Executive Summary

Saudi Basic Industries Corp, SABIC is one of the world’s leading manufacturers of chemical and intermediates, fertilizers, industrial polymers, and metals (SABIC 2008a, par.1). Founded in 1976 and Headquartered in Riyadh, Saudi’s Capitals Markets Authority, Tadawul currently lists SABIC as the largest public company in Saudi Arabia (Revenue: $33.667 billion), with 70% of the shares owned by the Saudi government (SABIC 2008a, par.1).

The Australian market can be considered politically and economically stable. In addition, Australia is a potentially lucrative new market for SABIC Innovative Lexan sheet with an increasing number of people in need of housings. However, the competition from local industries with the possibility of support from the governments is presenting some challenges. SABIC’s Innovative technology is based on its high standard technological know-how that helps them make high-quality products. They also rely on their huge presence in other global markets with mainly big subsidiaries in Europe and America. These strengths should help them cut into the Australian market with relative ease, with various assumptions that the current market situation persists.

SABIC will operate with a selected distributor across Australia with established links with the consumers. During the first year of market entry, SABIC should target cooperation with five retailers who will get them feedback for improvement as per their policy of continuous improvements in customer-oriented innovations. In order to promote the product, it will be crucial for SABIC to have a web presence that defines Australian cultural and social beliefs, to have presentation kits that suit Australian conditions and to train their Australian distributor appropriately as he will present and promote SABIC Innovative and its products in this new market. A good relationship is important to maintain a unique brand image. SABIC Innovative can use its existing pricing strategy for Europe and America.

Introduction

Saudi Basic Industries Corp (SABIC) is one of the world’s leading manufacturing companies that specializes in a diversified portfolio of products ranging from chemical and intermediates, fertilizers, industrial polymers, and metals (SABIC 2008a, par.2). Founded in 1976 and Headquartered in Riyadh, Saudi’s Capitals Markets Authority, Tadawul currently lists SABIC as the largest public company in Saudi Arabia (Revenue: $33.667 billion), with 70% of the shares owned by the Saudi government (SABIC 2008a, par.2). The remaining 30% of the shares are owned by private investors from both within Saudi Arabia and other countries comprised of among others the six-nation Gulf Cooperation Council (GCC). At the global stage, SABIC is ranked among the world’s top five petrochemical companies worldwide, the second-largest producer of ethylene glycol and projections show that it will be the number one once the newly launched projects pick up (S.A 2008, par.3).

SABIC bought GE Plastics (the present Innovative Plastics unit) for $11 billion in 2007, hugely enlarging its scope in American operations (Harrison, 2009, par. 8). “Our commitment to the plastics industry and our customers is unshakable. It is clearly evidenced by the aggressive steps we are taking to continue accelerating the development of newer and better sustainable, high-performance, top-quality materials” Charlie Crew, president and chief executive officer, SABIC Innovative Plastics said recently, adding that the company’s goal was to catapult its materials to greater technological excellence, creating the most innovative products on the market today (Harrison, 2009, par. 8). Under polymers and metals, the company has established the SABIC Innovative Plastic Film and Sheet business, where it manufactures Lexan corrugated iron sheets for a wide range of projects among them housing. This brand has grown considerably in its European, Gulf region, and American markets. Lexan corrugated sheet is made in high-performance polycarbonate with excellent light transmission and high impact resistance and weatherability (SABIC 2009b, par.2). Lexan general-purpose corrugated sheet is especially suited for patio, carport, and pool coverings (SABIC 2009b, par.2). Lexan corrugated sheet with drip guard is excellent for greenhouse applications (SABIC 2009b, par.3). Again apart from unique diffusion and IR blocking technology for heat and light management, SABIC also offers a specialty corrugated storm panel to protect glass windows and doors during severe weather including high winds and flying debris (par.3). In order to confirm their commitment to the quality of the product, SABIC gives a ten-year warranty for light transmission and yellowness and five years for hail damage (par.4).

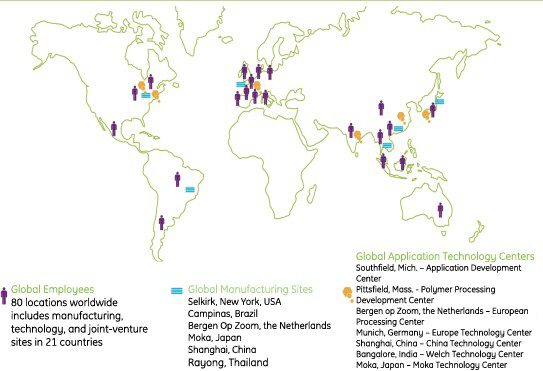

The company currently employs slightly over 31, 000 people. Presently, the company wants to expand its operations in the Australian market to add to its pool of large-scale productions and heavy presence in the major American, Asian and European markets like the USA, Netherlands, China and India (Harrison 2009, p.2). This is one step to expand and extend its operations in order to reach new markets in the South Asian Pacific region, so as to increase its presence and size worldwide (SABIC 2008a, par2). This international marketing plan should be able to help SABIC to identify the options they have in order to penetrate this potentially rich Australian market with their Lexan corrugated Sheet.

Corporate Objectives and Strategy

“Stable, reliable, capable – and global: SABIC Innovative Plastics is a world technology leader in engineered plastics. Wherever you are, you can draw from technology centers and production sites in 60 locations across 20 countries, benefiting from the rapid response and fast delivery of the materials you need” ( SABIC 2009a, par.1).

