Introduction

An objective analysis of the market in which the firm is doing business will enhance the understanding of the costs and capabilities of the firm. This will form the foundation for the development of strategies by the firm. The strategic analysis along with the application of creativity enables a firm to evolve varied options and opportunities to devise and implement strategic plans for expanding existing markets and entering new markets (Ross, Westerfileld and Jordan).

Setting a strategy needs acquisition of knowledge in the areas of firm’s customers, competencies and competitors. Analysis of customers provides knowledge on the needs and preferences of existing and potential customers and the markets. The firm can use this knowledge to build better brand equities by enhancing customer satisfaction and to identify profitable customer segments. Analytical view of competencies extends to the exploration of the skills, knowledge, proficiency and expertise possessed by the firm, which will help the firm to sustain its competitive capabilities. The knowledge gained enables the firms to ascertain their core competencies and develop on them so that the firm can improve on its competitive strengths. It also helps firms to identify its cost effectiveness, which in turn enhances the competitive ability.

One of the most important elements in the complete strategic analysis process is the analysis of competitors. Unless the firm makes a thorough analysis of the existing and potential competition, it cannot counter the actions of the competitors. Lack of competitor analysis will make the firm lose its market share to the competitors. The analysis will also inform the firm about areas of threats and the areas where the firm operates strongly. Strategic analysis in the areas of customers, competencies and competition is interrelated. In this context, this paper presents a strategic analysis of “Du” – a telecommunication services provider in the UAE.

History, Development and Growth of Du

Emirates Integrated Telecommunications Company PJSC (EITC). EITC has the trade name of Du, which is the new telecommunication services provider in the UAE. They are an integrated service provider offering voice, data, video, “fixed and mobile telephony, broadband connectivity and IPTV services to individuals, homes and businesses, and carrier services for businesses,” (Arabcom 2009 Summit). The company offers value-added services by engaging high-tech expertise to enhance quality of the service and customer satisfaction.

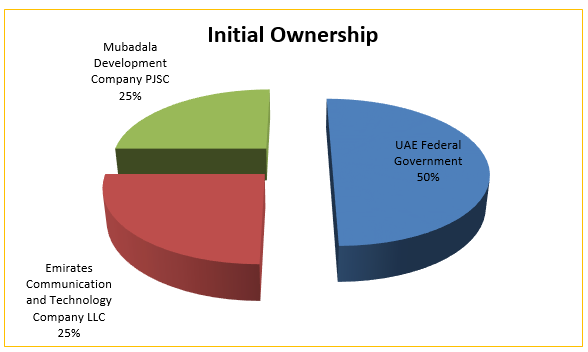

The company was incorporated on December 28, 2005 for its introduction as a major competitive player in to the UAE market, which is highly penetrated and developed. The company was formed as Public Joint Stock Company with 50% of the capital contributed by the federal government. Emirates Communication and Technology Company LLC and 25% of the capital by Mubadala Development Company PJSC contributed Twenty-five percent of the initial capital of AED 4 Billion. The above figure shows the initial ownership of the share capital by different entities (Annual Report 2007).

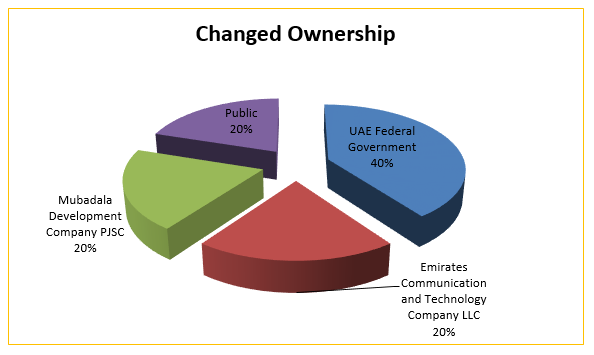

Following an Initial Public Offering (IPO) of sale of 20% of the share capital on the Dubai Financial Market (DFM) by the founding shareholders, the issue was oversubscribed to the extent of 166 times. After the IPO, the shareholding pattern changed. “It is 40 percent owned by the UAE Federal Government, 20 percent by Mubadala Development Company, 20% by TECOM Investments and 20% by public shareholders,” (AME Info).

The changed shareholding in the company by different stockholders is shown in the above figure.

In December 2005, EITC acquired the ongoing business of “Sama Communications Company (Samacom)”, “DIC Telecom International Operations Limited” and “Tecom’s technology division” from Tecom Investments FZ LLC. This acquisition gave the head start for the business of the EITC as these businesses had a subscriber base of 19,100 business and personal consumers. In 2006, the government of UAE allotted the second telecom license in the country to EITC. This license enabled EITC to operate in the domains of fixed and mobile telephony network. Using the license EITC is able to provide integrated telecommunication services across UAE. EITC adopted the new brand name of ‘du’ in February 2006.

They contribute to the transformation of the UAE by providing customers with choice and making a difference in quality, innovation, and pricing. There are 2.9 million active subscribers, who have opted for using the services of du as of June 2009. This substantiates the strong hold set up by the company in the telecom market of the country. “As a rapidly-growing enterprise, we have close to 2,000 staff working to enhance and expand our bouquet of service offerings,” (Arabcom 2009 Summit). Their staff originates from over 60 nations – “we mirror the rich cultural diversity of our nation, while being able to serve their customers in a variety of languages.” (Arabcom 2009 Summit).

Over half of their top management executives and filed staff hail from UAE and they stay entrusted to provide quality services to the company, as they perform in a multinational setting. The company has an authorized, issued and paid up capital of AED 4 Billion. “It is listed on the Dubai Financial Market (DFM) and trades under the name Du,” (AMEINfo).

Du, as an integrated service provider in the telecommunication area in UAE, introduced mobile telecommunication facilities in early 2007 across the country. This service was introduced along with other services of internet, and pay TV in some specific locations of Dubai. The company also launched “Call Select” a newly developed landline services for voice telephony available throughout the nation in July 2007.

