Introduction

Accountants and other finance professionals are needed to develop a business organization that ensures the delivery of quality products and superb services. Without a doubt, this great demand for top-notch professionals is felt at a greater degree in the context of the banking sector, as well as key industries within the United Arab Emirates. The importance of accountants and finance professionals is seen not only in the necessity to develop a competitive advantage over other companies, but it is also manifested in the need to comply with accounting standards. Just like the rest of the globally competitive firms all over the planet, UAE-based corporations are also compelled to follow the IFRS framework or the Financial Reporting Standards.

Corporate leaders’ use of the IFRS framework is strengthened by the application of other methods that enhance the reporting process. The end goal is to ensure the profitability of the organization and prevent the negative outcome of poor financial accounting. In order to hire highly qualified professionals that will serve as accountants and company regulators it is imperative to create the best strategy to attract and retain them through an effective hiring mechanism. It is also important to be mindful of the development of learning institutions that help shape the skills of accountants and finance professionals. The proponent of this study attempted to present an overview of the requirements of UAE-based firms when it comes to hiring accountants and finance professionals.

Literature Review

Globalization and technological developments have opened the international market. Therefore, accounting career needs some adjustments in order to prepare professionals to work in the increasingly competitive marketplace (Landgraf, Stanko, and Jinkerson 56). The issue related to internationalization of accounting is already attracting interest of some accounting scientists to carry out a more elaborate studies that address difficulties and innovations which usually arise on a daily basis.

Accounting expertise is performed by accounting professionals. Research studies in the UAE indicate that irreproachable ethical attitude and thorough accounting knowledge are the two major attributes valued among accountants by most employers. When exercising expert function, an accountant has the obligation of demonstrating all possible efforts in pursuit of honest transactions by transcribing to Expert Assessment Report (France 47). Accountants are also expected to exercise maximum independence and absolute ethics in the course of discharging their duties.

The accounting expertise as an activity or function can never be regarded as a profession according taken by some financial scholars since it demands a lot of commitment. There are still several problems and obstacles to be overcome by the accounting class (Rao, Higgins, and Baird 56). The profile of a modern accountant comprises of an individual who has accumulated a lot of knowledge within the accounting and general knowledge domain. Nevertheless, it has a guaranteed job market(Landgraf et al 57).

Needless to say, a higher pay requires quality work. The professionals in this field have to be technically smart and possess creative ability, be proactive, and have high integrity. They should not be afraid of taking risks, be selfless, have good communication skills, and understand the systematic and economic financial conditions.

Accountants are also supposed to comprehend the technical aspects of their responsibilities at work. It has been observed that beyond the technical domain of the profession, the accounting experts must be able to apply knowledge from other disciplines (Mucenski-Keck, Hintz, and Fedoryshyn 540). In defining the competencies and skills required in accounting profession alongside the desired profile, the following aspects stand out:

- Appropriate use of accounting terminologies and language used for communication

- Background accounting and Actuarial Sciences knowledge

- Ability to prepare opinions and reports that contribute to the efficient and effective performance of a firm irrespective of the organizational models that are in place

- Developing, analyzing and implementing accounting information systems

An accountant makes a difference in day-to-day operations of an organization. Hence, it allows other management teams and employees to focus on more strategic activities that do not necessary deal with accounting (France 42). An accountant should always be available, refresh operational knowledge and know how to work in teams. Accountants should also be swift in executing the mission, vision and organizational culture of a firm. An accountant should be available and proactive. In addition to seeking basic qualifications when hiring an accountant for an organization, research studies document that a rigorous academic training is necessary. He or she should also be a registered member of a professional accounting body (Landgraf et al 57).

The hiring team should assess how the job seeker responds when faced with situations that are beyond the traditional scope of their work even if he has the ability to perform additional services in an organization (France 42).A successful accountant responds promptly to demands. One of the attributes of successful accountants is innovative ability not only in their area but in other market sectors.For this reason, they should constantly take extension courses and seek technical training to improve in their proficiency. An accounting officer may act in several professional fronts, in addition to his or her own accounting management job. Companies, public bodies and non-governmental organizations do hire accounting professionals in various fields.

Forensic Accountant

Increasingly judicial and arbitral awards seek to be guided by technical reports from accounting experts since they provide the rigor of research, the independence and reliability of calculations and opinions on controversies as tax assets, profits, tax disputes and evaluation of equity (France 49).

