Introduction

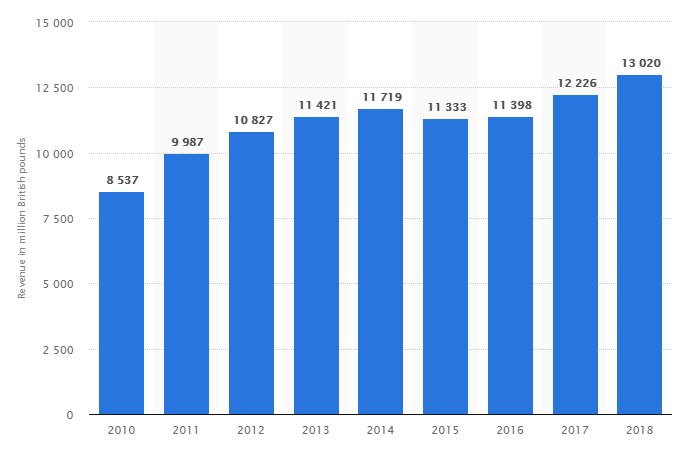

British Airways (BA) is the national flag carrier of the United Kingdom (UK). Supported by about 45,000 employees, it is also one of the leading airlines in Europe and a member of the One World Alliance (Cooper 2018; British Airways PLC 2018). A general analysis of the firm’s finances suggests that it has had a positive performance between 2014 and 2018 (Statista 2019). For example, in 2014, it posted a profit of£702 million (Good Growth Market 2016). Figure 1 below provides a general analysis of its revenue growth.

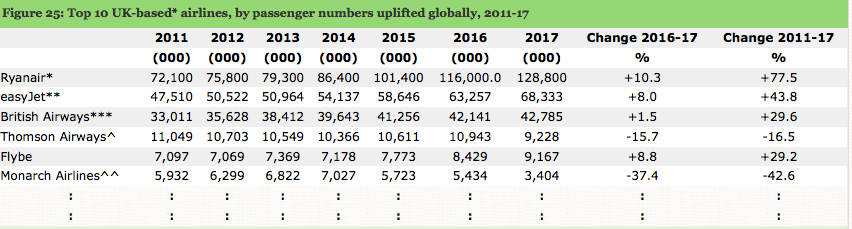

BA’s positive performance can be further supported by the company’s high online search traffic from its e-commerce platform (Good Growth Market 2016). It also leads its European rivals in having the most significant impact on the global aviation industry (Cooper 2018; British Airways PLC 2018). This capability is visible in the American market, where BA has outwitted its rivals to become the most dominant European player (Good Growth Market 2016). The company’s leadership position is also visible in its passenger numbers because, as highlighted in Appendix 2, it only follows EasyJet and Ryanair in having the highest passenger traffic in Europe. BA has also increased its route network because it now operates in more than 80 countries, as opposed to 72 that it had in 2017 (Cooper 2018).

Although BA’s performance has been largely positive, competition from its rivals such as Virgin Atlantic, Delta and American Airlines is still expected to have an impact on the company’s performance (Sharma & Singh 2017). For example, the entry of low-cost carriers in Europe has led to a decline in the airline’s market share (Gollan 2017; Cooper 2018). Nonetheless, a broad assessment of the company’s overall performance shows promise in maintaining a leadership position in Europe.

Strategy Choices – Competitive Advantages

The biggest differentiating factor for BA is its Heathrow operational base. Many carriers around the world would want to have such a strategic positioning, but the available slots are only limited to a few airlines, and BA is one of them (Heathrow Airport Limited 2019). Here, it is important to point out that such busy airports have few landing slots, and BA enjoys the privilege of operating from the same location (Heathrow Airport Limited 2019). The company’s access to such a vital transport installation partly explains its privilege as one of the oldest airlines in the UK and a key pillar of British society. Using this strategic positioning, BA easily has access to one of the world’s most strategic airports because Heathrow is a central transport hub for the transatlantic route, which is deemed a lucrative one (Good Growth Market 2016; Airline Trends 2015).

