Introduction

The report of Coach Inc begins with a strategic analysis of the company with a detailed SWOT analysis of the organization based on its current position. This report would focus on a number of major points regarding the external and internal environments, goals, strategic missions, business, corporate and global strategies, resources and capabilities, strength, weakness, opportunities and threats, corporate governance programs, organizational structures, PEST analysis, innovative features and many other issues of related to the strategic competitiveness to earning more than average income. It report also consider and critically evaluates a variety of key implementation alternatives, recommendations and organizational changes with recent global crisis.

Background in Brief

The prosperous heritage of Coach has been started from 1941 in a Manhattan as a family-run business of handcraft and leather goods with unique quality and craftsmanship. In 1985, Sara Lee Corporation was purchased the Coach and was incorporated under the state law of Maryland. It was listed in NSE (New York Stock Exchange) in 2000 with 68 million ordinary shares that accounted 19.5% of the Sara Lee’s common stock.

The Organization Today

Within the time, span Coach has turned into the most first-rated brand of America as a most exceptional designer and manufacturer of gift items including leather wares, accessories and fashion jewelry. The company has extended its operation out of USA like Japan and Europe. Coach branded products exists in more than 900 department stores of all the states of US. Out of US market in 20 countries at 167 department stores retail store Coach, branded products are hot sold. According to the annual report 2008 of Coach Inc, It has 297 retail stores in North America, 102 factory stores in North America; in Japan, it has 149 operated stores. The continuous research & development has been fashioned increasing new product and segmentation.

Mission of Coach Inc

The Brand Coach is a benchmark for the company. The company Coach Inc. would like to drive itself as a principal brand of quality with standard of life contributing classic and modern US styling in the same horizon. Coach Inc. exploits the professionalism, dignity and experiences gained on a global level and plan finding the way to help the economic and social growth of the country. Starting its activity from 1941 it is committed to detect the need of its clients through appraisal of top designers of this time and to raising efficiency.

Vision of Coach Inc

Coach inc. aimed to develop the professionalism and the experiences to take the challenge of US gift & handicraft market to coup with the standards and to achieve the core competence with loyalty to its customer and its vision states as

Customer contentment overriding is the main aspect of Coach’s vision. Its brand stands for a unique combination of quality, realism, value with encouraging US style. Coach emphasis attributes of the brand above all as a landmark of quality.

Gaining customers Integrity is the style that Coach inc. strives for its internal and external customer’s services to guarantee the perfect needs and seeks to set up long-term affairs on reliance and satisfaction with Innovative drives and attractive performance.

Coach inc. is eager to extend collaboration to face challenges in every aspect of business and make every effort to be a lively and flexible business unit dedicated to mounting stakeholder’s value.

Business area & Product line

Coach is a manufacturer, distributor as well as retailer of highest standards for materials. Its product line included 65% handbag, 28% men & women accessories and all other novelties are 7%, which was accounted in 2006.

Stakeholders

The success of Coach has been rooted in adamant devotion to sincerity and sprite of its dynamic human resources. In 2008, the employees of Coach were accounted 12,000 inhabitants together with full and part time employees. Of these employees, approximately 3,700 and 6,400 were full time and part time. Moreover, it has 50 overseas employees for negotiate agreements. Coach believes that with its employees relations are excellent and never has any strike. Board of Directors of Coach is directly elected by the vote of shareholders. Shareholders enjoy a suitable earning from dividends and some time the right issues (Coach Inc. (2008)). Coach maintains a strong supplier’s chain with concerned community who stand behind its products staking its reputation.

External Analysis

Hitt, M. A., at al (2006) has mentioned that since external environments are more complicated, turbulent and becoming global, it is turning to adopt for those companies for adopting with that environment. In order to achieving this capability, firms tend to engage in a process called environmental analysis on continuous basis basically involves four activities by which technological association can be tailored according to their own organizational need.

External environment or PEST analysis of Coach Inc

According to the view of Porter, M. E. (2004), the modern political, demographic, social, technological factors are reformulating this industry’s historical potential. For Coach’s external environment, this can be experimented by a PEST analysis as below-

- Political factors: Coach has established global operating principles such as in issue of investment, investment policy, device supply, stockholders are bound by various laws, they has to follow different rules and regulation. From 1945, Coach Inc is operating in many countries in the world and the earning a significant amount of profits from them; it has been affected by the local rules and regulations of imports of those. There also exists a chance of political spoilage on sales by such nations. In order to be transparent to customers and local governments Coach Inc has maintained its regular activities with honesty, reliability & fair dealing and in conformance with high ethical standards as well as it never condone unlawful payments to any individual, institute, or government.

