Introduction

Rationale for the Business Idea

Drugs Manufacturing Company (herein referred to as DMC) is a business organisation operating in the pharmaceutical industry. It deals with the manufacturing of generic medicine. DMC is located in Jordan, Middle East. Generic medicines are also referred to as generic drugs or simply as generics (Reast et al. 2011). They are drugs that are largely comparable with branded medicines with regard to intended use, performance and quality characteristics, route of administration, strength, and form of dosage.

The term “generic” is used in extension to refer to drugs that are marketed under their chemical names (Cameron et al. 2011). Generics are manufactured by various companies in Jordan, but their production and sale is regulated by the government. Generic drugs are cheaper than branded ones. However, they still have the same efficacy because they contain the same active components. The cost of producing generics is lower because the companies do not invest in research to develop the drug.

Additionally, there is high competition in the industry after the expiry of the patents. Generics are quite common in the Middle East because most people cannot afford branded versions of the drugs. Most of the generic drugs used in Jordan are produced in the country. However, there are still few imports from India (Bertagnolio et al. 2012).

Scenario Chosen

The scenario that was chosen for this project is that of a generic drug producing company, dubbed DMC, which is located in Amman. In addition to being the capital city of Jordan, Amman is also the largest city and cultural centre of Jordan. The population of the city is close to 3 million. After Dubai, Amman is the second most favourite location for regional headquarters of international business (Abbott et al. 2012).

The pharmaceutical sector in Jordan is growing very fast and is currently the second largest exporter in the nation. Local pharmaceutical companies in the city produce branded generics. Branded generics contribute 90 percent of total revenue from the pharmaceutical sector, while the remaining 10 percent is realised from companies operating under licenses from multi-national companies. DMC will join various companies in the city that produce branded generics (Daly 2011).

Aims and Objectives of the Work

The main objective of this business development plan is to outline how DMC will enter the pharmaceutical industry and become profitable. Other objectives include:

- To provide affordable medicines to all our customers

- To take responsibility of the effects of our corporate activities on the environment.

- To improve the quality of life in the local community by providing high quality medicines and participating in social events.

Structure of the Work

The current business plan is divided into five chapters. The five are introduction, the business concept, feasibility, strategic analysis and business model, and business plan.

Business Concept

Mission Statement

The mission of DMC is to become the most successful company in the production of generic drugs in Jordan, and to diversify its operations by expanding throughout the region.

Vision Statement

The vision of DMC is to attain profitability and success through the manufacture of high quality generic medicines that will be available at affordable prices. Through product diversification and price leadership, the company will endeavour to increase its customer base beyond the borders of the country.

Concerned Product

All the products of the company are generic drugs that will be manufactured in two plants operated by the company in Jordan.

Positioning

Within the first three years, the company will especially focus on communicating the uniqueness of the DMC brand to attain brand equity and market share. Unlike other companies in the country, the company will not use a “me too” approach to attain differentiation. On the contrary, our efforts will be targeted at promoting the brand on the same plane on which other companies are competing.

Scale and Growth Anticipation

Within the first five years of business, the company endeavours to grow in both revenue and profitability by at least 80%. DMC will adopt e-commerce to increase its sales channels using Search Engine Optimization (herein referred to as SEO).

Feasibility

Primary and Secondary Market Research

Market research is very essential because it helps in gathering important information that explains consumer needs, buying habits, opinions and choices. It is used by organisations to determine the marketing mix that is most appropriate for the company’s success. Market research links the marketer to the customer, consumer, and public via information. Such information is used to define and identify opportunities in a market.

In addition, it is used to define and identify problems, evaluate necessary marketing actions, monitor the performance of the market, and assist the marketing department to understand dynamics of different markets (Lewis & Trevitt 2003).

Market research is divided into primary and secondary research. In primary research, the marketer collects new information through such processes as market surveys, questionnaires, and focus group and telephone interviews. The company directly contacts the customers to get information. Organisations customise primary research according to specific needs. It is based on statistics and as such, sampling techniques are used (Birn & Forsyth 2002). In the current business development plan, market surveys will be used to collect primary data.

Secondary research refers to the processing of data that was previously collected by other researchers. The researcher consults press articles, reports, and research projects that had been conducted earlier on. The data used in secondary research is gathered from previous studies, which are usually conducted by trade associations, government agencies, or other organisations. In comparison to primary research, secondary research is cheaper because it does not employ new research techniques. However, because of time difference, the findings may not be accurate. In addition, the objectives of study are usually different between past and current studies (Birn & Forsyth 2002).

Product Feasibility

The generic drugs’ market in Jordan has undergone a great deal of transformation since 1962 when the Arab Pharmaceutical Manufacturing Company was formed. Currently, the country has six main pharmaceutical manufacturers. Like most countries in the region, the market is branded. Both generic and patented medicines are sold under certain brand names (El-Said & El-Said 2007). The demographic changes in the country and the region in general have increased the rates of literacy and life expectancy, leading to enhanced cognizance of health issues.

Consequently, there is an increasing demand for generic drugs and other pharmaceutical products. Life expectancy in Jordan increased from 69 years to 71.5 years between 1995 and 2005. By the end of 2005, the 15 year-plus rate of literacy in the country was 91.8%. The demand for generic medicines has also been heightened by the increasing rate of lifestyle related ailments, such as cardiovascular diseases and diabetes (Millar et al. 2011).

DMC will be involved in the production of more than 100 over-the-counter (herein referred to as OTC) and prescription products in various dosage strengths and formulations. DMC will produce drugs in diverse therapeutic categories, mainly antibiotics, dermatological, gastrointestinal, cardiovascular, analgesics, respiratory, anti-histaminics, and anti-rheumatics. The company will work in collaboration with the Jordanian Pharmaceutical Manufacturing Company (JPHM).

JPHM specialises in the production and transfer of technologies and patents in the industry. JPHM’s technology transfer includes formulation, development, scale up, quality control, and quality assurance. DMC will also collaborate with JPHM to develop and upgrade the company’s quality systems to make sure they comply with Good Manufacturing Practice (herein referred to as GMP) requirements.

JPHM is also collaborating with other companies in the Arab world and Sub-Saharan Africa, such as Simed in Sudan, Saiph in Tunisia, Pharmagreb in Tunisia, Shefaco in Yemen, Sigmatau in Sudan, Novopharma in Morocco, Balsam in Syria, Elbour in Egypt, Azel in Eritrea, and Finalpharma in Mozambique (Abbott et al. 2012). Within the first ten years of operation, the company is poised to achieve at least 600 generic product approvals.

Industry Feasibility

The Health Care System

The country’s ministry of health is the main healthcare provider. The ministry is responsible for providing quality and affordable care to all citizens. It operates hospitals, comprehensive and primary healthcare centres, child health and maternity centres, chest disease centres, and dental clinics. The ministry of health also provides the citizens with public insurance. On the other hand, the Royal Medical Services (herein referred to as RMS) provides healthcare services to members of the public security agencies and the military, as well as their families (Reast et al. 2011).

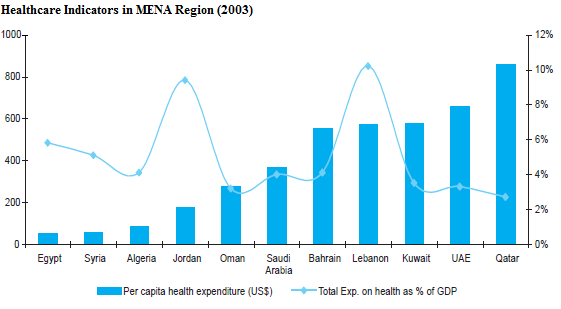

Private care is also gaining ground in the country. The health per capita expenditure of the nation in 2003 was 177 USD, which is largely comparable to that of Egypt, Syria, and Algeria. However, it is lower than that in GCC countries. In the same year, the total health expenditure in the country was 9.5% of the nation’s GDP, which was slightly higher than that in GCC and other countries in the Middle East (Millar et al. 2011). The table below represents healthcare indicators in MENA regions as of 2003:

Because of the thorough healthcare system in the country, Jordan has become one of the most preferred treatment destinations in the Middle East. Currently, the country has very efficient facilities for specialised treatments in such areas as cardiology, kidney transplant, laparo-endoscopy, ophthalmology, oncology, plastic surgery, and neurosurgery. It is approximated that more than 40 percent of all tourists visiting Jordan travel to seek medical services. The patients mainly come from Sudan, Palestine, Libya, and Yemen (Correa 2006).