Auditor

These are professionals with academic background in accounting discipline. They are also expected to acquire higher education and enrolled in a professional body in a region like the United Arab Emirates. They may audit and issue opinion on various entities. In a research study conducted to establish the job roles of accountants, it was found out that most respondents give feedback like independent auditors and tax agents (Landgraf et al 57). Research studies document that majority do not specifically understand the roles executed by accountants in organizations. In fact, quite a large number of accountants sometimes fail to understand their roles at workplace (Meymandi, Rajabdoory, and Asoodeh 137).

Accounting knowledge is applicable in various workplace applications and different firms or organizations. For example, the functions of a chief financial officer tend to overlap with that of the internal auditor of a company or the independent director (Dalton, Davis, and Viator 64). In regards to job advertisements for accountants, the different accounting portfolios are usually spelt out and different so that the prospective job applicants can appreciate the various roles, academic background, professional and educational training as well as experience.

Nonetheless, financial reporting quality is the threshold of professional accounting jobs in organizations. When employers advertise for accounting positions in UAE and the rest of the world, the most outstanding requirement is usually the quality of services to be offered. Safeguarding the integrity of a business organization is largely determined by the nature or standard of financial reporting. All forms of financial data generated by an organization should be treated with due caution by the concerned accountants (Meymandi et al 138).

Methodology

The presentation of facts was made possible by scouring the World-Wide-Web and following leads generated from previous research with regards to the nature of the jobs performed by accountants and professionals. Information that was gleaned from the Internet was complimented by peer reviewed materials, such as, journals and books. The authors of the said material discussed the needs of 21st century business organizations, as well as the trends when it comes to handling the requirements of the IFRS framework. For example, in one reliable source, the author described the nature of the banking industry within the UAE. The author featured several well-known banks within the region. The author also highlighted the reasons for the success of the said banking institutions.

In the finance journal Accounting & Economics the value of hiring a finance professional with skill sets that were well-suited to the organization was an eye opener. Furthermore, one of the critical components in the hiring process made it compulsory for the creation of a filtering mechanism that weed out candidates that are not going to adhere to certain ethical standards. Business leaders must choose finance professionals that are not going to tolerate unethical practices for the sake of creating misleading reports that paint a deceptive picture of the financial performance of the company.

In addition, the Journal of Business Education provided insights as to the challenges faced by finance professionals eager to move up into high-paying positions, as well as those who are determined to work for the best company in the industry. This material reminded the proponent of this study that it is important to develop a remuneration package that is attractive to the top candidates in the job market. However, it is also a reminder to create an effective hiring mechanism that communicates the needs of the company.

Finally, one of the most helpful sources of information was the Journal of New Business Ideas & Trends, because this material provided key insights with regards to management accounting and job advertisements that were created to attract top candidates in the field of finance management and accountancy. The information collated from various sources provided the backbone for the creation of a report that describes the skills set that accountants and finance professionals must possess in order to improve the financial regulation of the company.

Description of Data

Roles

Table 1: Roles.

From the role perspective, potential employees are mainly supposed to handle standard accounting procedures and provide the relevant consultations. More specific operations, such as financial control and analysis were to be found in only two advertisements.

Sector

The major part of accounting-related advertisements was to be found in the healthcare sector. A large percentage of vacancies were posted in the engineering and IT specialties.

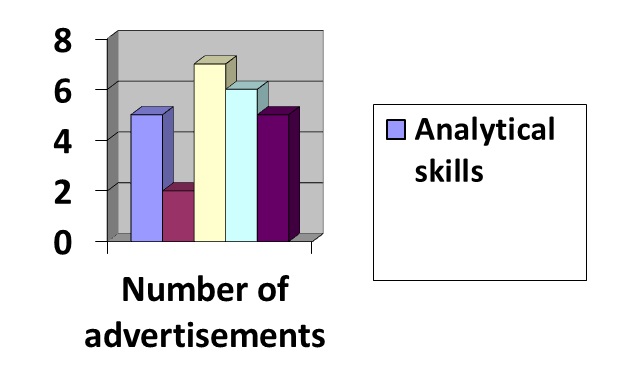

Type of skills

From the standpoint of the skills required, the analysis of the advertisements shows that the major part of employers are interested in such skills as interpersonal, communicational, and the ability to use specific computer programs (Word Excel, Power Point, etc.). Additionally, it should be pointed out that most of the recruiters would prefer to collaborate with bilingual speakers – almost all the advertisements requires that the applicant speaks both English and Arabic languages.

Professional qualification

Table 3. Professional qualification e.g. CPA, CIMA, ACCA.