- Economic factors: Coach Inc is now in strong position economically in spite of serious global financial crisis and to maintain its position it has reduced expense in all sectors. The Annual report 2008 of Coach Inc shows that in the fiscal year 2008, the Gross profit of Coach was $ 2,407,103, operating income $ 1,147,129, income from continuing operations $ 783,039, Working capital $ 934,768, total assets $ 2,273,844. Comparing to the previous year it can be found that it has developed its earning from all sectors for example, in 2007, Gross profit of Coach was $ 2,022,986.

- Socio-cultural factors: In Europe, America, there are lived people from different culture, race and religion and among them 40% are minorities of the total population. Its culture influences on quick and relax decision formulation on a plain, formulated network though it is characterized by huge bureaucracy. Therefore, officially, it uses English in speaking, documentation and the overall electronic communication. The Board of Directors arranged four scheduled meetings each year in order to develop employee relationships, selecting, evaluating and compensating the CEO as well as overseeing CEO succession planning, reviewing, approving and observing fundamental financial & business strategies.

- Technological factor: For the Coach Inc technology is most important issue among other factors. Since 1945, it has been manufacturing different hand-mixed product as well as commercial product using technology. Porter, M. E. (2004), said that technological changes affect many policies and procedures of this industry and sensor technologies offer huge consciousness about the environment. Now-a-days most of the multinational company is highlights in implementing INSIS functional system to serve the purpose of in main process, object system, maintenance, data security and so on. Additionally, INSIS functions are leveraged enough for process efficiency IS integration, high control and productivity, important insight practice, actuarial and calculation by reporting alternatives and future growth support for insurance companies are demanding day-by-day. However, Coach should more careful on manufacture their product and it should try to reduce emanation of noxious gases such as Carbon dioxide (CO2) which is cause of Global warming.

Industry Environment & Analysis of interaction of External Forces

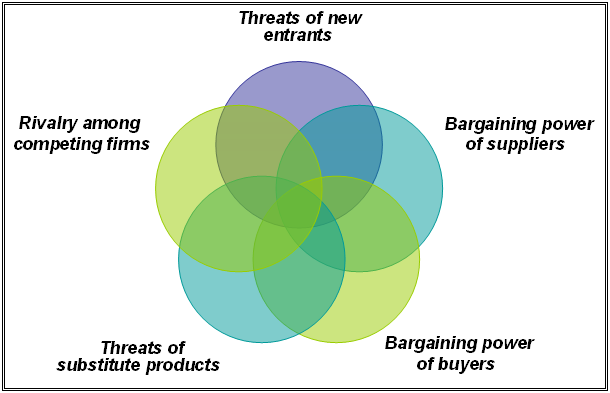

Hitt, M A., et al (2006, p 154) argued that the competitor analysis could be observed in the light of 5 forces model of competition that recognizes that along with those direct competitors, suppliers and buyers could become competitors as following-

- Threats of new entrants: The US handbags, and accessories market is not extraordinary in this regard as it is regrettable as the new entrants are frequently have the potential to be quite threatening to existing incumbents. Consequently Coach Inc. has a valid threat that few unexpected new comers may move to the market with less capable level of premium and less establishment cost that will be unsuccessful in covering the minimum costs as well as a threat for handbags, and accessories business, which can simply damage the market. Skinner, S. J., & Ivancevich, J. M. (2003) mentioned that a new firm’s entry in the market has two major tasks-

- The barriers to entry take account of economies of scale as marginal improvements in good organization as an incremental size boost, product differentiation and essential resources for investment as a lack of enthusiasm of current investment recently, controlling cost regarding customer’s buy the product of other company, access to distribution channel and government policy.

- Expected retaliation from Coach Inc. and the existing firms.

- Bargaining power of suppliers: Coach Inc. experienced as one of the major suppliers of US handbags and accessories companies. If Coach Inc. can exert power over firms, those will be incapable to get better costs and price that will trim down profitability.

- Bargaining power of buyers: Coach’s buyers involved demand for high quality, service, and call center with lower premiums.

- Threats of substitute products: From the prospect of Coach Inc., a number of local & international banks and financial companies are also make available services for security of life and property to overcome recessionary impacts.

- Rivalry among competitors: The competitors of Coach Inc. included both national and global, public and private institutions and generally local handbags, and accessories firms of US market.