Regulations

The Jordan Food and Drug Administration (herein referred to as JFDA) is charged with the responsibility of ensuring that pharmaceutical products meet set standards. In comparison to other countries in the region, the country has a set of very strict laws on intellectual property. The difference is traced back to 2000 when the nation joined the World Trade Organization (WTO) and subsequent adherence to Trade Related Aspects of Intellectual Property Rights (TRIPs) and General Agreement on Tariffs and Trade (GATT) requirements.

Before the WTO admission, the country only recognized “process patents” and as such, chemical entities could not be patented. Any company could manufacture any product as long as they used a formula or a process that was different from that of the originator. In 2001, the country and the US entered into a Free Trade Agreement and since then, Jordan has been committed to protecting intellectual property. Since the ministry of health in the country is compliant with TRIPs, the country’s laws on intellectual property cannot supplant international copyright and patent obligations (Daly 2011).

Companies can apply for 20 years’ patents. The nation has a Bolar Exception, which means that patented drugs can be developed and tested before a patent expires. Because of the 2001 agreement with the US, the patents for particular pharmaceutical products can be extended. In Jordan, originator companies are offered a five year period of data exclusivity after JFDA registration. During this period, no other company can sell the product of the company as a generic drug using the originator company’s technical data.

Multinational organisations use the five years of protection to guard against the generic threat in the country. All pharmaceutical products are approved by the JFDA before they are allowed into the market. JFDA registers generic versions that are in compliance with the requirements of the administration (Johnston et al. 2011).

In order to register a generic drug, the company that intends to manufacture the product presents a technical profile that complies with the International Conference on Harmonization (herein referred to as ICH) guidelines and bioequivalence data. The product that the company wants to base its generic product on must have been registered for a year. The product must be registered both in the country of the applicant and in the originator’s country.

According to the regulations in Jordan, all the products that are marketed in the country must be produced in facilities that comply with World Health Organization (WHO) and Arabian GMP guidelines. In Jordan, originator companies register branded drugs at a cost of 2,000 USD, while companies registering generics are charged 1,000 USD per product. The process of registering either branded or generic drugs takes approximately one year (Johnston et al. 2011).

Price Regulation

In addition to registering drugs, JFDA sets the prices of both OTC and prescription drugs that are sold in the country. The first generic that is locally manufactured is sold at 75-80 percent of the originator drug’s price. Other generics of the same drug are sold at a cheaper price. For generics that are imported, the JFDA first considers the price of the drug in the MENA region, other surrounding countries, and in the originator country. For imported branded drugs, JFDA also takes into consideration the price of the drug in the European Union (Cameron et al. 2011).

Organizational Feasibility

For the first five years, the company will only operate in Jordan. From the sixth year, it is anticipated that DMC will expand into the region, mainly through exports. Within the first three years of exporting the products, the company plans to reach out to markets in Sudan, Lebanon, Yemen, UAE, Bosnia, and Algeria. Three years later, the company will expand to Egypt, Tunisia, Eritrea, and Kazakhstan. After the first ten years of being in business, the company expects that its market share in Jordan will have risen to 2 percent.

With time, DMC will diversify its products and business model. However, the main business of the company will remain largely related to the pharmaceutical industry. The company will achieve diversification by forming subsidiaries that deal with natural products, biotechnology, medicine delivery systems, and marketing the company’s products both in Jordan and beyond. The natural products arm of the business will deal with developing and producing herbal and plant medicinal products using standardised plant extracts.

The subsidiary will also provide and market its technology throughout the Arab world. It will be formed five to seven years after DMC is fully operational. The biotechnology plant will be formed for the purpose of making diagnosis easy. It will concentrate on formulating easy-to-use diagnostic kits. With time, the biotechnology subsidiary will venture into the production of biogenerics. The company will compete with Aragen, the main producer and supplier of diagnostic kits in Jordan (El-Said & El-Said 2007). The range of products for this arm of the business will include rapid tests, such as pregnancy tests, serology kits, clinical chemistry, febrile antigens, and reagents used for blood grouping. The management plans to locate the company in the Shahab Free Zone.

The manufacturing facilities of the company will be located in two different regions. The first will be located in Omm-Al-Amad, while the second one will be opened in 2015 in Naour. Both of them will be dedicated to the production of branded generics. However, the Omm-Al-Amad plant will also be used for the production of biotechnology kits and natural products after the company diversifies its range of products. For a start, each of the plants will have 30 employees.

All the facilities of the company will be GMP approved and the company will lay essential emphasis on the quality of processes and products. Most of the Active Pharmaceutical Ingredients (API) raw materials that will be used in the two plants will only be sourced from suppliers in China and India. All the suppliers of the company must be GMP approved. In addition, the company will import approximately 20% APIs from Europe.

Sourcing raw materials from China and India will give the company a competitive edge over most of the companies in the region, who make most of their purchases in Europe. DMC will begin making its own strategic APIs after being in operation for at least 15 years. However, even then, the company will still have to import raw materials that cannot be efficiently produced in the country. The company will put in place measures to make sure that there are at least 50 contractually committed suppliers to ensure constant supply of raw materials. In order to ensure that supply is continuous, the company will have at least two suppliers for all the main products.

The research and development division of the company will work on increasing approvals and credentials of DMC that will be submitted to regulatory organisations in the Middle East and North Africa (MENA), Europe, and the United States. The division will be in charge of formulation, bio-equivalency monitoring, and process design as far as the entire DMC business portfolio is concerned. R&D will also focus on the development of generic injectables, liquid, semi-solid, and solid pharmaceuticals.

In addition, the department will be responsible for the upgrading and improvement of manufacturing techniques, as well as other research and development procedures, such as chemical synthesis and fermentation. By the time the company is going into full-fledged production, all the scientists and professionals will be based in Jordan. However, as the company expands into the region and in other parts of the world, other professionals will be based in Europe and in the United States. The company will collaborate with Hikma Pharmaceuticals (a multinational pharmaceutical firm based in Jordan) to accelerate its research and development endeavours. Each year, DMC will be investing at least 4 percent of all its revenue in research.

Financial Feasibility

Sales Forecast

Table 1 below shows the sales forecast from the first year of business. For the company to get started, it will require an initial cost outlay of 200,000 USD. Half of the funds (100,000 USD) will be sourced through a bank loan while the remaining half (100,000 USD) will be contributed by all the partners in equal measure. All funds will be banked into the company’s bank account on 5th January 2013. The money will be used to set up the Omm-Al-Amad plant. After one year, the company will decide whether to set up the other plant at Naour or to wait for another year depending on the progress of the business.

Table 1: Sales Forecast.

Project financing requirement

Table 2 below shows the cash flow summary.

Table 2: Cash flow summary.

Profitability

Table 3: Profitability.

Investment appraisal

Table 4: Investment appraisal.

Breakeven analysis

The total fixed costs of the project is 90, 000 USD, the variable cost per unit is 0.8 USD while average price of each drug unit is 3 USD. The breakeven point is thus 40,910 units. DMC will have to sell 40,910 units of generic drugs in order to break even.