SABIC’s mission is to provide quality products and services through responsible innovations with the encouragement of learning and operational excellence to keep up strong value for their stakeholders (SABIC 2009b, par.2). They also aim to use their natural resources as well as human talent to their maximum advantage to increase innovation, education and develop the most recent technology for sustainable business practices, safety and environmental care.

Objectives will be to extend its operation to reach new markets in the South Asian Pacific region to open new markets and increase its presence and size worldwide. Australia sets to be a very attractive market bearing in mind the harsh environment in some Australian regions that highly need some of SABIC products that offer property protection against the harsh environments (SABIC 2009b, par.3).

Corporate objectives

- Penetrate South Asian Pacific region markets by successfully introducing their innovative Lexan corrugated iron sheet into the Australian market.

- Expand operations to increase the investment value from $20 billion (2007) to $70 billion (2020); and total production from 56 metric tons (2008) to 135 metric tons (2020) (SABIC 2009b, p.4)

Corporate strategy

- Develop a strong logistics base in order to build a strong and long-term customer base by investing in the building of long-term customer relationships and influencers in the value chain (S.A 2008, par. 3-4).

- Increase its research and technology (R&T) activities by collaborating the department with the strategic business units so as to help improve the manufacturing processes and strengthen the technical know-how for quality production (SABIC 2008c, par.2)

- Work with the highest level of integrity as well as operating with the highest standards of ethical business conduct, with the ultimate aim of maintaining the current culture.

- Strong operating systems and mechanisms so as to maintain compliance, with continuous enhancement of quality products over time to help ensure our vision of continued compliance and preventive action. This is enhanced through programs that are meant to observe environmental, health, safety and security policy. Helping suppliers and customers improve key areas of their daily performance that include environmental impacts of operations and product use and applications;

- A clear focus on the delivery of the highest near-perfect products and services through the highest disciplined approach to the Six Sigma production process that relies on design, production and distribution to enhance quality and marketability for the resultant product (SABIC 2008a, p.2).

Organizational Resources

SABIC is a worldwide company with its headquarter based in Riyadh, Saudi Arabia. It has a strong presence in both Asian, European and American markets, where it has over 17 affiliate companies and about 22 subsidiaries. With decades of experience, SABIC Innovative Plastics is armed with some of the widest material portfolios in the building and constructions industry and visibly unmatched industry expertise in helping architects and builders realize the innovative solution to match the demanding needs of the customers (ARCAT 2009, par.1). SABIC Innovative Plastics, Specialty Film and Sheet, provides a variety of materials aesthetic appeal of glass with both aesthetic appeal and value-added performance (ARCAT 2009, par.1). The product is based on Lexan polycarbonate resin, considered to be one of the world’s most versatile materials, characterized by high impact strength, an excellent balance of low weight and high stiffness, impact and fire-resistant, weatherability and naturally “crystal-clear” transparency and design freedom (ARCAT 2009, par.1). SABIC Innovative Plastics products can be used to help deliver creative, easy-to-install glazing that is built to last and with an additional 10-year warranty covered of 10-year against excessive yellowing, loss of light transmission and loss of strength due to weathering, the Lexan corrugated sheet offers one of the world’s most demanded products (ARCAT 2009, par.1).

The freedom of design is found in the SABIC Innovative Plastics’ versatile high technological products ranging from Lexan sheet, monolithic and multi-wall which are found to help in the tailoring towards different segments of the market demand since they offer options for a variety of lightweight, colors, prints, textures, special effects and coatings like superior weatherability, self-cleaning, and anti-drip (ARCAT 2009, par.1).

The product is commonly applied in the architectural interiors, cladding and facades building, swimming pool covers, transportation infrastructure, sound walls, stadium roof glazing and arena applications, industrial glazing, security glazing and greenhouse use (ARCAT 2009, par.1).

The company enjoys vast technical ability in terms of resources for continuous innovations and flexible designs that enable them to meet the stringent needs of its customers (ARCAT 2009, par.1). This is seen in the pool of technical ability in their American market where they have been acknowledged as one of the best innovation pioneers, supported by their human resource capacity worldwide.

Operating Business Environment

This section summarises the main findings from the business and economic environment, and the analysis of the market and competitors that SABIC will encounter in their new market of Australia. This brief summary below provides an overview that is in the SWOT analysis. The combined strength/ weaknesses and opportunity/ weaknesses provides the balance between the ability and difficulty for SABIC and may provide a platform for how to cope well with the business environment in Australia.