The company launched its outlets located in different areas over all the parts of United Arab Emirates in early 2007, which supports the clients of du.

“Among du’s many firsts is its historic Number Booking Campaign for both individuals and business, Pay by the Second billing system, Mobile TV, Mobile Payments, first of its kind ‘WoW’ recharge card (which offers customers the choice between more credit and more time) and Self Care. du business offers include Closed Business User Group and preferred International Destinations,” (Linkedin).

Mission Statement, Vision and Board of Directors

Du makes the mission statement in its annual reports as to make the customers happy and to become one of the employers of choice to attract and retain best talents. The company as a part of its mission strives to create optimal value through creating excellence in its business operations and adopting innovative technological measures. Du also strives to contribute its maximum to the heritage and diversity of the nation of UAE as a part of its mission.

The company has the vision to “connect, inspire and reward.” The company adopts core values of confidence, honesty and friendliness to deliver the mission of the company. The company has a vision of establishing itself as the “operator of choice for the majority of new subscribers in the UAE market.” As a part of its vision the company likes to offer value, du continue to engage state-of-the-art technology for enabling the customers to experienced satisfaction level. The company like to mix the rich culture of the nation of UAE and at the same time provide services to varied nationalities domiciled in the UAE in different languages.

Du functions under the Chairmanship of Mr. Ahmad Bin Byat assisted by a Chief Executive Officer, Chief Commercial Officer, Chief Technology Officer, Chief HR and Corporate Services, Chief Financial Officer, Chief Strategy and Investments Officer and Chief Corporate and Affairs Officer (Annual Report 2008).

Analysis of Internal Strengths and Weaknesses

The analysis of the situation is considered very important from the angle of the external or macro environment to assess the growth potential of the industry and the competitive conditions prevailing in the industry. Similarly, the internal or micro environmental analysis becomes important to make a judgment on the capabilities of the company depending on its competencies, capabilities, resources, strengths and weaknesses and competitiveness. It is crucially important that these analyses are undertaken so that the strategic planning can identify opportunities for value creation for the firm. A good situational analysis always leads to good strategic choices.

A firm’s external environment is divided in to three major areas: the general environment, the industry environment, and the competitor environment. “The general environment is composed of dimensions in the broader society that influence an industry and the firms within it. The industry environment is the set of factors that directly influences a firm and its competitive actions and competitive responses.” (Fahey).

SWOT Analysis

The SWOT analysis brings the internal strengths and weaknesses and the opportunities and threats to the industry from the external environment. SWOT analysis of Du is presented below:

Strengths

- Professional management team is the major strength of the company

- The brand identity created by the company is another strength

- Strong revenue growth and growth in EBITDA

- Use of innovative technological ideas in product offering

- Focus on providing high quality service and customized solutions

- Increasing mobile subscribers and network coverage

- Support from a strong employee base

Weaknesses

- Higher concentration of prepaid subscribers might lead to sudden decline in revenues

- Decline in voice based Average Revenue Per User

Opportunities

- Increased market share in mobile broadband provides the base for revenue growth of telecom companies

- Change in the market trend with increased preference to data based services from voice based services. This will provide more opportunities for introducing innovative technology and product offerings

- Increased focus on niche targets with increase in corporate segment clientele

- High young age population of UAE and higher per capita GDP

- Continued influx of expatriates to supplement shortage of manpower in the country

Threats

- Shrinking of the market with the economic downturn

- Low market responses to the introduction of new services

- Decline in margins because of lowering of prices to increase the market share

- Lack of knowledge among masses to adapt to changing and latest technology

The Internal Factors Evaluation (IFE) matrix provides the relative position of the company with respect to the effect of strengths and weaknesses of the firm acting on the firm. Since the weighted score of du is 4.95 as shown by the following table is the above the average score of 2.5, the company can be said to enjoy a strong internal position. The External Factors Evaluation (EFE) matrix provides the relative position of the company with respect to the effect of opportunities and threats acting on the firm. With the total weighted score of 3.65 as shown in the following table is above the average score of 2.65 the company operates in a better external environment.

The competitive profile matrix indicates the strong presence of Etisalat in the UAE market as compared to du.

Analysis of Organizational Structure of Du

The company incorporated as a public joint stock company in the UAE has a board of directors under the leadership of Mr. Ahmad Bin Byat who holds the position of Secretary General of the Executive Council of Dubai Government. He also holds a number of senior administrative positions. The board consists of directors who are eminent personalities in the country of UAE. While the board of directors is entrusted with the responsibility of making policy decisions, the day-to-day administration of the affairs of the company is looked after by a professional management team consisting of CEO assisted by a number of professionals acting in various capacities.

The members of the management team hold high level of professional experience and controls different functional areas to guide the organizational members towards achieving the overall organizational objectives of the company.

Analysis of Organizational Culture of Du

The organizational culture of du has several dimensions. The foremost is the attention to detail. Du cares about all the details like customer follow up. This implies that the company takes into account the opinions of the customers by calling them on telephones to assess the customer satisfaction level. The company also makes several offers suitable for the customers. Du is oriented more towards customer satisfaction rather than on maximizing its earnings. Since the company has entered the UAE market recently, it is under pressure to capture sizeable market share from its competitor Etisalat.

Both the companies offer discounts, and new services with innovative technologies to attract the customers. Nevertheless, du has the corporate mission of putting the customers first and the company uses customer satisfaction as the key market strategy for its business growth in the UAE. The company’s organizational culture is to build a unique relationship with the customers by offering “superior and compelling propositions to meet the communication needs and lifestyles” of the customers. The customer orientation of the company is evident from the fact that the company has a mix of more than 30 nationalities in its customer care staff. The company provides necessary training to all of them to provide a superior quality service to the customers.