Strategic Analysis and Business Model

Strategic analysis of business idea

Kaplan Norton model

In order to determine how an organization is performing, there is need to focus on both financial and nonfinancial measurements. The selection of measures should be inclined to the general objective of the company. The main challenge in only using financial measures is that they only provide information on what happened but not what should be done (Ching-Chow & Tsu-Ming 2009).

According to the Kaplan and Norton model, managers should outline indicators on the basis of four dimensions. The four are financial, internal process, customer, and learning and innovation dimensions (Kaplan, Norton & Rugelsjoen 2010). Such a four-dimensional focus enables an organisation to pay attention to the long term and not fall into the trap of immediate returns. The 15 to 20 measures should be chosen in such a manner that a person outside the company can easily see the strategy of the company through them.

While selecting measures under the four different categories, there should be a focus on value creation and transforming strategies into quantitative information. For instance, there is no need to increase capacity that will not be used. The Balanced Scorecard (herein referred to as BSC) yields motivation on the part of the employees who do not feel like they are being pushed towards the attainment of financial goals; instead they realize that all their actions are welcome as long as they steer the company towards its vision (Ching-Chow & Tsu-Ming 2009).

In 1993, Kaplan and Norton outlined that the selection of measures should be guided by corporate strategy. In their 1996 improvement they added that companies should take into consideration cause and effect relationships during the implementation of the BSC. The third improvement was the addition of Destination Statements. Destinations Statements refer to the future vision of a company after the attainment of strategic goals (Kaplan et al. 2010).

Hemel and Prahlad’s Core Competencies Model

The model points out that the strategy of an organization should be based on its core competencies/strengths (Morard, Stancu & Christophe 2012). Unlike other approaches such as the Porter’s five forces which emphasize on the importance of the customer, the competition and the market in formulation of strategy, the Hemel and Prahlad model is an inside-out approach.

The mainstay of the model is that the long term competitiveness of an organization is determined by creating, at the lowest cost and faster than competitors, the core competencies that lead to the production of unanticipated products. The success of organizations is determined by the ability of the management to consolidate its corporate-wide production skills and technologies into competences which enable the enterprise to change at the same speed as the market (Khan, Halabi & Masud 2010).

A core competence has various characteristics. To this end, such a competence is one that:

- Allows the business to access various markets.

- Significantly contributes to value addition as perceived by the customer.

- Is inimitable.

After identifying core competencies, an organization builds them through continuous enhancement and improvement. The management then proceeds to identify the people and projects that are closely related to such competencies. Corporate auditors audit the number, location and quality of people to embody the core competence (Berrah & Clivillé 2011).

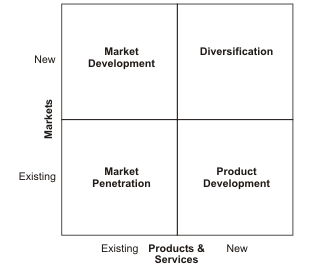

Ansoff Model

The Ansoff’s model was invented in 1957 and since then, it has come in handy for business owners in helping them to strategically plan for growth (Agha et al. 2012). The Ansoff model is a matrix that matches new and existing products with new and existing markets (Taylor 2012). The figure below is an illustration of this model:

The model explains growth with reference to risk levels. As a company grows and moves from one quadrant to another the level of risk also increases. In a case where a company is poised to supply an existing market with its existing products, it is bent towards achieving market penetration (Business Monitor International 2011). According to Taylor (2012) there are four objectives of market penetration:

- To either increase or at least maintain current product’s market share. The organization combines competitive pricing with advertising, personal selling and sales promotion.

- Secure dominance in growing markets.

- Restructuring a mature market by getting rid of competitors. The company needs to have a very aggressive marketing and promotional strategy and pricing to keep competitors at bay.

- Keeping existing customers and increasing usage among them, for example by the introduction of loyalty schemes.

The marketing penetration strategy is one where the company plays safe by only dealing with familiar products and markets. When a company is pursuing this strategy, it makes minimal investment in searching out new markets (Carver & Kipley 2010). When the company has found new markets for its existing products, it then engages in market development (Richardson & Evans 2007).

The company can use various approaches to implement this strategy:

- Locating new geographical target markets; for instance by exporting products to another country.

- Adopting new product packaging or dimensions.

- Finding new channels of distribution; for instance shifting from brick and mortar retailing to e-retailing.

- Different pricing approaches to segment the market or reach out to different customers.

The risk involved in market development is higher than in market penetration. The strategy where businesses introduce new products into existing markets is called product development. At this point customers have already utilized the existing products and may shift to competitors because of changes in tastes, fashions and preferences (Taylor 2012). In order for a company to succeed in product development, its resources are directed towards:

- Innovation and research.

- Insight into the changing needs in the market.

- Being the first to promote products.

Diversification is the strategy used by enterprises to introduce new products into new markets. This is the riskiest of the four strategies because the enterprise has no experience in the new market. In order for a company to be successful at diversification, the management has to conduct an honest risk assessment and be very clear on what to expect (Cilley 2011). By the same token, the strategy is considered to be very rewarding when the organization has a right risk-reward balance (Tarn & Chien-Chih 2012). DMC will use the Ansoff model where it will begin by introducing existing generic drugs into the Jordanian market. However, the strategic plan of the company is to seek for international markets of its products after the company is established in the MENA region.

Value Chain and SWOT

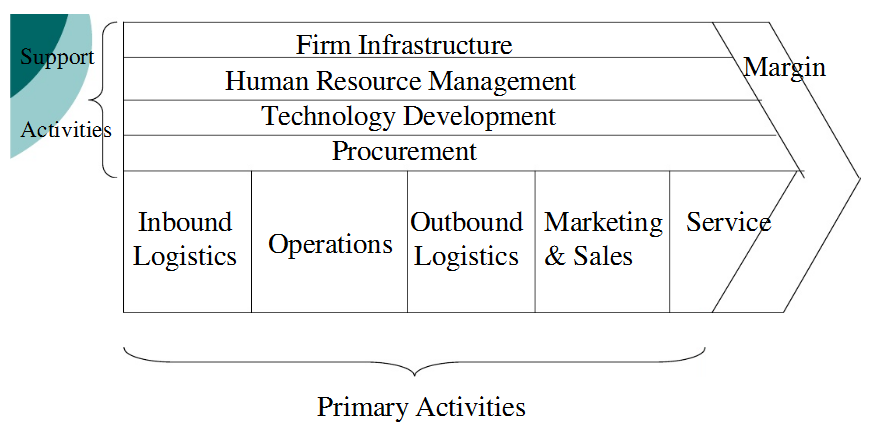

Value Chain Analysis

Value refers to what remains after deducting product development and marketing costs from the revenue (Oyson 2011). The value chain helps to:

- Identify, diagnose and integrate activities that create value.

- Identify cost drivers that contribute to cost leadership or differentiation.

- Identify potentials of competitive advantage that lead to sustainability.

The figure below is an illustration of a value chain:

Primary Activities

Inbound Logistics

All the raw materials will be received and stored at the company’s warehouse that will be located at the manufacturing plant. The driver of the company’s truck will make sure that all supplies arrive at the plant at the right time. Supply will be scheduled by the secretary who will also work in collaboration with the accountant to make payments to our suppliers (Hermelo & Vassolo 2010).

Operations

Twenty of the thirty employees at the Omm-Al-Amad plant will be charged with the responsibility of operating all machines and transforming inputs into final generic drugs. Five of the 20 assembly line employees will do the packaging of drugs.

Outbound Logistics

All the finished products will be stored in the company’s warehouse awaiting the truck for distribution and delivery to customers (Osterwalder 2011).

Marketing and Sales

During the first year, DMC will market its products through advertising on the television, radio and internet. In order to promote sales and increase brand awareness, the company will sell antibiotics at discounted prices in all the major chain stores (Parker 2010). The price of our products will be set at the current market price.