Note: Please for more detailed information refer to appendix 1& 2

Further Analysis

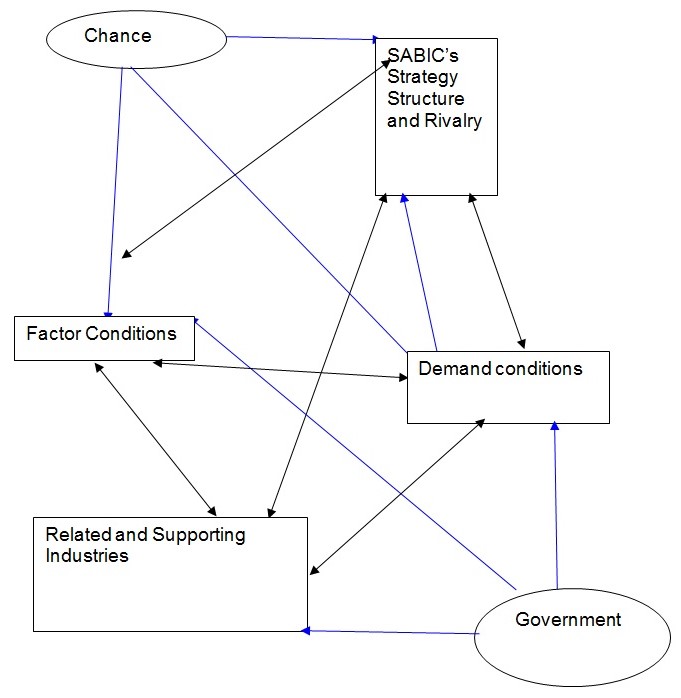

The summery of the SWOT analysis above and the detailed one at the referred appendices gives a combination of both the opportunities and threats that exist in the Australian market for the entry of its Lexan corrugated iron sheet. It is apparent that SABIC has a competitive advantage over the competitors with its huge capital base, the increased growth in the target market and unique innovative approach to highly technological products. For further analysis, it is important to apply some of the commonly used theories to explore in detail what the market environment will look like. The following stage below represents Porter’s Diamond Theory (Porter 1998) which will be used to expose the competitive advantage that SABIC is bound to have in the Australian market.

Porter’s diamond

According to Porter (1998, p.126), there are four determinants that encompass the Diamond namely:

- Factor condition: Expounds on a county’s status as regards factors of production like skilled labor and infrastructure (P.126). Australia, as a country is considered to be one of the countries with excellent infrastructure, with the most modern rail transport already providing many companies with good means of transport. Furthermore, the location of Australia and its easy connectivity to Europe make it easy for the SABIC to import some of its factors of production from its huge and well-established subsidiaries in Europe. The trend of long working hours in the Australian market may reduce SABIC’s cost of employing many staff hence reduce cost of operation. Again the recent deregulation of the Australian industry means the company has a chance to use external contractors to help boost production. The present harsh environmental factors like frequent hailstones and storms may provide a perfect opportunity to market the highly rated lexan corrugated sheet for quality housing projects.

- Demand conditions: There is a steady increase in the Australian population, consequently the increase in demand for housing. There were 20.55 million people by May 2006, and it was estimated to steadily rise by 1.2% yearly (Jackson, 2009, p.20). The social trends such as the move towards smaller households, the increasingly aging population, the rising number of households and the increasing single parenthood are likely to further drive the need for housing (Jackson 2009, p.21). Thus the projected demand for new dwelling places in the country is approximately 128,000 per year up to 2014, and later to rise in a higher figure (Jackson, 2009, p.20). Furthermore, Australians increased income per household means the possibility of increased leisure activities that will mean more constructions of recreational centers and their components like swimming pools. All these factors coupled with the Australians show of pride for high quality products will work in favor of SABIC. There is also the increased demand for horticultural activities which lexan thermonuclear drip guard sheet offers a perfect solution for its high quality and usability. This may be used by SABIC to expand its demand.

- Related and supporting industries: Australia is a technologically advanced country, with a highly sophisticated level of technology. Australians are amongst the leading internet users in the world with the bulk of the population preferring online purchases over the traditional physical purchases. Many manufacturing companies in Australia have invested heavily in the research and development of new technology (Gorrill 2007, p.41). This would provide an opportunity to market and sell the lexan product online Again Australians have highly qualified architects with international reputations. They have won international accolades in various occasions like the Beijing Olympics construction projects and building of several stadiums across Asia as well as Middle East (Fletcher & Brown 2005, p.122). It is possible to establish a good rapport with these skilled workers to market the lexan corrugated iron sheet.

- SABIC’s strategy, structure, and rivalry: SABIC has a legacy for pioneering innovations in many areas of their operations such as metal and chemical line industries. Their philosophy of continuous innovation while focusing on the customer need is what keeps them apart from their competitors. This is visible in their continuous educational strategies for its employees and attachment with recognized institutions in Asia, Europe and America to produce top-class experts in the manufacturing industry. They intend to increase their contact with their customer to have custom-made products unique for their customers hence the attachment with the sales team as it happens in their European marketing team. For example, the SABIC Innovative Plastic Specialty Film and Sheet business is the leading supplier of high-performance engineering film and sheet products. With its cutting edge performance of flame, smoke and toxicity compliance, exceptional strength and modulus at elevated temperature, broad chemical resistance and stiffness make the products fit for a wide variety of usage as has been shown by leading airline companies in Europe and the United States like British Airways and United Airlines respectively (SABIC 2008a, par.2).

Porter (1998) further states that other than four determinants, the nations’ competitive advantage is seen in how governments and natural events can influence the business environment (p.312). He, therefore, highlights such areas as changes in the socio-cultural trends among the populations, the political initiatives, and technological advancements to be potential areas that may alter the entire market condition (Porter, 1998, p.333). Some of these factors may not be visible at present but cause much influence on the progress of the business. It is therefore hoped that there would be full government support and continuous deregulation of the construction industry.

It is worth noting that Australia provides a competitive advantage to SABIC according to Porter’s Theory. Such strengths for competitive advantage could be seen in its modern infrastructure and high level of technological advancements, highly recognized engineers, and most importantly, the daily soaring of housing need would present a business opportunity for the SABIC. However, it is critical for the company to take advantage of the prevailing competitive advantage to have its lexan corrugated product adapted to the market. This calls for what is known as Market Mix Strategies and Tactics to help them succeed in this area which will be discussed later in the plan.