Industry Analysis – Porter’s Five Forces

Based on the present change in the customer preferences of mobile and voice needs and other data based services coupled with substantial growth in the mobile internet services, du is poised for enhancing its revenues over the long run. The company will be able to stabilize its position in the market through its innovative capabilities. The company may strive to enhance its growth by catering to exclusive customer segments like females and youth and thereby improve upon its market share and positioning. On the element of quality of service du focuses on increasing the network coverage in shopping complexes and remote locations remaining unconnected. The company also has taken efforts to increase the customer satisfaction by enhancing the quality of service.

Competition in any market /industry takes its root in the underlying economic conditions of the country/market in which the firm is operating (HusainThaker). There is most likely the existence of competitive forces that operate to act against the capabilities of a firm significantly in a particular industry.

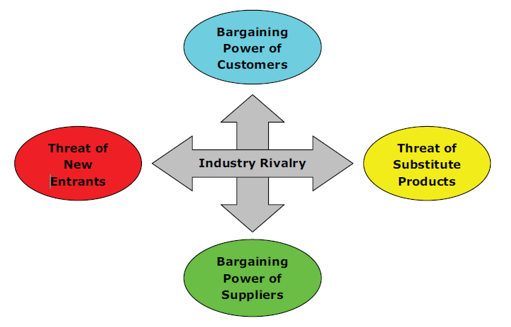

The competitive environment of du in the setting of UAE and the influence of different market forces on the business of du can be analyzed using five forces model evolved by Michael Porter. The above figure illustrates the five forces affecting the competitive ability of a firm in any industry.

Bargaining Power of Customers

The power of buyers is one of the important forces that affect the capability to value creation by any industry. The size of the market denoted by the volume of customers and the concentration of customers are the major deciding factors of consumer influence. With 10.17 million mobile subscribers in the UAE and the stiff competition from Etisalat to woo customers makes the buyer bargaining power significant force acting on the market. With 78% of the population living in the urban areas, the customers possess a thorough knowledge on the price and quality aspects of telecom services, which makes the force buyer power intense.

Bargaining Power of Suppliers

The competitive forces acting on any industry will be affected by the concentration of suppliers and the degree to which the products can be substituted by other sources of supply. The other factors that determine the bargaining power of suppliers is the level of importance the buyer attaches to the supplier and the switching costs for the buyer to source from the alternative sources of supply. Hence, the same issues that affect the negotiating influence of consumers will become applicable to the suppliers also. The UAE mobile space is found to be very competitive in terms of rates, quality levels of services and launching of value added services.

Therefore, the force of bargaining power of suppliers is medium for du, with its focus on expatriate market segment, powerful brand image and the moves of the company to provide integrated communication solutions to corporate and business clients.

Threat of Substitute Products

“If there are similar products that can be used as substitute then the demand for the product will increase or decrease as it moves upwards or downwards in price relative to substitutes,” (Purcell) There will be shift in the consumer demand to the plenty of alternatives available in the market. The switching costs to the buyers to the alternative products are also not heavy which makes this force a serious one in determining the competitiveness of the industry. The only competition Etisalat with its renewed vigor to introduce new products may be considered as threat. However, with its ability to introduce innovative product offerings and to compete effectively with Etisalat on pricing, du should be able to overcome the influence of this force easily.

Threat of New Entrants

This force acts when the new entrants could enter the market without difficulty and pose a competition for an existing business. “Therefore, the greater the threat from new entrants entering the sector, the higher the levels of competition,” (ACCA). The capital cost of entry, the scale economies, product and price differentiation, switching costs, the expected retaliation from the existing player, legislative measures and access to the distribution channels are some of the factors that influence the ease of the new entrants. Considering the current economic scenario and the large capital outlay needed to enter the Telecom market, there is no likelihood that any new firms will enter the market. The UAE federal government owns 40% share each in the capital of both Etisalat and du. Therefore, the chances of the government issuing further telecom licenses are slim and therefore this force is not strong.

Industry Rivalry

The telecom market in the UAE is a duopoly with Etisalat and du operating to capture the market share of each other. There will be no room for price wars between the companies; but the companies have to compete with each other based on technology and innovativeness of products. Therefore, this force can be reckoned as moderate.

Analysis of Financial Performance

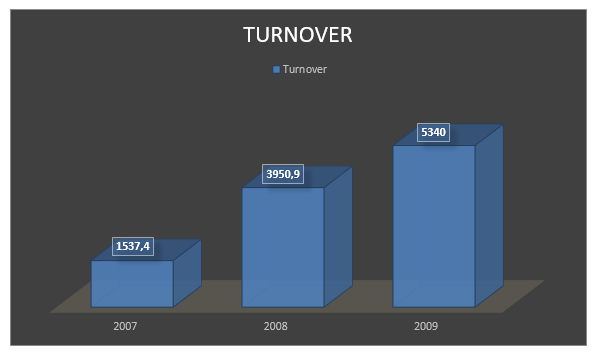

The analysis of the financial performance of du for the year 2009 reveals a net profit (before royalty) of AED528 Million (USD143.7 Million). This is against the net profit earned by the company for the year 2008 of AED8 Million. The increase in profitability is attributed to the growth in the number of mobile subscribers of the company. In respect of turnover du has posted an increase of 35% growth in sales revenue as compared to the previous year.

“The company’s full year 2009 revenue grew by 35% to reach AED5.34 billion, compared to AED3.95 billion in 2008, while earnings before interest, taxes, depreciation and amortisation (EBITDA) totalled AED1.06 billion, up 189% year-on-year compared to the AED369 million recorded a year earlier. In the fourth quarter of 2009 total revenues reached AED1.53 billion, up 25% compared to Q4 2008 and representing Du’s highest every quarterly figure, while EBITDA totalled AED366 million, corresponding to a 55% increase compared to the AED236 million posted in the fourth quarter of 2009. Net profit before royalty of AED209 million was generated in 4Q09, up 155% year-on-year,” (Information Society Portal for the ESCWA Region).