Service

We will have two front office employees who will provide customer care services. The company will also provide a round-the-clock customer service number to all our customers (Syrett 2007). In order to ensure that the company is producing the best quality products and services, we will have annual training for all our employees.

Support Activities

Procurement

As aforementioned, all the raw materials will be imported from China, India and Europe. We will put measures in place to make sure we have at least 50 contractually committed suppliers to ensure constant supply of raw materials. The company will have at least two suppliers for all the main products.

Technology Development

In addition to our own technological base, the company will work in collaboration with the JPHM and Hikma to make sure that we access the latest technology in drug development (Tantash 2012). Moreover, each year the company will allocate at least 4 percent of its revenue to developing its technology and research and development.

Human Resource Management

The board of directors will be responsible for hiring and training employees.

Firm Infrastructure

The management of the company will contain five members. They will include the general manager, finance manager, legal adviser, production manager and another employee. The management will be responsible for day to day running of the manufacturing plant.

SWOT Analysis

Strengths

- The company has in place an efficient business model that will help us build scale and size.

- Research and development collaboration with the best companies in the market that will ensure a robust product pipeline.

- Highly qualified personnel.

- Starting off from one of the best markets in the region.

- Easy access to equity capital.

Opportunities

- DMC has the opportunity to also collaborate with some of the leading companies in consumer health care such as P&G.

- The manufacturing plant at Naour is a viable expansion opportunity.

- The growing demand for generics throughout the world.

Weaknesses

- Increasing competition in the MENA region.

- We are not able to start the two manufacturing plants simultaneously because of capital limits.

Threats

- Pricing wars in the generic drugs sector because of intense competition.

- The high cost of maintaining an effective and productive workforce in the industry.

Sources of Competitive Advantage and Sustainability

Currently, there are many challenges that are facing pharmaceutical companies when it comes to creating sustainable competitive advantage. It has become very hard for companies in the industry to please customers because of growing scepticism.

For DMC, we will focus more on our customers than products in order to sustain interaction and communication with the market. The customer-focused approach will ensure that we not only meet our marketing and sales objectives but also assure better health outcomes. Today the race to gain competitiveness has become very tight and urgent (Ameer & Othman 2012). It has become very tight in the generics sector because after the expiry of a patent there are hundreds of companies who apply for genericization. In such a situation the only option is to be ahead in marketing and very customer-centric.

In order for DMC to maintain loyal customers it will avoid treating customers homogenously but as individuals who have needs we must meet (Lindgren, 2012). However, it is not possible to have marketing strategies that are targeted to all potential customers. Therefore we will group our customers into categories that can be easily managed. The next challenge is to define the criterion that will be used to segment customers.

Customers can be grouped together on the basis of behavioural characteristics or demographic profiles. However, the most basic segmentation should be based on motivations and social values (Eigenhuis & Dijk 2008). There is a plethora of evidence that suggests that companies only remain competitive depending on their degree of brand loyalty and trust. Consequently, it is needful to remain in an intimate communication with customers.

In order to attain the necessary level of intimacy with customers there are two main undertakings for all companies. The first is to find out the deep-seated reasons responsible for the behaviour of customers in the particular market. Second is to come up with marketing and sales strategies, and value propositions that are in congruence with the worldview of the customers (Ameer & Othman 2012).

In order to come up with the most suitable segmentation model, DMC will conduct a survey that will be aimed at determining the values and motivations of its customers. Social values and other complementary dimensions are fundamental to constructing successful psychographic segmentation models. The information that will be gathered during the survey will largely inform the marketing and sales strategies of DMC. The reason why pharmaceutical companies should adapt to the motivations and social values of physicians, patients, and other customers is because they are human and as such their behaviours and attitudes are founded on complex value constructs that determine their mind sets and worldviews (Sarin, Challagalla & Kohli 2012).

There are various values that we will be monitoring during the survey. One important factor is to distinguish between aspects that are important to customers and those that are perceived as important. The information will be used to inform the allocation of organizational resources at DMC. Another important set of values is the one that define the orientation of patients to the control of wellness and health versus the dependence on the delivery of medical services by medical professionals like pharmacists and physicians.

Such values have an impact on how patients use the healthcare system and their anticipations of all stakeholders in the system. There are also values that determine a person’s orientation towards a certain job or profession. For instance, in the case of physicians, there are those who are more inclined towards curative care and others towards preventive care. Moreover, there are values that identify customers as people; things they find to be generally important in life. These values are either quite obvious or not-so obvious (Eigenhuis & Dijk 2008).

Social values are beliefs about the objectives that one has in life and how they will achieve them. People are conscious of such values and they articulate them to others. They include notions such as the essence of family, the need for hard work, and respect among others. It is easy to determine to what degree a person embraces such values. In addition to these conscious values there are others that people form mostly in the formative stages of live and they embrace them either subconsciously or unconsciously. They are harder to ascertain in people. They are important feeling and thought tendencies that include motivational, emotional and mental postures that define how people transact and provide information on their future behaviour (Porter & Siggelkow 2008).

Demographics are no longer strait jackets that constrain people. For instance, today there are older customers who are very flexible, experimental, adaptive, and open-minded, whose purchase trends are mainly associated with youthful experience-seeking and exuberance. Technological changes, the internet community and endless possibilities for reinvention and exploration have broken the bounds of demography (Sarin et al. 2012).

In the same manner, simply looking at how a customer behaves is not enough. There is a lot of research that has identified the behavioural profiles of customers. However, such profiles lack the explanatory appeal. For a marketer, who seeks to understand the thought patterns of customers and construct value propositions that have an enduring capacity to persuade and a deep customer congruence, they only provide limited-utility information (Ameer & Othman 2012).

It is important to note that some patients have medication regimen preferences which permit them to choose the dosage of choice while others opt to use a physician’s regimen. However, by understanding the thought patterns and values that culminate in such behaviours and attitudes, DMC will be able to effectively communicate with customers (Lindgren 2012).

Selection of strategies for success

There are different formulas of business strategies (Fifield 2008). Success strategies can be divided into two; traditional and modern. Traditional strategies are founded on the external environment and competition while internal strategies are based on a company’s internal resources. Examples of the newer business strategies are the customer-oriented, innovative and dynamic strategies. All these strategies are very viable but they are only as effective as they relate to the kind of business in focus. In most cases, businesses pick parts of a strategy and integrate into the business depending on the availability of resources and the level of competition they are facing. The resulting strategy is very unique.

However, there are various considerations to make before deciding on the kind of strategy to adopt. The first requirement is a vision. The vision is a vivid picture of the business in the short, mid and long term. The next step is to tabulate the weaknesses and strengths of the business. This includes assessing all the departments of an organization and all the resources of the company such as service and product quality, service and product advantages, human resource, technical excellence and financial assets.

Such an assessment makes it possible to evaluate growth at the departmental level (Ndofor, Sirmon & He 2011). In this regard, DMC will produce the strategic indent which will include all the strategy pathways and alternations that have been adopted. In order to make sure that there is a culture of trust and confidence, the company will share the plan with all internal stakeholders.

The marketing strategy is one of the main components of a successful business strategy. It includes the techniques that are required to create brand equity. Branding depends largely on competition and the external environment. As aforementioned, advertisement will be used as the main marketing tool. As a new business, we do not have a lot of money to spend and as such DMC will negotiate to have best deals during the purchase of raw materials and other inputs.

In addition, we will negotiate with our suppliers for extension of due dates and credit terms. In order to stay above the competition, the company will invest in keeping up with technological changes. We will achieve this coming up with training seminars and technology transfer programs. The management will also enrol in management skills class to equip them with the competencies necessary to get the business off the ground.