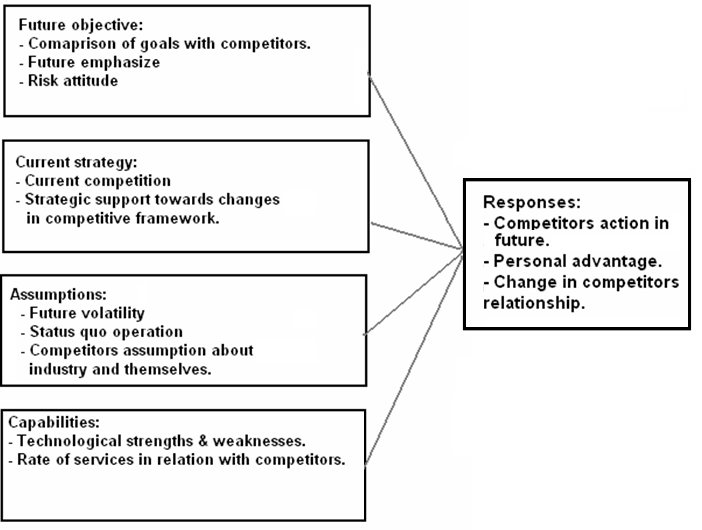

Competitor analysis components

Kotler, P., (2006), mentioned that by over-viewing all the components regarding future objectives, current strategies, assumptions, capabilities and responses, it can be stated that the use of IT or IS will influential for making competitive advantages in terms of product differentiation. It will also be helpful in case of fast service, project management, and account management, payment control, scheduling and processing, accounting records in current and future perspective.

Internal Analysis

The mechanism of internal analysis can be motivated to competitive advantage and strategic competitiveness of developing the resources and capabilities of Coach Inc, which will be discuss as following

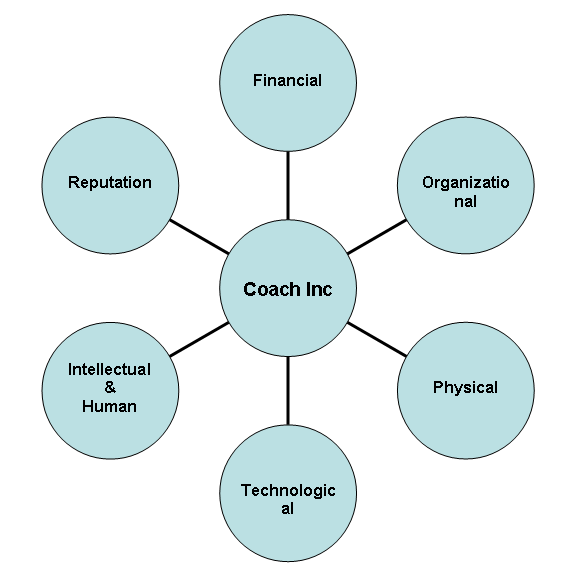

Resources

Generally, a company owns both tangible & intangible resources which can be categorized into six parts according to the resource- based theory (Griffin W. Ricky, 2006, p-90). In this sense, Coach’s several resources can be demonstrates as follows-

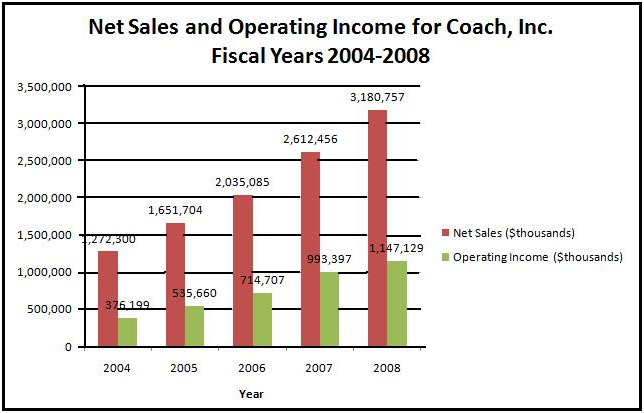

- Financial resources: From the Annual Report 2008 of Coach Inc can get clear knowledge about its financial resources. After the end of the fiscal year 2008, it is found that Coach’s net sales have increased in both direct and indirect sectors. Coach Inc, Form 10-K (2008) indicates that it average net-sales has increased all over the world fro example, in North- America net-sales has increased 22.0% from last year.

From the above figure, it was found that in 2008 its net sales were $ 3,180,757 and operating income were $ 1,147,129, which was better than previous year. In 2007, its net sales were $ 2,612,456 and operating income were $ 993,397, in 2004, its net sales were $ 277,300 and operating income was $ 326,199. After comparing the data, it is found that its financial position is now in strong position and it is increasing day by day.

