Introduction

The Supply Chain Management designs and implements methods to coordinate raw material transportation and delivery, work in progress, processed items and commodities from different manufacturing places to their market destination. Modern businesses acquire factors of production from suppliers before processing and selling them as finished products (Zhou et al., 2021). A car contains hundreds of components, but a smartphone includes a significant amount of materials and sub-assemblies. Vendors may now manufacture and assemble these elements on a committed basis due to the advantages of economies of scale, item concentration, and cost reductions.

Original Equipment Manufacturers (OEMs) such as Dell, Ford, and Apple Inc. acquire these parts from reduced cost production and emerging economies like India and China that assemble and sell goods under their trademark (Zhou et al., 2021). Given the enormous distances associated with moving parts between countries, SCM enables OEMs to handle their supply chains (Zhou et al., 2021). The objective is to add benefit at each part of the supply chain, ensuring delivery of items of the needed standard, in the proper proportions, on time, and at the lowest possible cost (Yazdani et al., 2017). This paper explores Apple iPhone’s supply chain management and risk assessment strategies.

Supply Chain Overview

Apple iPhones are ubiquitous and are frequently referred to as fashion accessories. Apple sells about 250 million units annually. It is worth noting that all parts are exported. The smartphones are built at Pegatron and Foxconn’s factories in Henan, Shanghai, Shanxi, and Guangdon in China (Li, 2021). A $700 iPhone 7 has direct input costs of $215 and translation charges of $5 per unit, resulting in an operating income of $480 per unit (Li, 2021). Through an extensive distribution network with devoted and motivated vendors, excellent protection, and no supply constraints (Li, 2021). Notably, Apple has replicated the distribution network for all iPhone smartphones.

Apple has over 1180 vendors located in 31 nations (Li, 2021). China has 349 vendors (Li, 2021), followed by 139 in Japan (Xing, 2021), 30 in South Korea, 60 in the United States of America (Xing, 2021), and the remainder in Mexico, Germany, Hungary, UAE, and Malta (Xing, 2021). These suppliers deliver display, sensor, power cells, CPU, RAM, and touch screen technologies to Chinese work locations (Li, 2021). The UAE acts as a market for iPhone smartphones and it has a higher market share compared to other smartphone distributors like Samsung, Xiaomi, and Huawei.

Automating significant operations improves efficiency and decreases faults. Packs of iPhones, pamphlets, headphones, and adapters are distributed to distribution sites worldwide. The entire SCM business is managed by robust SCM software, which oversees appointments, organizes for ordering and drop to vendors (Li, 2021). A backward SCM accumulates damaged things, warranty products, and repairable units for future action.

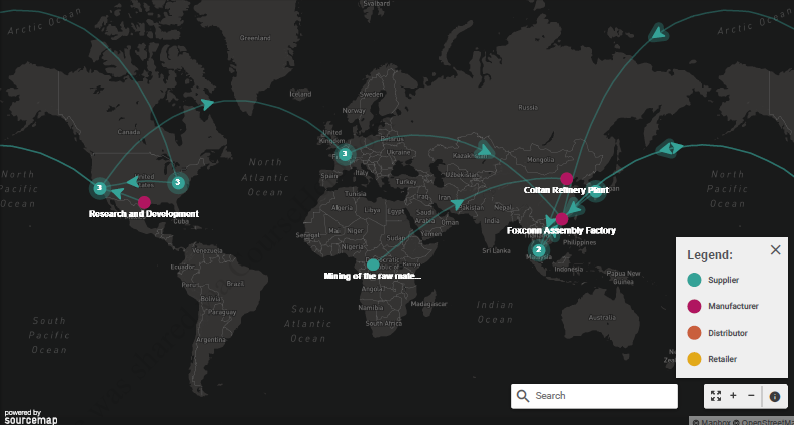

Supply Chain Visualization

The following figure 1 shows the supply chain visualization of iPhone.

Overview of Risks and Threats Associated with iPhone’s Supply Chain

Numerous firms have been shaken by accidental supply-chain exposures and interruptions, resulting in refunds totaling vast amounts of money across various sectors, from medicines and consumables to technology and cars. Additionally, various federal organizations and commercial enterprises have been harmed by supplier ecosystem failures, leading to the loss of critical property rights (Omitola & Wills, 2018). At the core of these disasters is a recurring theme – a lack of effective systems for identifying and managing increasing supply chain contingencies as the globe grows more intertwined.

Several threats and vulnerabilities to Apple’s iPhone distribution network include a transformation in the macroeconomic climate, supply interruption, supply shortage, and limited data and openness. Fluctuations in the macroeconomic environment like recession and inflation in OEM countries significantly impact the supply chain of iPhone smartphones (Lockamy III, 2017). Downturns have had a profound influence on all levels of the iPhone’s supply chain, affecting cash flows as well as material and product flows (Lockamy III, 2017). Most Apple’s iPhone customers, for instance, in the UAE have reacted immediately by discontinuing purchases, withdrawing orders, postponing supplies, and deferring payment on purchase requisitions and invoices.

The consequences of buyer and seller behavior might on the iPhone’s supply chain has been severe. For instance, if Apple’s iPhone consumers cease to purchase and accept deliveries while vendors continue to supply components, Apple Inc. will face an inventory overflow (Lockamy III, 2017). Additionally, Shamout and Elayan (2020) enumerate that the iPhone market in the UAE has reduced drastically due to the entry of Xiaomi smartphones in the UAE market. Therefore, Apple Inc. will be flanked with cash at precisely the moment they require it – except that it is locked incorrectly as inventory. If clients stop purchasing and defer payment on the cash flow, and Apple Inc. will keep paying their vendors following the contract; thus, the overall result is profit pressure (Lockamy III, 2017). Consumers can mostly cut a company’s revenue faster than the business can lower its expenditures.