We will put measures in place to make sure that our customers remit payments in good time. DMC will work with the main customers on contract basis where payments are made on a specific date. All the other customers will either pay using their credit cards or email based methods such as Paypal. In order to ensure commitment, we will require all our main customers to pay 15 percent of the total price before supplying.

Afterwards, they can pay the rest of the money within an agreed period. As a startup business, we also plan to make sure that our expenses are on the minimum. For instance, after we are fully in production there are seasons when we will require a large labour force. However, because of our capacity we may not be able to hire many employees, therefore we will have to outsource workforce depending as need arises.

Development of appropriate Business Model

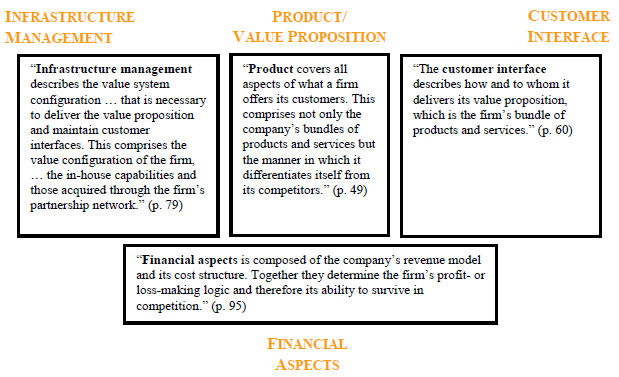

The process of choosing a business model that will ensure the sustainability of a business is not easy because different models have been designed with different industries in mind and they address different problems. Recent literature points to two rigorous theoretical and conceptual frameworks. The first is by Alexander Osterwalder which is more inclined to e-commerce but also includes a broader concept that is applicable to diverse businesses. Zott and Amit have also elaborately worked on business models especially in the statistical measurement of topics on business models (Johnson 2012).

A business model has some relationship with the business strategy but the two are not synonyms. The former is a sophisticated conceptualization of the all the activities of a business and differs from the tools and concepts of management because it has a systemic and holistic approach. According to Dubosson-Torbay, Osterwalder & Pigneur (2002), “a business model describes the rationale of how an organization creates, delivers and captures value.” In simpler terms it refers to the logic of the business.

Osterwalder presents a framework that is derived from various fronts such as the Balanced Scorecard and expanded by business model elements from his 1998 to 2011 publications. The conceptual design suggested by Osterwalder is widely accepted because in addition to many other advantages it clearly outlines the difference between business model and business strategy (Johnson 2012).

The four most essential aspects of a business model as identified by Osterwalder are:

- Products and/or services.

- Customer relations.

- Firm infrastructure.

- Finance.

The figure below represents the four pillars:

In comparison to meta-studies on business models, the four pillar approach adequately defines a generic model. Osterwalder compares this generic template with the BSC which as earlier indicated points out that the four essentials for any enterprise are finance, customers, internal processes, and learning and growth. Furthermore, Osterwalder also refers to the what, who and who of a business as developed by Markides (Dubosson-Torbay et al. 2002).

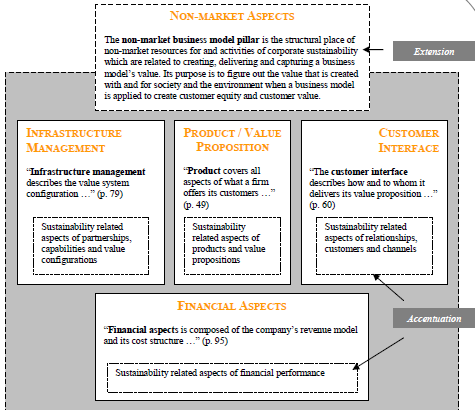

However, it is essential to outline that unlike in the suggestion of Osterwalder there are inherent differences between the four pillars and the Kaplan and Norton perspectives. In addition the perspectives of Osterwalder, and Kaplan and Norton are focused on the conventional business that only has an economic inclination. DMC is prepared to not only be a profitable corporation but also a responsible corporate citizen. The BSC takes into account some non-financial aspects but they are largely undeveloped.

There is need to formulate a generic model that factors in the environment and the society. For this particular paper the most suitable business model is the generic template that was developed by Osterwalder. However, it is only suitable with the addition of a sustainability facet. The Osterwalder model can be made more sustainable through accentuation and extension. Accentuation means that the model should inherently factor in sustainability in the four pillars, while extension involves the introduction of sustainability pillar.

As a result, the strategy is transformed into a five pillar model. Sustainability aspects (activities and resources) are outlined in the four pillars but there is need to exemplify how they relate to market mechanisms and the business of a company. On the other hand extension creates the structural allowance for non-market activities and resources. The figure below illustrates the modification that should be done on the generic business model suggested by Osterwalder with reference to extension and accentuation (Johnson 2012). The figure below is a representation of modified business model:

Business Plan

Business Plan Overview

A business plan is regarded as a formal statement that outlines the goals and objectives of a business entity (Arriot 2010). A business plan is instrumental towards the propagation of the business venture towards achieving its respective goals. It has a time line and it is a requirement if the venture has to attract investors. In this respect, DMC came up with its business plan detailing on the capital structure, financial plans, marketing strategy and analysis, competitor analysis, operations analysis, industry background analysis and management structure (Theodre, Carney & Robert 2007).

Capital Structure

Setting up a generic drug manufacturing company and acquiring the necessary compliance is quite expensive. As a result of this, DMC will use a capital structure that entails both the use of debt and equity. The starting capital shall be used in the process of registering the business. Additionally, the amount shall be used in securing the necessary patents for the generic that will be manufactured (Mittra, Anadi & Sahu 2007). Compliance to both local and international standard to ensure quality is of importance to DMC and therefore, a detailed market research has been financed by part of this money.

The capital required sum of 100,000 euro pounds. Due to the potentiality of this industry, the company will acquire the debt from development banks totalling to 50,000 euro pounds. The rest shall be raised through the issue of shares. These shares are expected to attract both local and international investors. This should help DMC embrace an international image. Leasing plans are considered too (Kerzner 2003).

Financial Plan

Financially, DMC will be preparing financial statements at every end of three months. The financial statements to be prepared will be the balance sheet, cash flow statement and income statement; these three will be subject to internal and external auditing (Mittra et al. 2007). This effort is to keep the company in check and avoid bankruptcy. The company will have an asset base of 100,000 less current liabilities. It will also use loans and credit supply as forms of liabilities. In case of shortage in capital, the firm will issue additional shares and also rights issue.

Marketing Plan

DMC’s marketing plan clearly states out the company’s blue print towards approaching market dynamics. This blue print provides the market analysis, marketing model, marketing strategy and market segmentation. Baker (2008) point market analysis is provided through an intensive research carried out earlier shows the great potential in the pharmaceutical industry. As earlier mentioned, most of the generics are imported and the market is flooded with branded medicines. Affordable generics will be exported from the Asia (Global Investment House 2007). Therefore, DMC is expected to bridge this gap providing the best quality of generics at affordable prices. The focus group for these products will be the poor who find branded medicine expensive but seek alternative medication.

Marketing Strategy

Various marketing strategies shall be used in order to market DMC’s products. DMC will use the media to intensively market its products. The company will also hire qualified sales person who shall be involved in direct selling of the company’s products.

This means that most of the middlemen will be cut off to make the products cheap. The direct selling model shall be utilized where the company shall station its collection points all over major markets in Israel for accessibility to retailers and consumer. Moreover, DMC will use the web as bait for its products providing in-depth information about its product. The hook in this circumstance will be the generics (Pinson 2004). With such laid down clear strategies, the company is expected to increase its market share by two percent the second year of operation.