- Organizational resources: Annual report 2008 provides that net cash provided by operating-activities and investing activities were $923.4 million and $445.4 million, which were more than $ 142.2 million and $ 69.6 million from last year. In the fiscal year 2008, the net-cash of Coach from financing activities has also been enlarged and $ 1.19 billion increased for the repurchase common stock.

- Physical resources: Physical resources includes machinery, property and equipment, buildings and construction, production, measurement, furniture and fixtures which also been depreciated over lives of 5-7 years and furniture and fixtures has depreciated over lives of 3-5 years. The amount of total current assets of Coach is $1,385,709 and a total asset is $2,273,844.

- Technological resources: It has merger with an Internet payment technology company, developed information technology, option e-business; it has advanced technological development team. From designing to manufacture finished product it has used modern technology in order to get better outcomes in all sector of marketing.

- Intellectual and human resources: Its business is operated by its employees, managers and officers, and CEO and here the CEO has directed the employees and has taken all the important decisions. Moreover, Coach has maintained several Boards, to improve the long-term value of Coach Inc for its stockholders and the Board of Directors is selected by them to develop management’s accountability and to ensure that all interests of the stockholders will be served on time.

- Reputation resources: The Coach Inc has implemented an impairment assessment in fiscal year 2006 to 2008 by estimating the fair value of the Coach reporting-units based on discounted cash flows as well as determined that there is no impairment in fiscal 2008 and the total value of goodwill and other intangible assets was $258,906 in 2008.

Capabilities

According to the view of Hitt A. Michael (2006), capability enables the company for creation and exploitation of opportunities for the development of sustainable advantages while a utilization of adroitness and insights. The flow of capabilities of any successful company can be shown as-

The main capabilities of any organization is based on increasing, carrying and exchanging information and knowledge by the firm’s intellectual and human resources. Here, few examples should be considered as follows-

- Coach can improve its market position by maintaining of stronger logistics through the larger economies of scale over the major competitors.

- Starting up of a new flagship store, introduction of new retail stores in North America and Japan, introduction of e- marketing campaigns and reformulation of the pattern of distribution channels take a major role in marketing of Coach Inc.

- Core competency and effectiveness in manufacturing of their products and Controlling and evaluating the performance of every project is necessary for success.

- It should initiate for co-branding as well as marketing performances with other companies.

- It has highly automated technology in all level of its manufacturing goods.

- However, connection of strong R & D for generating technological, stylist and materialistic goods can increase the value of intangible assts.

Core competencies

It indicate Coach’s resources and capabilities, which are providing as a modem of competitive advantage, like- quality, taste, design and diversification that distinguish it competitive and glorify its image and personality.

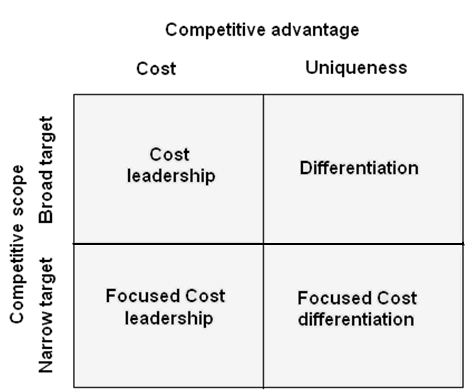

Business Level Strategy

From this strategy, it can be found the Coach’s industry situation in relation with other rivals as it has been indicated as one of the largest company in the North America focusing on 6% growth rate annually, specially it is continuing to drive-growth by expanding its distribution to reach local customers as well as international wholesale distributors & authorized retailers. Therefore, the Coach Inc can generate Porter’s five forces view as its business- oriented strategy, such as

In this cost leadership strategy, Coach Inc can deliver the highly sophisticated handbags, accessories, footwear, gift products at lower costs relative to Ann Taylor Stores Corporation, Kenneth-Cole Productions, Inc., Nike Inc, The Body Shop, Tiffany & Co., Talbots, Inc., Ben Sherman and Williams-Sonoma, Inc and other major competitors.

Thompson, A. et al (2007), argued that differentiation strategy recommend to the selling of non- standardization of products to match to the unique demand of the customers through the addition of jackets, sweaters, gloves, hats & scarves, including both cold weather and fashion, and other Coach jewelry line. Hitt, M. A., Ireland, R. D., and Hoskisson, R. E. (2006, p 154) argued that for developing thus, besides customer satisfaction with connecting people, it is also possible to charge premium prices although there lay a number of influential factors like rivalry with competitors, buyers and suppliers bargaining power, substitutes, threats of entrants etc.