The growth in turnover is represented by the following figure.

“During 2009 Du acquired 1.011 million active mobile subscribers (including 337,900 in Q4 alone), representing a 41% increase year-on-year. At 31 December 2009 the company recorded a total wireless customer base of 3.47 million,” (Information Society Portal for the ESCWA Region). The number of post-paid users more than doubled during the year 2009. The number increased to 137,500 in 2009 from 66,300 in 2008. Strong mobile revenue at AED 3.73 billion constituted the major part to the total revenue of the company.

The growth in respect of mobile revenue was up by 42% year-on-year. The highest mobile revenues for a quarter were registered when the company earned AED1.11 billion on this account during fourth quarter 2009. “The fixed line business, including fixed telephony, TV and broadband, generated revenue of AED970 million,” (Information Society Portal for the ESCWA Region).

There was an increase in the fixed line customer base of du in the year 2009, which showed an increase from 280,300 at the end of 2008 to 405,900 as of December 2009. To substantiate the business growth the company enhanced its capital expenditure. The company spent an amount of more than AED2 billion on capital items in 2009, with total capital expenditure standing at AED2.43 billion as at the end of the year 2009 (AED2.34 million in FY08).

The capital expenditure for the fourth quarter, 2009 alone accounted for AED960 million. “During 2009 the company added 717 2G cell sites extending coverage to 99% of the UAE’s population, along with an extra 786 3G sites resulting in population coverage of more than 80%,”(Information Society Portal for the ESCWA Region). The company has set aside AED2.2 billion for network expansion and improvement in 2010.

Analysis of Financial Statements – du

As a main issue that it has been reflected in all of the financial statements of Du, is that Du is a new company to a market that controlled by only one monopoly company (Etisalat). The company has to put more efforts to build its own market share than a company that rose up in different market sectors where a fair competition is. The company managers should consider that in a situation like this, it would take more time and funds to Break-even and start making profit.

Common Size Statement

It is a way that used to compare between two companies in the same sector by taking a percentage of each item in the balance sheet as a percentage of assets, and income statement as a percentage of sales. By using 2006 as a base year for DU balance sheet shows that the percentage of non-current assets increased from 50% on 2006 to 70% in 2008 toward the total assets. At the same time, the Current assets went down from about 50% in 2006 to 30% in 2008.

This implies that the company now is illiquid than it was in 2008. However, but it is normal for new company that trying to build its assets such property, plant and equipment to spend more cash on their non-current assets. On the other hand, the percentage of current liabilities went down from 73% to 46% in 2008. From the balance sheet, it is obvious that the only current liabilities the company had for the past years were the accounts payables and accruals that the company paid about 30% off in 2008. For non-current liabilities, the percentage raised from 27% to 54% in 2008. The cause of this increscent in debt that the company starts to borrow long-term debt in 2008 after it was only relaying on shareholders’ equity of 4 billion.

Ratio analysis is the relationship that determined from firm financial information that used for comparison. A general idea about DU financial ratio is that there is growth in its revenue from year to year toward the company break-even. It shows how well the company has been managed for the past three years that been used in the analysis.

Short-term liquidity ratios

Current ratio shows 3.77 AED in 2006 that decreased to.94 in 2008. What we understand from the it that the company starts with having about 3 AED in current assets for every 1 AED in current liabilities but in 2008, it has.94 AED for every 1 AED in current liabilities. Quick ratio for Telecommunication companies is about the same as the current ratio since they are providing services to customers they do not have much of inventories. Du started with 3.60 AED and ends with 0.92 in 2008, which has only slight different from what it had in Current ratio.

Cash ratio had decreased from 3.05 to.52 in 2008, which it shows how much cash the company has toward every 1 AED it has in Current liabilities. As it has been explained earlier the company spent many cash on building long-term assets and that shows whey the cash ratio has decreased over the past three years. NWC to assets ratio for both companies is low. The reason behind it is that the company has a high current liabilities comparing to their current assets.

The debt ratio shows the percentage of debt that the company is using in its total assets. Began with.18 times in 2006 that increased to.68 times in 2008, which explain the amount of many borrowed to build its long-term assets. Even in total debt and the equity multiplier ratio, it shows that the company has borrowed a lot of long-term money it has been explained earlier. The equity multiplier ratio is the dept ratio plus 1 and that is why there are no much different between them except the one that been added. The dept amount has been increased over the three years between the equity is still the same, which is 4 billion.

The long-term debt ratio as increased over the three years to reach.53 times and it was.34 times in 2006. For the times interest ratio the company did not have any earnings in the first 2 years. It was experiencing a loss and that is the reason it was zero in both years. In 2008, it became 2 times one the company start making profit.

Turn over ratios and profitability

In the inventory turnover rate, the company started with zero turnover rates but in 2008, it got to 27 times of the inventory. It shows how well the inventories used toward the cost of goods sold. The first two years the company experienced no net income that is why it has no profit margin, ROA, and ROE. In 2008, the company started gaining return and that showed in.1% in profit margin,.05% on ROA, and 16% on ROE. By going in the same direction and business path Du would be able to increase its income, which would be shown in a better profitability ratios.

Du has not experienced any real earning that could be reflected in earning per share or any other market value. At the same time, it is expected that it would gain a great market value in the next few years, since the financial statements of the company reflect a good performances in the past few years.

Strategies and Objectives of the Company

“The most recent figures published by the UAE’s two network operators, Emirates Telecommunications Corporation (Etisalat) and Emirates Integrated Telecommunication Company (du), suggest that the UAE had almost 10.17mn mobile subscribers at the end of June,” (ReportBuyer). Du entered into the telecommunication market of the UAE with the strategic intent of introducing a new and dynamic age in to the telecom sector.