Planning Assumptions

There are specific major assumptions in this marketing plan. They are made on the basis of theoretical predictions of some events or situations that may occur in the market. They are as follows:

Political development in Australia: It is assumed that the stable political environment that has characterised Australia will stay. The recently elected labour party had been known to push the labour relations in favor of workers and their union with not much consideration. It is assumed that they will work with both workers union and associations of manufacturers to balance the labour industry.

Australian Economic Development: The fact that Australian economy has experienced continuous steady growth in the past few years gives ground for a theoretical assumption that the economy will continue growing. In 2007, Australia’s GDP measured on purchasing power parity basis was estimated at $760 billion and accounted for 1.1% of the gross world product (TradingEconomics 2009, par.1). The projected demand for new dwelling places in the country is approximately 128,000 per year up to 2014, and later to rise in a higher figure (Jackson 2009, 22). This aspect is important because the construction industry depends very much on the economic situation at any time.

Demographic development in Australia

With an estimated population of 20.55 million people by May 2006, and an estimated steady rise of 1.2% yearly (Jackson, 2009, p.20), it is assumed that the trend will continue. The social trends such as the move towards smaller households, the increasingly aging population, the rising number of households and the increasing single parenthood are likely to further drive the need for housing (Jackson, 2009) is also expected to boost the housing demand. All these are major assumptions that may or may not happen.

Competitive structure of the industry

The competition in the Australian market is assumed to continue be in its current state. It is expected that none of the current companies dealing in similar products as SABIC e.g. corrugated iron sheet will not merge and gain a competitive advantage in terms of economy of scale and other r factors. It is also assumed that the competitors will play a catch-up game after SABIC launches its unique brand of Lexans variety.

Marketing Objectives

SABIC Lexan corrugated Iron sheet objective: To provide high-quality corrugated iron sheets for diverse environmental conditions of the world in order to boost the housing and construction industry needs.

Objectives:

- To be number one in the technological innovation and produce world-class products which are client-tailored

- To corporate with as many dealers as possible within the next five years so as to penetrate the potentially lucrative Australian market

- Cooperate with dealers in Australia within the next five years in order to penetrate the Australian market.

- Create an awareness of the necessity for Lexan corrugated iron sheet and achieve the biggest market share in Australia

Market Entry Strategy

Launching a new brand in a foreign market can be tricky for a company considering numerous barriers that are eminent (Tracy 2000, p.7; Lusch & Lusch 1987, p.41; Roger 1995, p.71). It, therefore, follows that launching an own-brand of Lexan corrugated sheet in the Australian market will certainly be challenging due to the number of factors posing threats. One such complexity is that SABIC is mainly known for its chemical manufacturing rather than metallic or sheet making, despite good performance in these areas. However, there are some specific target market sectors that seem lucrative like the building and construction industry. First, brand positioning will be essential since it will be a key factor in successfully establishing the new brand name (Williamson, Cooke, & Jenkins 2004, p.51). Taking into consideration the strength of SADIC (manufacturing and resource base) it should be in a position to launch an effective brand identity in the Australian market. According to Williamson, Cooke, Jenkins (2004, p.78), there is a need for proper inclusion of all marketing strategies. For example, the product will need to be tailor-made to the Australian market. Where and how it can be purchased will also be important, especially regarding positioning. There needs to be an available answer to such questions as which distribution strategies should be used? What type of distributors will work effectively? To avoid the complex nature of distributions that exist in the Australian market, it will need to embrace collaboration with an established distributor who has a strong network in the country (Langford & Male 2003, p.213). Launching of the product would need a complete and comprehensive strategy that entails place and time of launch. SABIC can use its wide knowledge of market entry strategy that made them create a great impact in European and American markets.

Generic marketing strategy

SABIC’s competitive advantage is the continuous innovations that make them produce unique brands that emerge with cutting age in their eventual markets. Again their custom-made approach of manufacturing for specific market needs is a cut above the rest. This is made possible with continuous research and development strategies they have employed in their other markets. Further, the act of merging the research and development with the manufacturing team has proved very successful somewhere else, since they are able to get direct feedback from customers and act on the necessary adjustments. Their 10 year warranty for Lexan corrugated sheet should make it easy for them to acquire loyal customers who may feel insured by such a warranty especially when doing first attempt purchase.

SADIC has direct access to high-quality, innovative production facilities and manufacturing know-how as compared to its competitors. The SABIC Innovative Plastic Specialty Film and Sheet business is the leading supplier of high-performance engineering film and sheet products. With its cutting edge performance of flame, smoke and toxicity compliance, exceptional strength and modulus at elevated temperature, broad chemical resistance and stiffness make the products fit for a wide variety of usage as has been shown by leading airline companies in Europe and the United States like British Airways and United Airlines respectively (SABIC 2008a, par.4). The company will use this to extend its own strength for competitive advantage.

The Polymer Processing Development Center in the US is recognized as a center of excellence and is equipped with a state-of-the-art laboratories and facilities for sophisticated analysis and advanced technology of processing (SABIC 2008a, p.5). Its current twelve manufacturing sites across the US, Canada, the Netherlands, Italy, Austria, China and Japan, its ability to reach and serve customers around the globe with a wide range of products, in a tailor-made delivery system (SABIC 2008, par.2). Besides, its wide variety of resources makes it one of the best and highly recognized manufacturers of corrugated iron sheets, with the ability to deliver real-time business (IBISWorld, 2009, par.2). This is in no doubt why the Fortune 500 ranked SABIC as the Middle East’s largest and most profitable publicly-listed non-oil company, in terms of market capitalization in 2005, further placing it at number 331 on this particular year’s top Fortune 500 (World Cargo News 2009, p.2-3).