Market Share and Size

In order to remain relevant in this dynamic industry, DMC will allocate 4 percent of its revenue to the research and development department. Not only shall this effort retain market leadership but remain the most attractive company to do business with. The approach towards our market shall be through market segmentation. Markets and their sizes shall be analysed intensely before making any move towards that market. Analysis shall be based on market research and SWOT analysis (Kurtz 2010). The findings from the two shall be used to guide any future investment decisions and keep the company ahead of others.

Industry Analysis

The pharmaceutical industry is considered to be one of the most lucrative industry in the middle east with giant companies investing in it, whereby generics provide 90 percent and branded medicine provide 10 percent of the entire revenues in this industry.

The industry is regulated by the JFDA. It carries out a series of quality testing and assessment generics and branded medicines. The generics and medicines are only allowed to be sold in the market after passing the test. International regulation standards dictate that three test be done, the first one for three months on a small group of people and side effects noted if any (Vega-López, Grudgen & Decker 2006). The second group of people around 100-300 take the drugs then side effects noted. The last group of people above 400 use the drugs then side effects noted. If in all three cases no one or there was extremely minimal side effect, then the drug is certified to be sold in the market. Other regulations in the market involve API and cGMP (World Health Organization 2009).

Competition Analysis

The Jordanian pharmaceutical company is quite fragmented. As of 2007, there was no one single who had a market share of 10 percent. This is attributed to the fact that there are several players in the industry drawn from local, regional and international. Some of the industry payers that DMC is going to join are Hikma Pharmaceuticals, Dar Al Dawa Development and Investment Company (DADI), Arab Pharmaceutical Manufacturing Company (APMC), Jordanian Pharmaceutical Manufacturing Company (JPHM), Middle East Pharmaceutical and Chemical Industries (MPHA), Hayat Pharmaceutical Industries (HPIC) and Arab Center for Pharmaceutical and Chemical Industries Company (APHC) and other unlisted companies (Global Investment House 2007).

DMC will use competition intelligence to counter their competitive plans (Pfeffer & Salancik 2011). DMS has put forth plans of acquiring for smaller companies that face bankruptcy. Another competitive strategy that the company will use will be price discrimination. The strategy will work well considering that the company will be enjoying economies of scale through its collaborative plans.

Collaborative Links

The current standing position places DMC in a favourable position to expand its market share. Through aggressive acquisitions and quality control, the company can end up grapping the biggest. Collaboration has already been established with Hikma and JPHM in an effort to strategically place the company in the market. Such collaboration extended from knowledge transfer production assistance. In addition, there will be exchange of production technology so that the company does not use obsolete technology. DMC has also established key strategic plans from other companies and hence strengthening its weak side (Kerzner 2003).

Operations Analysis

DMC will take advantage of the current expiry of patents of branded medicines and come up with a variety of generics. Furthermore, the company will launch court battles over patents which can be challenged in efforts of increasing the number of generic drugs that it will manufacture. Patents shall also e used to protect the company’s drugs. Having flooded the market with a quality variety of DMC’s brands at affordable prices, there is no doubt that the market will end up purchasing more of our products (Solis 2011).

Overall Assessment of the Business Development Proposal

Currently, the pharmaceutical industry has to deal with changes in regulations, increasing decline in approvals and stiff competition. DMC appreciates these challenges and therefore seeks to adopt systems and practises that address these issues at the same time improving overall quality and compliance (Vega-López et al. 2006). It will be achieved through assessing the quality systems, developing key performance indicators (KPI) and reduction of risk. Theodre et al. (2007) notes that these strategies shall be couple with corrective action/preventive actions (CAPA), change management, performance and quality monitoring systems and management reviews of processes performance and product quality.

DMC will come up with an organizational structure, procedures and resources that are used by a manufacturing pharmaceutical company in line with applicable regulations. According to Brooks & Muhammad (2012), such a system will involve ‘quality planning, quality control, quality assurance and quality improvement for achieving consistent product quality’. Score cards and audits shall be used to assess the developments of the business development.

Process Performance and Product Quality Monitoring System

Such a system shall ensure that DMC is operating in the right state. The system shall provide assurance of the safety, efficacy and quality of the products through checking the process and controls of the manufacturing system. The major KPI under performance and quality monitoring systems is a scorecard developed in accordance Global Quality Assurance standard and Regulatory Intelligence Vendor Management Internal Audits (Brooks & Muhammad 2012). These indicators should the quality of systems being used and compliance to regulatory needs.

Another key are in this indicator is the use of a consulting firm. As aforementioned, Hikma and JPHM shall act as the consulting firm. DMC will benefit from its long-term experience. Hikam shall assist in formulating action plan to address and resolve risks and compliance issues, whereas JPHM will advice the company on suitable production technology to be used.

Corrective Action and Preventive Action System

It is a systematic approach towards mitigating and preventing the occurrence of gaps in regulatory inspections. The system identifies and monitors gaps so as to ensure regulatory compliance, organizational effectiveness and operational efficiencies (Brooks & Muhammad 2012). The system works on three major areas; development of an appropriate management and manufacturing system, monitoring and an analysis and lastly elimination and continuous upgrade of these systems to mitigate potential nonconformities.

The system also allows continuous improvement as a corrective measure. It will be aided with strong investigative processes. In a nutshell, CAPA works on root cause analysis, identity and verifying actions, implementing CAPA, ensuring CAPA effectiveness and finally management review.

Change Management System

A quality system can only work in a flexible environment. The flexibility is brought about by the current changes initiated by pharmaceutical regulatory bodies and new risks that the industry is facing. Consequently, continuous improvement on the management system is inevitable. Factors such as risk assessment, safety of the generics and their performance should be addressed while the DMC is still developing.

It is important to note that change management system should be monitored and reviewed at specific and consistent intervals. The reason behind it is that it affects various players in the company starting for the suppliers, managers, employees, external evaluators and interested stakeholders (Mittra et al. 2007). It is important for the system to have contingency closure. The advantage after implementing change management is that regulatory impact shall be reduced drastically.

Management Review of Process Performance and Product Quality

The management review of process performance and product quality is the last element in ensuring that quality in products and management of the firm is the first priority for DMC (Theodre et al. 2007). Management reviews systems shall ensure that the quality of the product is of best standards throughout the products lifecycle. To ensure that management reviews are not biased, training, conferences and workshops will be carried out to equip the management with the knowledge of what is expected from them. Thereafter, consistent regulatory inspections and product audits will be carried out to determine the quality of the products. The process will discourage production of inefficacy and poor quality generic drugs.

Performance Appraisal

There shall be annual employees’ reviews. The appraisal system shall run from the top management of DMC going down wards. In this manner, every employee will be evaluated in order for them to remain to the company. Those who pass the test evaluation will be apprised in form job promotions, awards and bonuses whilst those who fail shall be served with warning letters (Baker 2008). The employee who receives such warning for the third time in a row will be demoted or fired.

External Inspections and Audits

Apart from the regular inspections and audits done by the industry regulators, the company shall hire a third to conduct inspection of the working condition of employees and audit the books of accounts. DMC’s core objective in pharmaceutical industry is to ensure that everyone is safe starting from the workers to the customers who use the product. A good working environment will ultimately motivate the employees towards giving their best to the company. Books of accounts will be audited after every quarter report, not a culture in limited companies, but as a stringent measure to ensure that misappropriation and embezzlement does not occur.

Environmental inspections and audits shall be carried out to ensure that the company reduce the effect of green house gases (Kerzner 2003). This shall be achieved through the use of green technology. In the same area, the company will invest heavily in research and development so as to come up with production ways that do not adversely affect the environment. Waste disposal shall be done within the company’s premises after removing poisonous contents.