The company was expected to face the intense competition from the government owned Etisalat. Du had the strategic objective of delivering business excellence and innovative product offerings to meet the needs of both individual consumers and business and government organizations. With this objective in mind, du initiated a complete range of quadruple play suite to the UAE telecommunication market. This range consisted of “fixed line, mobile, broadband, IP and access, TV, managed services and tailored business solution.”

The first product offering took place in early 2007, in the form of mobile services with integrated telco led by telecommunication expert Osman Sultan. The superiority of the product was enhanced with world-class 3.5G network, which is in accordance with the objective of the company to offer innovative communication services, which is expected to change the telecommunications sector in the UAE for reaching the level of excellence. The objective of establishing du was an attempt to de-monopolize the telecom market of the UAE and to provide the customers a real choice of choosing their telecom service provider. At the time of introduction du had the strategic priorities of “competitive pricing, next-generation communication services, simple solution and innovative payment schemes,” (Business Management).

In the words of Osman Sultan, CEO of du “The inception of du was in line with the government’s strategy to create a highly competitive liberalized telecom industry in the UAE. It was only natural for du to understand its mission and the challenging competition ahead, our aim was to make our customers experience and perceive communication in a totally new dimension and we have clearly differentiated our services around those key pillars,” (Business Management).

Enhanced competition would enable the consumers to derive more benefits. The company had the objective of fulfilling the customers’ needs in creating all its products and services, the company followed the strategy of being updated on the latest requirements and preference of its customers. The company was keen in becoming the “business and telecom partner of choice” of its customers. The company evolved the strategy of differentiating itself through the offer of integrated solutions, which are tailor made to meet the expectations of the business customers. The company strategized that such product offerings would enable it to partner with large and powerful business corporations functioning and thereby would be able to bring world-class customer support services to improve the customer satisfaction.

First victory to the strategic intent of the company is the agreement from the integrated telecom service provider to spin its network extension swiftly and with a full commitment. This has enabled du to acquire a customer base of over 2 million customers across the country of UAE in the first 15 months after the company commenced its operations.

During the year 2008, du adopted as part of its strategic growth and expansion plans of continuing to enter into strategic partnerships and agreements with major global telecom players to adopt and initiate best practices. With this strategic initiative, the company expected to achieve complete integration of end-to-end services to business customers, which was vital for the revenue growth of the company. During the course of the year 2008, du geared itself in all respects to emerge as the partner of choice of major telecom operators across the world to meet booming demands in the area of information and communication technology (ICT) demands of varied business entities including small and medium business sector enterprises.

The objective was to make available smart communication solutions, which will help the entities enhance their efficiency as well as productivity. This strategic initiative has further strengthened the Telco’s position within the vertical markets, which found a rapid development in the UAE market after the entry of du. “This will further strengthen the Telco’s position within the rapidly evolving verticals market , primarily the real-estate, financing and hospitality sectors,” (Business Management).

The other strategic area where du wanted to penetrate and capture the market share of Etisalat was the customized voice communications and data services, which during 2008-09 were identified to be the key business drivers for improving the efficiency of small and medium sector enterprises and fight the market challenges like increasing production costs. During the year 2008, du equipped itself with the necessary infrastructure and technical knowhow and excellence to achieve distinctive dominance in providing telecom solutions to the industrial customers. The strategy in this area was to offer, “service bundling through defined business engagement models with partners and customers,” (Business Management). This strategy was adopted in addition to the one of focusing on expanding the customer base.

Meeting the Customer Needs through Simple Communication Models

The strategies and objectives of du were aimed at pursuing the policies of becoming a completely integrated telecom operator. By doing so du wanted to provide the customers with a one-stop-shop business model for meeting all their telecommunication needs and preferences. However, the company during its initial periods of functioning realized that to introduce communication models, which are simple, was a complex and challenging affair. Nevertheless, within one year of launching its strategic initiatives, the new telco was able to establish itself as an able and efficient telecom service provider. The company offered a “bundled product portfolio of fixed-line, broadband and television services as well as next generation mobile services.”

Since the telecommunication needs of a business enterprise are complicated in, nature there is the need to make a proper assessment of the business needs. “The world of business communication can be a complicated one, so du established a business division to cater to more than just business telecommunication needs and requirements,” (Business Management). This division was made to provide more than the usual telecom solutions in the form of integrated communication models to improve the efficiency of business enterprises in the SME sector.

In addition, the division also met the telecom needs of large business houses and corporate business entities. “du business enables small, medium and large companies across vast industries and market groups to improve their productivity, efficiency, reduce the operational cost and enhance performance,” (Business Management). Du currently has placed itself in the position of an exclusive communication solution provider to large number of companies in the UAE.

Du business Objectives and Product Offerings

With its variety of product offerings to meet the demands of different customer segments, the company has emerged as an integrated telecommunication solution provider in the UAE market.

“du business mobile services provides a host of business and entertainment features with single structured billing, mobile roaming , closed business user group, competitive calling rates coupled with preferred international destinations and power -Bill for added convenience to businesses across the UAE,” (Business Management)

The business of du could traverse beyond the traditional boundaries by offering mobility solutions such as BlackBerry and Mobile Data. This enabled the customers to revolutionize their business processes. In this strategic area, the telecom solution provided by du would enable business managers to connect and access data relating to their businesses even while they are on the move, without any territory restrictions. du has also introduced specialized service offerings in the voice solutions. “du voice solutions offer an array of value-added services as well as premium reporting and billing options for inbound and outbound voice traffic,” (Business Management). The establishment of “business contact centre, hosted voice, call select and several other solutions” represents the strategic initiatives of du in the area of product portfolio offered to different segments of customers in the UAE market.

Du developed certain other products and services in the field of internet & IP access solutions. “du’s internet & IP access solutions namely MPLS, IPLC, DLC, IP VPN and broad band services, are designed to provide reliable data connectivity for domestic and international business,”( Business Management). Managed business TV services are another strategic product initiative created by du, which includes a wide range of TV content solutions.