Identification of the three most at Risk Countries and Reasoning

The three most at-risk countries of iPhone smartphones are China, Japan, and UAE. China is the largest assembler and has contract assembly suppliers such as Foxconn and Pegatron, which operate extensive operations (Li, 2021). Additionally, they coordinate component delivery from suppliers, organize conveyor belts according to necessary productivity, and assemble. As enumerated by Li (2021), the plants have a daily output of 500,000 units when a new commodity is introduced. As such, as an assembly point of Apple’s iPhone, China faces the difficulty of commercial manufacturing.

Furthermore, the current US-China trade wars have negatively impacted the overall sales of Apple’s iPhone on the Chinese market. According to Hosain and Hossain (2019), China provides the largest market for Apple’s iPhone. In Japan and UAE iPhone faces stiff competition from similar manufacturing companies of other smartphones such as Xiaomi Inc. (Asia) and Sony Cameras (Japan) that Apple Inc. incorporates in the iPhone smartphones.

Risk Assessment for the three Riskiest Countries

China

Apple conducts its manufacturing iPhone at China’s Foxconn to accomplish large-scale production at a reduced cost. Apple Inc. has been chastised for allegedly employing worker exploitation and squeezing earnings (Sun et al., 2021). Occasionally, the demand for Apple products increases unexpectedly, forcing them to work longer hours without compensation (Sun et al., 2021).

Foxconn’s workplace environment is similarly substandard, and therefore, most employees have either fallen sick or injured themselves while working. The intense political atmosphere between the USA and China has created a sociopolitical risk to the supply chain management of the iPhone. The continuous trade wars between the USA and China have seen trade between the two nations reduce drastically, lowering the sales volume, thus reducing the company’s overall profitability (Hosain & Hossain, 2019). Additionally, the substandard workplace environment has had a detrimental effect on Apple’s image.

Japan

Apple Inc. is dependent on Japan’s Sony Camera Company accessories as the company is a sub-assembly point of some elements of the iPhone. The company provides Apple Inc. with a lens module by Largan precision, an 8-megapixel camera by Genius Electrical Optical, and CMOS by Sony. However, Apple’s iPhone faces stiff competition from the Sony mobile Company that incorporates similar camera qualities in their smartphones. With this dependency, it creates a third-party vulnerability, and as such, production processes may be delayed and interrupted, thus leading to supply shortages.

United Arabs Emirates

Apple Inc. Company is also dependent on UAE as a market for its iPhone products. In the UAE, Apple’s iPhone faces stiff competition from other smartphone companies such as Xiaomi Inc., an Asian company. South Korea’s LG Company for its iPhone touch screen components. Xiaomi Inc. has been producing better smartphone models with similar internal features as those of iPhone at lower prices. Xiaomi increased its market share from 1.8 percent to 5.10 percent in less than a year, establishing itself as a new contender in the smartphone industry in UAE (Shamout & Elayan, 2020). In their analysis, Shamout and Elayan (2020) reveal that Samsung and Apple have lost customers and have a smaller market share. Since manufacturing is highly differentiated, the consumption of Xiaomi has increased notably in the UAE and throughout the world.

Conclusion

Supply chain mapping plays a crucial role in ensuring that the various players involved in making a particular product play their part in ensuring that the product’s final image is perfect as initially projected. Apple’s iPhone, which sees the various vendors that deal with multiple smartphone components, ensures that Apple Inc. obtains the desired end product. However, with the numerous vendors in different countries involved, the iPhone’s supply chain experiences associated risks and vulnerabilities such as changes in the macro-environment climate and trade wars between nations involved.

These risks and vulnerabilities have seen the sales of the iPhone reduce drastically hence their profitability. Therefore, to mitigate the consequences of such threats and hazards, Apple Inc. should develop and implement effective solutions such as supplier diversity, shipping insurance, and supplier risk awareness.

References

Hong, S. (2020). Asian financial crisis and LG electronics paradigm shift. In Cultural Translation of Management Philosophy in Asian Companies, 21, 137-152. Web.

Hosain, S., & Hossain, S. (2019). US-China trade war: Was it really necessary? International Journal of Business and Economics, 4(1), 21-32. Web.

Li, Y. (2021). Apple Inc. analysis and forecast evaluation. Proceedings of Business and Economic Studies, 4(4), 71-78. Web.

Lockamy III, A. (2017). An examination of external risk factors in Apple Inc.’s supply chain. In Supply Chain Forum: An International Journal, 18(3), 177-188. Web.

Omitola, T., & Wills, G. (2018). Towards mapping the security challenges of the Internet of Things (IoT) supply chain. Procedia Computer Science, 126, 441-450. Web.

Shamout, M. D., & Elayan, M. B. (2020). A comparative analysis of strategic planning practices in gulf cooperation council region: A case study of Huawei and Samsung Companies. Journal of Talent Development and Excellence, 12(1), 4891-4910. Web.

Sun, G., Li, J., Cheng, Z., D’Alessandro, S., & Johnson, L. (2021). Consumer personality factors and iPhone consumption in China. Journal of Consumer Behavior, 20(4), 862-870. Web.

Xing, Y. (2021). How the iPhone widens the US trade deficit with China: The case of the iPhone X. Frontiers of Economics in China, 15(4), 642-658. Web.

Yazdani, M., Zarate, P., Coulibaly, A., & Zavadskas, E. K. (2017). A group decision making support system in logistics and supply chain management. Expert Systems with Applications, 88, 376-392. Web.

Zhou, Y., Xiong, Y., & Jin, M. (2021). The entry of third-party remanufacturers and its impact on original equipment manufacturers in a two-period game-theoretic model. Journal of Cleaner Production, 279, 123635. Web.