Hitt, M. A., et al (2001, p-154) also mentioned that by introducing the focus strategy, a company would have to design its items for serving the needs and demand of particular segmented customers while it is characterized as the exploitation of the short- focused target differences from the equalization of the industry with centralized efficiency and effectiveness. Finally, the focused- differentiation concerns with highly differentiated goods along with above- average return. As a result, Coach Inc always follows these business level strategies in order to increase its profits.

Corporate Level Strategy

Coach Inc has maintained the moderate to very high-levels of diversification where sales revenue of a Coach is not depends on the single-product business, that means, it forms of less than 70% of revenue creates from dominant-business and in production process all businesses share materials, technology, marketing process and distribution channels. According to this concept, it provides handbags, accessories for male and female, footwear, jewelry, watches, travel-bags, fragrance and so on but it has earned 62% from handbags, 29% from accessories and 9% from other products. From this discussion, it can be said that Coach Inc is followed moderate to very high level of multi-product or corporate level strategy.

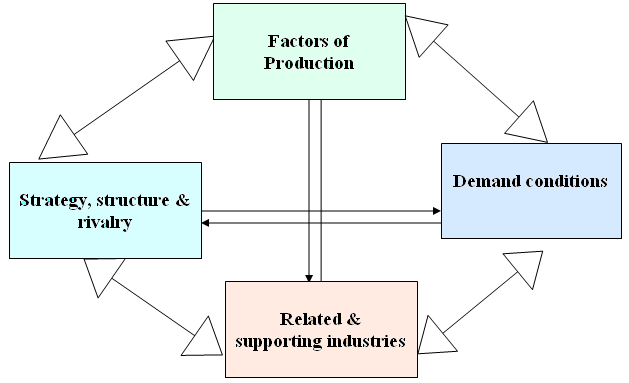

International Strategy

Coach Inc is a multinational company but its main manufacturing and distributing mainly based on in North America, Japan and few other Asian countries. Therefore, specific international strategies for being successful in each of those regions are required. Important considerations are-

Coach is expanding their business, therefore, its product are now available in Asian and European countries. At the same time as geographic diversity assists to decrease the Coach’s exposure to risks in any-one country, Coach is subject to risks linked with international operations, including, changes in exchange-rates for foreign currencies, which may have adverse effect on the retail price of its goods and it may reduce international customer demand or enlarge supply-costs.

Developing international cost leadership strategy will enable it to gain the economies of scale with vast demand, like- third world countries as delivered by Japan Coach. It should mention that as corporate- level strategy, it could go for multi- domestic plan for decentralization of operations in a single country for tailoring products to local market. On the other hand, by global strategy, it can improve standardized products regardless competition and demand and through transitional strategy, it can go for global capacity and local responses in political or economic instability or altering macroeconomic condition in international markets.

Cooperative Strategies

Coach Inc has a number of strategic options regarding this strategies which is discuss as follows-

- According to the method of strategic alliances, Coach can formulate partnership with firms through a mutual interest of resources and capabilities from designing to distribution level.

- By means of a joint venture, Coach can promote a new venture with other by amalgamation of their resources.

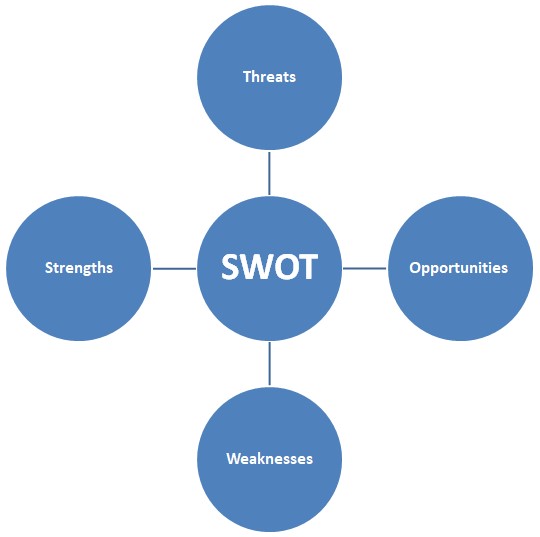

SWOT analysis Coach Inc.

Strengths

- Coach has excellent brand awareness and quality image, which helps to increase its profit day by day. Therefore, Coach’s product has found in 32 countries of the world and still expanding.

- Coach Inc provides important information and latest news in their websites, which play vital role to spread its business.

- The experience and efficient designers of Coach Inc always consider customers demands to satisfy the customers

- Besides regular customer, new customer is also important to develop company’s market segments. In order to attract and retain new customers Coach Inc use videogames and online face book.

- Moreover, Coach Inc has advanced technological support as well as administrative control to save the company from global financial crisis.

- Well-known celebrities play important role by using Coach’s products, which help to expand its business.