This product is intended for the benefit of commercial and hospitality industry customers, where cost of getting these services is an important business consideration. The goal of Managed Services is to increase the return on IT investments by ensuring increased operational efficiency and quality of service. The ultimate aim is to help customers exercise their control over their IT operations according to their whims while staff is enabled to focus on developing core business competencies.

The company understood that it could thrive in the competitive markets and acquire sizeable market share only by placing the customer at the center of its strategic formulation. With the intention of winning the competition from the sole and powerful competitor, Etisalat the fully integrated telco has placed customer satisfaction at the core of its strategic initiatives. As a strategic measure du offers the services of “high-touch account management with industry expertise” to its business customers.

The corporate clients can use this service as a hands-on consultation and get precise business advises on the effective utilization of business facilities. “Professional services offers pre-sales technical consultancy, complete project management, implementation and support, performance management and service auditing to enable businesses take the right decisions at every stage of the business life cycle,” (Business Management).

Du has equipped itself with the availability of dedicated service professionals having extensive technical and industrial knowledge and expertise for creating tailor-made solutions designed to suit the needs of complicated and multifaceted business enterprises. The company has established a special “business customer support” division to offer high quality service support all through the day in more than 30 languages to make sure that customer service requests and queries are attended to swiftly to enhance customer satisfaction level.

Du entered the telecom market in the UAE as a second player to the all-powerful monopoly of Etisalat. At the time, the company entered the market the mobile penetration was already 100% complete. The company could fact the competition only by being different in its approach and product offerings apart from offering competitive prices. The report of the CEO state “We have an overriding desire to offer choice to the people of the UAE. Our strong customer centric approach, together with an unusually broad scope of innovative products and tailored value propositions at launch, led to a string of extraordinary achievements,”

This statement clearly underpins the initial strategy of the company to being customer-centric and to making product offerings using innovative technology. From the inception, the company has been following the strategy of focusing on the delivery of relevant products into the market. To this extent, the company has been following a customer-centric strategy. The company strives to achieve shareholder value maximization by adopting the strategy of introducing innovative and customer-oriented products. This strategy of the company has a close bearing on the organizational culture of the company.

In order to achieve the objective of introducing innovative products, du has spent considerable time and efforts on the creation of new product. With the result, the company was the first in the world to offer “memorable number booking campaign”. This initiative was to meet the objective of providing personalized mobile phone numbers. This strategy was driven by a clear understanding of the needs of the customers to have their own personalized numbers.

Another objective of the company from the time the company came into existence is to offer the customers an exciting communication experience.

With the intention of pursuing the core, value of honesty the company delivers to the customers whatever it promises. Keeping customer satisfaction at the core, the company has installed a range of measurement tools like comprehensive brand health indicators, mystery shopper and mystery caller programs to ensure sustained level of customer experience.

In line with the strategy of the company to bring its consumers added value as well as varied lifestyle experience du has entered into a partnership with Red Bull as the official Telecom partner in the UAE for a series of high-energy events to b held in the UAE on the sponsorship of Red Bull.

In order to enhance its market presence the company entered into a strategic partnership with Vodafone from UK. Under the strategic partnership du will get an exclusive right for dealing in the products of Vodafone in the UAE. The company will also be benefited from the supply chain experience and technology development knowledge of Vodafone. Improved inter-working between networks is an added advantage to du out of this association. With this arrangement du will be able to offer improved voice and data roaming in more than 67 countries across the world to its customers.

Strategic Issues in the General Performance of du

This section presents an analysis of performance of du in this section to assess the strategic capabilities and objectives of the company.

Mobile Services

In order to arrive at the number of active mobile subscribers the telecom operators requested Telecom Regulatory Authority (TRA) to define an “active subscriber”. The request was made as the operators used to include all the prepaid and post paid subscribers irrespective of the fact whether they continue to use the service or not. In April 2008, TRA finally issue a notification defining ‘active subscriber’ to include “any mobile customer who has made a call, sent an SMS or MMS, or received a call within the last 90 days.”

Based on this definition du announced it had 1.43 million active mobile subscribers as at the end of first quarter of 2008. It is expected that du’s mobile subscriber base will grow from the reported 1.46 million subscribers in 2007 to 2.03 million in 2008. The number of subscribers was expected to go up to 2.81 million in 2009 and reach the figure of 4.05 million by 2012. This growth estimates represent an increasing mobile market share of 22 %, 28 % and 34% in the years 2008, 2009 and 2012 respectively. Even with the existing competition from Etisalat, du would be able to achieve this performance with its established brand name.

“Revenues from mobile operations will grow to AED 2.54 billion ($680 million) in 2008, AED 4.32 billion ($1.1 billion) in 2009 and to AED 7.09 billion ($1.9 billion) by 2012. We see ARPU from mobile operations growing in line with market share from AED 104 ($28.3) in 2008, to AED 128 ($34.8) in 2009 and peaking at AED 148 ($40.2) by 2011 as du completes its mobile network rollout and captures more high spending customers,” (CPI Financial).

The forecast for mobile ARPU of du from the year 2012 will be a decline, though marginally, to the extent of AED 146 ($39.7), which will be equal to that of Etisalat’s ARPU in the year 2012E of AED 148 ($40.3).

Fixed-line and broadband

The present marketing strategy of du is to offer triple-play services (voice, IPTV, data) to all its residential and business consumers. The company uses its fiber network for offering these services in some of the localities in the UAE. For example, the company offers the services in, “New Dubai” which is a planned freehold developments property area. Since the company covers corporate clients, most of its revenues are derived from this segment.