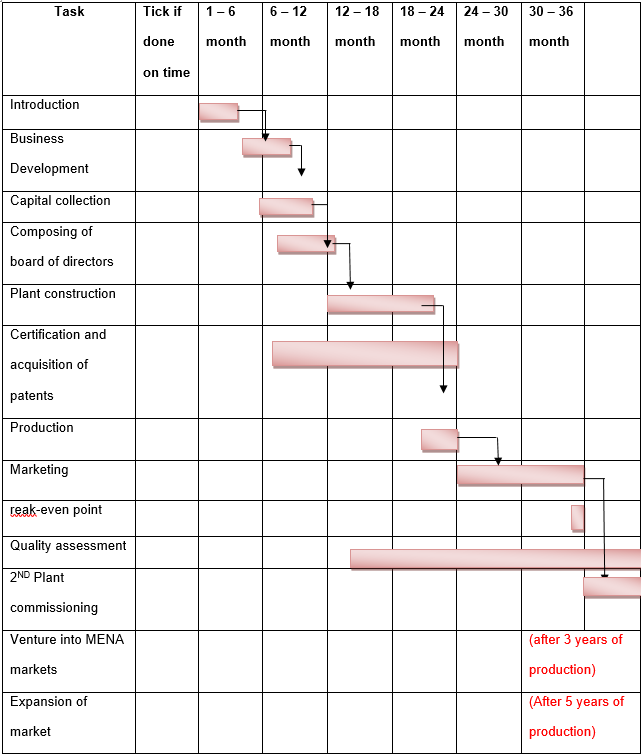

Business Plan Schedule

As earlier outlined, the company has put forth various measures that will make it emerge as a key industry player. Before the kick-off of the company in 2014, an intensive market research shall be undertaken for a period of six months. The market research shall be carried out in sequence. The main reason for this is to carry out a feasibility study on the proposal of DMC. The marketing research shall cover such areas as product feasibility, industry behaviour, sales forecast, and project financing requirements. Other areas that will be covered include profitability analysis, financial feasibility, market analysis, break-even analysis, and investment appraisal.

After a thorough market research, the report will be presented to the promoters of the business to come up with a draft proposal. The proposal will be submitted to an investment advisory panel based in the ministry for industrial development.

The panel will assess the proposal which can be declined or approved. If the panel decides to decline, then this will be the end of the process for the investors, but if approved, then it will proceed to the business plan development stage. Here, the investors will put present their plan for assessment and they will be advised promptly. Contracting and implementation of the business plan. The investors will be issued with a certificate for incorporation will be issued to the investor after successful acceptance of their memorandum of association.

The schedule for forming the DMC is as follows:

- Introduction stage of the company

- Submission of the market research

- Composing of the draft proposal

- Submission of the proposal draft to the advisory panel for advisory

- Business development stage

- Evaluation of the development plan

- Approval and issuance with the certificate for incorporation

- Capital collection from investors

- Investors are expected to submit their pledges for the capital start-up by the end of 5th January 2013

- Composing of board of directors.

- The board shall have the responsibility of recruiting top managers thereafter the managers will recruit support staff with the recommendation of the board.

- Construction of the 1st plant

- The procedure for setting up the plant will include construction of the plant in Omm-Al-Amad and equipping it with the required equipments. It is expected to take a period of 9 months.

- Certification and evaluation in accordance with the FDA, cGMP, QCA, TRIPS. Acquiring of patents for the company’s products.

- First production to run for three months.

- Aggressive marketing campaigns to run for a full year

- Break-even point after one year

- Quality assessment systems to be put in place this shall run for the entire projects life. The systems were discussed under 5.1

- Construction of second plant after the second of operation*.

- (*change two years from the one year that the other writer provided)

- The third year venture into MENA market.

- Expansion to Europe and United States Market

Critical Success or Failure Factors

Sequentially, for the company to succeed as outlined there are some factors that can make the company not to realise the stated goals. In this section, the writer will analyse the Dos with the intention that the company realises profit. Eventually, the flip side of the pints will show the Don’ts.

Quality assurance is the foremost factor that the company should look at. It is in the record that any fault discovered in the quality of any drug will have devastating effects to the company. Revocation of license, loss of good will and loss of market are just some of the effects that the company will have to deal with (Flyvbjerg et al. 2005). Such a development can be avoided through regular evaluation of the quality system.

Various standard requirement from APIs, cGMP, TRIP, GQA and Q10 Pharmaceutical Quality System Guideline should be harmonized. Harmonizing these standards will make it easier for its employees to understand what is required of them.

The company’s team of biochemists, pharmacists, scientists, chemists, chemical and industrial engineers should ensure products integrity. The competence of the R&D and marketing department is highly required (Pinson 2004). This two departments are the keys to the success of the company with the help other departments. Generally, the company will adopt a system of employing qualified staff providing them with the best payroll in the market. Consequently, they should ensure professionalism and competence at all levels.

Remaining updated with the current trends in the market is another factor that can make the company to succeed. New associations formed, acquisitions and mergers are threats to the company. Moreover, new regulations provided should also be incorporated as a major factor to be updated about (Silos 2011).

DMC should also be updated about the progress of patents and TRIPS. Being updated in this area will minimize court battles on infringement of intellectual property and patents. The company can maximize on expired patents so as to increase the number of products it avails in the market.

Joint procurement can make DMC to succeed. When DMC and its affiliates procure raw material or production equipments jointly, they cut on the cost of purchase. Thus, a reduction in the cost of purchase will increase the available resources which can be diversified into other uses (Arriot 2010).

References

Abbott, R Bader, R Bajjali, L ElSamen, T Obeidat, T Sboul, H Shwayat, M & Alabbadi, I 2012, ‘The price of medicines in Jordan: the cost of trade-based intellectual property’, Journal Of Generic Medicines, vol. 9 no. 2, pp. 75-85.

Agha, S Alrubaiee, L & Jamhour, M, 2012, ‘Effect of core competence on competitive advantage and organizational performance’, International Journal of Business & Management, vol. 7 no. 1, pp. 192-204.

Ameer, R & Othman, R 2012, ‘Sustainability practices and corporate financial performance: a study based on the top global corporations’, Journal of Business Ethics, vol. 108 no. 1, pp. 61-79.

Arriot, O 2010, Introduction to business planning, Free Press, New York.

Baker, M 2008, The strategic marketing plan audit, Live Oak Book Company, Austin, Texas.

Berrah, L & Clivillé, V 2011, ‘Towards an industrial performance quantification model according to the balanced scorecard’, Supply Chain Forum: International Journal, vol. 12 no. 3, pp. 64-73.

Bertagnolio, S Penazzato, M Jordan, M Persaud, D Mofenson, L & Bennett, D 2012, ‘World Health Organization Generic Protocol to assess drug-resistant HIV among children <18 months of age and newly diagnosed with HIV in resource-limited countries’, Clinical Infectious Diseases, vol. 54 no. 4, pp. S254-S260.

Birn, R & Forsyth, P 2002, Market research, Capstone Pubishers, Oxford.

Brooks, E & Muhammad, Y 2012, The continually improving pharma quality system. Web.

Business Monitor International 2011, Jordan pharmaceuticals and healthcare industry update quarter 4. Web.

Cameron, A Roubos, I Ewen, M Mantel-Teeuwisse, A Leufkens, H & Laing, R 2011, ‘Differences in the availability of medicines for chronic and acute conditions in the public and private sectors of developing countries’, Bulletin Of The World Health Organization, vol. 89 no. 6, pp. 412-421.

Carver, M & Kipley, D 2010, ‘Ansoff’s Strategic Issue Management System: a validation for use in the banking industry during high turbulent environments’, Business Renaissance Quarterly, vol. 5 no. 2, pp. 59-76.

Ching-Chow, Y & Tsu-Ming, Y 2009, ‘An integrated implementation model of strategic planning, BSC and Hoshin management’, Total Quality Management & Business Excellence, vol. 20 no. 9, pp. 989-1002.

Cilley, J 2011, ‘A road map for growing your business’, Business NH Magazine, vol. 28 no. 10, p. 32.