- Customer choice is the first priority of Coach Inc and to fulfill customer demands they change their design from season to season. They also change their design considering country, for example, they made different product for Asian countries.

- Pricing and availability for all sorts of customers are strengths for Coach Inc. Most of the time for the high price of its bags and other products become harmful for market and it may lose customers, therefore, Coach Inc offers lower-priced products to attract to middle-income people who are unable to afford higher-priced products.

Weaknesses

- Coach Inc spend comparatively larger budget for advertisement and promotion.

- In the US market, Companies such as product of Nike Inc had built strong sales that Coach Inc would have to achieve in that area.

Opportunities

- Coach Inc has the opportunity to provide quick customer service with high satisfaction

- Increased consumer interest on on-line shopping,

- The last five years has also been forecasted for rising all over the world retail services at an optimistic level for the coming period.

- Coach Inc has Strong capital and resources for further expansion.

- However, the competitors are the threat for Coach Inc but they may be future customer.

Threats

- Global financial down turns creates some uncertainty future expenditure of the customer which may affects on discretionary of customer for example now customers would like to purchase other products than apparel, bags and other products.

- Competitors are the main threats for Coach Inc. Manufacturers and apparel designers are the major competitor of Coach Inc. Its sales may reduce and increase costs for these competitors.

- Customer choice or quickly changing fashion trends is also threats for Ben Sherman.

- Now-a-days people are busy to meet the necessity rather than luxury.

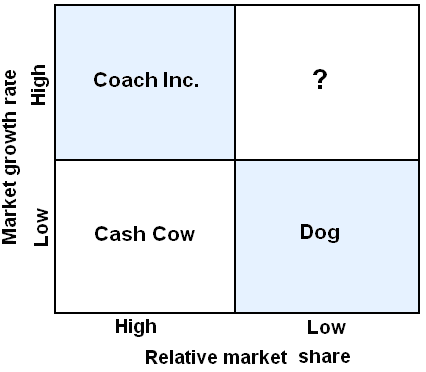

BCG Matrix and Coach Inc.

By using the Boston consulting group representation, the Coach Inc. can classify the entire of its SBU’s (Strategic Business Units) in accordance with the growth share matrix demonstrated below-

In this report, the Cash cow is low market growth, high share businesses and goods those require less investment to sustain the business, however, Coach Inc. shows opposites market growth.

In this figure, the Dogs are low growth and low sharing businesses or goods other than its goods those engage an absolute inverse position of coach’s market growth and relative market share.

Here, the Question marks indicate low down allocated business units inside the high growth market, they need abundant resources of cash to transmit on their share, and move alone boost them.

Lastly, the most important part of there figure is Coach Inc, which indicates the highest position of the matrix, which is perfect for its products which they offers is in the superior market share by way of an enhanced growth rate than several of its competitors.

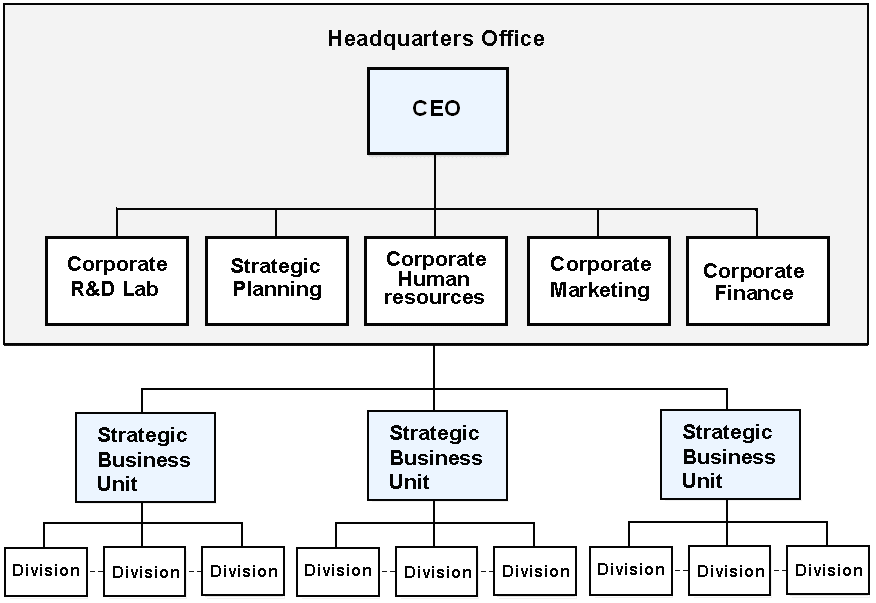

Organizational Structure of Coach Inc.