Du offers to its customers, fixed-line telephone services including inland and overseas calls at rates almost equal to that of the competitor Etisalat. “IPTV services include TV package offerings across more than 260 channels,” (CPI Financial). The company currently relies on copper and coaxial cabling for providing broadband services for last-mile delivery. However, significant investments, which the company has made in Next Generation Network (NGN) infrastructure development is expected to, increase the speed of broadband services within short time.

The strategy of the acquisition of many of the TECOM subsidiaries enabled du to offer fixed-line internet services covering limited localities. However, “delivering wire-line service to every development in the UAE would not be financially prudent, so alternatives to cabling must be pursued, WiMAX being one possible alternative,” (CPI Financial). Du can consider WiMAX as one of the possible alternatives in this respect.

It is not feasible to build an additional fixed line network covering the entire country. Therefore, the company is left with the option of focusing in the emirates like Dubai and Abu Dhabi, which have the highest population densities, which would allow du to depend on increasing its revenues from the high-revenue generating cities. du adds to its revenue stream by targeting high value overseas voice connections through its offering of the whole day overseas call tariffs, which matches the prices of Etisalat.

Overseas Business

“The International and Wholesale Division manages routing for du’s international traffic, generating revenue by providing voice and data connectivity to international telecom operators in addition to managing international relationships covering roaming, data, IP and voice interconnect,” (CPI Financial). The strategic objective of du is to operate as a hub for all overseas players who want to gain access to the UAE region. “Accordingly, the company has invested strategically in its own submarine cable capacity on the FLAG Falcon cable system and the upcoming Europe-India Gateway, as well as in its own landing stations,” (CPI Financial).

In addition, the company has exposure in the proposed Europe-India Gateway and in its own landing stations. “By connecting its terrestrial cable networks to neighboring countries, du is well-positioned to capture additional portions of the value chain,” (CPI Financial).

The revenue from the broadcast business though consistent is not significant in the overall revenue stream for du (2.3 per cent of total revenues in 2007). There is the likelihood this may grow at 3% annually considering the market position of du in this segment.

The major strategy of du focuses on offering converged services using its NGN (Next Generation Network). The company uses the same wire for providing its “triple play services of voice, video and internet.” The company would do well by including the mobile services also by offering handsets, which can be connected to the landed line network at home using WiFi. The mobile network may be used for voice services away from home. The company will be able to enjoy the benefit of reduced cost in terms of operating expenses and capital expenditure of an NGN. The company can also enjoy the benefit of high bandwidth and network scalability offered by an NGN.

Current Strategies

Du still functions effectively on a startup mode. The company is focusing around two strategic initiatives. First is the network Expansion. The company cannot compare its current geographic coverage to that of Etisalat.

“du currently has over 1,200 base stations in operation compared to Etisalat’s 7,743, of which 1,606 are 3G sites. Having depth and breadth of coverage is crucial if du is to compete with Etisalat in the mobile segment of the UAE telecoms market and] avoid paying and interconnect fees to Etisalat,” (CPI Financial).

The increased coverage will enable du avoid paying interconnect fees to Etisalat and would contribute to increased revenues. Second is the strategic marketing.

“Using its strength in marketing to create innovative campaigns targeted at specific segments of the market. Examples of du’s marketing prowess include the Me & Mine product, which offers a 10 per cent discount on two selected international numbers for no annual fee, which is attractive for the large expatriate population,” (CPI Financial).

This offer is found attractive by the large expatriate segment. One of the other marketing strategies is the joint promotions undertaken by du in collaboration with other companies. “du is also carrying out joint promotions with other companies, for example with Barclaycard, giving a free SIM and AED 280 worth of credit when a person applies for a new credit card,” (CPI Financial).

Presently the operations of du are focused within the territory of UAE, rather than extending to international operations as is the case with Etisalat. It is the indication from the management of du that the company will focus only on UAE market for a near future. This decision appears to be sensible, as du would currently find it difficult to raise the finance for funding overseas licenses and for deploying network infrastructure in foreign locations.

Investment Probabilities

Population Changes

Strategically du would prolong to use the changes in the demographics of the UAE to its revenue growth. According to the forecast provided by Etisalat there would be a change in the number of people from other countries in the UAE during a term of five years. However, du thinks differently in that the company expects the churn to happen more rapidly. Therefore, the company has formulated its strategy differently. du has decided to continue with its strategic marketing campaign with the target of reaching potential new customers from the expatriate segment. This strategy includes offering “special, time-limited, promotions that offer virtually free subscription and value added services,” (CPI Financial) to woo the new customers.

Du is confident that these initiatives would have any negative impact on the ongoing revenue streams as these offerings are less in proportion and for time limited time only. Moreover, the company does not enter into direct competition with Etisalat on price factors.

Powerful management

“The management team at du brings a wealth of experience from both international developed market telecom companies as well as regional emerging market telecom companies,”(CPI Financial). CEO Osman Sultan has long years of experience in the field and was instrumental in setting up Mobinil the Egyptian Company for Telecom Services. The “chief financial officer Mark Shuttleworth was formerly group chief financial officer of Qatar Telecom. The head of corporate strategy and strategic marketing was formerly with Orange Group in the UK,” (CPI Financial).

“Other senior management have had experience with both mobile and fixed line operators including Vodafone, British Telecom, France Telecom, Cable & Wireless, Telstra, Singtel and Tecom.,” (CPIFinancial). The vast experience of the management team enhances the strength of du.

Marketing Competence

du within the limited period of its operation has proved its strategic marketing abilities and it could turn its possible weak spots into power. For example, the initial introductory campaign of the company should have come along with the launching of MILLIONP. Generally, this delay in launching MILLIONP would have resulted in a big drawback for du. Nevertheless; du turned this delay in to its benefit by introducing a number reservation campaign. This campaign allowed the probable customers to choose and reserve their Etisalat number (bar the prefix) on the network of du, which was an attractive offer for many customers who wanted to retain their Etisalat number in du’s network.