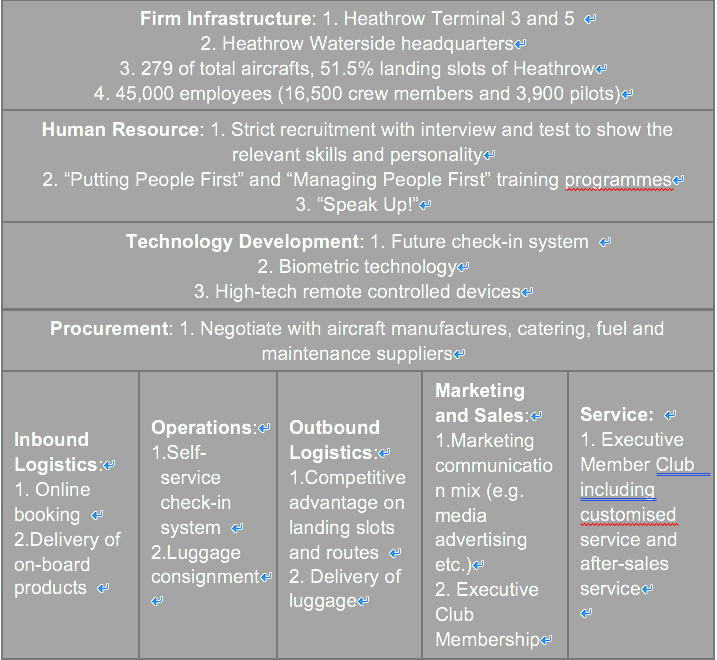

The centrality of Heathrow airport is partly highlighted in the company’s value chain model (highlighted as Appendix 2), which shows that the airport is a key part of the company’s infrastructure. Consequently, it is a central pillar of its operations.

Another differentiating factor for BA is its state brand support. Indeed, it is considered the UK’s national flag bearer and a beneficiary of the state’s goodwill to succeed (Branding Forum 2019). This privilege accords it the “right” to receive state support – a benefit that would be useful to its rivals. BA’s operations on the route between Heathrow and the John F. Kennedy (JFK) airport in New York is also another differentiating factor because few airlines have a high number of flights on this lucrative route as BA does.

BA’s strategic positioning, as a subsidiary of the IAG Group of companies, is also another differentiating factor for the airline because the parent company often acts as a business partner (IAG 2016). For example, IAG Group has been effectively negotiating deals, such as those involving airline purchases and access to airports, better than its rivals have done (International Airlines Group 2019). It has also negotiated some of BA’s most profitable mergers and acquisitions, such as the one with Iberia, and code sharing agreements it has with other airlines (International Airlines Group 2019). These contributions have improved BA’s competitive power.

Strategic Direction

The Ansoff matrix described below summarises BA’s strategic direction

Table 1. Ansoff Matrix (Source: Developed by author).

Market Penetration

According to the Ansoff matrix outlined above, BA’s market penetration strategy is characterised by competitive pricing, aggressive promotional campaigns and increasing the customer base through loyalty programs. The company’s pricing strategy has been relatively successful because it has allowed customers to choose whichever type of service they are comfortable paying for (Bhasin 2019). The goal of this pricing strategy is to make the company’s services affordable. The opposite is also true because it allows customers who value comfort to get the luxurious services they want as well. BA’s pricing model has been divided into a three-pronged framework for billing its customers: premium pricing strategy, medium pricing strategy and low pricing strategy. This sophisticated model has enabled the airline to penetrate different market segments.

BA’s aggressive promotional campaigns have also enabled the company to increase its effectiveness in achieving high levels of market penetration because it has increased brand awareness across different countries (BA Media Center 2019b). In addition, it has cemented customer loyalty for its most trusted clients because it rewards their patronage (BA Media Center 2019b). Its sensitivity to customers with special needs has also complemented its loyalty program (BA Media Center 2019b). The refurbishment of some overseas terminals have similarly added to passenger comfort and improved customer satisfaction levels (BA Media Center 2019c)

BA’s market penetration plan has also been supported by its decision to increase customer numbers through loyalty programs. These programs are designed to retain new customers because they are incentivised to be loyal to the airline. Most customers want these benefits; therefore, they become loyal customers – a process that has significantly increased the airline’s market share, especially in terms of passenger traffic (Bhasin2019; Statista, 2018).

The adoption of e-commerce has also been a key pillar of the company’s strategy. Broadly, e-commerce gives BA an opportunity to access its customers from different online platforms, such as social media, web-based programs and even emails. This strategy is unlike past ones where customers had to walk to travel agencies and book flights. Alternatively, customers were forced to go to the company’s offices and have their concerns addressed. This brick-and-mortar model made it difficult for the airline’s clients to access the company. Therefore, it limited BA’s options to access new customer segments. Consequently, the airline has been relying on its e-commerce strategy to bridge the gap.

Evaluation

In this section of the report, BA’s strategies are evaluated according to their suitability, accessibility and feasibility, as outlined below.

Suitability

BA’s strategies have paid off through increased revenues and adaptability to current market dynamics. The company’s access to vital transport hubs, such as the Heathrow Airport, has helped the company to gain access to one of the world’s most strategic airports on the transatlantic route (Good Growth Market 2016; Airline Trends 2015). In this regard, this vital installation is a key pillar of its value chain model, and it should be protected.