Correa, C 2006, ‘Implications of bilateral free trade agreements on access to medicines’, Bulletin of the World Health Organization, vol. 84 no. 5, pp. 399-404.

Daly, R 2011, ‘Similar concerns’, Modern Healthcare, vol. 41 no. 28, pp. 38-40.

Dubosson-Torbay, M Osterwalder, A & Pigneur, Y 2002, ‘E-business model design, classification, and measurements’, Thunderbird International Business Review, vol. 44 no. 1, pp. 5-23.

Eigenhuis, A & Dijk, R 2008, HR strategy for the high performing business: inspiring success through effective human resource management, Kogan Page, New York.

El-Said, H & El-Said, M 2007, ‘TRIPS-plus implications for access to medicines in developing countries: lessons from Jordan–United States Free Trade Agreement’, Journal of World Intellectual Property, vol. 10 no. 6, pp. 438-475.

Fifield, P 2008, Marketing strategy masterclass: the 100 questions you need to answer to create your own winning marketing strategy: including the new ‘scorpio’ model of market strategy, Elsevier Butterworth-Heinemann, New York.

Flyvbjerg, B Mette, K Skamris, H & Buhl, L 2005. ‘How accurate are demand forecasts in projects? Journal of the American Planning Association, vol. 71 no. 2, pp. 131-146.

Global Investment House 2007, Jordan pharmaceutical sector. Web.

Hermelo, F & Vassolo, R 2010, ‘Institutional development and hypercompetition in emerging economies’, Strategic Management Journal, vol. 31 no. 13, pp. 1457-1473.

Johnson, EJ 2012, ‘Business model generation: a handbook for visionaries, game changers, and challengers – by Alexander Osterwalder and Yves Pigneur’, Journal of Product Innovation Management, vol. 29 no. 6, pp. 1099-1100.

Johnston, A Asmar, R Dahlöf, B Hill, K Jones, D Jordan, J Livingston, M MacGregor, G Sobanja, M Stafylas, P Rosei, E & Zamorano, J 2011, ‘Generic and therapeutic substitution: a viewpoint on achieving best practice in Europe’, British Journal Of Clinical Pharmacology, vol. 72 no. 5, pp. 727-730.

Kaplan, R Norton, D & Rugelsjoen, B 2010, ‘Managing alliances with the balanced scorecard’, Harvard Business Review, vol. 88 no. 1/2, pp. 114-120.

Kerzner, H 2003, Project management: a systems approach to planning, scheduling, and controlling, 8th edn, John Wiley & Sons, Carlifornia.

Khan, M Halabi, A & Masud, M 2010, ‘Empirical study of the underlying theoretical hypotheses in the balanced scorecard (BSC) model: further evidence from Bangladesh’, Asia-Pacific Management Accounting Journal, vol. 5 no. 2, pp. 45-73.

Kurtz, D 2010, Contemporary marketing, Cengage Learning, South-Western.

Lewis, R & Trevitt, R 2003, Market research language, Nelson Thornes, Cheltenham.

Lindgren, P 2012, ‘Business model innovation leadership: how do SME’s strategically lead business model innovation?’, International Journal Of Business & Management, vol. 7 no. 14, pp. 53-66.

Millar, T, Wong, S, Odierna, D, & Bero, L 2011, ‘Applying the Essential Medicines Concept to US Preferred Drug Lists’, American Journal Of Public Health, 101, 8, pp. 1444-1448.

Mittra, S, Anandi, P, & Sahu, R. 2007. Practicing Financial Planning for Professionals (eds), Rochester Hills Publishing, Cape Town.

Morard, B, Stancu, A, & Christophe, J 2012, ‘TIME EVOLUTION ANALYSIS AND FORECAST OF KEY PERFORMANCE INDICATORS IN A BALANCED SCORECARD’, Global Conference On Business & Finance Proceedings, 7, 2, pp. 568-581.

Ndofor, H, Sirmon, D, & He, X 2011, ‘Firm resources, competitive actions and performance: investigating a mediated model with evidence from the in-vitro diagnostics industry’, Strategic Management Journal, 32, 6, pp. 640-657.

Osterwalder, A 2011, ‘Designing Business Models Workshop: Strategic methods for visionaries, game changers, and challengers’, DMI News & Views, p. 8.

Osterwalder, A, & Pigneur, Y 2005, ‘CLARIFYING BUSINESS MODELS: ORIGINS, PRESENT, AND FUTURE OF THE CONCEPT’, Communications Of AIS, 2005, 16, pp. 1-25.

Oyson, M 2011, ‘Internationalisation of value chain activities of small firms: An international value chain approach’, Small Enterprise Research, 18, 2, pp. 100-118.

Parker, PM 2010, ‘The 2009-2014 Outlook for Ophthalmic Pharmaceutical Drugs in Africa & the Middle East’, Regional Outlook Reports, p. N.PAG.

Pfeffer, J & Salancik, G 2011. ‘The External Control of Organizations’. Institute for Operations Management and Managements Science, vol. 35 no. 4, pp. 351-397.

Pinson, L 2004, Anatomy of a business plan: a step-by-step guide to building a business and securing your company’s future (6th ed), Dearborn Trade, Chicago, USA.

Porter, M, & Siggelkow, N 2008, ‘Contextuality Within Activity Systems and Sustainability of Competitive Advantage’, Academy Of Management Perspectives, 22, 2, pp. 34-56.

Reast, J, Lindgreen, A, Palihawadana, D, Spickett-Jones, G, & Barnes, B 2011, ‘Prescription drug communication strategies: A comparative analysis of physician attitudes in Europe, the Middle East, and the Far East’, Journal Of Marketing Management, 27, 3/4, pp. 336-360.

Richardson, M, & Evans, C 2007, ‘Strategy in Action Applying Ansoff’s Matrix’, Manager: British Journal Of Administrative Management, 59, pp. i-iii.

Sarin, S, Challagalla, G, & Kohli, A 2012, ‘Implementing Changes in Marketing Strategy: The Role of Perceived Outcome- and Process-Oriented Supervisory Actions’, Journal Of Marketing Research (JMR), 49, 4, pp. 564-580.

Solis, B 2011, Engage!: The complete guide for brands and businesses to build, cultivate, and measure success in a new market, John Wiley & Sons, Inc.

Syrett, M 2007, Successful Strategy Execution : How To Keep Your Business Goals On Target, n.p.: Economist in association with Profile Books, Inc.

Tallon, PP 2011, ‘Value Chain Linkages and the Spillover Effects of Strategic Information Technology Alignment: A Process-Level View’, Journal Of Management Information Systems, 28, 3, pp. 9-44.

Tantash, M 2012, ‘Middle East generics: Challenges & opportunities’, Journal Of Generic Medicines, 9, 1, pp. 13-20.

Tarn, D, & Chien-Chih, E 2012, ‘Knowledge Outsourcing: A Proposed Model’, International Journal Of Management, 29, 1, pp. 247-266.

Taylor, EC 2012, ‘COMPETITIVE IMPROVEMENT PLANNING: USING ANSOFF’S MATRIX WITH ABELL’S MODEL TO INFORM THE STRATEGIC MANAGEMENT PROCESS’, Allied Academies International Conference: Proceedings Of The Academy Of Strategic Management (ASM), 11, 1, pp. 21-27.

Theodre,B, Carney, Y, & Robert, F. 2007. The pharmaceutical industry and its dynamism (eds), McGraw-Hill, New York.

Vega-López, S, Grudgen, D & Decker, J 2006, ‘Generic drugs and their potential growth’, American Journal of Clinical Nutrition , 84 (1): 54–62.

World Health Organization 2009, Pharmacogenetics and existing therapies, WHO Drug Information, Vol 17 No. 2, pp. 251-300.