SABIC has a strong portfolio presence in the major global market. The Saudi parent company will act as the supplier of skills in technology and resource base. Its wide range of experience in the industry rather looks like it is a familiar entrant in many world markets. Since its subsidiaries in Europe and North America have a wide and recognized establishment just like the Saudi Arabian headquarter, it will use the resources available to establish its competitive advantage in the Australian market. Besides, the 18 affiliates in Saudi Arabia will act as the resource providers, including highly skilled human resource (SABIC 2008b, par.4).

Many major buyers in other global markets already recognize SABIC as a market leader, thanks to the high ratings from major familiar brands like Fortune 500, Bloomberg (ranked SABIC 13th largest company in the world) and Forbes Magazines (ranked SABIC 145th the World) (Zawya.com 2008, par.4). These rankings are highly valued by buyers around the globe and make SABIC’s reputation much easier to associate with. SADIC has excellent environmental conservation efforts. The company also offers a ten-year warranty for its lexan corrugated sheet (SABIC 2008a, par.3), hence extending its reputation with the clients. In order to cut into the Australian market, the company will have to use appropriate available data to get access to this potentially rich market, by building its public relations.

Target market and positioning

At present, only 15% of Australian buildings are constructed using basic steel framing materials, as compared to the UK’s 70% and United States’ 50% (IBISWorld 2009, par.2). This means that United States and UK developers have embraced steel framing technology than their Australian counterparts. However, the present efforts to make more heat-proof buildings from the new technology have presented a new dimension altogether, making steel demand projections to be on the upward trend in the coming years (IBISWorld 2009, par.6). Furthermore the old notion among Australian housing developers that steel was an expensive alternative to concrete framing has been ruled out by a detailed comparison of cost and time in five-building projects that showed that both the financial cost and time were more or less the same, and with more research, the overall result is bound to favor steel (Aspen 1990, p.78).

Australians are increasingly getting informed of environmental and social issues. In a survey conducted in 2001, about 69% of Australians were concerned with environmental issues and would consider the product’s environmental status when making a decision to purchase (Jackson 2009, p.18). The recent data may not be available but considering the increased awareness, the percentage is most likely high at present. In other words, customers, suppliers as well as the general public are increasingly demanding that every business, particularly manufacturing firms, reduce any negative impact of their products and operations in the natural environment and preserve the existing resource for sustainability. This means that any new product and its production process must be environmentally friendly in order to cut into this market. Because of the culture of strong labor union in the country (Gorrill 2007, p.81), it is necessary that SABIC becomes ready to observe ethical issues related to employment as well as working conditions.

Agricultural production focus shows a downward trend hence the likelihood of digging deep into the national economy of the entire country. This is because it is one of the major contributors to the Australian economy. The current trend is attributed to the current and expected worsening of drought, water insecurity, global warming, and the general change in climate (Gorrill 2007, p.29). This negative impact is likely to be mainly on the horticulture productions. Traditionally, horticulture industry has supplied Australian population with fresh vegetables and fruits, a system that had been affected by the loosened border control, allowing importers to import cheap agricultural products (Gorrill 2007, p.37). However, since this was sealed, the country is likely to face high demand for agricultural products in the future, putting a lot of pressure on the farmers to increase their production capacity, a scenario likely to increase greenhouse farming. With vegetables, fruits, and wheat making top ten crops likely to be affected in the country, farmers are likely to resort to greenhouse farming, hence increase the demand on SABIC products of Lexan film sheet for greenhouse farming.

Preferred Strategy

The preferred strategy of SABIC will be to segment the Australian marketing approach through innovation approach of making a superior-high-quality product with unmatched durability for the increasingly unfavourable weather conditions of Australia. Being aware of Australia’s attitude towards quality and beauty, the company will balance between maintaining Australian pride and manufacturing high-quality products. This will be emphasized by the 10-year warranty approach for lexan corrugated iron sheet as non of the competitors has dared to take pride in the durability of their products by offering such a long term warranty agreement with their customer.

Marketing Mix Strategies and Tactics

This section will provide suggestions to major adaptations of the SABIC lexan corrugated iron sheet plus a suggested planning budget

Product

The Australian market situation dictates that environmentally friendly products are produced for the target consumer market to purchase the product. It is therefore important for SABIC to establish Research and Development on the Australian base to ensure a similar trend applied in the American and European markets continues. The product manufacturing will have to be oriented to the Australian market.

Distribution

The best distribution strategy for SABIC would be through established distributors all over Australia, who would be working with the sales team to establish true on sale demand and changes needed. The increasing use of the internet as a way of purchasing goods and services may mean that SABIC establishes an online store to cater to its technology-savvy market niche. This would not be a difficult part as the company is already technologically ahead of its competitors.

Planning Implications for the Organisation

For SABIC to have a proper penetration, it will be critical that the company adopt the outsourcing of its distribution activities with reputable distributors. The following criteria should therefore be used to establish a reputable distributor:

- Should already have or soon establish contacts to specialize in the distribution of building materials in the Australian market (ABS 1973, p.42).

- Should have a profound knowledge in the building and construction industry thus providing SABIC with substantial information about the market situation at any time to help adjust production and /or product delivery.