Here, it should consider the organizational structure of Coach Inc and it has followed strategic business unit (M-Form) which has been shown in the following figure.

Coach Inc should follow this organizational structure because here divisions within each Strategic-Business Unit mainly focus on the transferring core-competencies rather than on sharing assets & actions. Comparing to the other organizational structure it has also five major departments such as corporate R & D Lab, strategic planning, corporate HR, Corporate marketing and Corporate- Finance, however, these are illustrated & controlled by CDEO or corporate-headquarters as well as both strategic controls & financial-controls are exercised in order to assess each department.

From the above discussion, it can be said that the SWOT is fit with strategy of Coach Inc because still now they are fall in recession, they managed all sectors, reduce costs and increase their profit from previous years.

Alternatives

This report has been identified most pragmatic policies headed as A1, A2, A3 and A4, which will be considered, for Coach’s alternatives.

Alternative-1 sustains with the status quo of existing policies without changing any features that is Coach can follow its existing strategy. Alternative-2 indicates Coach Inc would consent to purchasers of their products in order to provide the necessary improvements and potential financial commitments for assuage in turn unevenness problems. Alternative-3 enforce contact fees on the buyers of Coach Inc emphasizing on the minimum costs of essential infrastructural perfection in regulate the production and distributions. Alternative- 4 suggests that the policy maker of Coach Inc can give importance on population of poverty level and before attempt to implementation their projects, they can take an opportunity to overlook the competitor’s policy or lot splitting regulation to find out another alternatives, which ensure all facilities for the population of poverty level.

Criteria for Evaluation

- Economic Criteria: The foremost strategy analysis incorporates at least a single economic criterion such as effect on the economy, effect on government spending or predictable public sector revenues, when the ordinary economic criteria are costs.

- Equity Criteria: The equity is a public concern that looks the social allocation of benefits and burdens. If the anticipated policy alternatives reallocate the benefits and burdens, it must keep an impact on equity. Equity sustained with equal opportunity and corporate social responsibility.

- Technical Criteria: The efficiency and implication are the criterion which reviews proposed strategy with goals, target and uncertainty consideration.

- Political Criteria: It reviews the political viability of the projected strategy alternative with acceptance to the different groups.

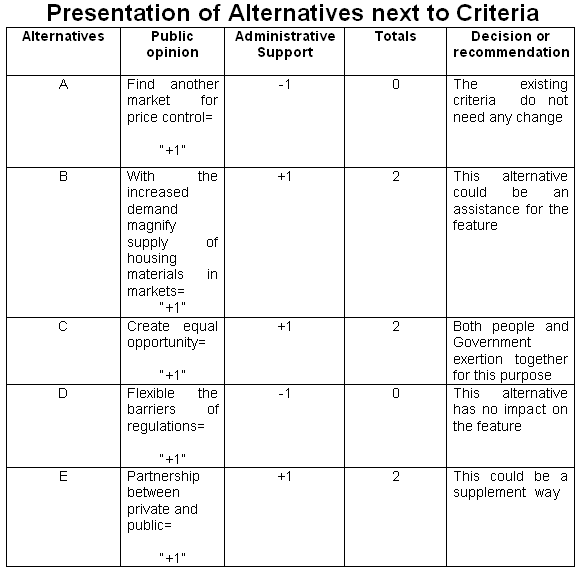

Matrix of Criteria to Alternatives

This report have been meditate on next to the abovementioned standards and scored with weight +1, 0 and -1 in apiece grouping where “+1” indicates that the alternative has complied with previously defined criteria, “-1” reveals that the alternative has not complied with the standard and “0” is a sign of neutral rejoinder to the criteria. The weights for every alternative has been placed diagonally the criteria designed for total weight allocated with comparability in the table bellow, which shows when Coach should change its strategy.

Recommendation

The most part of the up to date political economy of USA is very distressing. Credit crush as well as collapse US Banks has created a fracture on money flow. Job cuts are tremendously increasing. Consequently, the recession has seriously effected the consumption and customers purchase power of US market. The Bail out Bill before now has failed to pick up the market dynamics and put a stop to current unpredictability of falling oil price and account surplus furthermore overseas asset position. If the recession lasts for long term, the situation of US market would turn in more dangerous and an unpredictable condition. For a real progression the Coach Inc., the company required re-shaping its strategy for US market and reducing its dependency of US market and at the same time, it is has been urging to increase the market drive in the new overseas markets rather than Europe. To continue put into practice more effective strategy- Coach Inc has recommended as–

- Coach Inc. has been advised to configure its products; services and solutions in a portfolio originated on or after competitive operations with an inventive image of balanced strategy as well as value recognition.