Although some of BA’s plans have failed to achieve their intended goals, the reliance on technology is a strategic part of the company’s overall plan because most of the firm’s operational functions are virtual (Good Growth Market 2016). For example, its booking strategy is mostly online-based (BA Media Center 2019a). The suitability of this strategy is supported by an article authored by Good Growth Market (2016), which shows that BA has achieved tremendous market growth through the implementation of its technology strategy. However, the author proposes that the company needs to pay more attention to its execution (Good Growth Market 2016). For example, the company’s toolbox for its e-commerce strategy has been deemed inferior to its competitors (Good Growth Market 2016). This weakness can be seen through several limited applications the company uses to advance its technology strategy. For instance, it only uses Google Analytics for its webpage reviews (Good Growth Market 2016).

Nonetheless, the growth of the airline industry offers BA unlimited potential in increasing sales. This finding is supported by a report authored by Bicknell (2018), which shows that 50% of the airline’s revenues could be sourced from advances in the industry. However, it is impossible to achieve such a target by relying on the brick-and-mortar business model. Therefore, BA can only benefit from the implementation of its strategies by ensuring they are suitable to current market trends.

Acceptability

In the past, BA’s strategies have been a source of contention between managers and employees. However, through increased consultation, its strategies have been received better by its stakeholders (Good Growth Market 2016). To further increase the acceptability of its current strategies, the airline needs to match the physical infrastructure demands of implementing its plans (in terms of scheduling more flights and penetrating potential markets) with the demand that will emerge from new markets once the strategies are holistically implemented. For example, the company’s focus on technology is likely to be accepted by prevailing market conditions because of the popularity of smartphones around the world. In other words, BA can access an unlimited pool of customers through these devices. This unrestricted access of customers and the high-tech data analysis techniques available to the company to profile its customers means that BA has a good opportunity of increasing its market share if it can match the demand that could arise from implementing its strategies with its operational supply capacity.

Feasibility

It is feasible to implement BA’s strategies without much difficulty because experts have pointed out that the company could realise a frictionless customer engagement if it increases investments on its website and product differentiation plans (Good Growth Market 2016). This strategy would not only improve its appeal to customers outside the UK but also provide a platform for getting valuable feedback from them. In light of this concern, it is important for BA to increase its customer engagement plans by making its products more user-friendly. Overall, the company stands a good chance of increasing its international appeal by focusing more on its e-commerce strategy.

Suggestion

According to BA’s SWOT analysis outlined in Appendix 1, one of the problems affecting the company is increased competition from its rivals. This problem could be solved by revamping its market differentiation strategy to set the company’s products apart from others in the airline industry. Particularly, the airline should leverage its vast knowledge and experience in the industry to develop unique products that will provide value to its different customer segments. BA should also stop focusing on the UK and European markets (alone) as its main transport routes and diversify to new places because many other destinations around the world are underserved. For example, the African market is a new and emerging subsector of the airline industry that could offer profitable returns for the airline.

Appendix

Appendix 1: SWOT Analysis (Source: Developed by Author)

Appendix 2: BA’s passenger numbers (Source: Developed by Author)

Appendix 3: BA’s Value Chain (Source: Developed by Author)

Reference List

Airline Trends. 2015. Differentiation. Web.

BA Media Center. 2019a. British Airways announces its latest initiative to enhance customer service – with a bespoke new online help centre. Web.

BA Media Center. 2019b. British Airways becomes first and the only airline to receive an autism-friendly award. Web.

BA Media Center. 2019c. British Airways announces a move to New York JFK’s terminal 8. Web.

Bhasin, A. 2019. Marketing strategy of British Airways. Web.

Bicknell, D. 2018. BA ready for e-commerce take-off. Web.

Branding Forum. 2019. British Airways. Web.

British Airways PLC. 2018. British Airways PLC annual report and accounts year ended 31 December 2017. Web.

Cooper, R. 2018. BA’s state-of-the-art technology for the airport of the future. Web.

Gollan, D. 2017. ‘How bad is British Airways’. Forbes. Web.

Good Growth Market. 2016. British Airways: the battle for the Atlantic. Web.

Heathrow Airport Limited. 2019. British Airways. Web.

IAG. 2016. IAG takes flying to a new level. Web.

International Airlines Group. 2019. IAG results presentation. Web.

Sharma, MG & Singh, KN 2017. ‘Servitization, competition, and sustainability: an operations perspective in aviation industry’, Vikalpa, vol. 42, no. 3, pp. 145-152.

Statista. 2018. British Airways Plc’s passenger cargo uplifted in the United Kingdom (UK) between 2008 and 2017 (in metric tonnes). Web.

Statista. 2019. British Airways Plc’s worldwide revenue from FY 2010 to FY 2018 (in million GBP). Web.