- Should be ready and willing to take training on the SABIC organized training on their products

Price

The extensive network of SABIC in major European and American markets should give them a strong advantage in terms of marketing. It is believed that good pricing techniques that have made them succeed in other competitive markets will offer a good starting point in this case. Despite its superior innovative product, SABIC will not put its price above its competitors but the pricing strategy will be based purely on its overall cost of production and the projected profit before and after-tax. This is expected to be realistic approaches to pricing rather use the competitor’s current pricing methodology. It will be crucial for SABIC to maintain this pricing model in the Australian market in order to avoid grey markets and the emergence of unauthorised distribution channels.

Promotion

SABIC’s promotion strategy would be basically to strengthen their Lexan product brand. This is important in justifying their pricing Vs product quality balance (Fahey & Narayman 1986, p.31). To communicate this strategy to its chosen distributors, SABIC will train the said distributors on the actual value of the products and ensure that the distributors have the product knowledge to promote that brand image to the consumers.

Training a new distributor will require about a one-week training session. A sample of the training cost in Australia is illustrated in the Appendix. SABIC could use this as a starting point in establishing its schedule and budget. It will be necessary to include more samples to come up with a well-balanced training plan. It is also important if SABIC embraced the available trade shows in Australia to showcase their unique products and learn from competitors.

Planning Budget

A monthly budget for SABIC innovative plastic is shown on the following page from January – December 2010. The calculations are based on the following assumptions:

- Getting a distributor to lexan corrugated iron sheet is expected to take three months. Thus no sales would be made from January to March. In April & May, one retailer shall be identified and will be selling lexan products. In June there will be 4 then followed by five in July.

- The expected sales boom from June due to the summer period is to increase sales by 50%

- R&D expenses vary and are highest just before and during the initial market entry stage in order to adapt the products to the Australian needs. They decrease later. However, R&D is a continuous activity.

- Marketing costs: The marketing costs are listed individually, like the trade show booth reservation in June 2008.

- Note: please see appendix 3 a& b for more details on planning activities and budget.

Apendix

Appendix 1

The Business and Economic Environment

Political Environment: The political environment of Australia is relatively stable, considering its regular democratic elections (Gorrill 2007, p.21). The following issues related to politics and the manufacturing industry are very crucial for effective penetration of the Australian industrial product market: Nationalism and Patriotism: Several consumer types of research have repeatedly shown that Australians give preference to local products, hence would monitor the labeling of the product to confirm whether it’s locally manufactured. For example, in 2005, McDonald Australia Ltd, a local company in Australia announced it would stop sourcing all its potatoes (raw materials for fries) from Tasmanian producers, announcing a new deal with supplier from New Zealand (Gorrill 2007, p.42; Deutsch 2007, p.4). This resulted into a nationwide protest against McDonald Australia Ltd to create awareness on the verification of the local product by the public before purchase (Gorrill 2007, p.44). Such is the level of culture of patriotism in Australia and it is worth taking the time to monitor such cases before launching a new product. In other words, the national pride is reflected through preference of the local products, and this if not well analyzed, may work against SABIC.

Government and general population’s support of Australian Brands and manufacturers: Australian manufacturing industry was highly regulated in the past decades (ABS 1973, p.55). The government of Australia restricted the entry of new industries, especially the manufacturing foreign industries in an effort to protect the local industries (Aspen 1990, p.188). However, presently, the manufacturing industry has been deregulated, giving foreign industries a lease of life to establish themselves. However, observers see the newly elected labor government enacting new policies to protect Australian jobs, thereby making it difficult for the new firms to import labor and the existing firms reorganize their labor. This is likely to alter labor relations of many companies.

The general Labor Trend: A Reserve Bank (RBA) compiled Labor Force Survey data showed that employment in the manufacturing industry has steadily declined in the past two decades. This was attributed to the increasing use of additional capital per unit of labor inputs and improvement in multifactor productivity (IBISWorld 2009). Again, an increase in average hours of work per person employed in manufacturing and the relocation of labor to more capital-intensive activities have also reduced employment requirements in the manufacturing industry (IBISWorld 2009). However, a reverse trend has emerged especially in the last two years, when the manufacturing companies employed a record 40,000 Australians (IBISWorld 2009).

Safety, quality and Standards: In every government and region, there are specific safety and quality standards. The government would put standards of quality e.g. durability, and safety of its uses. These guide the process of manufacturing and distribution (Gorrill 2007, p.34).

Economic Environment

Economic stability: Australian economy has experience continuous steady growth, and at this moment, the economy is steady and strong (IBISWorld 2009). It is thus worth noting that the purchasing power has increased as much as the living standards have continued to improve. Economic projections indicate that the country’s economy will continue to prosper, with many seeking comfortable shelters as part of their basic needs (IBISWorld 2009).

State of Agricultural Economy: Agriculture is one of the major contributors to the Australian economy. The forecast shows agricultural production is likely to decline at an alarming rate, largely as a result of the expected worsening of drought, water insecurity, global warming, and the general change in climate (Gorrill 2007, p.29). This negative impact is likely to be mainly on the horticulture productions. Traditionally, horticulture industry has supplied Australian population with fresh vegetables and fruits, a system that had been affected by the loosened border control, allowing importers to import cheap agricultural products (Gorrill 2007, p.37).