Considering the required professional qualification, it turned out to be the secondary issue for many employers. Thus, some advertisements fail to mention this point at all, while others would state that any additional professional qualifications might be potentially appreciated. Only few employers are specific about this point, emphasizing the need for such qualifications as ACA, ACCA, and CPA.

Educational Qualifications

Table 4. Educational qualification.

The need for educational qualifications is outlined more evidently. Thus, it might be supposed that there is a consensus on the target education within this job market –most employers agree on the fact they will be satisfied with bachelor’s degrees. However, it is likewise clear that a master in the relevant specialization is considered to be a significant advantage.

Experience

The desirable experience period might be summarized as 2-5 years. Hence, most of the employers wish to higher experienced workers that have some understanding of the job specificity and know how to operate the necessary accounting programs. Only a couple of employers indicated the need for proved experience record.

Discussion

The accountants and other finance professionals play an important role in managing accounting transactions and controlling the finance of the organization. The importance of finance professionals has increased in the banking industry and other industries in the United Arab Emirates (UAE). The organizations are following International Financial Reporting Standards (IFRS) and other best practices for financial reporting that enhance their financial performance. The banking industry recruits qualified and skilled accountants and it requires significant experience to perform different accounting responsibilities as compared to other industries.

The UAE banks seek highly qualified accountants in different capacities to meet the standards set by the UAE regulatory bodies and government. The UAE government gives high value to the accounting education and offers free education to UAE nationals in this field. Different institutes have been established to provide high-level education and technical training in different skills such as finance, accounting, and banking.

Finance professionals perform different tasks such as examining financial records, preparing financial statements, and ensuring completeness and accuracy of financial data. The banking industry requires applicants to hold a Master’s degree in Accounting and Business Administration. Individuals with professional certifications are also preferred. The banking industry requires various skills such as analytical skills and communications skills. On the other hand, the construction industry mostly requires applicants to hold a bachelor’s degree and also low-skilled workers as compared to the banking sector. It requires candidates with relevant experience so that they can understand the business requirements and perform their duties effectively.

Conclusion

The table provided above show that the banking industry requires individuals to have 5-10 years of experience. Other industries require individuals seeking jobs in accounting and finance departments to have less than five years of experience. The banks employ individuals for different senior positions that are different from other industries. The UAE experience is mandatory for certain accounting and finance jobs in the banking sector. In 2015, the UAE banking industry experienced a significant growth that enhanced the country’s economy.

The accountants and finance professionals are directly involved in the development of the banking sector. Therefore, it is crucial for banks to hire highly skilled and qualified individuals for performing different accounting and finance tasks. The competition is high between Emirates NBD, National Bank of Abu Dhabi, Noor Bank, and Dubai Islamic Bank, and they seek the best candidates (MarketLine 7).

The IT and software service industry also needs highly experienced and qualified individuals for Finance Controller and Accounts Administration roles. The candidates with analytical, interpersonal, leadership, cooperation, accounting ethics, and other skills are given preference for different accounting positions. Recruiters in different industries review the educational and professional background of individuals and only those individuals who have relevant education and experience are hired for accounting and finance related roles. The banks and other financial institutions directly depend on the performance of the finance department and employees working in this department are considered as key assets for managing and improving their performance.

Appendix 1

References

Dalton, Derek, Ann Boyd Davis, and Ralph Viator. “The Joint Effect of Unfavorable Supervisory Feedback Environments And External Mentoring on Job Attitudes And Job Outcomes in The Public Accounting Profession.” Behavioral Research In Accounting 27.2 (2015): 53-76. Print.

France, Adrian. “Management Accounting Practices Reflected In Job Advertisements.” Journal of New Business Ideas & Trends 8.2 (2010): 41-57. Print.

Landgraf, Ellen, Brian Stanko, and DarciaJinkerson. “Preparing For The Profession: The Accounting Job Search And Beyond.” Contemporary Issues In Education Research 5.4 (2012): 315-326.Print.

Meymandi, AzamRoosta, HosseinRajabdoory, and ZibaAsoodeh. “The Reasons of Considering Ethics In Accounting Job.” International Journal of Management, Accounting & Economics 2.2 (2015): 136-143. Print.

Mucenski-Keck, Lynn, Arthur Hintz, and Michael Fedoryshyn. “Planning For Your Second Accounting Job.” American Journal of Business Education 5.5 (2012): 539-546. Print.

Rao, Arundhati, Leslee Higgins, and Jane Baird. “Traditional Gender Roles And Job Attribute Preferences: A Look At Viewpoints of Male And Female Accounting Students.” Academy Of Business Research Journal 3.1(2014): 47-63. Print.