- To play down the risk of US recessionary impact on US currency and apparent inflation Coach Inc required invoicing for its export items in Euro or any other than US dollar.

- Coach Inc. required taking into account the US recession and its impact on the global market to think about of difficult economic conditions for which the global effectiveness may reduce.

- Coach’s actually powerful and aware safeguarding of brand name to sustain and develop current market share and operation.

- Coach Inc. would emphasize on mass customization and co-branding with new companies where overheads are low.

- Due to slow extension of global subscribers, substitute of sales of current handbags and accessories by the demand precipitate services should be introduced.

- It needed to consider the changing dimension and characteristic of the global handbags and accessories market by sustaining quality, demand and effort to guard the segment sales and profitability.

- Coach Inc. required to continuing its investment in the low waged countries of for product & production as well as R&D.

- Coach Inc.’s cost management is mostly of the essence to look after price wearing down by analyzing the next generation pricing of the company through the operating of cost saving devices.

- Coach‘s extensive growth of suppliers, resourceful and effective implementation of logistics obligatory to be more ensuring customer’s safety trust as well as values.

Implementation of strategies

The Implementation of the above four strategies is run by the following parties-

Corporate governance in Coach Inc

Most recently much big business has been collapsed for not to follow the measures designed for expense of remuneration paid to the directors’ guided in the Companies Act, therefore corporate governance is essential part for Coach Inc. It indicates the co-relation of stakeholders for determining the control and directive performance of Coach Inc formatted by Companies Act that is responsible for carrying out strategies by some sequential stages.

Role of the board

The Board is responsible conforming guidelines, previous plan approval and investment as well as divestment strategies. Hence, the corporate, audit, personnel committee, governance and nomination committee conducts the operations and self- evaluation for refining the strategies as well as to ensure long-term interests of the stockholders.

Independence of Directors

According to the New York Stock Exchange (NYSE) a majority of the directors should be independent of the company, in addition, a committee configuration must be place in order to advance the responsibility of the selection of the executives, the salary of the directors as well as the audit procedure. Coach’s corporate responsibility offer to follow the rules of NYSE and they provide five situation when a director would be accountable for their activities.

Compensation of Employees

Remuneration is the payment made to an individual for the services that he or she provided to the organisation. Director’s remuneration is a most energetic issue in the today’s business world. Coach Inc should be designed for attracting and deriving the talent human resource for successful strategic implementation that focuses on base rate of pay, competitive compensation package over time, balance of gifts etc.

Conclusion

The current strategic analysis of Coach Inc. with its handbags and accessories in USA has addressed with the critical problems and drawn attention on the company’s up to date pose to the global market. It also enlighten on Coach’s strengths and weaknesses major competitors, along with a number of opportunities and threats. It has been acknowledged that Coach Inc.’s major goals and objectives has maximized profit by developing the sales promotion, advertisement, brand development using on the whole marketing mix components. The exacting strategies that has recommended that it would be functional to accomplish the goals, this could be forecasted that the Coach Inc. would be continually triumphant with its strategic management in long run for customer satisfaction by appropriate planning; implementation and Coach Inc. USA would be accepted as the improved adopter of strategic functions.

Bibliography

Coach, Inc. (2008), Company Profile. Web.

Coach, Inc. (2008), Mission statement. Web.

Coach Inc. (2007), Annual Report 2007.

Coach, Inc. (2008), Coach, Inc. Web.

Coach, Inc. (2008), Coach, Inc. Corporate Governance Principles.

Coach, Inc. (2008), Global Integrity Guide Revise MECH. Web.

Coach, Inc. (2008), Supplier Section Guidelines. Web.

Coach, Inc. (2008), Global Operating Principles. Web.

Coach, Inc. (2008), Annual report 2008 of Coach. Web.

Griffin, R. W. (2006), Management, 8th Edition, Houghton Mifflin Company, Boston New York. Web.

Hitt, M. A. Freeman, R. E., & Harrison, J. S. (2001) The Blackwell Handbook of Strategic Management, Blackwell Publishing. Web.

Kotler, P. (2006), Marketing Management, 11th edition, Prentice Hall, NJ. Web.

Porter, M. E. (2004), Competitive Strategy, Export Edition, New York: The Free Press. Web.

Skinner, S. J., Ivancevich, J. M. (2003), Business for the 21st Century, Homewood, Boston. Web.

Thompson, A. et al (2007), Strategic Management, 13th edition, Tata McGraw- Hill Publishing Company limited, New Delhi, India.