However, since this was sealed, the country is likely to face high demand for agricultural products in the future, putting a lot of pressure on the farmers to increase their production capacity, a scenario likely to increase greenhouse farming. With vegetables, fruits, and wheat making the top ten crops likely to be affected in the country, farmers are likely to resort to greenhouse farming, hence increase the demand on SABIC products of Lexan corrugated for greenhouse farming.

Socio-Cultural

Consumer Trend and Social Awareness Issues: There is an increased awareness of environmental and social issues in Australia. In a survey conducted in 2001, about 69% of Australians were concerned with environmental issues and would consider the product’s environmental status when making a decision to purchase (Jackson 2009, p.18). The recent data may not be available but considering the increased awareness, the percentage is most likely high at present. In other words, customers, suppliers as well as the general public are increasingly demanding that every business, particularly manufacturing firms, reduce any negative impact of their products and operations in the natural environment and preserve the existing resource for sustainability. This means that any new product and its production process must be environmentally friendly in order to cut into this market.

The Australian labor market is highly unionized and Workers rights are at the forefront in the labor market (Gorrill 2007, p.81 Beacham, 2009, p.66). It, therefore, follows that every company must be willing and ready to observe ethical issues related to employment as well as working conditions.

Demographics and Housing: There is a steady increase in the Australian population, consequently the increase in demand for housing. There were 20.55 million people by May 2006, and it was estimated to steadily rise by 1.2% yearly (Jackson, 2009, p.20). The social trends such as the move towards smaller households, the increasingly aging population, the rising number of households and the increasing single parenthood are likely to further drive the need for housing (Jackson, 2009, p.29). Thus the projected demand for new dwelling places in the country is approximately 128,000 per year up to 2014, and later to rise in a higher figure (Jackson, 2009, p.31)

Education and Skills: The Australian skilled labor is no doubt below par, especially technical skills needed in the manufacturing industry (Jackson 2009, p.25). Fabricators, architects, engineers, designers, and detailers are in short supply, and if there are, then they are the ageing baby-boomer generation (Jackson 2009, p.21). This may complicate matters for the new entrant in the Australian market and it may need proper arrangement and realignment of the human resource strategies of the company.

Attitude on Available Brands: It is noted that many Australians are not only brand-aware but also brand-conscious; hence they would want to purchase particular brands that they can identify with. SABIC will need to look at the brand positioning very keenly and closely

Technology

Australia is a technologically advanced country, with a highly sophisticated level of technology. Australians are amongst the leading internet users in the world with the bulk of population preferring online purchases over traditional physical purchases. Many manufacturing companies in Australia have invested heavily in the research and development of new technology (Gorrill 2007, p.41). Every other effort is made to improve technological advancement to escalate productivity for the local industries. Furthermore other many international companies in the manufacturing industry generally have highly sophisticated technology to offer them competitive advantage. Due to this, the companies were able to use of technology to increase efficiency with their clients through the use of new technology in the manufacturing industry, enhancing the speed at which they could reach their clients with minimal contacts.

SABIC, therefore, has to get adequate information about the Australian market; knowing what the target customer needs most will require that they develop fact-based information to support the claim of strength and uniqueness of their steel product (Zawya.com 2008, par.6).

Appendix 2

SWOT Analysis

Products: SADIC has direct access to high quality, innovation production facilities and manufacturing know-how as compared to their competitors. The SABIC Innovative Plastic Specialty Film and Sheet business is the leading supplier of high-performance engineering film and sheet products. With its cutting edge performance of flame, smoke and toxicity compliance, exceptional strength and modulus at elevated temperature, broad chemical resistance and stiffness makes the products fit for a wide variety of usage as has been shown by leading airline companies in Europe and the United States like British Airways and United Airlines respectively (Zawya.com 2008, par.2).

The Polymer Processing Development Center in the US is recognized as a center of excellence and is equipped with state-of-the-art laboratories and facilities for sophisticated analysis and advanced technology of processing (SABIC 2008b, par.6). Its current twelve manufacturing sites across the US, Canada, the Netherlands, Italy, Austria, China and Japan, its ability to reach and serve customers around the globe with a wide range of products, in a tailor-made delivery system (SABIC 2008). Besides, its wide variety of resources makes it one of the best and highly recognized manufacturers of corrugated iron sheet, with the ability to deliver real time business (IBISWorld, 2009, par.4). This is in no doubt why the Fortune 500 ranked SABIC as the Middle East’s largest and most profitable publicly listed non-oil company, in terms of market capitalization in 2005, further placing it at number 331 on this particular year’s top Fortune 500 (World Cargo News 2009, par.3).

Support and Affiliations: SABIC has a strong portfolio presence in the major global market. The Saudi parent company will act as the supplier of skills in technology and resource base. Its wide range of experience in the industry rather looks like it is a familiar entrant in many world markets. Since its subsidiaries in Europe and North America have a wide and recognized establishment just like the Saudi Arabian headquarter, it will use the resources available to establish its competitive advantage in the Australian market. Besides, the 18 affiliates in Saudi Arabia will act as the resource providers, including highly skilled human resource (SABIC 2008b, par.3).

Reputation: Many major buyers in other global markets already recognize SABIC as a market leader, thanks to the high ratings from major familiar brands like Fortune 500, Bloomberg (ranked SABIC 13th largest company in the world) and Forbes Magazines (ranked SABIC 145th the World) (SABIC 2008b, par6). These rankings are highly valued by buyers around the globe, and make SABIC’s reputation much easier to associate with. SADIC has excellent environmental conservation efforts. The company also offers a ten-year warranty for its lexan corrugated sheet (SABIC 2008b, par.2), hence extending its reputation with the clients. In order to cut into the Australian market, the company will have to use appropriate available data to get access to this potentially rich market, by building its public relations.

