior amounts to 10−15%” (p. 311).

It is possible for my company to surpass these benefits for a large portion of the safe drivers by implementing a dynamic pricing model. Through the instant feedback from the telematics device, they’ll be able to monitor the current premium and adjust their behavior accordingly.

Annual premiums for my customers will be equal to a relatively small set premium plus dynamic additions. The direct cost will come from miles driven, safety factors (driving during high traffic hours, the number of emergency breaks, and other parameters), and driver experience. By holding the total amount of claim costs low, usage-based insurance allows companies to widen profit margins (“The future trends of usage based insurance and telematics,” 2020).

The customer category of my company is highly price-sensitive, therefore, it will require close tweaking of prices to suffice customers’ needs and to keep the company profitable. My target customer base regularly drives 12,825 miles per year. According to Gerbis (n.d.), “insurance companies maintain a profit margin of around 5 percent, with 68 percent of premiums applied toward paying claims, 25 percent spent on overhead and 2 percent set aside for taxes.” To stay competitive, the price per mile in a safe setting must be below $0.08, and up to $0.1 in a potentially risky environment.

Discounts and Allowances

Usage-based insurance is built around an extensive set of options, including rewards and discounts for customers who adhere to the rules on the road. My company will provide these rewards by introducing a loyalty program with clearly defined levels for long-term customers who do not get into accidents and follow their stated timeframes for driving. Dijksterhuis et al. (2016) argue that “in addition to informing drivers directly about the financial consequences of their driving behavior, other reward mediums could also be considered, such as providing points” (p. 1159).

Consumers tend to overvalue the importance of rewards, making the points system is preferable over direct monetary discounts since it allows companies to create an illusion of considerable savings (Dijksterhuis et al., 2016). Dijksterhuis et al. (2016) argue that “the effectiveness of a UBI may be affected by the way that feedback on driving behavior and monetary rewards is delivered to the driver” (p. 1167). Therefore, my company will provide customers with bonus points based on their adherence to the rules on the road.

Another option includes a secondary objective beyond adding value to the product. Referral programs are popular among insurance agencies and have a positive impact on the number of customers (Leonard, 2019). These programs allow participants to gain monetary rewards if they bring a new customer to the company. This system can be easily integrated into the bonus point system and expand the opportunities to reduce premiums for existing customers.

Channels

The Main Channel

As my company will be the direct provider of the service, it will be essential to provide the customers with the most convenient options for them to acquire the product. As the company’s primary target group consists of young people, the most common place for them to visit and communicate through is the Internet. Therefore, the main channel where the customer can experience the product and learn more about its features will be my company’s website. Regarding the website design, it will be mandatory for it to have a clear layout with a header navigation bar that will allow visitors to access all information from the title page.

It must be obvious for a visitor where to look for the detailed descriptions of all provided options, as well as what limitations these options imply. It might be beneficial to state the benefits of usage-based insurance on the title page to spark the interest of the first-time visitor.

Additional Channels

While the most considerable portion of the customer interactions is expected to take place on the website, it is absolutely necessary for my company to own an office at a convenient location. As the desired customer base consists of low- and middle-income households, the place must be chosen closer to the areas where the potential customer will travel by vehicle, yet out of high-traffic areas.

Regarding the choice of location, the lack of high traffic will allow my company to link an image of a free road with low premium payments. It will be essential to use billboards for advertising in the area, and not all customers are expected to search for a local insurance company on the Internet. For this purpose, my company will make a contract with a local advertising agency, which is expected to provide a list of suitable locations based on the customer base.

Marketing Communication

The primary idea my company would like to convey via advertisements is that the service it provides reduces the strain of insurance payments on a regular vehicle owner. As the target audience consists of mostly young people, it will be crucial to create advertising content that will be relatable to them. It must concern such topics as economy, freedom from mandatory obligations, and safety on the road.

The concept that I plan to use in my first advertisement is a short video that aims to highlight the essential features of my company’s product while linking it with a setting that our customers desire. The advertisement will feature narration of the list of the available options and a short explanation of the benefits of usage-based insurance over the traditional one. At the same time, the video will follow a young driver in a non-luxurious car who drives across a semi-empty road inside a town setting. The video can be shown on such platforms as YouTube and Facebook to reach the target customer base.

The second marketing option is radio advertisements, as this source of media is often used by vehicle owners. It will be necessary to analyze what radio stations are the most popular among the population that will likely seek low-premium insurance options. Moreover, my company can choose a time period during which the traffic on the streets is low and run the advertisement during it to link the driver’s current situation with potential monetary benefits.

The advertisement itself must contain a short sentence about the technology, an average bonus for safe drivers when compared with regular insurance expenditures, and the location and the website of my company. The message of the advertisement is that people can save money if they mostly use vehicles during off-hours and adhere to all rules on the road.

References

Blue Corona. (2019). 11 insurance marketing ideas and strategies for a digital world. Web.

Cassels, K. (2020). Pay as you go insurance. Uswitch. Web.

Dijksterhuis, C., Lewis-Evans, B., Jelijs, B., Tucha, O., de Waard, D., & Brookhuis, K. (2016). In-car usage-based insurance feedback strategies. A comparative driving simulator study. Ergonomics, 59(9), 1158–1170. Web.

Ely, T. L., & Propheter, G. (2018). Colorado’s middle-class families: characteristics and cost pressures. The Bell Policy Center.

Gerbis, N. (n.d.). What is the actual cost of auto insurance?. HowStuffWorks. Web.

Gupta, S. (2020). Usage-based insurance market worth $125.7 billion by 2027. Markets and Markets. Web.

Hunt, J. (2019). The 7 best usage-based insurance options of 2020. The Balance. Web.

Kotler, P., & Keller, K. L. (2016). A framework for marketing management (6th ed.). Pearson Education.

Leonard, K. (2019). Marketing strategies for insurance companies. Small Business – Chron. Web.

Manchester, P. (2020). Why the insurance industry needs to rethink its value proposition. EY – US | Building a better working world. Web.

Motor1.Team. (2020). Allstate insurance: Reviews and our take. Web.

Ralph, O. (2019). Insurance sector prepares for disruption. Financial Times. Web.

Sims, M. B., & Walker, D. (2020). Usage-based car insurance and telematic systems [Easy guide]. AutoInsurance. Web.

The future trends of usage based insurance and telematics. (2020). IMS. Web.

Vavouranakis, P., Panagiotakis, S., Mastorakis, G., & Mavromoustakis, C.X. (2017) Smartphone-based telematics for usage based insurance. In: Mavromoustakis C., Mastorakis G., Dobre C. (eds) Advances in mobile cloud computing and big data in the 5g era. Studies in big data, 22. Springer, Cham. Web.