The consumers have inadequate option in respect of products from du particularly for mobile, as compared to that of Etisalat, which offers a product that suits every one. However, the company has ensured its success in other segments of the mobile market. The success is felt in many other segments, particularly for MVNOs. In this segment, the company can target over 100,000 users for enhancing its revenue stream.

With the limitation of consumer options, du would do well to apply its marketing power for assessing the profitability of different segments of the industry and make its product offerings to meet the needs of different customer segments by using various products. Sine UAE government and associated entities hold 60% of the capital of the company du has a strong support and help for its success. The government contacts have enabled the company to achieve many of its planned goals. It is also imperative that the company should ensure a benign regulatory environment. This will help du from coming in direct competition with Etisalat for example in the area of prevention of predatory pricing.

Inadequate Geographic Coverage

While the mobile network of du extends to cover 98 per cent of the country’s people, it cannot be said to have an extensive exposure to a majority of locations. The network coverage of the company cannot be compared with that of Etisalat. This might act, as deterrent for many customers to choose du. However since a major portion of the people reside in cities, business of du may not suffer from this issue. du is also focusing on reducing the congestions by incurring additional capital expenditure on its infrastructure. Du continues to operate its fixed line telephony only in limited localities like New Dubai. The company may have to incur substantial capital expenditure to match the aggressive nationwide network of Etisalat.

Network Obstacles

One of the obstacles that du had to face was that, despite the fact that it had government authority, the company however had to meet the fulfillment requirements of and get support from local authorities and agencies for developing the necessary communication network. Du suffered significant delays, because of the need for support from the local governments. This slowed or prevented the deployment of networks depending on the locality. The strategic priority for the company is to extend the presence over the whole nation, which might take two to three years. According to Osman Sultan, the chief executive of du, the company Mobinil had to struggle for more than two years before it could deliver its services all over Egypt.

Comparison with Etisalat

The differentiating factor for du being a new entrant is the product offering with the latest and up to date technology. This should enable du to compete effectively against Etisalat. However, this may not be achieved easily by du, as Etisalat has in the past proved an early adopter of latest technological innovations in its products. In addition, Etisalat has the financial strength to acquire and introduce latest technology without strain on a national basis. On the other hand, du would be able to invest in technology only when it has the assurance of attracting and retaining its customer network with far more limitations on its financial ability.

As against the position of Etisalat, which has international operations in more than 16 countries, du has its operations concentrated only in the UAE. This makes du run the risk of depending on the revenue streams from only one geographic location with no means of diversified revenue streams. On the other hand, Etisalat is better placed for realizing revenue from diversified sources. However, the lack of diversification can be seen as strength for du as the management would be able to focus on the UAE operations alone.

Economic Situation

The immigration into the UAE is likely to decline because of increased cost of living. There is also the likelihood of large-scale exodus of expatriates out of UAE. These two factors will have their negative impact on the population growth, which is one of the main drivers of revenue enhancement. This situation may become detrimental to du as well as Etisalat. Since du has no revenues from any international operations, this situation will influence the revenue growth of du negatively. With the continued exposure to capital expenditure du may be impacted by increased capital project costs due to inflation caused by the recent economic recession.

The overseas expansion projects of the telecom operators into MENA region and the beginning of competition inside the GCC telecoms market has created a huge demand for telecommunication professionals in the Gulf region. This is a potentially serious issue for du and it has to hire more professionals for operating efficiently in the UAE, while Etisalat does not face this issue with its established presence over three decades.

SMART Objectives

The SMART objectives of du can be enumerated as below:

Specific plan of the business is to enlarge the operations of the company to capture fifty percent of the market share of UAE market. Measurable aim is to sustain a revenue growth of at least 25% in the fourth and subsequent years of operation. Achievable objective is to enhance the brand equity of the company in the UAE market. Realistic aim is to enlarge its operations in other Gulf nations. Time bound objective is to expand the business in the GCC countries in the next three years.

Strategies and Plans for Implementing the Strategies

In order to achieve the above SMART objectives, the company has to formulate individual strategies and take concerted action in respect of each of the strategies. The following table presents the strategies and plans for implementing the strategies in respect of the SMART objectives.

Conclusion

This report made a strategic analysis of the performance of du in the telecom market of the UAE. Within the short period of its inception du has performed exceedingly well. The analysis of the financial performance of the company reveals that the company has been operating profitably in the country, despite the stiff competition from the other semi-government owned telecom operator Etisalat, which is in existence for more than three decades.

The odds against the company to perform are too many in the form of limited market, lack of geographical network, stiff competition from Etisalat, economic down turn, lower churn of expatriate population, pressure to introduce innovative products and to control operating expenditure to offer better prices to customers. Despite these odds du was able to perform much better both financially and in establishing its brand equity among the diverse customer base of the UAE.

Work Cited

AMEInfo. Online payment option now available for pre-booked du numbers. 2007. Web.

Annual Report2007. du Annual Report. 2008. Web.

Annual Report2008. Du Annual Report. 2009. Web.

Arabcom2009Summit. Orascom Telecom. 2009. Web.

Business Management. du – Taking the UAE’s Communication Industry Forward. 2010. Web.

CPI Financial. UAE telecoms sector: A ‘Du-opoly’? 2008. Web.

Fahey, L. Outwitting, outmanuevering and outperforming competitors. New York: Wiley, 1999.

HusainThaker. Falcom Equity Research Report. 2008.

Information Society Portal for the ESCWA Region. Du FY09 results surge on mobile subscriber gains. 2010. Web.

LinkedIn. du. 2010.

Porter, Michael. Competitive Strategy. New York: Free Press, 1980.

Purcell, Sean. The Strategic Planning Process. 2007.

Report Buyer. United Arab Emirates Telecommunications Report Q4 2009.

Ross, Westerfileld and Jordan. Essentials of Corporate Finance. New York: McGraw Hill, 2003.