Weaknesses

Experience: Despite its heavy presence in main European and US markets, SADIC is little known in the Australian market. No major research has been done on the role its product will play in the Australian market and how it will be received, considering the harsh business environment prompted with the used to be high regulations and fierce competition among the existing businesses.

Brand Identity: SADIC is highly recognized for its chemical production more than metal and sheet products. This kind of brand identity may work against it as compared to its potential competitors who deal in one line of business, steel and metal products.

Brand positioning: Most Australians are not aware of the SADIC brand. This may take longer to establish in a market full of skepticism about foreign brands. With an increased preference for local brands by the locals, it will cost more resources, financial and time, to ensure the brand is positioned at par with other similar products.

Costs: The cost of launching a new brand in the Australian market is likely to be sky high due to the high regard placed on quality and pride: consumers like taking pride and identify with products of high quality to symbolize class, hence the high costs of advertisement, especially during the TV prime time advertisement.

It will be therefore essential to have a well-planned budget, with the use of low-cost PR techniques such as press releases and sending samples to key journalists, as well as combining advertising for possible discounts on larger total purchased.

Internal Obstacles: SADIC Saudi Arabia may object to its Australian market target, considering it a high-risk venture. Proper research must be done to establish the real threats and the possibilities of turning them into opportunities. This must be communicated to ensure the proper relationship is cultivated among the stakeholders.

Opportunities

Profits: The harsh climatic condition in Australia is likely to create larger potential for huge profits. Excellent marketing and sales strategies like strategic pricing will create huge profits for the company.

Growth: the steady rise in population and the changing social trends means high potential for growth and expansion in housing demands. The demand is likely to generate a lot more interest in housing projects by both private developers and government. This presents an opportunity for housing materials like SADIC products.

Threats

Competition: the two companies, BlueScope and OneSteel are well established and recognized brands in some form of monotony in the Australian market. This kind of position is a potential threat to SADIC, whose entrance will mean new strategies for competitive advantage by these companies.

Government support: Due to their local affiliations, BlueScope and OneSteel traditionally get support from government of Australia. For example, the provisions of subsidies and tax waivers have been traditionally given to local companies to encourage them to produce more with less and wade off competitors from outside the country.

Aggressiveness in competition: the present competitors, BlueScope and OneSteel, are expected to be more aggressive when a new market entrant comes in to compete with them. The competition may result in price wars, war of superiority claim, etc.

Limited emerging skilled labor: The Australian skilled labor is diminishing, putting a lot of pressure on the companies to pay more for less working hours. This is likely to be a real challenge to SADIC, with an option of importing skilled labor from outside Australia, at an extremely high cost.

Appendix 3 (a)

Consolidated Action Timetable

Appendix 3 (b)

Appendix 4

Global Presence {Adapted from SABIC (2009)}

Reference

ABS, 1973, Australian Standard Industrial Classification (ASIC) 1969 Edition, Cat. No. 1201.0, Mimeo: Canberra.

ARCAT 2009. Innovative Plastics SABIC Innovative Plastics. Web.

Aspen, C1990, Estimates of Multi-factor Productivity, Australia, ABS Occasional Paper, Cat. No. 5233.0, Mimeo: Canberra.

Beacham W 2009, SABIC seeks acquisitions in high-temperature polycarbonate, ICIS news. Web.

Deutsch, CH 2007, General Electric to sell plastics divisions, New York Times. 2009. Web.

Fahey, L & Narayman, V 1986, Macroenvironmental Analysis for Strategic Management: West Publishing.

Fletcher R & Brown, L 2005, International Marketing – An Asia-Pacific Perspective, 3rdedition, French Forest, NSW, Australia: Prentice Hall Australia.

Gorrill, R, 2007, Doing business in Australia: Australian social and business culture. Canberra: CIA World.

Harrison, R 2009, “SABIC climbing up the growth ladder”, Arab News. Web.

IBISWorld, 2009, Iron and sheet manufacturing in Ausralia: Australian Industry Report. Web.

Jackson, C, 2009, “Strengthening Australia’s steel industry”, Ministry of Innovation, Industry and Research, Vol.67, no.1, pp. 18-29.

Langford D A, Male S 2003, Strategic Management Construction, London: London School of Economics.

Lusch R F & Lusch V N 1987 Principles of Marketing, Kent Publishing.

Porter, M E. 1998, The competitive advantage of nations, London, UK: Macmillan.

Roger L K, 1995, Handbook of Strategic Planning, Cummings & Hathaway, East Rockaway, N.Y.

SABIC, 2008a, Lexan polycarbonate sheet: a solid portfolio. Web.

SABIC 2009b, Corporate Profile. Web.

S.A 2008. SABIC Marketing Iberica: Profile. Web.

Tracy, B 2000 The 100 Absolutely Unbreakable Laws of Business Success, Berrett, Koehler Publishers.

TradingEconomics, 2009, Australia GDP Growth Rate. Web.

Williamson D, Cooke P, & Jenkins W, 2004, Strategic Management and Business Analysis, New York: Wiley Publishers.

World Cargo News, February 2007, “PN wins Steel Deal” [Online]. Web.

Zawya.com 2008, Saudi Basic Industry Corporation. Web.